FLASH

29 August 2025

Export growth in July remained elevated but began to slow compared with the previous month.

The value of Thai merchandise exports in July 2025 remained elevated, expanding by 11%YOY to USD 28,580.7 million.

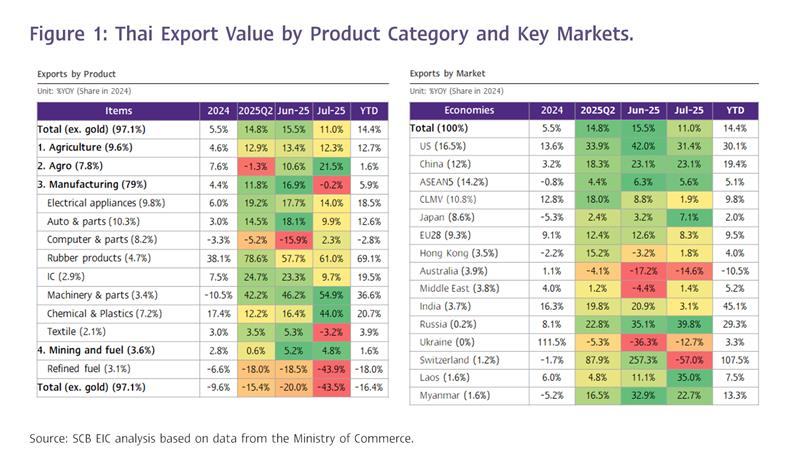

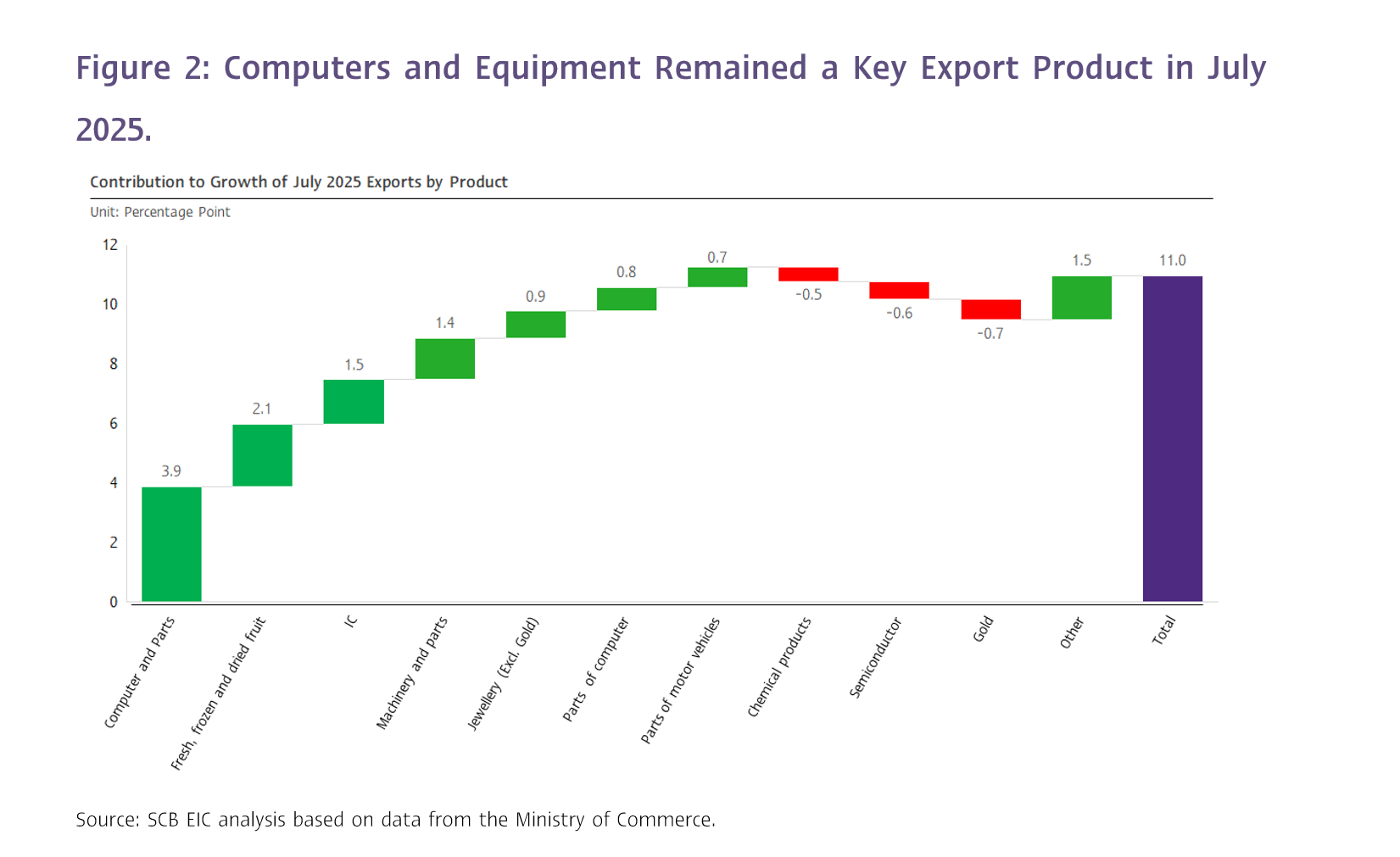

The value of Thai merchandise exports in July 2025 remained elevated, expanding by 11%YOY to USD 28,580.7 million. However, growth moderated from 15.5%YOY in the previous month, though the slowdown was less pronounced than anticipated (SCB EIC estimated 8.1%, and the Reuters Poll median projected 9.6%). Seasonally adjusted export data contracted by -1.6%MOM_SA from the previous month (following a -1.0%MOM_SA contraction in the prior month). Overall, Thai export value during the first seven months of the year continued to grow strongly at 14.4%. (Figure 1 and 2)

Exports this month continued to be supported by shipments to the United States and electronic product exports to multiple markets.

