Outlook Quarter 2/2019

EIC revises 2019 Thai GDP growth downward to 3.6% due to export slowdown amidst heightened global economic uncertainty and internal political risk

- Thai economy 2019

- Global Economy 2019

- Box: 2019 US Debt ceiling crisis risk

- Box: China lowered economic growth forecast to 6.0-6.5% and announced its economic stimulus package for 2019

- Thai Economy 2019

- External sector of the Thai economy: Exports and tourism growth would decelerate in 2019

Box: Monitoring the impact of trade discrimination measures and the US-China trade war on Thai exports - Box: A look at India - a high-value market for future Thai exports and tourism

- Domestic Economy: Strong investment growth outlook, albeit growing uncertainty

- Box: Nonfarm payroll employment conditions

- External sector of the Thai economy: Exports and tourism growth would decelerate in 2019

- Interest rates and exchange rates outlook in 2019

- Bull-Bear: Oil prices

- Data Analytics: Fiercer Competition, Major Challenge for Thai Businesses

- In focus: Assessing Thailand’s labor productivity "Manageable, yet inadequate and concerning"

- Summary of EIC forecasts

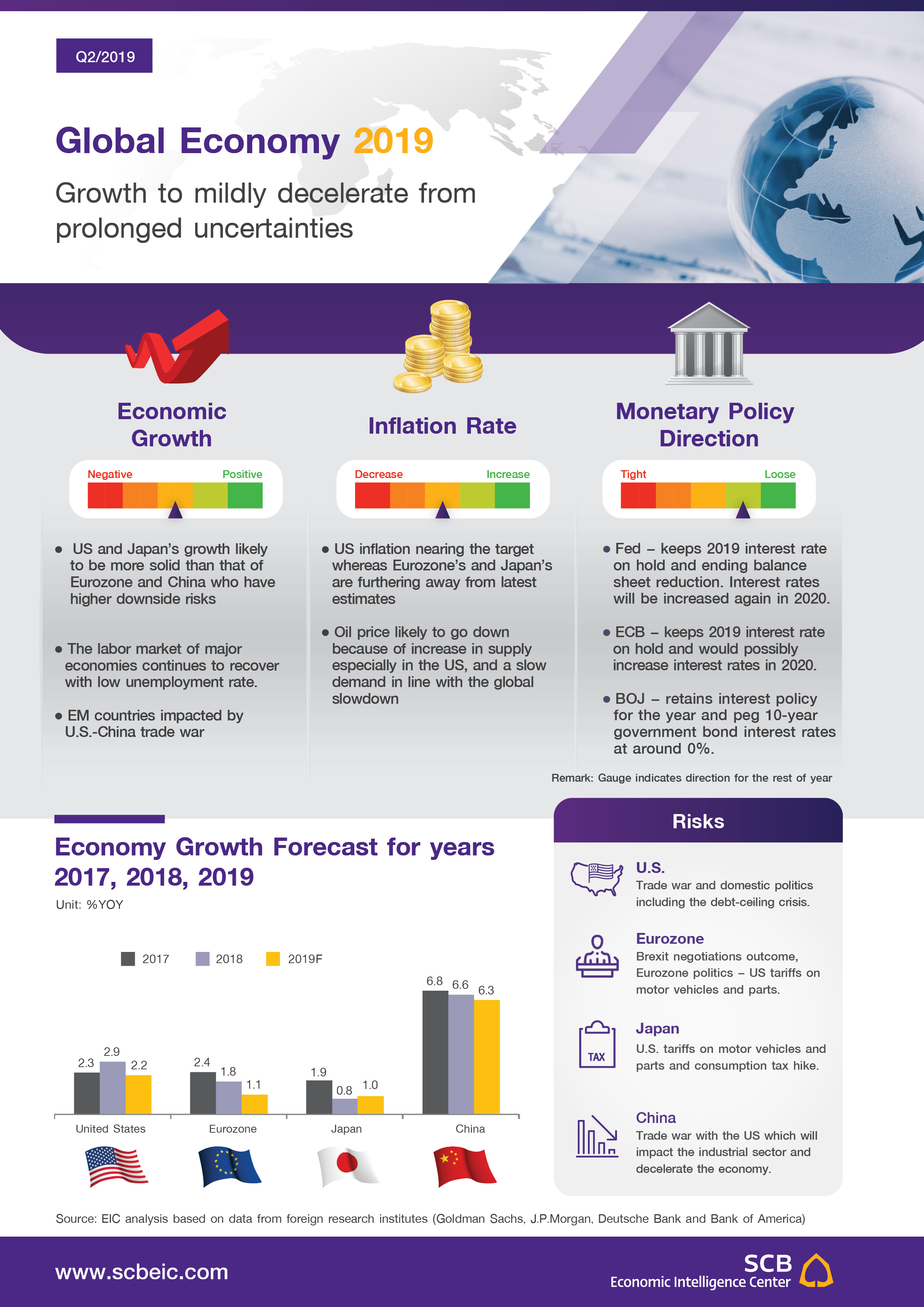

2019 Global Economic Outlook

Global economy continues to decelerate, especially in the manufacturing sector of the Eurozone and Emerging Markets (EMs) in Asia due to impacts from trade war while solid growth in the US and Japan is likely to put the economy on a firm footing. Global economic growth is likely to expand at a slower pace because of impacts from the US-China trade war which constantly affect exports, and from increased political uncertainties in several regions including the Eurozone with the Brexit issue showing signs of prolonged negotiations. Economies of the Eurozone and China have clearly slowed down, reflected by contracted economic activities especially in the manufacturing and export sectors, as a result of both common external factors such as trade war which causes uncertainties for business planning and internal factors within the Eurozone and China. Said internal factors include the slowdown of Germany’s automotive industry and protests in France, as well as efforts to curb shadow banking and debt deleveraging in China. These are key factors to economic slowdown in both regions. However, other major economies such as the US and Japan remain relatively robust. In the US, it is expected that the government has plans for large infrastructure investment. In Japan, both the public and private sectors are likely to ramp up investment before the Tokyo Olympics 2020, and household spending is likely to be frontloaded