Exports in November continued to expand for the 17th consecutive month, but face downside risks of a potential contraction in 2026 amid mounting headwinds.

Although exports expanded solidly in 2025, SCB EIC assesses that Thai exports in 2026 are likely to contract by -1.5% (balance of payments basis).

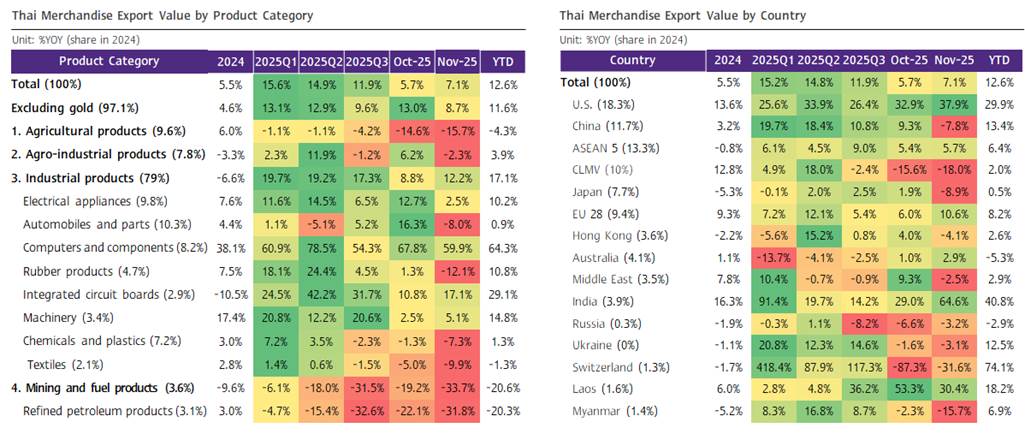

The value of Thai merchandise exports in November 2025 stood at USD 27,445.6 million, expanding by 7.1%YOY, accelerating from 5.7%YOY in the previous month and broadly in line with SCB EIC’s forecast of 7% (while the Reuters Poll median stood at 8.3%). Although exports continued to expand, clearer signs of a slowdown have begun to emerge, as reflected in seasonally adjusted exports contracting by -2.3%MOM_SA, following a -1.2%MOM_SA decline in the previous month. Nonetheless, cumulative export value over the first 11 months of the year still recorded a strong expansion of 12.6% (Figures 1 and 2).

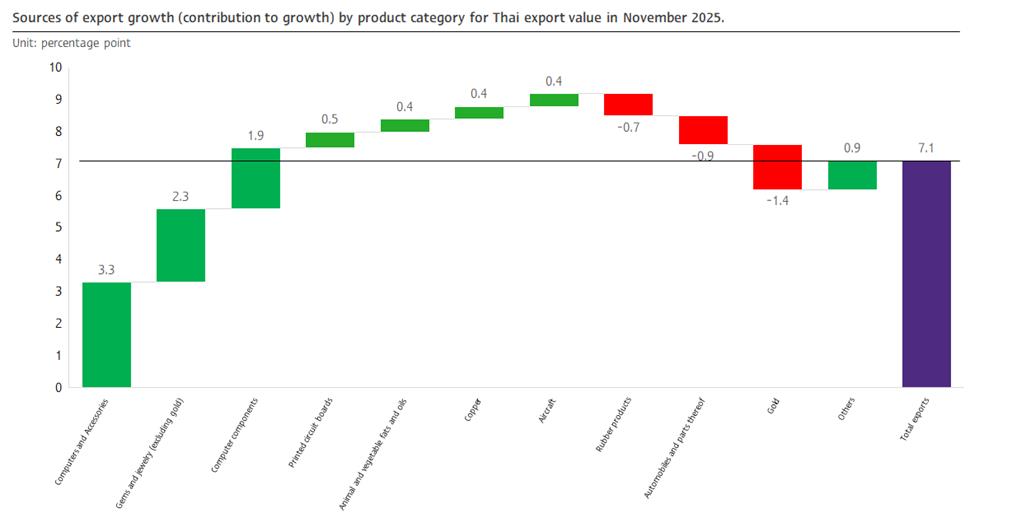

Exports of electronic products and shipments to the US remained the key growth drivers, while gold became a major drag for the second consecutive month.

1) Thai exports to the US continued to expand strongly in November, despite several products already being subject to tariff barriers.

Exports to the US surged by as high as 37.9%YOY, accelerating from 32.9%YOY in the previous month, even amid existing tariff measures. Among Thailand’s top 15 export products to the US, 11 items recorded solid growth, led by electronic products such as computers, equipment, and parts, which expanded sharply by 120%YOY.

2) Exports of electronic products continued to expand strongly, supported by front-loading electronic products shipment to the US market —which remain exempt from reciprocal tariffs—the ongoing upcycle in the electronics sector, and a favorable outlook for global investment in the electronics industry and data centers. Key products showing robust growth included computers, equipment, and parts, which expanded by 59.9%YOY, and electronic integrated circuits, which grew by 17.1%YOY, among others.

3) Gold became a major drag for the second consecutive month, after expanding strongly throughout the first nine months of the year. Exports of unwrought gold contracted sharply by -51.2%YOY, following a -76.9%YOY decline in the previous month, after having recorded exceptionally strong growth of 212.6%YOY and 144.0%YOY in September and August, respectively. This contraction is assessed to be partly driven by a high base effect, as gold exports in October and November 2024 had surged by 169.3%YOY and 174.7%YOY, respectively, amid heightened geopolitical tensions. In addition, gold price growth slowed in November, following a rapid increase in the preceding period, further weighing on gold export performance.