(1) The acceleration of exports to the United States (Front-Loading) ahead of the full impact of tariff measures in August led to a strong 31.4%YOY expansion in July, albeit slowing from 41.9%YOY in the previous month. Exports to the US grew across 14 out of 15 major product categories, especially in key electronic items that have yet to be subject to specific US tariffs—potentially to be announced later—including computers, equipment and parts (+84.9%), teleprinters, telephone sets and parts (+24.4%), and integrated circuit boards (+45.2%). In addition, Thailand exported as much as USD 161.9 million worth of unwrought gold to the US, compared to just USD 0.01 million in the previous month. However, exports of automobiles, equipment, and parts—already subject to a 25% product-specific tariff by the US—contracted sharply by -26.7%, a much steeper decline than the -2.6% recorded in the previous month. Overall, exports to the US contributed 5.8 percentage points to Thailand’s total export growth of 11%.

(2) Exports of various electronic products continued to perform well. Exports of computers, equipment, and parts surged by 61%, up from 57.7% in the previous month. However, growth in the US and Chinese markets slowed to 84.9% and 38.2%, respectively, from over 118% and 122.8% in the prior month. Meanwhile, exports of this product group saw exceptionally high growth in Malaysia, India, and Singapore at 238.0%, 180.5%, and 165.2%, respectively. As for electronic integrated circuits , exports expanded strongly by 57.7%, accelerating from 47.8% in the previous month, especially to Taiwan (291.2%), Hong Kong (78.0%), and China (69.4%), which together accounted for over 53% of Thailand’s total electronic integrated circuits exports this month.

Exports of electric transformers and parts, as well as Transmission apparatus , also expanded robustly. Overall, exports in this category contributed 6.2 percentage points to Thailand’s total export growth in July, accounting for more than half of the 11% headline expansion.

(3) Agricultural exports expanded considerably by 21.5%, driven by exports of fresh, frozen and dried fruit, which soared by 107.7%. Notably, exports to China surged by 123.3%, accounting for 92.1% of Thailand’s total export value for this product category. In addition, exports of spices and medicinal plants , as well as eatable meat and other animal parts , also posted strong growth at 93.6% and 84.6%, respectively. Exports of fresh, frozen and dried fruit alone contributed 2.1 percentage points to Thailand’s total export growth of 11% this month.

The value of merchandise imports slowed, in line with the trend in export value.