before the consumption tax hike in October. Despite the slowdown of the global economic cycle and prolonged uncertainties, major economies are still able to expand as a result of firm labor market recovery along with accelerating wage growth which in turn supports private consumption. The monetary policy of Developed Markets (DM) has become more loose in comparison with the previous quarters. The Federal Reserve (Fed) signaled the delay on a tight monetary policy by halting the policy rate increases in 2019, and ending the Fed’s balance sheet reduction by the end of September. The European Central Bank (ECB) announced additional monetary easing measures – TLTRO3 – to be effective in September, and the Bank of Japan (BOJ) still has no tendency to hike the policy rate as inflation expectations are still low. Lastly, the growth of Emerging Markets, especially in Asia, exhibits mild deceleration, resulting from slowdown in exports which stem from global trade uncertainties due to US trade protectionism measures on Chinese import tariffs (Section 301) which have been in effect since 2018, and tariffs on motor vehicles and parts (Section 232) which are still under consideration. Nevertheless, the growth of many EM countries would be driven by private consumption and public spending, mainly in infrastructure investment, to compensate for overall slowdown in exports.

EIC sees that there are 3 major risks for the global economy in 2019, namely, 1) trade war, 2) tightening financial conditions, and 3) geopolitical issues are still causing high uncertainty, but seem to be heading toward an improving trajectory. In the first quarter, the direction of global risks, especially those stemming from trade war and tight monetary conditions, seem to head to a more positive direction due to the efforts in trade negotiations between the US and China, the extension of temporary trade war truce and the reduced possibility of policy rate hikes of the Fed and the ECB this year. This created a relieved sentiment for the global financial market. Regarding heightened political risks especially for Brexit, despite the deadline extension from March 29, which has helped reduce the possibility of a ‘no-deal Brexit’, finding a solution that satisfies all parties is still a challenge and rather time-consuming. These uncertainties and risks are likely to affect the financial market and the business sector in the foreseeable future. Additionally, other risks, such as sanctions on Iran and Venezuela, and elections that are going to take place in many regions around the world are prone to contribute to the volatility of the global financial market.