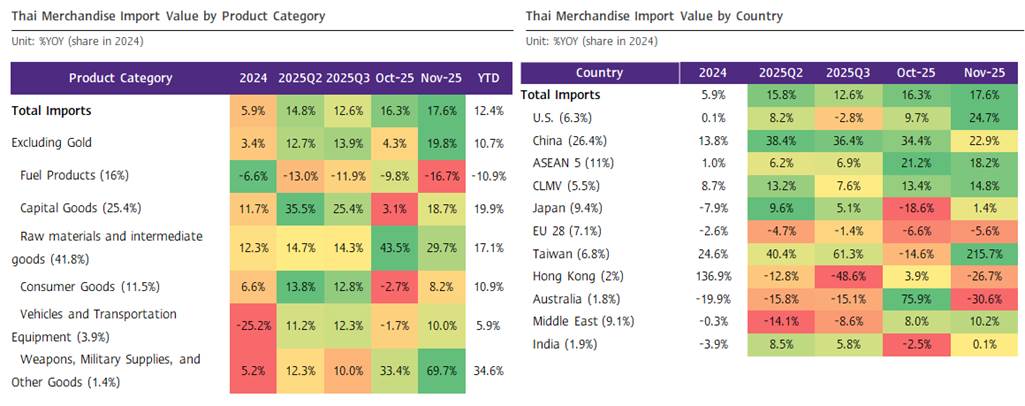

The value of merchandise imports continued to accelerate, particularly for electronic integrated circuits, resulting in Thailand recording consecutive trade deficits.

The value of Thai merchandise imports in November stood at USD 30,172.5 million, expanding sharply by 17.6%YOY, accelerating from 16.3%YOY and 17.2%YOY in October and September, respectively, and exceeding expectations (SCB EIC estimate: 10.1%; Reuters Poll median: 14%). As a result, cumulative import value over the first 11 months of the year expanded strongly by 12.4%.

By product category, imports of arms and ammunition surged by 69.7%YOY, while capital goods expanded by 18.7%YOY, vehicles and logistics equipment by 10.0%YOY, and consumer goods by 8.2%YOY. In contrast, fuel products imports were the only category to contract sharply, declining by around -16.7%YOY, following a -9.8%YOY contraction in the previous month (Figure 3).

The strong import expansion was driven mainly by a sharp increase in electronic integrated circuits imports, which surged by 195.1%YOY, accelerating from 33.3%YOY in the previous month. In particular, imports from Taiwan expanded significantly by as high as 605.1%YOY, accounting for 82.9% of total electronic integrated circuits imports in November.

The customs basis trade balance recorded a large and persistent deficit of USD -2,726.9 million this month, significantly wider than expectations (SCB EIC projected a deficit of USD -800 million, while the Reuters Poll median stood at USD -1,120 million). This was driven by the continued sharp acceleration in imports, particularly electronic integrated circuits from Taiwan. As a result, the cumulative trade balance over the first 11 months of 2025 registered a deficit of USD -4,956 million.

SCB EIC assesses that Thai exports in 2026 could potentially reverse into contraction amid multiple downside pressures.

The historically strong expansion in export value over the first 11 months of this year was supported by several factors:

(1) The upcycle in electronic products has led to stronger global demand for Thailand’s major export products.

(2) The intensity of US import tariff policies being lower than initially announced (for example, Thailand’s rate was reduced from 36% to 19%), alongside postponements in tariff collection across several product groups—such as certain electronic products—thereby limiting the impact of import tariffs on the global economy and trade, which have continued to expand at a solid pace.

(3) Strong gold exports, driven by higher gold prices and elevated demand amid heightened uncertainty, including special gold exports to India in Q1; and

(4) A low base effect in H1/2024.

Nonetheless, the strong expansion in export value was accompanied by an equally rapid acceleration in imports—particularly electronics-related products—suggesting that the net positive impact on the overall economy may be relatively limited.

Although exports expanded solidly in 2025, SCB EIC assesses that Thai exports in 2026 are likely to contract by -1.5% (balance of payments basis).

The key factors include: (1) a slowdown in global economic growth and global trade volumes in 2026, as the impact of US tariff measures under the Trump administration becomes more pronounced and fully materializes; (2) the fading of key supporting factors seen in 2025, such as front-loading of production and shipments to the US and special gold exports to India; (3) a high base effect in 2025, particularly in H1; (4) intensifying competition in global markets, as countries increasingly seek to diversify risks away from the US market; and (5) the impact of a stronger Thai baht, which erodes Thailand’s relative competitiveness—especially for export products that rely primarily on domestic inputs and therefore lack a natural hedge.

The Thai baht has appreciated by more than 9% since the beginning of 2025, ranking among the strongest in the region, second only to Myanmar, although it is expected to start depreciating from Q2/2026 onward. This assessment is broadly consistent with the Ministry of Commerce’s projection, which ranges from -3.3% to 1.1% (customs basis).

In addition, looking ahead, Thai exports may face further downside risks that warrant close monitoring, including:

1) Additional import tariffs imposed by the US, such as sectoral specific tariffs—particularly on electronic products—and transshipment tariffs, both of which carry tariff rates higher than the 19% currently faced by Thailand.

2) A deterioration in China–US relations, particularly the risk of renewed trade tensions, poses downside risks to the global economy and global trade.

3) High uncertainty surrounding Thailand–US trade negotiations, while tensions related to the Thailand–Cambodia conflict could delay negotiations with the US or weaken Thailand’s bargaining position; and

4) Increasing inflows of Chinese and US products into global markets (Twin Influx), which could undermine the competitiveness of Thai products both domestically and internationally.

Figure 1: Thai Export Value by Product Category and Key Markets.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 2: Electronic products remained a key growth driver despite some moderation, while gold exports continued to contract sharply.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 3: Thai Import Value by Product Category and Key Markets.

Source: SCB EIC analysis based on data from the Ministry of Commerce.