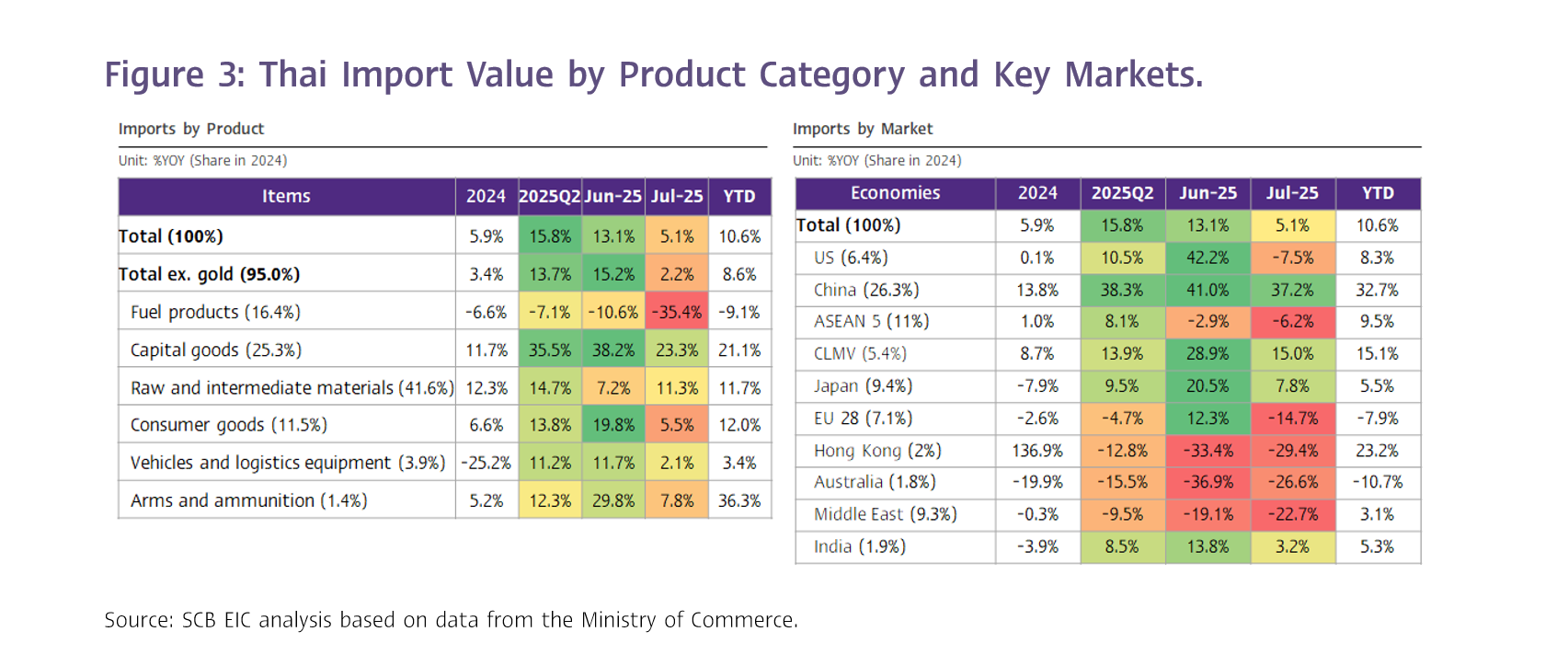

The value of merchandise imports in July stood at USD 28,258.6 million, expanding by 5.1%YOY—slowing from 13.1% in June and 18.0% in May. This figure came in below expectations (SCB EIC estimated 7.5%, Reuters Poll median at 4.9%). Imports of capital goods were the main contributor, rising sharply by 23.3%, particularly from China, which continued to grow by 54.2%, up from 48.7% in June and 45.9% in May. Imports from China accounted for 50.5% of Thailand’s total capital goods imports this month.

Meanwhile, imports of raw and intermediate materials (including gold), arms and ammunition , consumer goods, and vehicles and logistics equipment expanded by 11.3%, 7.8%, 5.5%, and 2.1%, respectively. In contrast, fuel products imports contracted by -10.6%, marking the 11th consecutive month of decline (Figure 3).

Thailand’s customs basis trade balance in July recorded a surplus of USD 322.1 million—contrary to prior expectations of a deficit (SCB EIC projected -1,300 million, Reuters Poll median at -500 million). Cumulatively, during the first seven months of 2025, the trade balance returned to a surplus of USD 259.9 million.

The United States announced new reciprocal tariffs, and Thailand successfully negotiated a reduction of nearly half to 19%, improving the outlook and lowering the likelihood of a worst-case scenario

