Thai Exports in March 2025 Achieved the Highest Growth in 3 Years, but Full-Year Outlook Remains at Risk from Trade Wars

The value of Thai merchandise exports in March 25 grew significantly by 17.8%YOY, reaching USD 29,548.25 million—the highest growth rate in 3 years.

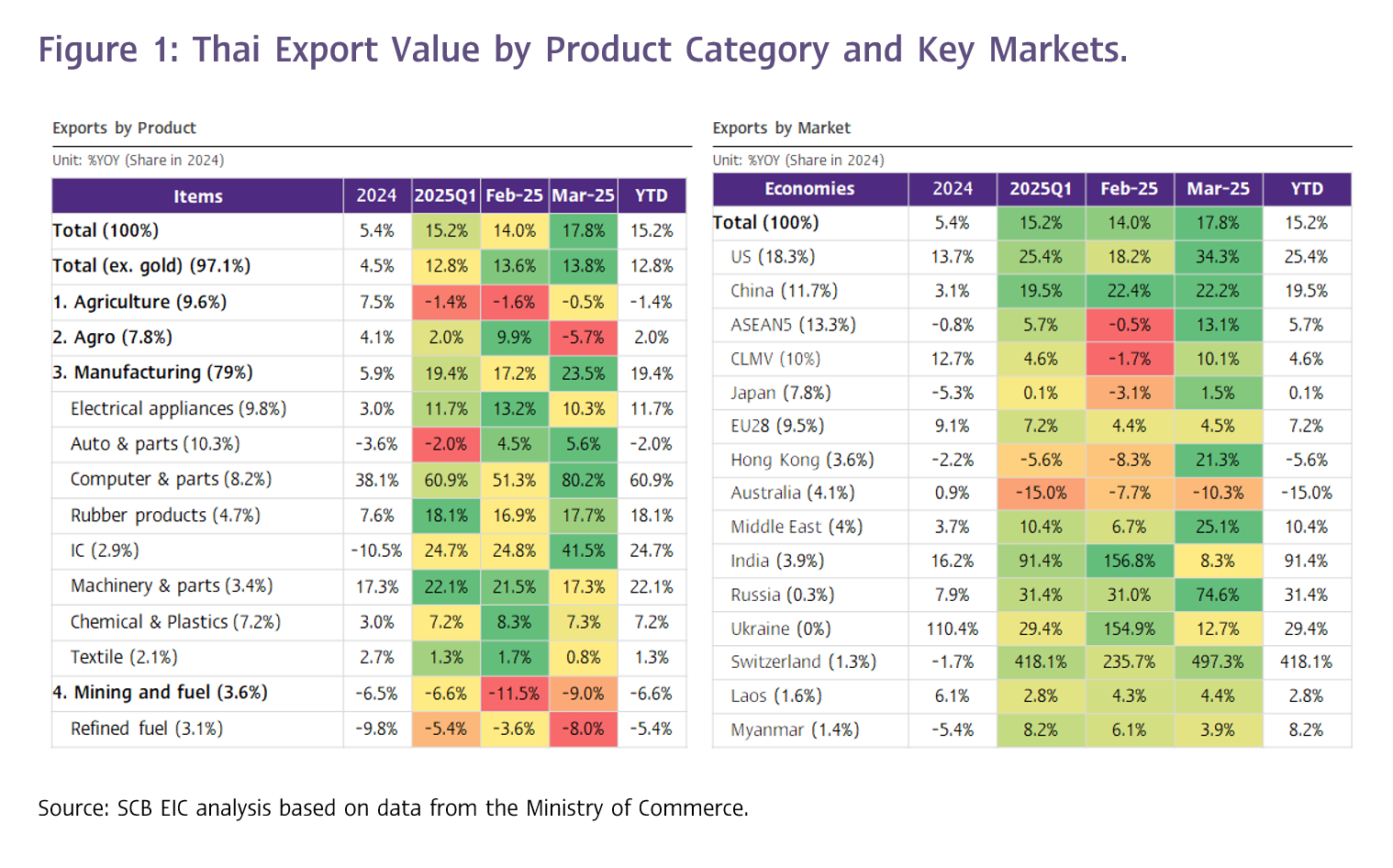

The value of Thai merchandise exports in March 2025 grew significantly by 17.8%YOY, reaching USD 29,548.25 million — the highest growth rate in 3 years. The outcome slightly exceeded expectations (SCB EIC forecasted 14.7%, while Reuters Poll projected 13.5%), following a good momentum of 14% and 13.6% in February and January, respectively. As a result, in Q1/2025, the overall value of Thai exports expanded by 15.2%.

SCB EIC assesses that Thai exports this month benefited mainly from accelerated production and shipments ahead of the US tariff imposition, alongside a favorable upcycle in the electronics sector. Such conditions were reflected by:

(1) Exports to the US surged by as high as 34.3%, marking the highest expansion in 3 years and 3 months. Particularly, exports of electronic products, such as computers, equipment and parts, and facsimile machines, telephones, equipment and parts, expanded significantly by 107.2% and 44.4%, respectively.

(2) Exports to China also expanded robustly by 22.2%, continuing the momentum from the prior month, mainly supported by intermediate and primary goods, including rubber products, natural rubber, and aluminum products.

(3) Exports of electronic products posted strong growth, with computers and equipment growing by 80.2%, computer components by 94.6%, and integrated circuit boards by 41.5%.

