The Upturn in the Electronics Cycle and Gold Push Exports in July to the Highest Growth in Over Two Years

SCB EIC expects Thai exports to grow 2.6% this year after last year’s decline, with slight further growth next year.

In July 2024, exports expanded by 15.2% YOY, the highest in 28 months.

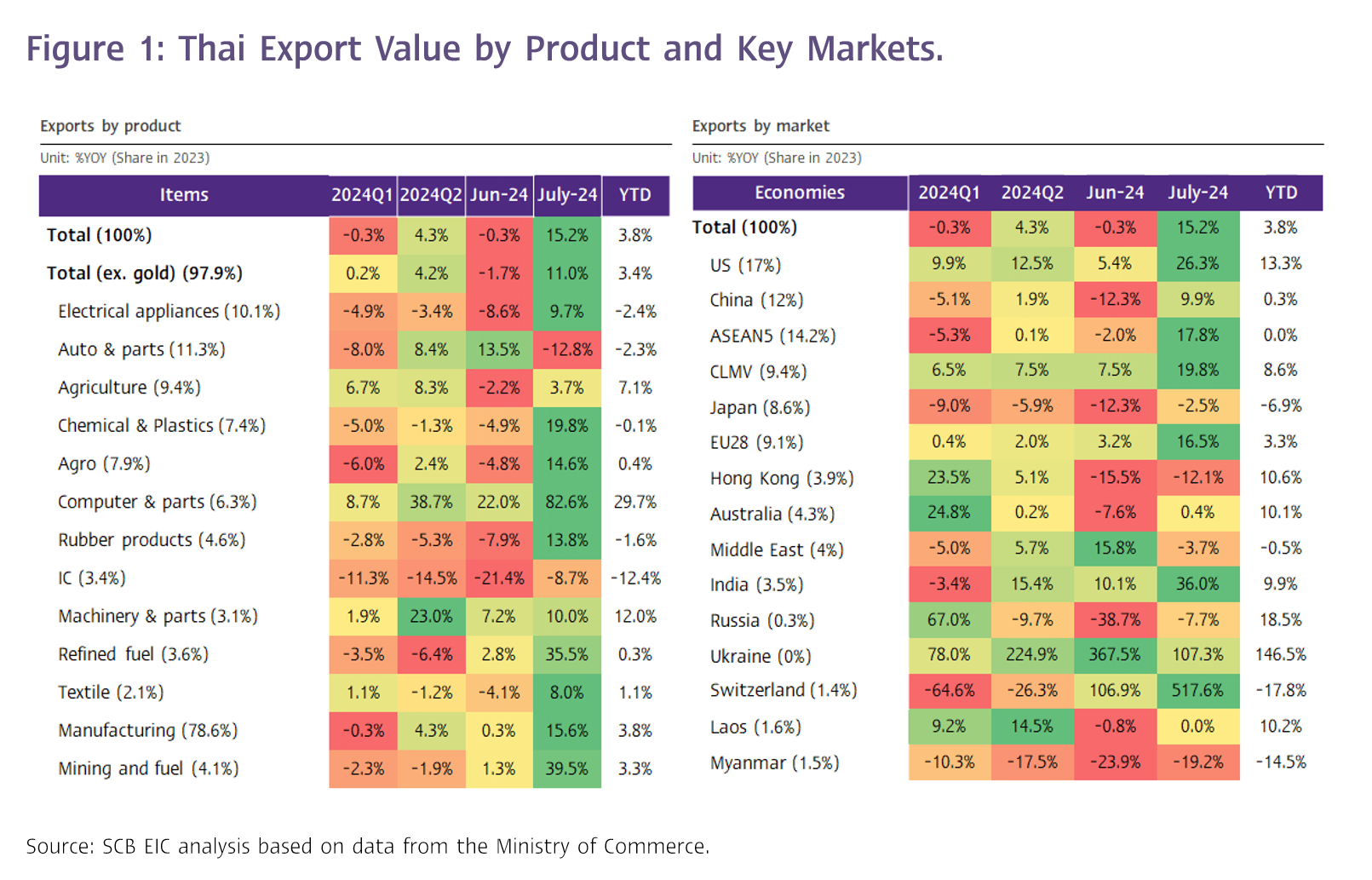

The value of Thai exports in July 2024 stood at USD 25,720.6 million, marking a significant 15.2% YOY growth (compared to the same period last year). This is the highest growth in 2 years and 4 months, and it considerably exceeded analysts' expectations (SCB EIC projected 8%, while the median estimate in the Reuters poll was 6%). In contrast, exports had slightly contracted by -0.3% in the previous month. For the first seven months of this year, the total value of Thai exports was USD 171,010.6 million, expanding by 3.8% (customs basis).