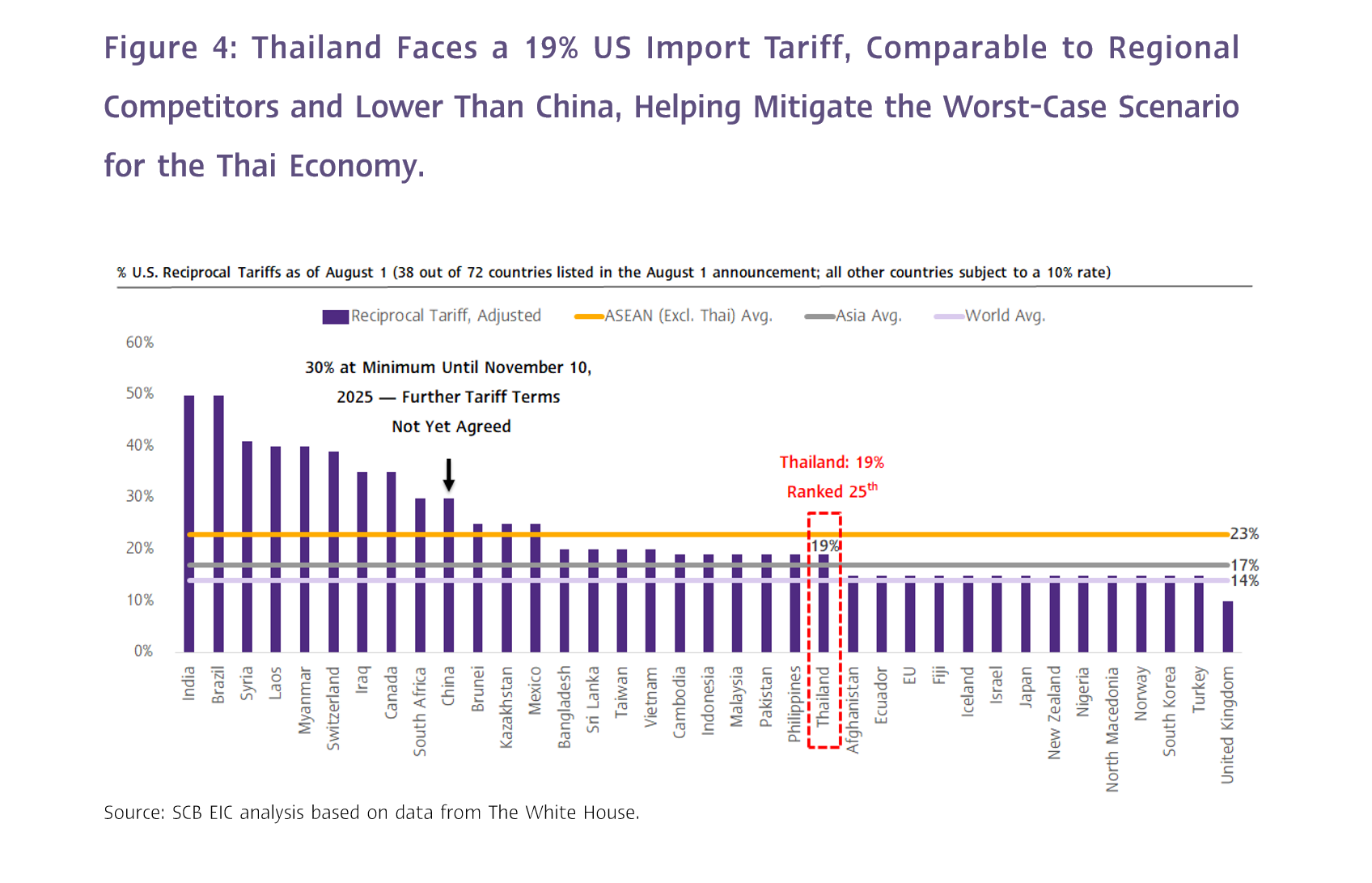

On July 31, 2025, the White House announced new reciprocal tariff rates on 72 trading partner countries, ranging from 10% to 50% (including country-specific tariffs), effective from August 7, 2025. Additionally, the US will impose a 40% transshipment tariff on goods in transit or on imports involving production processes with low local content or regional value content. However, details regarding the transshipment tariff remain unclear, particularly the criteria the US will use to determine the proportion of local content or regional value content required in the production and export process. Countries not included in the announcement will be subject to a minimum tariff rate of 10%.

Overall, the new retaliatory tariff rates announced by the United States were less severe than previously threatened in July, helping to reduce the likelihood of a worst-case scenario for the global economy.

1.The retaliatory tariff on Thai goods was lowered from the previously threatened rate of 36% to 19%, aligning with ASEAN competitors such as the Philippines, Malaysia, Indonesia, and Cambodia (all at 19%), and Vietnam (20%). These rates are lower than the 30% rate imposed on Chinese goods through November. Thailand’s negotiation outcome helped ease concerns over a potential significant loss of competitiveness in the US market to ASEAN and Chinese competitors.

2. The average retaliatory tariff on ASEAN goods decreased from 28% to 23%; for Asia, it declined from 19% to 17%; and the global average dropped from 16% to 14%.

3. However, the US imposed high retaliatory tariffs on BRICS countries, with Brazil and India at 50%, China at 30%, and South Africa at 30%. Russia remains under US trade sanctions. (Figure 4)

SCB EIC expects Thai exports to continue expanding this year, with a slowdown anticipated in Q3 and a sharp contraction in Q4. Meanwhile, the outlook for Thai exports in 2026 points to a contraction, particularly in the first half of the year.

Based on stronger-than-expected export data over the first seven months of the year, SCB EIC has revised its forecast for Thailand’s export value growth in 2025 to 3.0%, up from the previous projection of -0.1%. The upward revision is primarily due to:

1. Increased clarity in global trade policies and easing tensions between China and the United States (following the US decision to extend the 30% tariff on Chinese imports by another 90 days until November 10), which is expected to have a smaller negative impact on the global economy than previously anticipated.

2. Thailand’s successful negotiation to reduce the US import tariff rate by nearly half to 19%.

3. Strong Thai export growth of 14.4% during the first seven months, driven by accelerated shipments to the US—particularly electronic products that remain exempt from product-specific tariffs.

4. The temporary boost from special factor of exporting gold to India in Q1 this year.

5. A low base effect in H1/2024.

SCB EIC’s outlook aligns with the Ministry of Commerce’s view that Thai export value will begin to slow in August, while projecting full-year export growth in the range of 2–3%, with the possibility of exceeding this range.

Nonetheless, Thai exports are likely to contract considerably toward the end of 2025, particularly in Q4, due to the following factors:

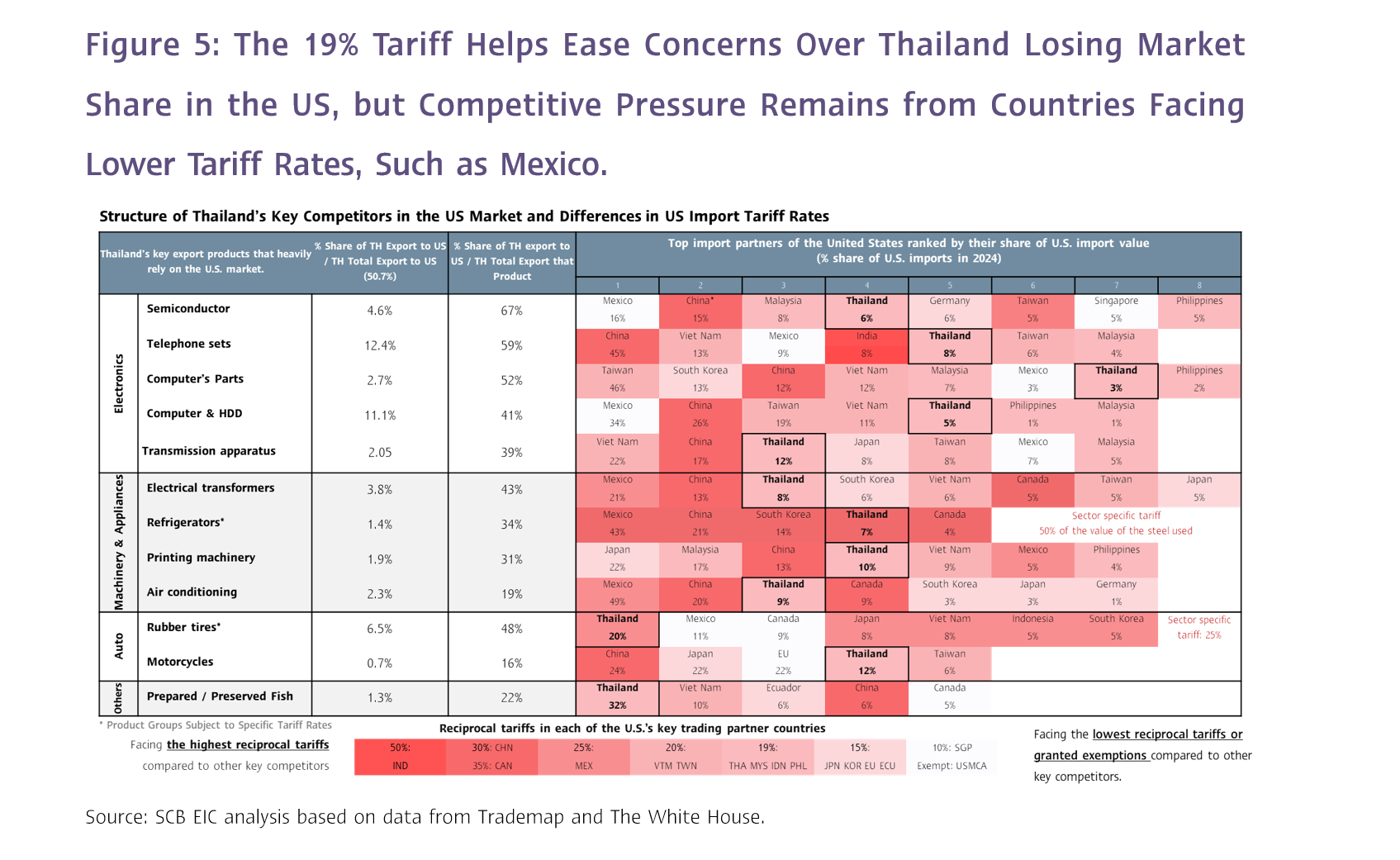

1) Thai exports continue to face both direct and indirect impacts from US import tariffs. Although many countries worldwide have successfully negotiated lower US tariff rates, the current rates remain higher than those prior to the Trump 2.0 administration and significantly above the minimum 10% rate imposed between April and July. As a result, the negative effects on the global economy are expected to become more evident. Moreover, US import tariffs on Thai goods remain higher than those imposed on several competitor countries exporting similar products to the US market (Figure 5), reflecting that Thai exports still face direct impacts from US tariffs—both through income and substitution effects—as well as indirect impacts from a global economic slowdown.

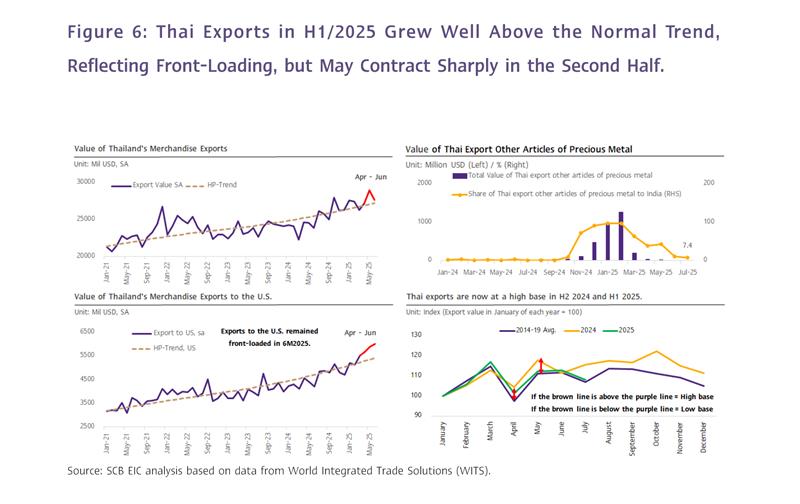

2) The supporting factors present in the first half of the year have faded. These include the front-loading of exports to the US, which is gradually tapering off; the special gold exports to India, which ended after Q1; and the low base effect from H1/2024—when exports grew by only 1.9%—which has now turned into a high base effect in the second half of this year, as exports grew strongly by 9% in H2/2024 (Figure 6, right).

3) Thai exports have expanded well above the normal trend for several consecutive months and are thus likely to contract in order to offset the earlier abnormal surge. As shown in Figure 6 (left), Thailand’s export value strongly exceeded the average during January–June (the purple line is above the brown line), particularly for exports to the US. This reflects the front-loading of shipments before the US began imposing retaliatory tariffs on its trading partners. Therefore, in the second half of the year, export values are expected to return to or fall below the average to compensate for the earlier outperformance.

