Exports in April 2025 Remain Robust, though Signs of Slowdown from a Trade War Are Becoming More Apparent.

SCB EIC expects Thai exports to slow down in Q2 and contract in the second half of the year.

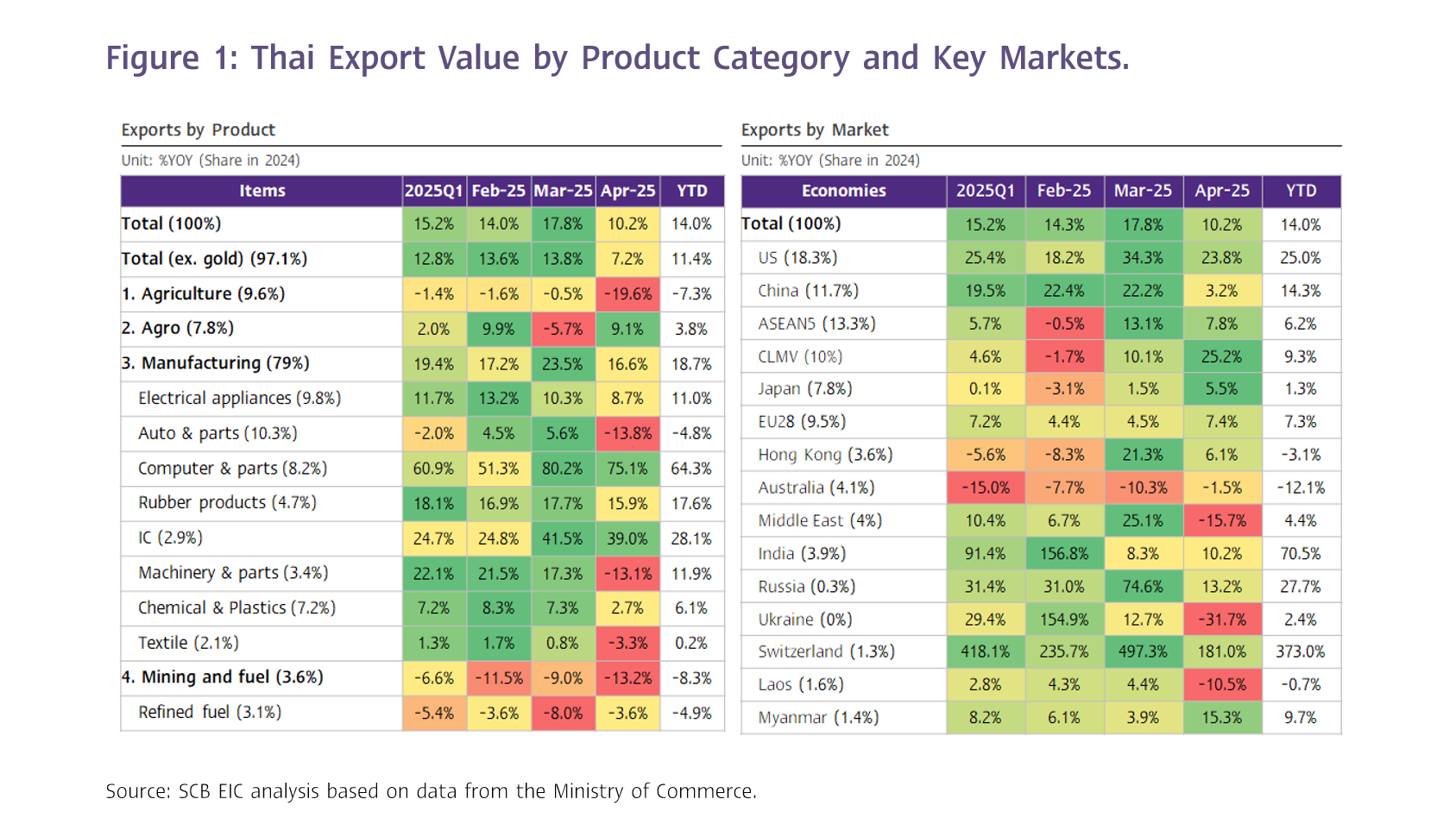

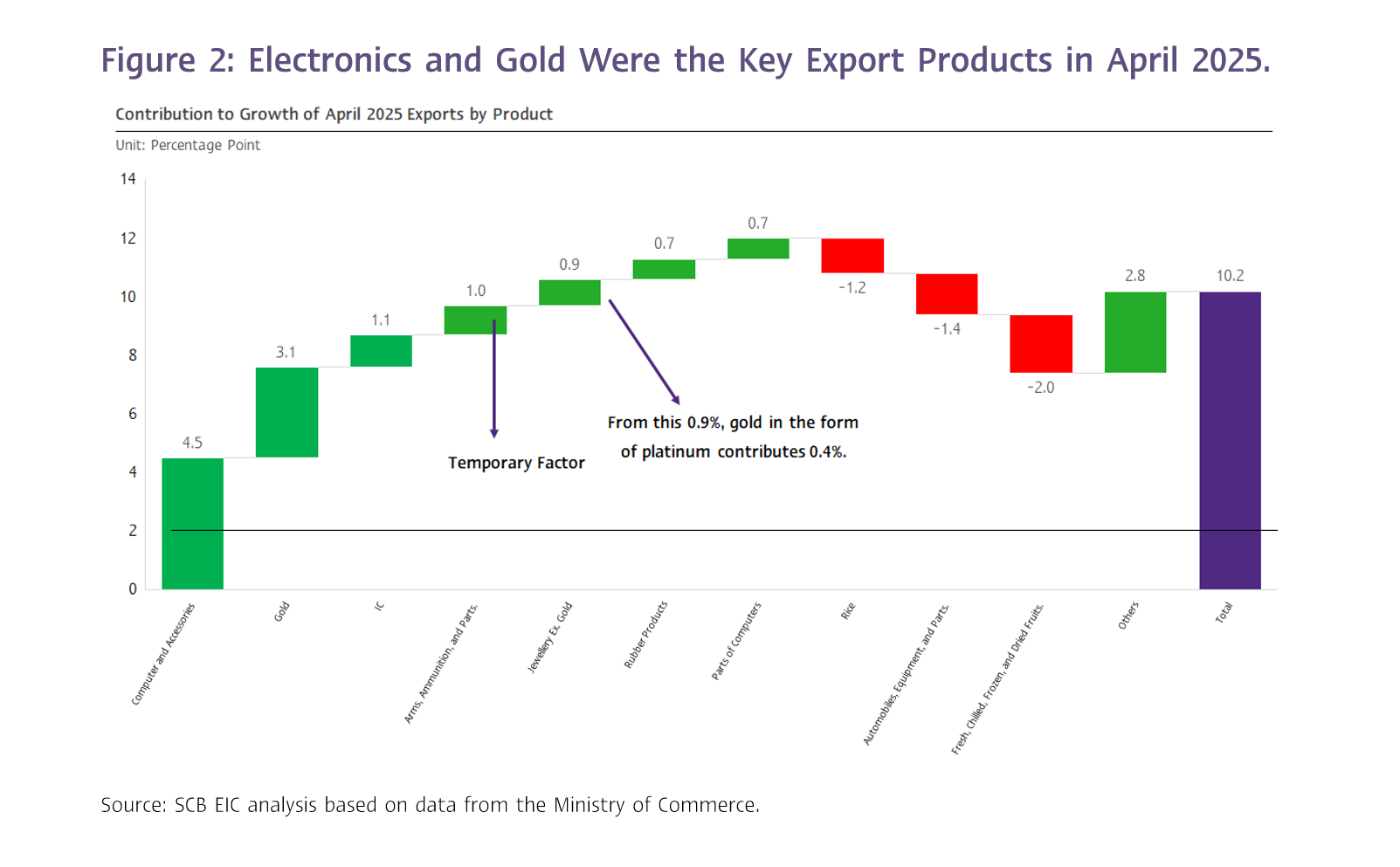

The value of Thai merchandise exports in April 2025 grew by 10.2%YOY, reaching USD 25,625.1 million—exceeding prior estimates (SCB EIC projected 5.3%, Reuters Poll median at 10%). Thai exports this month continued to expand solidly following the 15.2% growth recorded in Q1, bringing the cumulative export growth for the first four months of this year to 14%. However, seasonally adjusted exports contracted by -1.9%MOM_SA, reflecting a notable slowdown from the previous month (Figure 1 and 2).