EIC revises 2019 Thai GDP growth

downward to 3.6% due to export slowdown amidst heightened global economic uncertainty and internal political risk

EIC has revised 2019 GDP growth downward to 3.6% from the previous forecast of 3.8% to reflect lower growth in Thailand’s exports due mainly to the current global economic slowdown. Global economic growth is projected to decelerate more than previously expected and to more clearly exhibit a synchronized slowdown pattern. This is due to the US-China trade war and tightening global financial condition, especially in the second half of 2018, which continues to have a negative effect on global trade and investment. Moreover, in the first two months of the year, around 70% of Thai export markets have seen negative export growth. As a result, the EIC has revised growth in export value downward to 2.7% from the previous estimate of 3.4%. Similarly, private investment is predicted to decelerate from the end of last year, consistent with a slowdown in the export sector, global trade policy uncertainty, and post-election risks that could delay investment decisions. Nevertheless, the Thai economy still sees a boost from the tourism sector, which has shown improvement due to a faster-than-expected recovery in the number of Chinese tourists. Accordingly, EIC has revised its forecast of the number of foreign tourist arrivals upward to 40.7 million from 40.2 million, representing growth of 6.3%. In addition, public construction, consisting primarily of on-going projects, is estimated to be worth THB 760 billion this year, an increase of 7% and will be another key supporting factor this year. Private consumption is expected to expand gradually following an improvement in employment and wages as well as a boost from government stimuli. Nonetheless, durable goods consumption will likely decelerate from last year’s level due to the high base effect of passenger car consumption the previous year and the impact of a macroprudential policy aiming to curb household debt to an appropriate level.

EIC expects the policy rate to stay flat at 1.75% throughout 2019. This is because Thai economic growth tends to be slower than what the Monetary Policy Committee (MPC) previously projected. Furthermore, there are higher downside risks arising from both external and internal uncertainties. Headline inflation, moreover, remains at a low rate of only 0.7% in the first quarter of the year and is predicted to average only 0.9% this year, which is below the lower bound of the monetary policy target. This could be a key reason for the MPC to avoid hiking the rate this year. In this regard, MPC tends to use macroprudential policies as well as financial institution regulations to help alleviate specific vulnerabilities which could affect financial stability in the future, particularly household debt, which continues to accelerate faster than income, and underpricing of risks in financial investment. Regarding the Thai baht trend, it is anticipated to stay within a range of 31-32 THB/USD by the end of 2019, appreciating from the end of last year. The key reasons for the appreciation trend include a weaker USD, a more dovish FED, and strong Thai economic fundamentals, as reflected by a high current account surplus to GDP, which is expected to be around 6.4% of GDP in 2019. However, the Thai baht may depreciate if global financial condition becomes tighter and domestic political stability weakens.

Key challenges ahead will be from external global economic uncertainty and domestic political instability. Despite good signs from trade negotiations between the US and China as well as a more dovish tone from major central banks that could benefit global economic condition in the short run, challenges to global economic growth remain, which are 1) trade tension that will continue and might escalate again because it is a structural problem, 2) global financial conditions that could tighten again, 3) high debt problems in countries, such as corporate debt in China and the US, and 4) a Brexit that would have negative impacts on the UK and Eurozone economies and global financial volatility. Political instability would be a key risk factor internally, with political uncertainty remaining high even after the recent election. As the number of parliament members of both the government and opposition parties are close, there is a high chance that the new government could be a weak coalition government implying instability and low efficiency in implementing economic policy going forward. This might bring about a delay in both investment and consumption decisions until uncertainty subsides.