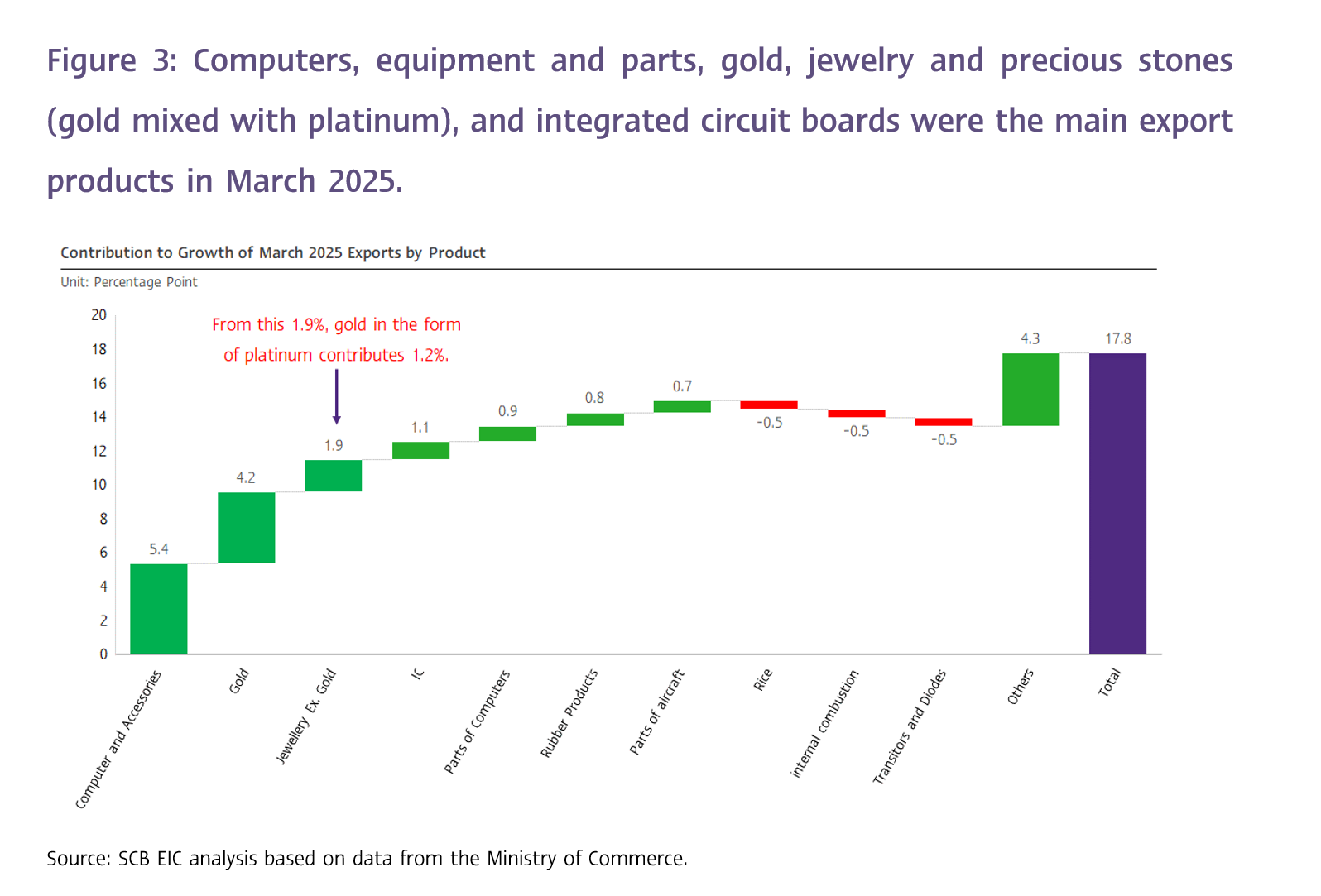

Gold remained a major driver of Thai exports in March 2025, although the special factors supporting gold exports over the past several months have started to fade. Exports of unwrought gold continued to surge sharply by 269.5%, accelerating from 26.1% in the previous month. Strong growth was particularly evident in key markets such as Switzerland (1,090.5%), Cambodia (60.5%), Hong Kong (195.0%), and the United Arab Emirates (100%), reflecting heightened global demand for gold as a safe-haven asset amid increasing economic uncertainties and soaring gold prices.