SCB EIC assesses that Thai exports this month continued to benefit from accelerated shipments to the US, despite the U.S. having implemented a minimum universal tariff of 10% on nearly all countries since April 9, along with specific tariffs of 25% on automobiles, steel, and aluminum. However, the imposition of reciprocal tariffs—additional tariffs above the 10% minimum—has been postponed by 90 days to July 9, and the US has not yet begun collecting specific tariffs on agricultural products, semiconductors, and electronics. As a result, accelerated exports to the US remain visible ahead of the full set of tariff measures taking effect.

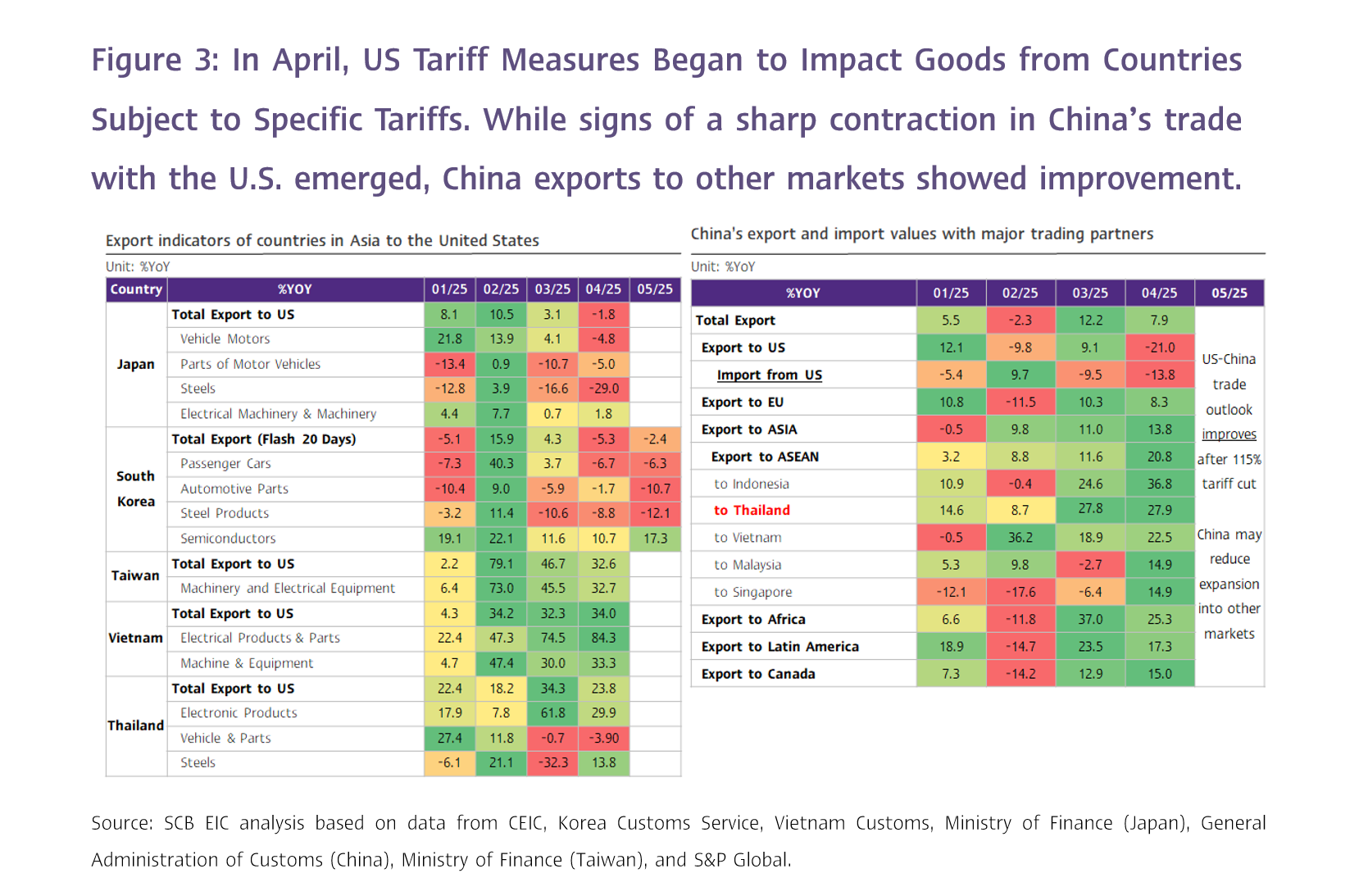

As a result, Thai exports to the US this month expanded considerably by 23.8%YOY, continuing from 34.3% in the previous month—particularly electronic machine products, which grew by 29.9%. Meanwhile, exports of motor cars, parts and accessories to the US began to contract this month by -3.8% (Figure 3, left). Although exports of steel products still grew by 13.8%, they are at risk of declining in the coming period. Notably, electronic machine products account for 38.3% of Thailand’s total exports to the US, while the shares of motor car-related products and steel products are relatively low at only 3.4% and 2.2%, respectively. Additionally, part of the strong export growth to the US this month was due to an unusually high increase in exports of arms, ammunition, and parts—surging by 1,925,055.6%—which is likely a temporary factor and does not reflect Thailand’s underlying export performance.

"Thailand’s frontloading trend (accelerated exports) to the U.S. mirrors that of other countries. Exports of electronic products to the US from Japan, South Korea, Vietnam, and Taiwan also recorded strong growth. In contrast, exports of steel, automobiles, and automotive parts contracted substantially in April (early trade data from South Korea for the first 20 days of May also reflects this pattern) (Figure 3, left). This indicates that the impact of the US tariff policy varies across countries, depending on the structure of their export products.

Countries who are heavily reliant on products face high tariff rates—such as the 25% tariff on automobiles and steel—are likely to experience more pronounced export disruptions. For example, Japan and South Korea, which depend heavily on automobile exports to the US (accounting for 36.0% and 33.5% of their total exports to the US, respectively), are expected to be more severely affected. On the other hand, countries that rely on exports of products currently exempt from high U.S. tariffs—such as electronic products—are likely to maintain strong export growth. Taiwan and Vietnam, for instance, export electronic products to the US at high shares of 79% and 50.4% of their total exports to the US, respectively, while their dependence on automobile and steel exports remains low.

