Outlook Quarter 1/2019

EIC forecasts the Thai economy will expand 3.8% YOY in 2019, lower than 2018’s estimated growth rate of 4.2%YOY.

- Thai Economic outlook 2019

- Global Economic Outlook 2019

- Box: Exploring US economic risks from the corporate credit market

- Box: Japan and Consumption Tax Hike in 2019

- Thai Economy 2019

- External sector: exports and tourism slowdown

- Box: Monitoring the impact of trade discrimination measures and the US-China trade war on Thai exports

- Box: A closer look at the competitiveness of Thai exports

- Domestic sector: Public and Private investment as growth engine for 2019

- Interest rates and exchange rates outlook in 2019

- Bull-Bear: Oil price

- In Focus: 3 Top Picks of the Thai Economy in 2019

- Summary of EIC forecasts

EIC revises down Thailand’s GDP in 2019 to 3.8%, entering the late expansion cycle

EIC forecasts the Thai economy will expand 3.8% YOY in 2019, lower than 2018’s estimated growth rate of 4.2%YOY. The figure signals that the Thai economy is entering the late expansion cycle owing to economic slowdown in major economies and the impact of the trade war which will put pressure on Thai exports growth this year. Moreover, Thailand’s financial cycle has already peaked, resulting in tighter financial conditions. However, the projected growth rate is still better than those of the previous 5 years (2013-2018), which averaged below 3%YOY. Positive factors contributing to the economy’s expansion include domestic spending especially investments, which are expected to accelerate as reflected in rising production capacities of various industries, continuing investments in the government’s mega-projects, and the relocation of production bases into Thailand by foreign businesses affected by the trade war. In addition, EIC expects the number of foreign tourists to expand by 5.7%YOY in 2019, with the number of Chinese tourists picking up again in the second quarter and becoming a driving force

in the economy’s expansion for the rest of the year. Household consumption is expected to increase

gradually thanks to low unemployment, a gradual income recovery, and government stimulus measures.

Challenges on both the domestic and international fronts lie ahead in 2019. External factors that may impact the Thai economy include 1) a possible intensifying trade war if negotiations between the US and China are prolonged and fuel uncertainty which will adversely affect the global economic growth; 2) tightening global financial conditions that will result in higher borrowing costs in many countries, while reduce capital flow to emerging markets and heighten financial volatility; and 3) geopolitical risks and political uncertainty in key regions such as Brexit, political situations in Italy, and the US sanctions to Iran. Domestically, major challenges include 1) concentrated spending patterns due to high household debts and a slow recovery of household income, which partly reflect the difficulties facing some workers and small and medium-sized enterprises (SMEs) in adapting to structural changes especially rapid change in technologies and higher competition; 2) tighter domestic financial conditions as a result of higher borrowing costs and macroprudential measures which aim to control household debt financing; and 3) uncertainties from the upcoming national election which will significantly affect consumer and investor confidence as well as future economic policy.

EIC expects Thailand’s economic stability to remain sound, but all sectors should adapt quickly to structural changes. Overall, the economy is in good conditions thanks to the current account surplus, adequate foreign exchange reserves, low unemployment, and relatively low public debts enabling the use of fiscal policy as an economic stimulus. Still, all sectors of the economy should work on risk management and boost comp automation in many industries, consumers’ changing behavior in everyday spending, and higher business competition from both domestic and international firms. Despite the Thai economic stability, these factors may have a negative impact on households, labors, and businesses that cannot adapt in time.