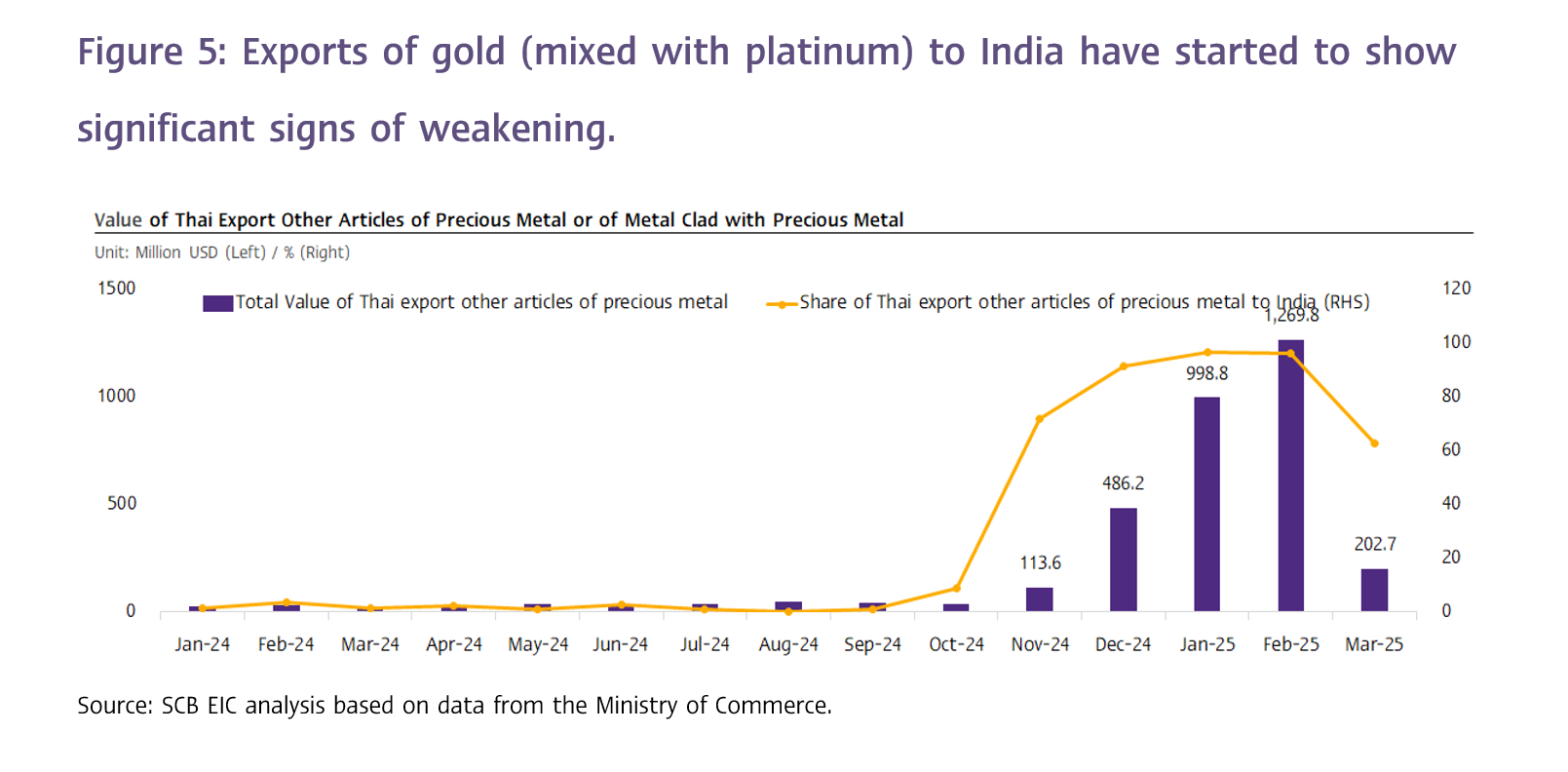

Regarding the special boost from exports of "precious metals and articles clad with precious metals" — which SCB EIC assesses to be almost entirely gold mixed with a small proportion of platinum exported to India1 for tax advantages — there were clear signs of a slowdown. The export value stood at only USD 202.7 million in March (expanding by 1,022.6%), a sharp decline from USD 1,269.8 million (expanding by 4,159.6%) in the previous month. This special factor is expected to gradually disappear, following India's policy adjustment in early March, where platinum alloys were removed from the duty-free import category. Only imports of pure platinum alloy (99%) remain exempted (Figure 5).

Overall, exports of gold and "precious metals and articles clad with precious metals" contributed as much as 5.4 percentage points to the total Thai export growth of 17.8% in March (Figure 3).

March Export Growth Driven by Industrial Products, While Other Major Categories Contracted

An analysis by product category revealed the following:

(1) Industrial product exports expanded by 23.5%, continuing strong growth for over a year. Key drivers included gems and jewelry excluding gold, unwrought gold, computers and equipment, computer components, aircraft, spacecraft and parts, rubber products, air conditioners, automobiles, equipment and parts, and machinery and mechanical appliances. However, exports of internal combustion piston engines and parts, toys, and semiconductor devices, transistors, and diodes contracted. Excluding gold and "precious metals and articles clad with precious metals," industrial product exports would have expanded by 17.1%.

(2) Agricultural product exports contracted by -0.5%, marking the third consecutive month of decline, although the rate of contraction eased somewhat. Notably, exports of natural rubber and fresh/chilled/frozen/dried fruits expanded well, while exports of cassava products and rice continued to contract.

(3) Agro-industrial product exports contracted by -5.7%, the first contraction in nine months after a strong expansion of 9.9% in the prior month. Growth was seen in pet food, canned and processed fruits, and other processed wheat products, while exports of sugar, animal and vegetable fats and oils, and canned and processed seafood contracted.

(4) Exports of mining and fuel products continued to contract by -9%, following a contraction in the prior month. Exports of refined petroleum products contracted sharply by -8.0%, worsening from

a -3.6% contraction in the previous month, marking more than six consecutive months of decline.

Thai Exports Expanded Across Nearly All Key Markets in March, Except Australia

An analysis by destination revealed that Thai exports in March expanded across nearly all major markets, except Australia, where exports contracted by -10.3%, marking the sixth consecutive month of decline. Meanwhile, exports to the United States and China — Thailand’s top two trading partners — expanded strongly by 34.3% and 22.2%, respectively (Figure 1, right).