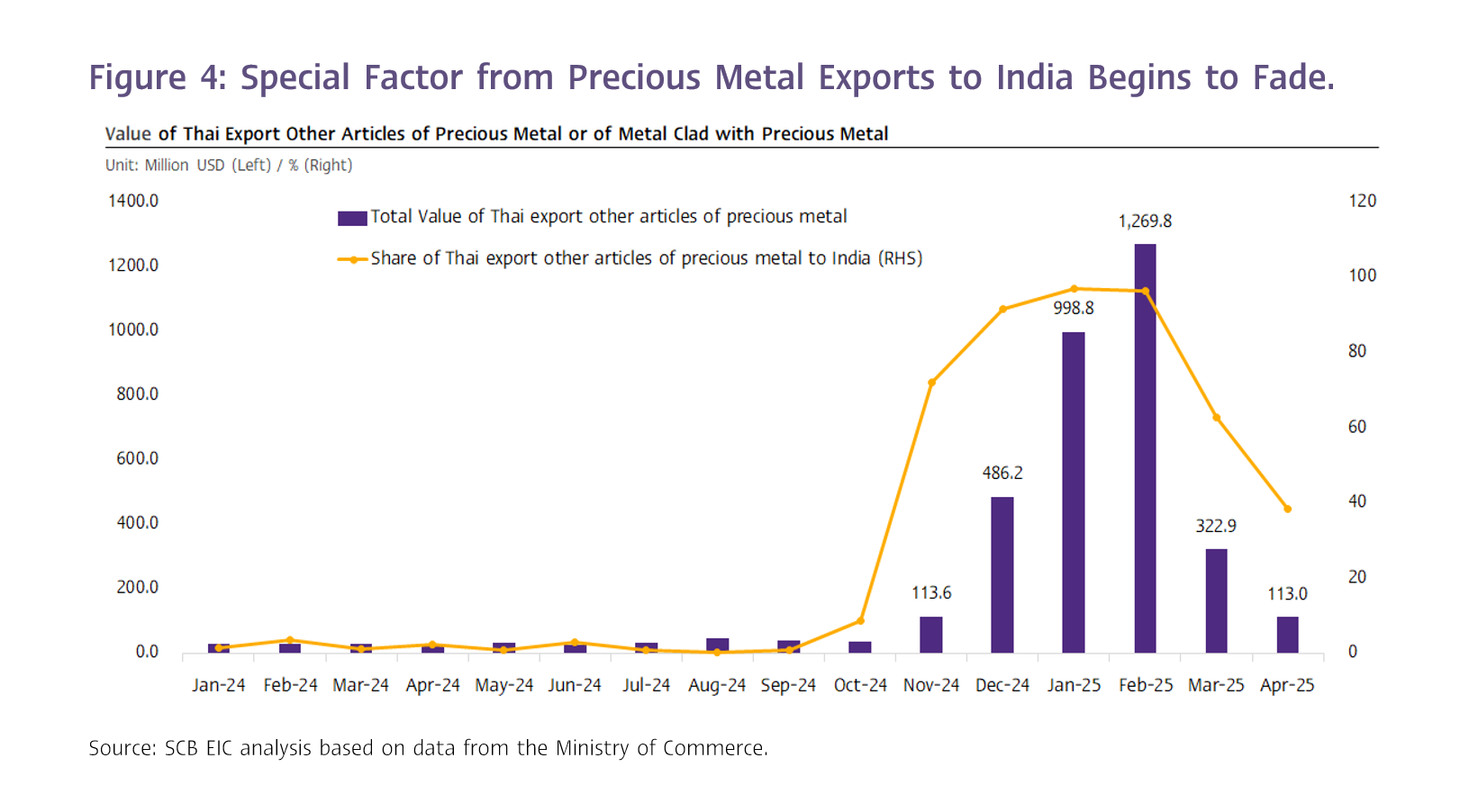

Gold remained a key driver of Thai exports this month; however, the special factor that had previously supported strong export growth has diminished considerably. Exports of unwrought gold continued to grow substantially by 250.5%, following 269.5% in the previous month, driven by heightened global demand for gold as a safe-haven asset amid rising risk and notably higher gold prices. Meanwhile, the special boost from exports of other articles of precious metal or of metal clad with precious metal—which SCB EIC assesses to be almost entirely gold mixed with a small proportion of platinum exported to India for importers' tax benefits—showed clear signs of weakening. The export value plunged to USD 113 million, a steep drop from the February peak of USD 1,269.8 million. (Figure 4).

The trade balance posted its largest decline in more than two years due to a spike in capital goods imports from China.

The value of merchandise imports in April stood at USD 28,946.42 million, expanding by 16.1%—exceeding prior estimates (SCB EIC projected 8.5%, Reuters Poll median at 7.9%) and accelerating from 10.2% in the previous month. Thai imports have now grown for ten consecutive months. Imports excluding gold rose substantially by 14.5%, with broad-based growth across nearly all categories: capital goods, raw materials and intermediate products (including gold), arms and ammunition , consumer goods, and fuel products, which expanded by 27.5% (notably imports from China surged by 38.8%), 17.4%, 16.1%, 11.9%, and 1.7%, respectively. Meanwhile, imports of vehicles and logistics equipment declined by -0.6%, marking the third consecutive month of contraction.