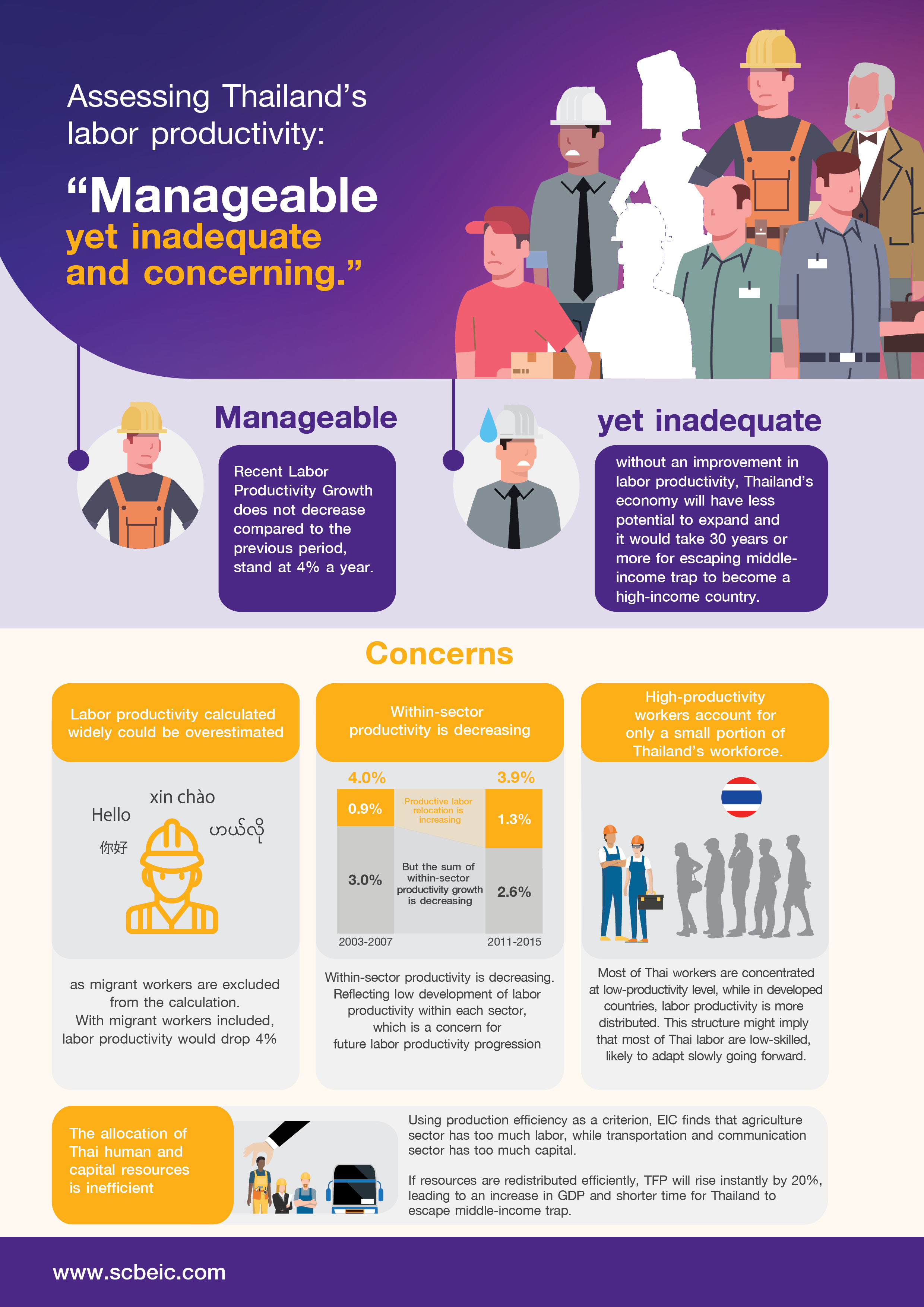

In Focus: Assessing Thailand’s labor productivity: “Manageable, yet inadequate and concerning.”

Thailand’s labor force has been in continued decline because of the aging population, which leads to a fall in the country’s potential growth. Therefore, to ensure a satisfactory rate of economic growth, migrant workers, especially high-skilled, can be brought in to boost the labor force. However, migrant workers can only provide a short-term fix, because when they eventually leave, the economy will suffer. Thus, it is necessary that labor productivity of Thai workers must be improved at the same time, so that they can make up for the declining workforce. As a result, this study provides a thorough assessment of the current situation with regard to Thailand’s labor productivity.

Summary

Assessing Thailand’s labor productivity “Manageable, yet inadequate and concerning”

Our study finds that the current condition of Thailand’s labor productivity is considered “manageable”, since the average annual growth in labor productivity in the current period (2011-2015) remained comparable to the period earlier (2003-2007). Nevertheless, this rate of growth is still “inadequate”, as it was unable to support a satisfactory rate of economic expansion. In EIC’s view, without an improvement in labor productivity, Thailand’s economy will have less potential to expand and it would take nearly 30 years or more for Thailand to escape the middle-income trap and become a high-income country.

Concerns

Although the current conditions of labor productivity remain manageable, several concerns are worth pointing out. These include:

1) Labor productivity calculated widely could be overestimated, as migrant workers are excluded from the calculation. – Labor productivity estimated in most studies only include Thai workers. However, in reality, the share of migrant workers in the Thai labor market is quite significant (statistics from 2011-2018 show an average of as much as 1.53 million migrant workers in Thailand, or around 4% of overall employment.) As a result, including only Thai workers will lead to overestimated per capita labor productivity. If migrant workers were to be included, per capita labor productivity would be lower. Based on data from 2011- 2018, when migrant workers are included in the calculation, per capita productivity falls from 250,064 baht to 240,253 baht per year, or equivalent to a 4.1% drop. Also, labor productivity growth declines from 3.1% to 2.8%.