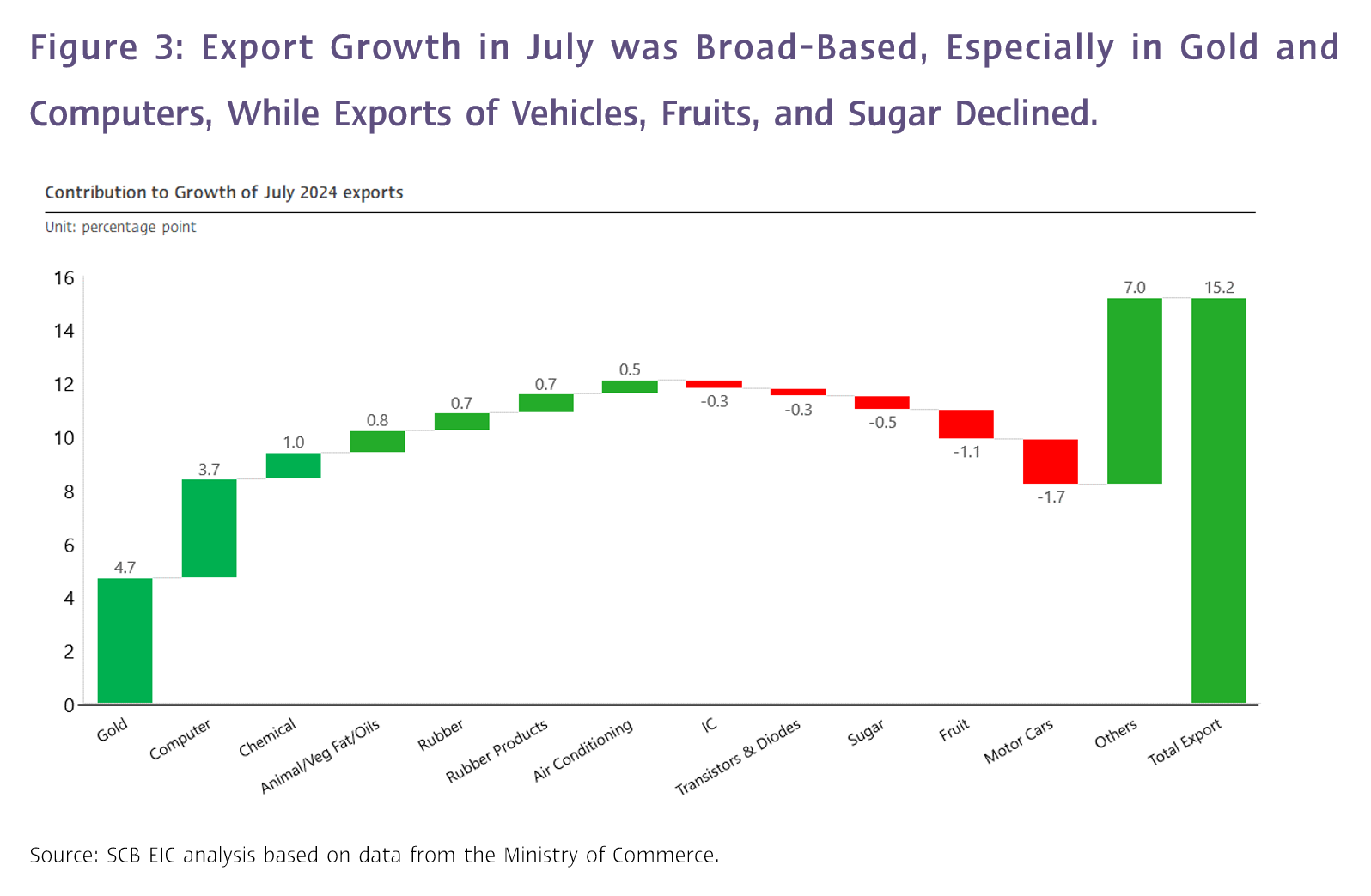

This substantial growth was driven by several factors: (1) Global demand for Thai products improved in the short term, as reflected in seasonally adjusted exports excluding gold, which expanded by 2% MOM_SA, the highest in three months. (2) The value of computer and parts exports surged by 82.6%, driven by the global recovery in the electronics cycle. This factor alone contributed to 3.7% of the 15.2% growth in exports in July (Figure 3). Additionally, (3) gold exports expanded by a remarkable 434.4%, contributing to a 4.7% increase in overall export value in July (Figure 3). Lastly, (4) the base effect played a role, as the export value in July of the previous year was relatively low at USD 22,320.5 million, compared to the annual average and the historical average for July.