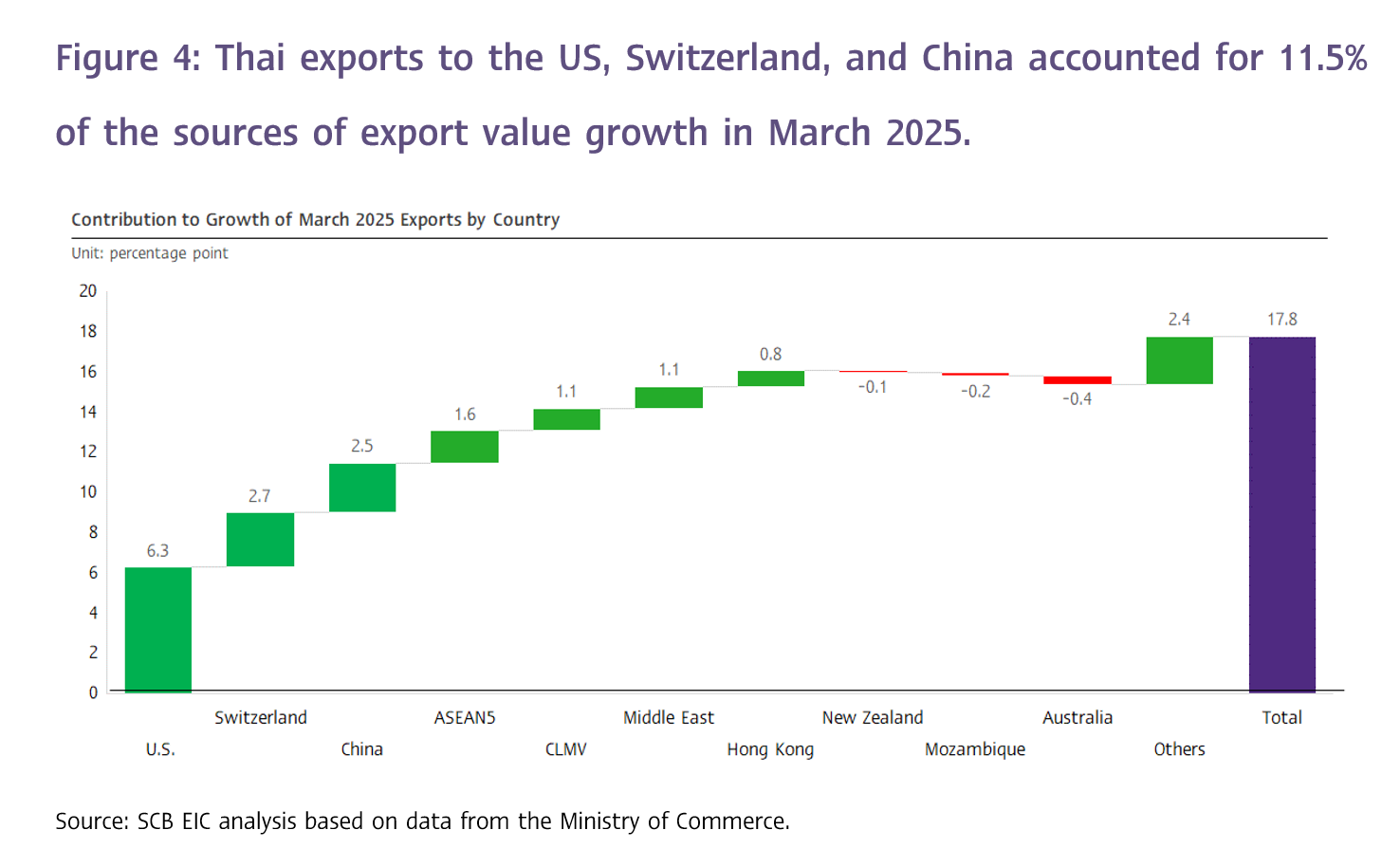

An analysis of export contributions by market revealed that in March, exports to the United States, Switzerland, and China were the main sources of growth, contributing 6.3%, 2.7%, and 2.5%, respectively (Figure 4). Key products driving export growth to the United States included electronic goods, such as computers, equipment and parts, facsimile machines, telephones, equipment and parts, air conditioners and parts, as well as machinery and parts. For Switzerland, strong growth was primarily driven by exports of jewelry and precious stones, particularly unwrought gold. Meanwhile, exports to China showed broad-based growth, led by computers, equipment and parts, rubber products, natural rubber, fresh/chilled/frozen/dried fruits, refined petroleum products, and aluminum products.