For 2026, SCB EIC projects that the value of Thai exports is likely to contract by -1.5%, particularly in the first half of the year, due to the high base effect (exports grew by 15.0% in H1/2025), along with several factors that will continue to weigh on Thai exports from the remainder of this year.

Additional downside risks in the remainder of this year and into next year.

1) US–China relations may become tense again after the temporary reduction in high tariff barriers expires, potentially leading to a further slowdown in the global economy.

2) The United States is preparing to announce additional product-specific tariffs on several items, including pharmaceuticals and medical supplies, large trucks, and wood and wood products—particularly electronic goods, which are key Thai exports and highly dependent on the US market. For instance, computers, equipment, and parts were Thailand’s top export to the US in 2024, accounting for 19.2% of total Thai exports value to the US and 42.9% of Thailand’s total export value for this product category. Trump has threatened to impose additional import tariffs on electronic goods ranging from 100% to 300% in early August.

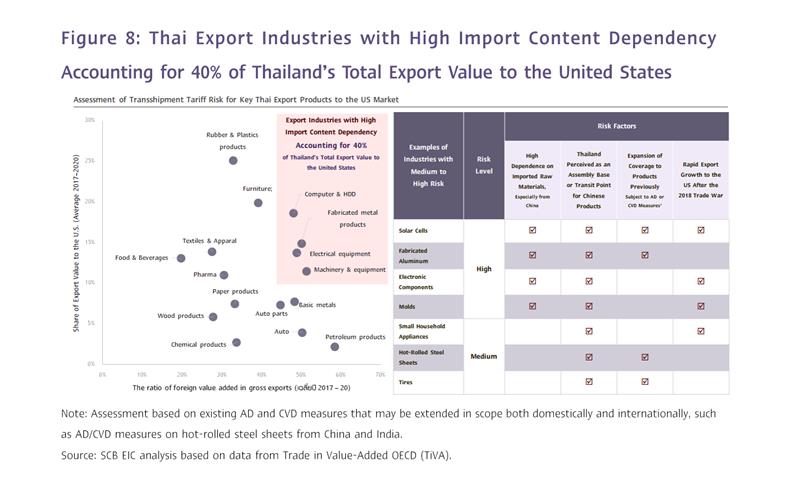

3) If the US mandates high local content requirements, Thai products could face a 40% transshipment tariff, substantially impacting Thai exports. Currently, export sectors in Thailand that rely heavily on import content account for approximately 40% of the country’s total export value to the U.S. (Figure 8). Certain export categories—such as solar cells, fabricated aluminum, electronic components, and molds—are at high risk of being subject to the transshipment tariff due to their high import content. Meanwhile, small household appliances, hot-rolled steel sheets, and tires face a moderate level of risk.

4) The Thai baht may continue to appreciate significantly against regional competitors. Recently, the baht has strengthened considerably, with the baht index (as of August 22) appreciating by 6.6%YOY, while the currencies of China, the Philippines, South Korea, India, and Vietnam have depreciated. This could further undermine the competitiveness of Thai exports at a time when they are already facing obstacles from U.S. tariff barriers.

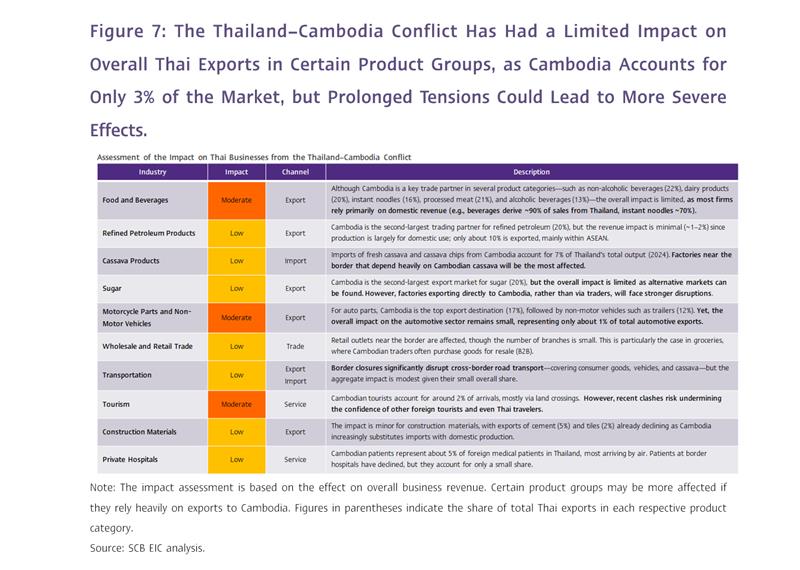

5) The Thailand–Cambodia border conflict may become prolonged and more severe, potentially exerting greater negative impacts on Thai exports in certain industries, such as automotive. Although Cambodia accounted for only 3.4% of Thailand’s total export value in 2024—indicating relatively low dependence and limited current impact. For example, the conflict mainly affects exports of motorcycle parts and non-automotive vehicles (Cambodia is Thailand’s top trading partner for motorcycle parts and the second largest for non-automotive vehicles, such as trailers). However, overall automotive exports to Cambodia make up only 1% of Thailand’s total automotive exports (Figure 7).