Thailand’s customs basis trade balance in April posted a deficit of USD -3,321.3 million, leading to

a cumulative trade deficit of USD -2,240.3 million for the first four months of 2025.

SCB EIC notes that the sharp increase in Thailand’s imports from China in April may be a result of China diverting trade routes to circumvent US tariffs. In April, the value of China’s exports to and imports from the US contracted sharply by -21.0% and -13.8%, respectively (Figure 3, right), following the imposition of reciprocal tariffs exceeding 100%. Nevertheless, China’s overall export value continued to grow solidly by 7.9%, as it expanded exports to other regions—particularly ASEAN markets, where exports surged by 20.8% (exports to Thailand increased by 27.9%).

These figures reflect China’s ability to offload export goods globally, leveraging its cost and scale advantages, which in turn affects the price competitiveness of Thai products. Moreover, if part of the Chinese goods entering Thailand are intended for re-export to the US—through processing or assembly in Thailand— as a means to circumvent high U.S. tariffs (constituting origin fraud), it could complicate Thailand’s trade negotiations with the U.S., which is closely monitoring such practices.

SCB EIC expects Thai exports to slow down in Q2 and contract in the second half of the year.

SCB EIC views that although Thai exports in April recorded solid growth, exports for the remainder of the year are expected to slow considerably, particularly in the second half, which may see

a contraction. This outlook is based on the following factors:

1. The impact of US tariff barriers is becoming more apparent, as evidenced by declining exports from China, South Korea, and Japan to the US. This signals that once the 90-day temporary suspension of reciprocal tariffs ends and the US begins imposing the full range of specific tariffs, global trade with the US is likely to deteriorate (Figure 3).

2. Global manufacturing is showing further signs of slowdown, especially in segments tied to international trade. This is reflected in some components of the Purchasing Managers’ Index (PMI), such as sharp contractions in new export orders and continued declines in backlogs of work.

3. Key export drivers seen in Q1 are beginning to fade, including a favorable upcycle in the electronics sector, front-loaded exports to the US ahead of tariff imposition, and special factors related to gold.

SCB EIC believes that the temporary agreement to reduce reciprocal tariffs between China and the United States highlights the urgency for Thailand to successfully conclude trade negotiations with the US within the 90-day window.

On May 12, China and the United States reached a temporary agreement to reduce reciprocal tariffs by 115% for a 90-day period (from May 14 to August 12). Under this agreement, China will impose

a 10% tariff on US imports, down from 125%, while the US will impose a 30% tariff on Chinese goods, down from 145%. However, the US will continue to collect specific tariffs of 25% on steel, aluminum, and automotive products from China.

Nonetheless, the US’s temporary suspension of reciprocal tariff imposition on other countries is set to expire on July 9. Countries unable to reach agreements with the US by then could face severe tariff hikes, as previously announced by the US on April 2—particularly several ASEAN countries at risk of facing higher reciprocal tariffs than China, such as Cambodia (49%), Vietnam (46%), and Thailand (36%).

SCB EIC views that the temporary reciprocal tariff reduction agreement between China and the United States, along with the progress of Thailand’s trade negotiations with the US, could impact Thai exports. This is because they will affect Thailand’s relative price competitiveness in the US market, given the uneven levels of reciprocal tariffs to be applied.

Therefore, securing a trade agreement with the United States within the 90-day timeframe is crucial for the outlook of Thai exports in the second half of the year. During the April data press briefing, the Ministry of Commerce expressed confidence in Thailand’s readiness to finalize negotiations with the US within this period, aiming to secure a reciprocal tariff rate for Thailand that is comparable to those negotiated by competitor countries.

Initial discussions with the United States Trade Representative (USTR) have been positive, with the US viewing Thailand’s proposal favorably. Additionally, the Ministry of Commerce also emphasized its ongoing efforts to conclude the Thailand–European Union Free Trade Agreement (FTA) within this year to further expand Thai export opportunities.