CLMV Outlook by EIC Q3/2020

With stringent lockdown measures, CLMV countries in 1H20 were able to contain the COVID-19 outbreak and ease their lockdown measures

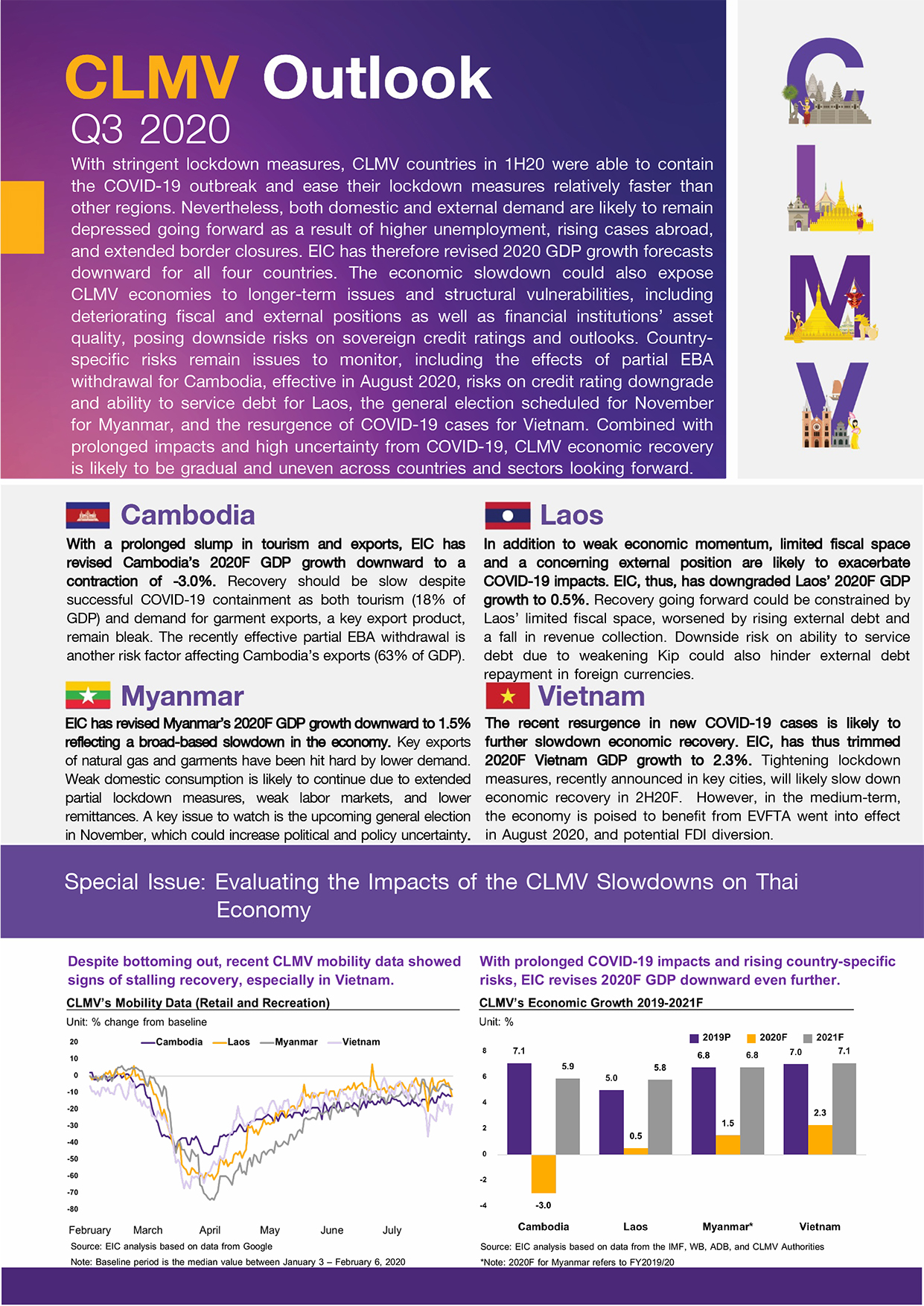

With stringent lockdown measures, CLMV countries in 1H20 were able to contain the COVID-19 outbreak and ease their lockdown measures relatively faster than other regions. Nevertheless, both domestic and external demand are likely to remain depressed going forward as a result of higher unemployment, rising cases abroad, and extended border closures. EIC has therefore revised 2020 GDP growth forecasts downward for all four countries. The economic slowdown could also expose CLMV economies to longer-term issues and structural vulnerabilities, including deteriorating fiscal and external positions as well as financial institutions’ asset quality, posing downside risks on sovereign credit ratings and outlooks. Country-specific risks remain issues to monitor, including the effects of partial EBA withdrawal for Cambodia, effective in August 2020, risks on credit rating downgrade and ability to service debt for Laos, the general election scheduled for November for Myanmar, and the resurgence of COVID-19 cases for Vietnam. Combined with prolonged impacts and high uncertainty from COVID-19, CLMV economic recovery is likely to be gradual and uneven across countries and sectors looking forward.

|