Global Economic Outlook 2019 Economic Intelligence

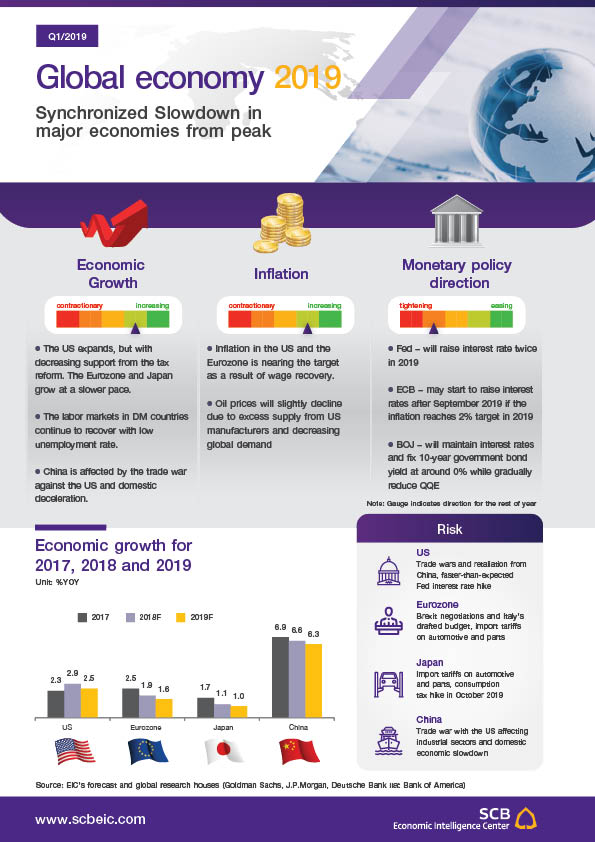

The global economy in 2019 is likely to grow at a slightly slower rate. Developed markets (DM) are expected to grow at a decreasing rate, while emerging markets (EM) on the other hand, are forecasted to grow steadily overall. The US, Eurozone and Japan economies will expand at a slower pace compared to 2018, as they have passed their peaks during 2017-2018. This deceleration is consistent with the global trade forecast that has slowed down. However, major economies still expand well for the most parts, due to continuous recovery of the labor market, accelerating wages and inflation. In terms of DM monetary policies, the US Federal Reserve (Fed) is likely to continue hiking the interest rates twice. The European Central Bank (ECB) is likely to raise interest rates for the first time in the second half of 2019, after ending the Asset Purchasing Program (APP) in December 2018. The Bank of Japan (BOJ) will continue to gradually reduce quantitative and qualitative easing (QQE), due to BOJ’s limitations on asset purchases in the bond market. As a result, overall global financial conditions continue to be tightened. As for EM countries, growth is likely to be moderate as monetary policies has been tightened since 2018 in many countries. Moreover, EM’s supportive force from the export sector is weakened due to decelerating international trade. Therefore, in many countries, EM will focus to derive growth from consumption, government spending, and private investment. At a glance, Chinese economy as well, is likely to slow down as a result of economic reforms that focus on controlling debts and US trade war damages on the export sector. Manufacturing industry is mainly affected, especially in technological, electronic products and machineries that will continue to be susceptible. Although the Chinese monetary and fiscal policies are doing their parts to stabilize the economy, however, the domestic slowdown, coinciding with the US trade war, is also an issue that must be kept an eye on. The downshift in Chinese economy will affect both global trade and commodity prices. This applies to goods in many categories that are regularly imported to China. Hence, China’s downshift would affect countries that are closely connected with China via trade and investment for the foreseeable future.

EIC views that 2019 global economic risks boil down to three important factors: 1) trade war 2) tighter-than-expected global financial conditions and 3) international geopolitical issues. Trade war risk continues to be a problem from 2018 that the world is still keeping an eye on US trade barriers imposed on China, especially the tariffs on China (section 301 of the US Trade Act), and import tariffs on the automotive and parts (section 232). Although the results of the G20 meeting in December 2018 have helped mollify the tension, that there is a possibility of ending the trade war temporarily, the negotiation is still in progress among the US, its trading partners and China. Importantly, if favorable terms could not be settled with China, the possibility of intensified trade wars and retaliation between the US and trading partners are still present. In terms of financial risks from tightening global conditions, the Fed’s interest rate hike will increase funding costs. Liquidity which was previously excessive, is now gradually reducing, as many countries are likely to adjust their monetary policies in response to the interest rate upcycle and returning to policy normalization. Risks will arise if the US dollar continues to strengthen, as it will continue to create volatility towards capital flows. The strength of the US dollar will increase volatility among EM countries with large current account deficits, low international reserves and large debt in US dollars. Finally, geopolitical issues such as Brexit and Italy’s drafted budget, will affect the economic and political stability of the European Union and the Eurozone. Sanctions against Iran along with elections in many regions around the world, will continue to contribute to the global financial volatility in months to come.

In Focus: 3 Top Picks of the Thai Economy in 2019

Despite the These include continuing government mega investment projects, new groups of Chinese tourists in Thailand, and positive sides of trade war which would yield opportunity for Thai businesses. Thus, these 3 issues are the EIC’s top picks in 2019 so we can see arising opportunities as well as be prepared for what awaits us in this year.