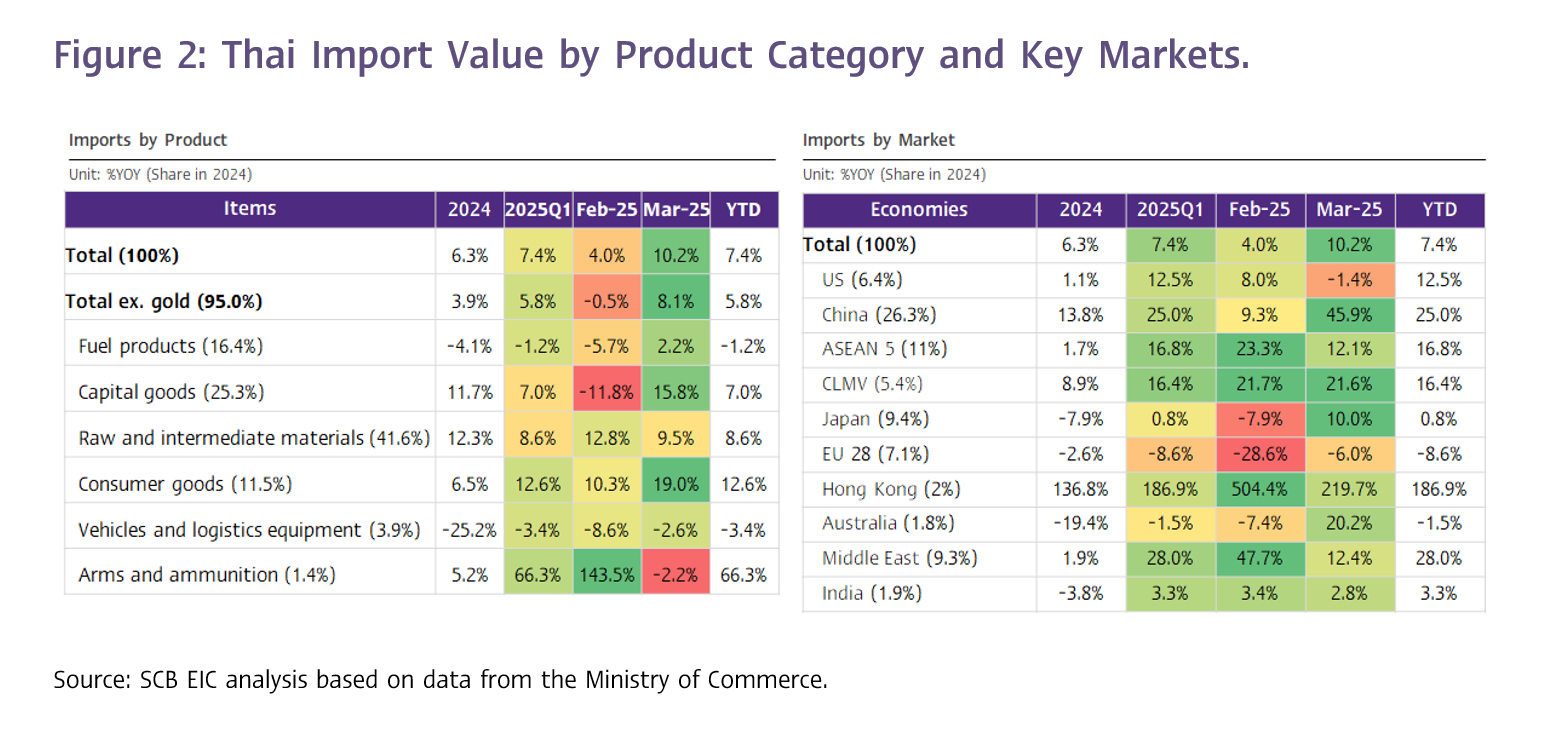

Imports in March 2025 Expanded Strongly, Especially for Consumer Goods

The value of merchandise imports in March stood at USD 28,575.3 million, expanding by 10.2%, higher than previously anticipated (SCB EIC forecasted 4.9%, and the Reuters Poll median was 6.1%). This marked an acceleration from 4.0% growth in the prior month and represented the ninth consecutive month of import growth. Excluding gold, imports expanded by 8.1%, a notable improvement from the -0.5% contraction in the previous month. By product category, imports of consumer goods, capital goods, raw materials and intermediate products (including gold), and fuel products expanded by 19.0%, 15.8%, 9.5%, and 2.2%, respectively. Meanwhile, imports of vehicles and transportation equipment and military arms and ammunition contracted by -2.6% and -2.2%, respectively. Thailand’s customs basis trade balance registered a surplus of USD 973.0 million in March, resulting in a cumulative trade surplus of USD 1,081 million for Q1/2025.

SCB EIC Assesses Thai Exports at Risk of Contracting by -0.4% in 2025, with Trade War Impacts Expected in H2

SCB EIC projects that Thai export value will expand robustly in the first half of 2025, with export value in Q1 growing by as high as 15.2%. However, growth is expected to slow considerably in Q2 as key temporary drivers begin to fade, particularly the front-loading of orders ahead of new US trade protection measures, the positive cycle in electronics, and the temporary boost from gold exports and gold alloy exports to India. Moreover, exports toward the end of Q2 are expected to face increasing pressure from the escalating trade war. President Trump has already imposed a universal minimum import tariff increase of 10% on nearly all trading partners globally, effective from April 9. In addition, specific tariffs have been announced for particular products and countries, notably a 25% tariff on steel, aluminum, and automotive products across almost all trading partners. Although Trump later announced a 90-day delay for implementing reciprocal tariffs on specific countries, China — one of Thailand's most important export markets — has already been heavily targeted, facing a reciprocal tariff hike of up to 125%. When including an additional 20% specific tariff related to allegations surrounding fentanyl, the total tariffs hike on Chinese goods amount to 145%.

SCB EIC projects that Thai exports in the second half of the year will face significantly stronger headwinds and heightened uncertainty. Export values are expected to contract sharply in H2, particularly in the final quarter, leading to a full-year export contraction risk of -0.4%, a downgrade from the previous forecast of 1.6% growth (balance of payments basis, as of March 2025).