High Growth in All Four Key Product Categories

Analyzing exports by product category reveals that: (1) Exports of mining and fuel products saw substantial growth of 39.5%, accelerating from 1.3% in the previous month. (2) Manufacturing products expanded by 15.6%, up from 0.3% in the prior month, driven primarily by gold, computers and parts, rubber products, and chemicals. However, exports of Motor cars, parts and accessories, as well as Semiconductor devices, transistors and diodes and electronic integrated circuits, declined. (3) Agro-industrial products rebounded with 14.6% growth after contracting by -4.8% in the previous month, supported by exports of animal and vegetable fats and oils, canned and processed seafood, and pet food, while sugar exports declined. (4) Agricultural products saw a slight recovery with 3.7% growth after contracting by -2.2% in the previous month, with rubber and rice exports performing well, while fresh, chilled, frozen, and dried fruits continued to decline, particularly in the Chinese market (Figures 1 and 2).

Export Performance by Market Remains Volatile from Gold

Examining exports by market shows that: (1) Exports to Hong Kong contracted by -12.1%, an improvement from -15.5% in the previous month, with computers and parts, electronic integrated circuits, and gold rebounding by 57.4%, 2.5%, and 23.5%, respectively, after sharp declines in the previous month. (2) Exports to Japan contracted by -2.5%, improving from -12.3% in the previous month, with only 5 out of 15 key export products to Japan contracting, compared to more than 10 out of 15 in previous months. (3) Exports to China turned positive, expanding by 9.9% after contracting by -12.3% in the previous month, with rubber products rebounding by 36.9%. Additionally, computers and parts, and rubber saw substantial growth of 102.9% and 48.6%, respectively, while fresh, chilled, frozen, and dried fruits, as well as plastic beads, continued to decline by -30.4% and -18.3%, respectively. (4) Exports to the US and India performed well in July and are expected to remain key markets for Thai exports in the second half of the year. (5) Exports to Switzerland surged by 517.6%, driven by a 1,148.5% increase in gold exports. (6) Exports to CLMV countries expanded by 7.5%, led by a 53.5% increase in exports to Cambodia, particularly with gold exports surging by 2,219.4%. Excluding gold, exports to Cambodia grew by 19.3%. However, exports to Myanmar contracted by -19.2%, partly reflecting ongoing unrest in the country, while exports to Laos remained flat, and exports to Vietnam expanded by 25.8% (Figure 1).

Thailand's Trade Balance Reverted to a Significant Deficit After Two Consecutive Months of Surplus