2) Within-sector productivity is decreasing. – If overall labor productivity growth is decomposed into 1) labor productivity growth in each sector (within-sector productivity) and 2) labor movements from low-productivity sectors to high-productivity ones (labor-relocation), it can be seen that labor productivity growth during 2011-2015 resulted from an increase in labor relocation growth (compared to 2003-2007 figure). However, the sum of sectors’ within-sector productivity had been in decline. This is a major concern , because the scope for labor relocation in the future is limited by many constraints, such as the inability for low-skilled workers to move to high-skilled jobs, and the skill mismatch problem. Given the limit to productive labor relocation, within-sector productivity growth is unavoidably the key to improving overall labor productivity in the country.

3) High-productivity workers account for only a small portion of Thailand’s workforce. EIC’s study shows that Thai workers’ productivity level is lower than developed countries’ level. Moreover, most workers in developing countries including Thailand are concentrated at low-productivity level and only a small share of workers has a high productivity. Unlike in developed countries, labor productivity of labors is more distributed.

Such labor market structure can become a constraint for economic development in the future, because a large share of low-productivity workers reflects limited skills or education of these workers. Thus, in the event of abrupt technological change, they may not be able to adjust, hindering economic development going forward.

4) The allocation of human and capital resources is inefficient. – Efficient resource allocation requires allocating resources to sectors that can produce the highest output using the constrained resources, or in other words, sectors with the highest productivity. Our study shows that resource allocation remains inefficient in many sectors.

With regard to human resource allocation, EIC finds that agriculture sector has too many workers. Therefore, it should be developed to improve its productivity, leading to lower number of workers required. Labors who exit from agriculture should be relocated to some high-productivity sectors such as manufacturing, wholesale and retail and transportation& communication sector. While in angle of capital allocation, utilities and transportation&communication sector have too much capital, reflecting that those sectors are inefficient in using capital to produce goods or services. If these resources are redistributed appropriately based on each sector’s efficiency, TFP will rise instantly by 20%. This means higher GDP growth, and shorter time until Thailand escapes middle-income trap.

Inefficient resource allocation can result from many causes. 1) Government policies that supports low-productivity businesses without providing long-term solutions can turn businesses into zombie firms, preventing resources from being relocated to more productive ones. Besides, regulations that obstruct innovation or development can also be the cause of resource misallocation 2) Underdeveloped financial sector will lead to suboptimal capital allocation in the forms of loan granting and collateral ownership. Finally, 4) insufficient competition means that firms do not have to adapt in order to survive. Hence, there is little resource relocation to boost competitiveness, leaving the overall allocation inefficient.

Approaches for future labor productivity development

Country-level

1) Invest in infrastructures – EIC finds that Thailand should invest in infrastructures especially water utility and rail system. Moreover, Thailand should also invest and advance in ICT infrastructures since these infrastructures are critical for economic development going forward.

2) Improve the quality of education and eliminate the problem of skill mismatch in the labor market – Education system should be improved for practicality and be more demand-driven in order to solve skill mismatch problem. For example, education system should produce more of technicians rather than social scientists as the market is currently lacking technicians.

3) Foster appropriate level of competition – Competition will bring more efficient resource allocation and development of innovations. Therefore, the government should reduce monopolistic competition and support free and just competition in a gradual manner, allowing time for business owners to adjust.

4) Use short-term subsidies in combination with long-term solutions – short-term supportive policies to low-productivity businesses, such as debt moratorium for farmers and soft loan for SMEs, can bring about more-than-necessary resource concentration in low-productivity businesses. Thus, measures for long-term development should be used together.

Firm-level

1) Increase productive investment – In addition to investment in tangible assets, investment in ICT systems is also necessary, since it is an important ingredient for advancing firm productivity. Moreover, firms have to recognize the importance of R&Ds, which is the key to future business success.

2) Hold regular and effective staff trainings – In the era of fast technological changes, trainings of new technology and the implications on the jobs are another important factor that will support more efficient workforce, directly boosting labor productivity.

3) Gain productivity from data analytics – Data analytics not only bring higher business opportunity such as creating customized products for precise target group, but also lead to lower cost by utilizing AI such as using Chatbot to answer questions replacing human.