1. The US Reciprocal Tariffs Are Potentially Higher and Broader in Impact Than Previously Expected

At the beginning of the year, SCB EIC had assessed that US trade protectionist measures would not be excessively extreme, and that reciprocal import tariffs would likely remain moderate with limited overall impact. It was initially estimated that the United States' Effective Tariff Rate (ETR) would increase by approximately 11.3%. However, if the US fully enforces all announced tariff measures, the ETR would rise by more than 20%, nearly double the original estimate, indicating a much broader and more severe impact than previously anticipated.

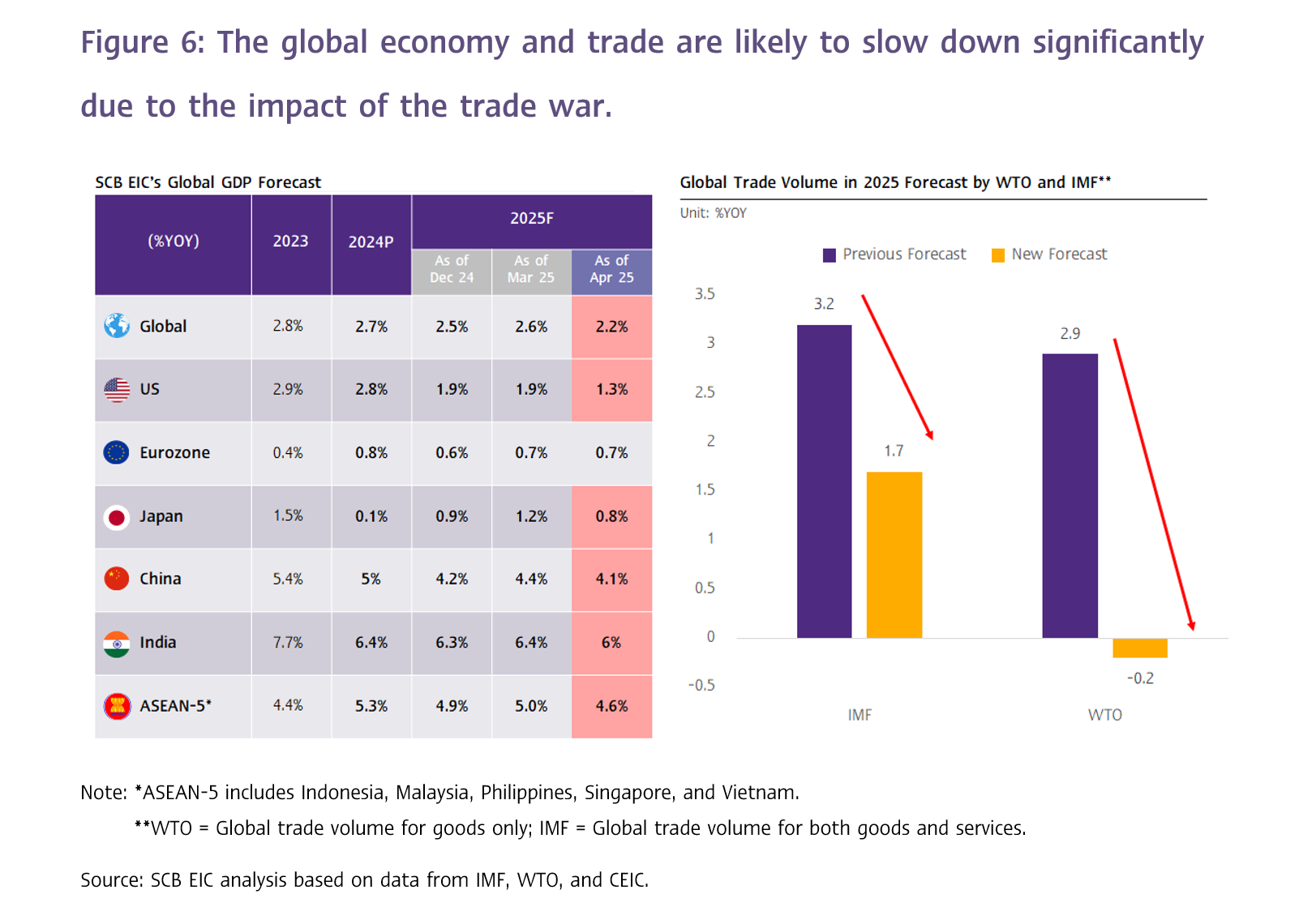

2. Trump's Tariff Policy Is Likely to Significantly Slow Down the Global Economy and Trade

SCB EIC assesses that global economic growth this year will likely slow to just 2.2%, compared to 2.7% in 2024 and 2.8% in 2023. Moreover, there is a 35–50% probability that the world could slip into a recession (Figure 6, left). In addition, global trade volume is expected to slow sharply. The World Trade Organization (WTO) and the International Monetary Fund (IMF) have revised down their global trade volume forecasts for 2025, lowering their estimates to -0.2% and 1.7%, respectively, from previous projections of 2.7% and 3.2% (Figure 6, right).

3. Thailand is likely to be significantly affected, given its high dependence on the US market and elevated risks of reciprocal tariffs.