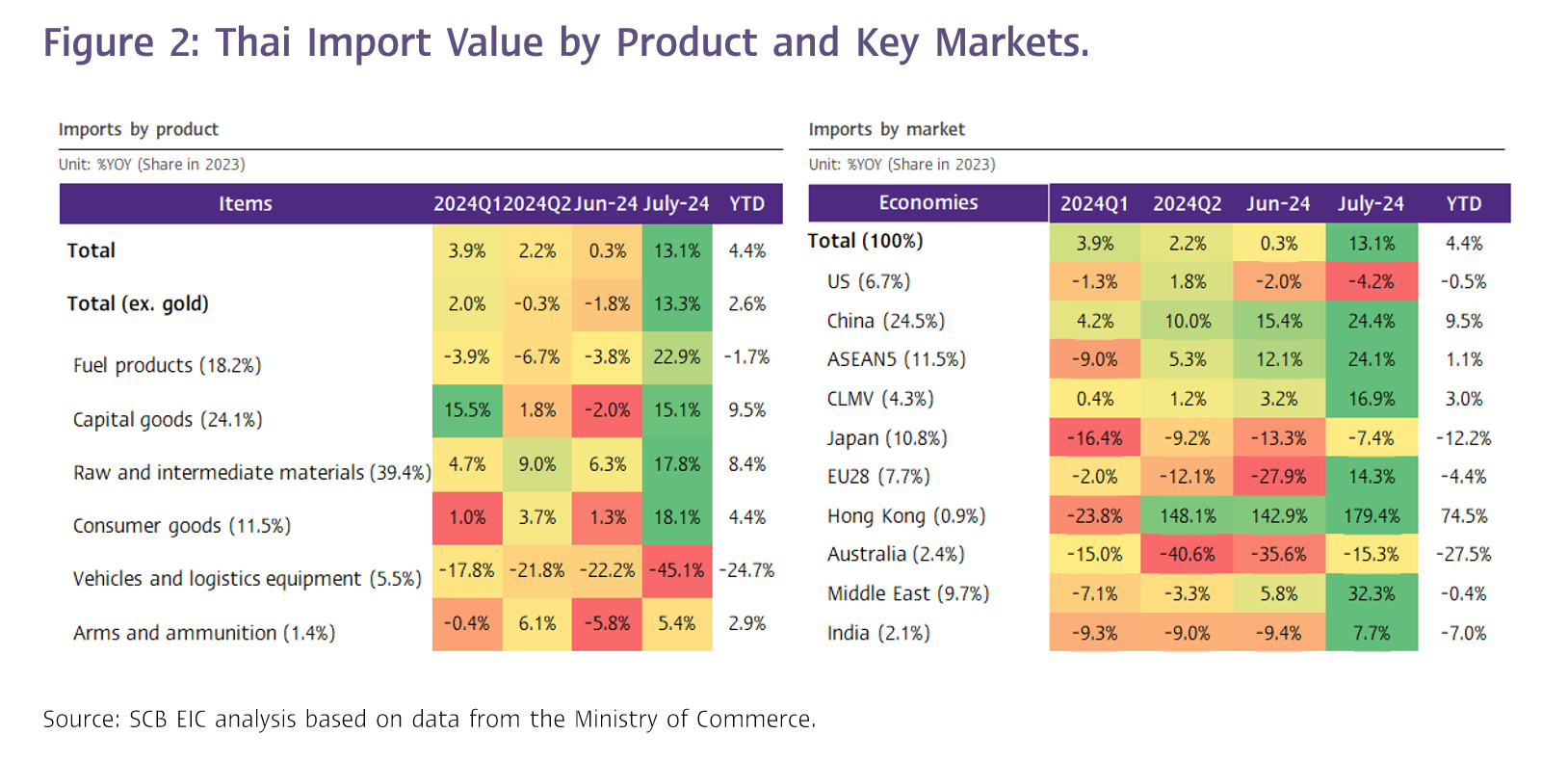

In July, the value of imports stood at USD 27,093.8 million, reversing to a 13.1% expansion after a marginal 0.3% growth in the previous month. Imports of vehicles and logistics equipment contracted sharply by -45.1%, worsening from -22.2% in the prior month. However, imports of fuel products, consumer goods, raw and intermediate materials , and capital goods grew substantially by 22.9%, 18.1%, 17.8%, and 15.1%, respectively. As a result, the customs basis trade balance in July returned to a deficit of USD -1,373.23 million after two consecutive months of surplus. For the first seven months of 2024, Thailand's trade balance remained in deficit at USD -6,615.90 million.

SCB EIC Maintains 2024 Export Growth Forecast at 2.6% and Revises 2025 Projection Upward to 2.8% (from 2.6%)

SCB EIC maintains its forecast that Thai export value will grow by 2.6% this year, recovering from the contraction in the previous year, and continue to see modest growth next year (balance of payments basis, as of August 2024). This outlook is supported by:

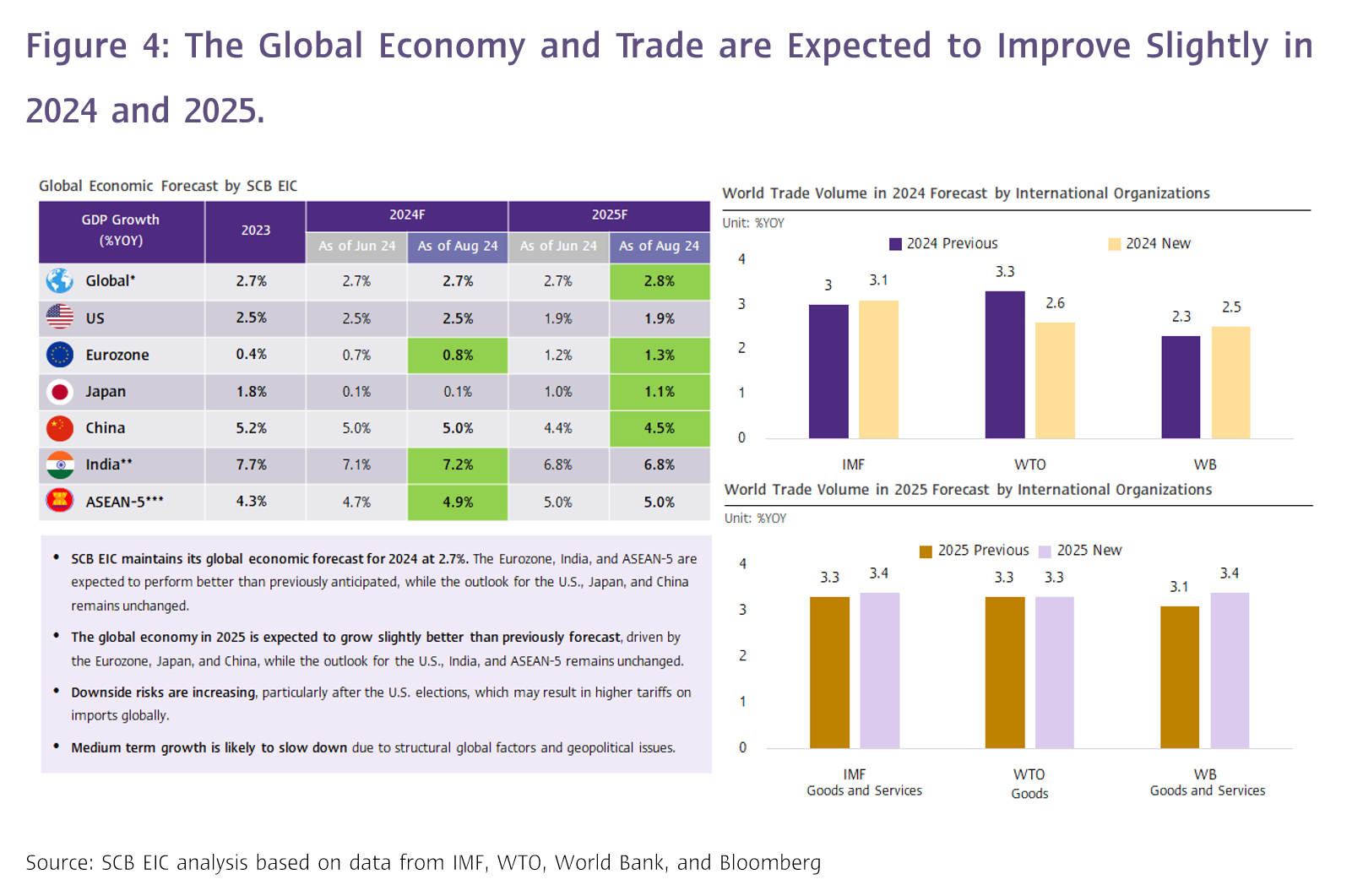

1. The global economy is projected to expand by 2.7% in 2024, consistent with the previous estimate, with a slightly improved outlook for some key trading partners, including the Eurozone, India, and ASEAN-5. The global economy in 2025 is expected to grow slightly higher than the previous estimate at 2.8% (from 2.7%), driven by better-than-expected growth in some key economies, particularly China, Japan, and Europe, which are major trading partners for Thailand, while maintaining the outlook for the US, ASEAN-5, and India (Figure 4, left).

2. Global trade volume is expected to rise slightly from the previous estimate, according to the World Trade Organization (WTO), International Monetary Fund (IMF), and World Bank. Factors supporting this include the gradual decline in inflation and interest rates, leading to increased demand for imported goods, particularly industrial products such as electronics. The IMF has revised its global trade volume forecasts for 2024 and 2025 upward to 3.1% and 3.4%, respectively (Figure 4, right).

3. Exports of electronics are expected to continue expanding, driven by sustained global demand for electronic components and Power electronics, consistent with the upturn in the computer cycle.