![trade-en1.jpg]()

![trade-en2.png]()

![trade-en3.png]()

![trade-en4.png]()

![trade-en5.png]()

![trade-en6.jpg]()

![trade-en7.jpg]()

![trade-en8.jpg]()

Exports this month continued to be supported by shipments to the United States and electronic product exports to multiple markets.

(1) The acceleration of exports to the United States (Front-Loading) ahead of the full impact of tariff measures in August led to a strong 31.4%YOY expansion in July, albeit slowing from 41.9%YOY in the previous month. Exports to the US grew across 14 out of 15 major product categories, especially in key electronic items that have yet to be subject to specific US tariffs—potentially to be announced later—including computers, equipment and parts (+84.9%), teleprinters, telephone sets and parts (+24.4%), and integrated circuit boards (+45.2%). In addition, Thailand exported as much as USD 161.9 million worth of unwrought gold to the US, compared to just USD 0.01 million in the previous month. However, exports of automobiles, equipment, and parts—already subject to a 25% product-specific tariff by the US—contracted sharply by -26.7%, a much steeper decline than the -2.6% recorded in the previous month. Overall, exports to the US contributed 5.8 percentage points to Thailand’s total export growth of 11%.

(2) Exports of various electronic products continued to perform well. Exports of computers, equipment, and parts surged by 61%, up from 57.7% in the previous month. However, growth in the US and Chinese markets slowed to 84.9% and 38.2%, respectively, from over 118% and 122.8% in the prior month. Meanwhile, exports of this product group saw exceptionally high growth in Malaysia, India, and Singapore at 238.0%, 180.5%, and 165.2%, respectively. As for electronic integrated circuits , exports expanded strongly by 57.7%, accelerating from 47.8% in the previous month, especially to Taiwan (291.2%), Hong Kong (78.0%), and China (69.4%), which together accounted for over 53% of Thailand’s total electronic integrated circuits exports this month.

Exports of electric transformers and parts, as well as Transmission apparatus , also expanded robustly. Overall, exports in this category contributed 6.2 percentage points to Thailand’s total export growth in July, accounting for more than half of the 11% headline expansion.

(3) Agricultural exports expanded considerably by 21.5%, driven by exports of fresh, frozen and dried fruit, which soared by 107.7%. Notably, exports to China surged by 123.3%, accounting for 92.1% of Thailand’s total export value for this product category. In addition, exports of spices and medicinal plants , as well as eatable meat and other animal parts , also posted strong growth at 93.6% and 84.6%, respectively. Exports of fresh, frozen and dried fruit alone contributed 2.1 percentage points to Thailand’s total export growth of 11% this month.

The value of merchandise imports slowed, in line with the trend in export value.

The value of merchandise imports in July stood at USD 28,258.6 million, expanding by 5.1%YOY—slowing from 13.1% in June and 18.0% in May. This figure came in below expectations (SCB EIC estimated 7.5%, Reuters Poll median at 4.9%). Imports of capital goods were the main contributor, rising sharply by 23.3%, particularly from China, which continued to grow by 54.2%, up from 48.7% in June and 45.9% in May. Imports from China accounted for 50.5% of Thailand’s total capital goods imports this month.

Meanwhile, imports of raw and intermediate materials (including gold), arms and ammunition , consumer goods, and vehicles and logistics equipment expanded by 11.3%, 7.8%, 5.5%, and 2.1%, respectively. In contrast, fuel products imports contracted by -10.6%, marking the 11th consecutive month of decline (Figure 3).

Thailand’s customs basis trade balance in July recorded a surplus of USD 322.1 million—contrary to prior expectations of a deficit (SCB EIC projected -1,300 million, Reuters Poll median at -500 million). Cumulatively, during the first seven months of 2025, the trade balance returned to a surplus of USD 259.9 million.

The United States announced new reciprocal tariffs, and Thailand successfully negotiated a reduction of nearly half to 19%, improving the outlook and lowering the likelihood of a worst-case scenario

On July 31, 2025, the White House announced new reciprocal tariff rates on 72 trading partner countries, ranging from 10% to 50% (including country-specific tariffs), effective from August 7, 2025. Additionally, the US will impose a 40% transshipment tariff on goods in transit or on imports involving production processes with low local content or regional value content. However, details regarding the transshipment tariff remain unclear, particularly the criteria the US will use to determine the proportion of local content or regional value content required in the production and export process. Countries not included in the announcement will be subject to a minimum tariff rate of 10%.

Overall, the new retaliatory tariff rates announced by the United States were less severe than previously threatened in July, helping to reduce the likelihood of a worst-case scenario for the global economy.

1.The retaliatory tariff on Thai goods was lowered from the previously threatened rate of 36% to 19%, aligning with ASEAN competitors such as the Philippines, Malaysia, Indonesia, and Cambodia (all at 19%), and Vietnam (20%). These rates are lower than the 30% rate imposed on Chinese goods through November. Thailand’s negotiation outcome helped ease concerns over a potential significant loss of competitiveness in the US market to ASEAN and Chinese competitors.

2. The average retaliatory tariff on ASEAN goods decreased from 28% to 23%; for Asia, it declined from 19% to 17%; and the global average dropped from 16% to 14%.