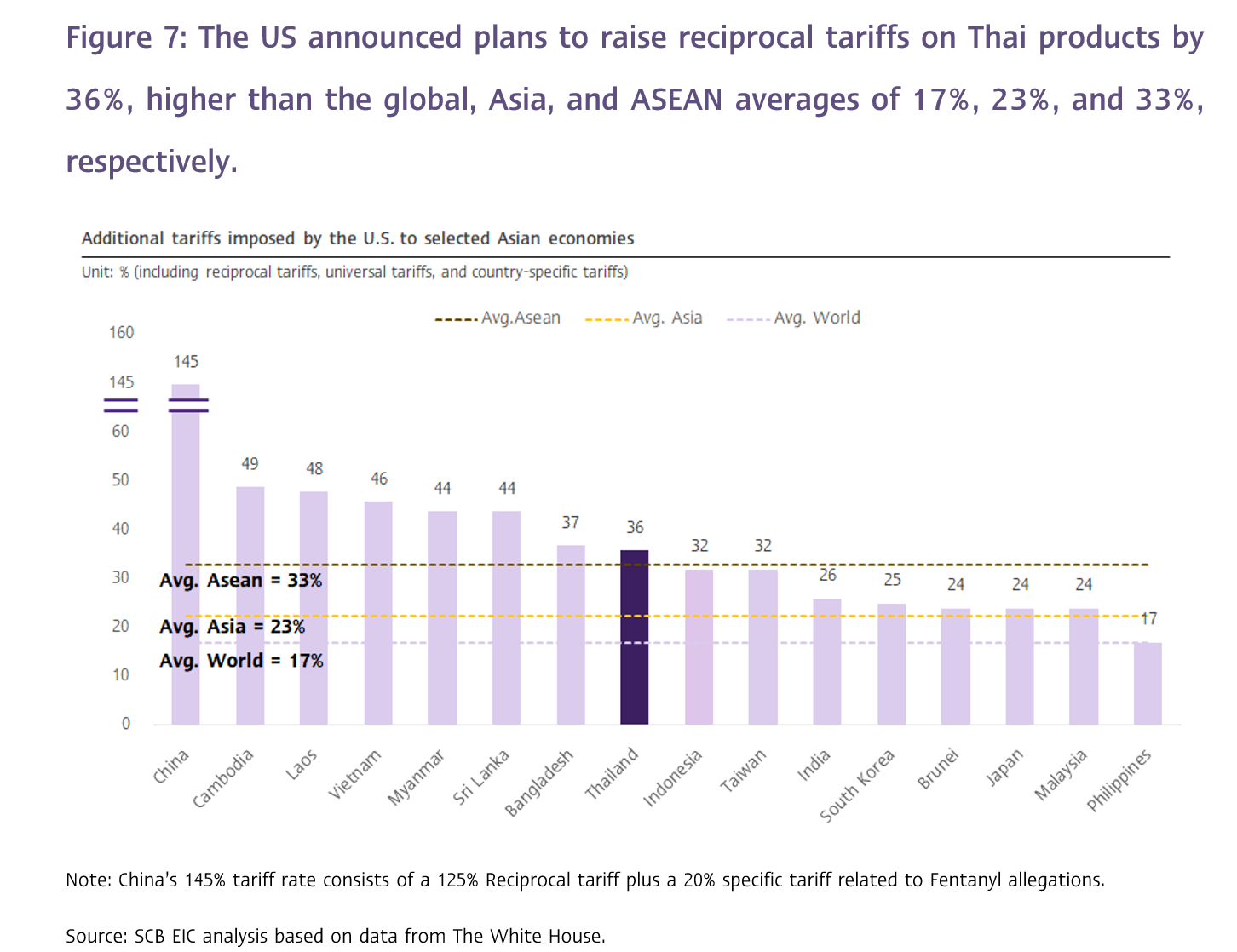

The United States has become Thailand’s largest export market, accounting for 18.3% of total Thai exports in 2024, a substantial increase from 12.7% in 2019. This share represents approximately 10% of Thailand’s GDP, a relatively high proportion. Moreover, Thailand may face reciprocal tariffs from the US as high as 36%, which exceeds the average rates for the world (17%), Asia (23%), and ASEAN (33%) (Figure 7).

As a result, Thai exports are likely to face significant direct impacts through two main channels: 1) Substitution Effect: With the United States imposing reciprocal tariffs of up to 36% on Thai products — compared to much lower tariff increases on other countries (most of which face only a 10% hike) — US importers may increasingly shift toward sourcing from cheaper competitors instead of Thailand. 2) Income Effect: The US may reduce its imports from Thailand and other trading partners as its own economy slows significantly due to the negative impacts of its protectionist tariff policies.

4. Indirect impacts on Thai exports could also be significant, as intensified competition outside the US market could further slow Thai export growth through the following channels: 1) Weaker demand for Thailand’s final goods due to the economic slowdown of trading partners, particularly for consumer goods. 2) Lower demand for Thailand’s intermediate and primary goods within global supply chains, as export production destined for the US declines. 3) Heightened competition in global export markets, as countries facing reduced access to the US market may have excess production capacity and seek to divert their goods to other markets, intensifying competition. 4) Shift in import behavior of trading partners, with some countries potentially increasing imports from the US to reduce their trade surpluses with the US, which could lead to reduced imports from Thailand.

