AEC and beyond … What’s next to Thai farm sector?

Unquestionably, one of several hot topics facing Thai society nowadays is the ongoing integration into the ASEAN Economic Community (AEC), which will officially take place in less than three years from now. This, naturally, presents both opportunities and challenges for Thailand, especially in the agricultural sector, which has long been our economic backbone and main source of employment. But what will be the benefits and challenges for Thailand's farm sector? And how should we prepare to reap the potential gains...?

ผู้เขียน: SCB EIC | Economic Intelligence Center

Unquestionably, one of several hot topics facing Thai society nowadays is the ongoing integration into the ASEAN Economic Community (AEC), which will officially take place in less than three years from now. This, naturally, presents both opportunities and challenges for Thailand, especially in the agricultural sector, which has long been our economic backbone and main source of employment. But what will be the benefits and challenges for Thailand's farm sector? And how should we prepare to reap the potential gains...?

Firstly, AEC means more opportunities to expand Thai agricultural shipments in the region. Southeast Asia is already one of Thailand's main agricultural export destinations. Thailand's farm shipments to ASEAN countries totaled around 270 billion baht in 2011, growing by 24% from the year before, mainly rubber, sugar, rice and various grains. AEC rules will give Thai exporters better access to the region's nearly 600 million people. And regional shipments of goods will become freer and more efficient because tax barriers will be eventually eliminated. Transport systems will become more deeply integrated, and logistics system will significantly improve. In other words, AEC will enable easier movement of goods, services, investment, capital and people. Ultimately, it will offer new ways of coordinating supply chains, or access to new markets for established products.

One noticeable industry set to benefit is sugar. As the largest sugar producer and exporter among ASEAN, Thailand is optimally positioned to serve regional demand, which is expected to grow steadily. Southeast Asia faces a long-term sugar deficit, as regional demand continues to outpace supply, driven especially by Indonesia, which is Thailand's biggest market. As new consumer demand emerges and usage of ethanol ramps up, we should maximize this sweet opportunity.

Beyond trade, AEC will also increase prospects for direct investment. Entrepreneurs who are financially and technologically prepared will discover new opportunities to invest in nearby countries that are rich in resources and other production inputs, especially cheap labor. To date, Thai agricultural investments in the ASEAN region have mainly focused on contract farming, whereby companies obtain land concessions for production of crops. The raw farm goods are brought to Thailand for processing and/or export to third countries. AEC will make it easier to invest in producing and processing farm goods. Companies can move their manufacturing operations to the countries that are best suited to host them, and can more easily spread and share their operating bases. AEC will build on the agricultural cooperation strategies outlined by ACMECS, the Ayeyawady-Chao Phraya-Mekong Economic Cooperation Strategy agreement established in 2003 by Thailand, Laos, Cambodia, Vietnam and Myanmar. Going forward, thus, agricultural development and investment will become more open and diversified within the region.

Among the original ASEAN members, or ASEAN-6, Indonesia offers the most opportunities for agricultural investment, especially for agro-processing industries. Indonesia has almost three times the agricultural area of Thailand, and the most farmland in Southeast Asia, while their agricultural labor force is 2.5 times as large as Thailand's. Indonesia also enjoys good terrain and weather for growing crops, especially on the two main islands of Java and Sumatra. Yet Indonesia's farm output is insufficient for the huge domestic consumption of such commodities as rice, corn, cassava, palm oil, cocoa, and coffee. Thailand has a golden opportunity to help fill the gap for Indonesia's population of over 240 million people. Besides, there are also good prospects to invest in agro-processing industries and adding value to agricultural products, with strong support from the Indonesian government. Certainly, these are areas where Thailand is already at an advantage.

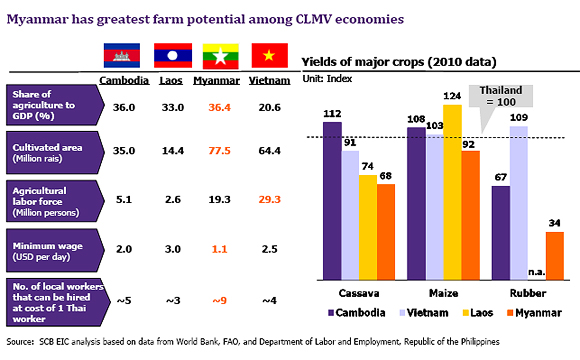

Myanmar is the most enticing country among the new ASEAN members, also known as the CLMV countries. Myanmar has a higher contribution of agricultural sector to GDP than Cambodia, Laos or Vietnam, supported by around 78 million rais of farmland and an agricultural workforce of 19 million people. It also has the lowest minimum wages among the CLMV countries. Yet productivity in growing many industrial crops in Myanmar is very low compared to Thailand and other ASEAN countries. This means there is a great opportunity for Thai companies to invest in Myanmar in order to help raise output and efficiency.

But AEC opens a two-way road. More regional farm goods will enter Thailand and compete in the domestic market. This will mean more competition for Thai producers, especially those with higher production costs compared to other ASEAN rivals. In rice, for example, Thailand will be pressured by higher competition from Vietnam. Malaysia and Indonesia compete well in palm oil, as Vietnam does in coffee and the Philippines in coconuts. Thailand needs to get ready. The government should help propel change by setting a national agenda for farm goods so that producers can increase efficiency, reduce costs and differentiate.

The Thai government should boost agricultural research and development and expand irrigation. The government still invests very little in agricultural R&D. A clear example is the R&D budget allocated for the rice industry, covering the country's most important crop. Thailand's spending is 15 times less than that of Vietnam, our major competitor in rice. Besides, Vietnam also has better irrigation, covering 80% of its rice fields, compared to Thailand's 25%. Thailand, thus, has to develop basic infrastructure programs to increase competitiveness. We have to seriously and consistently support agricultural R&D.

Thai farmers themselves must be readied for change. Surveys show that most Thai farmers lack an understanding of the AEC, which is an extremely worrying issue. The government needs to immediately start educating farmers and push them to be well-prepared for change as soon as possible, in order to raise their competitiveness and grasp new opportunities. Farmers have to shift from traditional practices to more modern ones. Efficient management systems based on co-operation among farmers can help ensure competitiveness and quality control. By forming cooperatives or other groups, farmers can become better informed on production and marketing techniques and better understand ASEAN consumer needs. We must also re-brand, to differentiate our products from competitors, penetrate niche markets and reach high-income consumers. This will help give them a better platform to better take care of AEC opportunities.

Going forward, the principle of comparative advantage and product specialization should become the golden rule. While greater integration within ASEAN will create new opportunities for regional producers, it will also create a more competitive environment in some markets that are currently protected, potentially threatening high-cost producers. So each country should focus on what it can produce best at the lowest cost, benefiting from specialization and economies of scale. This will generate greater gains for all than if we each try to produce everything on our own. One good example is palm oil.

It is economically justifiable for Malaysia to continue to specialize and expand palm oil production to enhance its intra-ASEAN trade under the principle of comparative advantage. While some other countries, including Thailand, should put more emphasis on promoting the development of value-added agro-industries using highly advanced techniques and marketing.

Last but not least, one major key to success is reducing non-tariff barriers and streamlining of certain administrative procedures, such as agricultural quality standards and policies, control of disease and insects outbreak, rules of origin, or even some forms of domestic protection. These are still sensitive issues and currently create obstacles to distribution, limiting trade. If these barriers can be gradually reduced and eliminated, this will, surely, help facilitate trade and investment as well as expand the region's farm industries.