3. However, the US imposed high retaliatory tariffs on BRICS countries, with Brazil and India at 50%, China at 30%, and South Africa at 30%. Russia remains under US trade sanctions. (Figure 4)

SCB EIC expects Thai exports to continue expanding this year, with a slowdown anticipated in Q3 and a sharp contraction in Q4. Meanwhile, the outlook for Thai exports in 2026 points to a contraction, particularly in the first half of the year.

Based on stronger-than-expected export data over the first seven months of the year, SCB EIC has revised its forecast for Thailand’s export value growth in 2025 to 3.0%, up from the previous projection of -0.1%. The upward revision is primarily due to:

1. Increased clarity in global trade policies and easing tensions between China and the United States (following the US decision to extend the 30% tariff on Chinese imports by another 90 days until November 10), which is expected to have a smaller negative impact on the global economy than previously anticipated.

2. Thailand’s successful negotiation to reduce the US import tariff rate by nearly half to 19%.

3. Strong Thai export growth of 14.4% during the first seven months, driven by accelerated shipments to the US—particularly electronic products that remain exempt from product-specific tariffs.

4. The temporary boost from special factor of exporting gold to India in Q1 this year.

5. A low base effect in H1/2024.

SCB EIC’s outlook aligns with the Ministry of Commerce’s view that Thai export value will begin to slow in August, while projecting full-year export growth in the range of 2–3%, with the possibility of exceeding this range.

Nonetheless, Thai exports are likely to contract considerably toward the end of 2025, particularly in Q4, due to the following factors:

1) Thai exports continue to face both direct and indirect impacts from US import tariffs. Although many countries worldwide have successfully negotiated lower US tariff rates, the current rates remain higher than those prior to the Trump 2.0 administration and significantly above the minimum 10% rate imposed between April and July. As a result, the negative effects on the global economy are expected to become more evident. Moreover, US import tariffs on Thai goods remain higher than those imposed on several competitor countries exporting similar products to the US market (Figure 5), reflecting that Thai exports still face direct impacts from US tariffs—both through income and substitution effects—as well as indirect impacts from a global economic slowdown.

2) The supporting factors present in the first half of the year have faded. These include the front-loading of exports to the US, which is gradually tapering off; the special gold exports to India, which ended after Q1; and the low base effect from H1/2024—when exports grew by only 1.9%—which has now turned into a high base effect in the second half of this year, as exports grew strongly by 9% in H2/2024 (Figure 6, right).

3) Thai exports have expanded well above the normal trend for several consecutive months and are thus likely to contract in order to offset the earlier abnormal surge. As shown in Figure 6 (left), Thailand’s export value strongly exceeded the average during January–June (the purple line is above the brown line), particularly for exports to the US. This reflects the front-loading of shipments before the US began imposing retaliatory tariffs on its trading partners. Therefore, in the second half of the year, export values are expected to return to or fall below the average to compensate for the earlier outperformance.

For 2026, SCB EIC projects that the value of Thai exports is likely to contract by -1.5%, particularly in the first half of the year, due to the high base effect (exports grew by 15.0% in H1/2025), along with several factors that will continue to weigh on Thai exports from the remainder of this year.

Additional downside risks in the remainder of this year and into next year.

1) US–China relations may become tense again after the temporary reduction in high tariff barriers expires, potentially leading to a further slowdown in the global economy.

2) The United States is preparing to announce additional product-specific tariffs on several items, including pharmaceuticals and medical supplies, large trucks, and wood and wood products—particularly electronic goods, which are key Thai exports and highly dependent on the US market. For instance, computers, equipment, and parts were Thailand’s top export to the US in 2024, accounting for 19.2% of total Thai exports value to the US and 42.9% of Thailand’s total export value for this product category. Trump has threatened to impose additional import tariffs on electronic goods ranging from 100% to 300% in early August.

3) If the US mandates high local content requirements, Thai products could face a 40% transshipment tariff, substantially impacting Thai exports. Currently, export sectors in Thailand that rely heavily on import content account for approximately 40% of the country’s total export value to the U.S. (Figure 8). Certain export categories—such as solar cells, fabricated aluminum, electronic components, and molds—are at high risk of being subject to the transshipment tariff due to their high import content. Meanwhile, small household appliances, hot-rolled steel sheets, and tires face a moderate level of risk.

4) The Thai baht may continue to appreciate significantly against regional competitors. Recently, the baht has strengthened considerably, with the baht index (as of August 22) appreciating by 6.6%YOY, while the currencies of China, the Philippines, South Korea, India, and Vietnam have depreciated. This could further undermine the competitiveness of Thai exports at a time when they are already facing obstacles from U.S. tariff barriers.

5) The Thailand–Cambodia border conflict may become prolonged and more severe, potentially exerting greater negative impacts on Thai exports in certain industries, such as automotive. Although Cambodia accounted for only 3.4% of Thailand’s total export value in 2024—indicating relatively low dependence and limited current impact. For example, the conflict mainly affects exports of motorcycle parts and non-automotive vehicles (Cambodia is Thailand’s top trading partner for motorcycle parts and the second largest for non-automotive vehicles, such as trailers). However, overall automotive exports to Cambodia make up only 1% of Thailand’s total automotive exports (Figure 7).