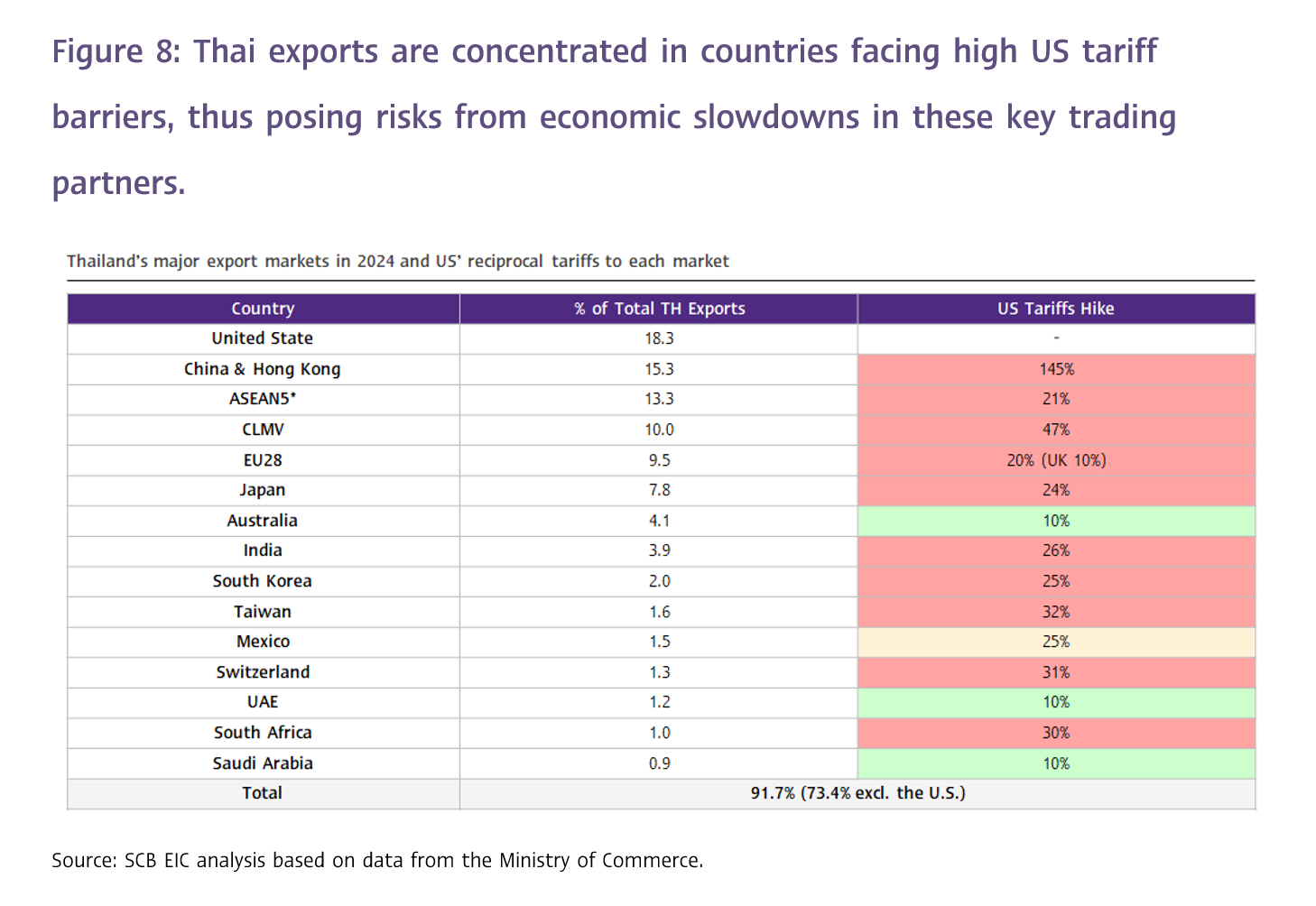

5. Thailand’s Other Major Export Markets Are Also Concentrated in Countries at High Risk of US Reciprocal Tariffs

SCB EIC finds that 12 out of Thailand’s 15 key export markets — accounting for 73.4% of Thailand’s total export value (excluding the US) — are at risk of facing higher-than-global-average US reciprocal tariffs, with the global average standing at 17% (Figure 8).

As a result, Thai exports to these major markets may also decline, driven by economic slowdowns in those countries caused by the impacts of US tariff measures.

6. Supporting factors since the beginning of the year are gradually fading, such as the acceleration of production and exports ahead of the actual US tariff imposition, the positive momentum from the electronics upcycle, the boost from gold exports driven by concerns during periods of high trade policy uncertainty, and the special factor related to gold-platinum alloy exports.

SCB EIC is scheduled to publish its monthly economic analysis, including the latest economic forecasts, following Trump's announcement to postpone the imposition of reciprocal tariffs by 90 days this week.

1 The Indian government revised its import tariff structure for gold, silver, platinum, gemstones, and jewelry during 2022–2024, creating a legal loophole that led Indian importers to increasingly source gold mixed with platinum from Tanzania, South Africa, and Thailand. These imports benefited from a 0% import tariff under India's Duty Free Tariff Preference (DFTP) Scheme for Least Developed Countries, as well as the ASEAN–India Free Trade Agreement. ( Read more. SCB EIC Flash : Thai Export Figures for January 2025 Driven by Gold, Upturn in Electronics Cycle, and Preemptive Acceleration ahead of Protection Measures)