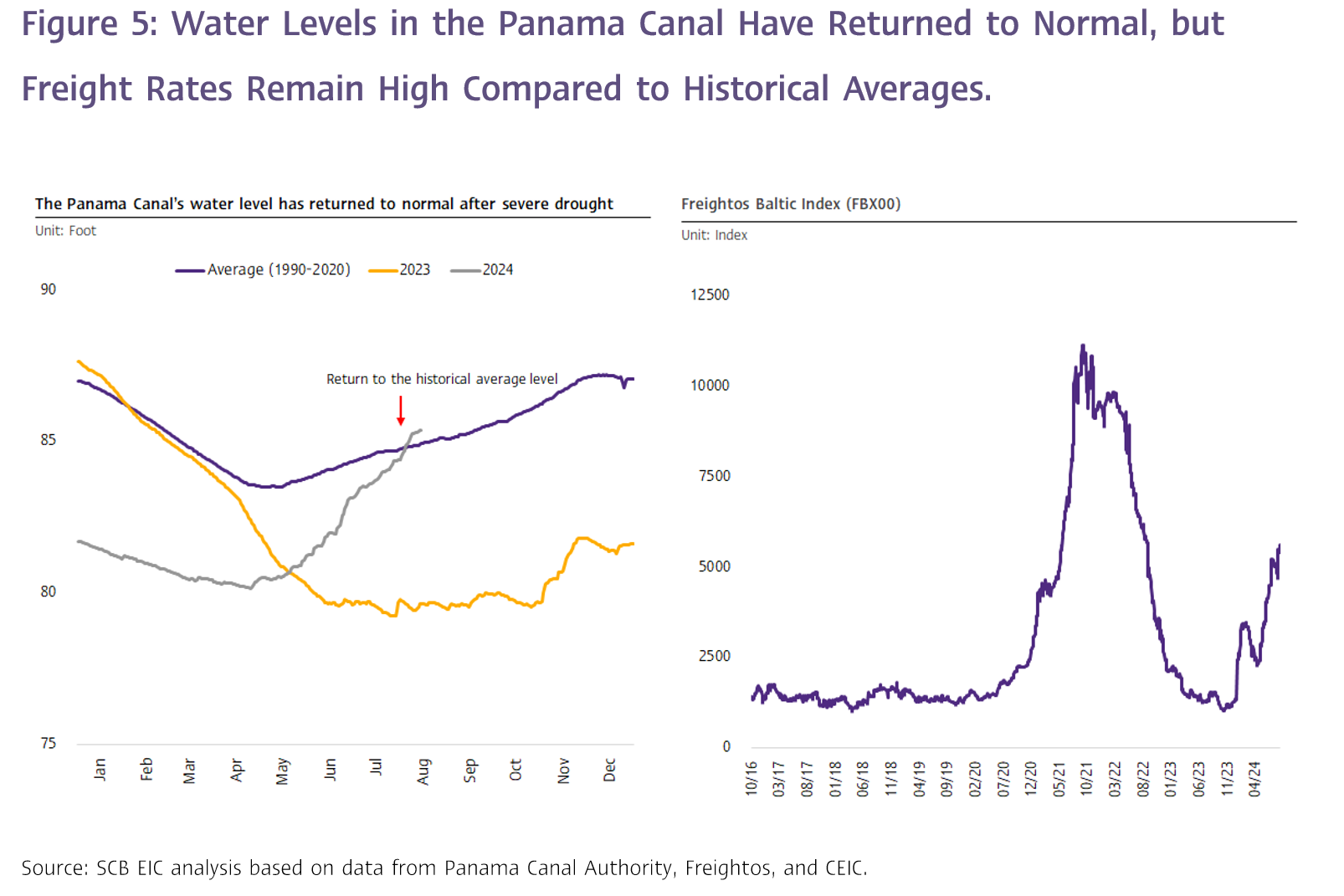

4. Water levels in the Panama Canal have returned to normal after drought conditions since 2023, allowing more regular maritime traffic between the Pacific and Atlantic Oceans, easing pressures on global trade (Figure 6, left). However, global freight rates remain high compared to historical averages, and shipping issues around the Suez Canal persist due to the ongoing conflict in the Middle East (Figure 6, right).

Nevertheless, SCB EIC views that Thai exports in the second half of 2024 and in 2025 will face several risks, including:

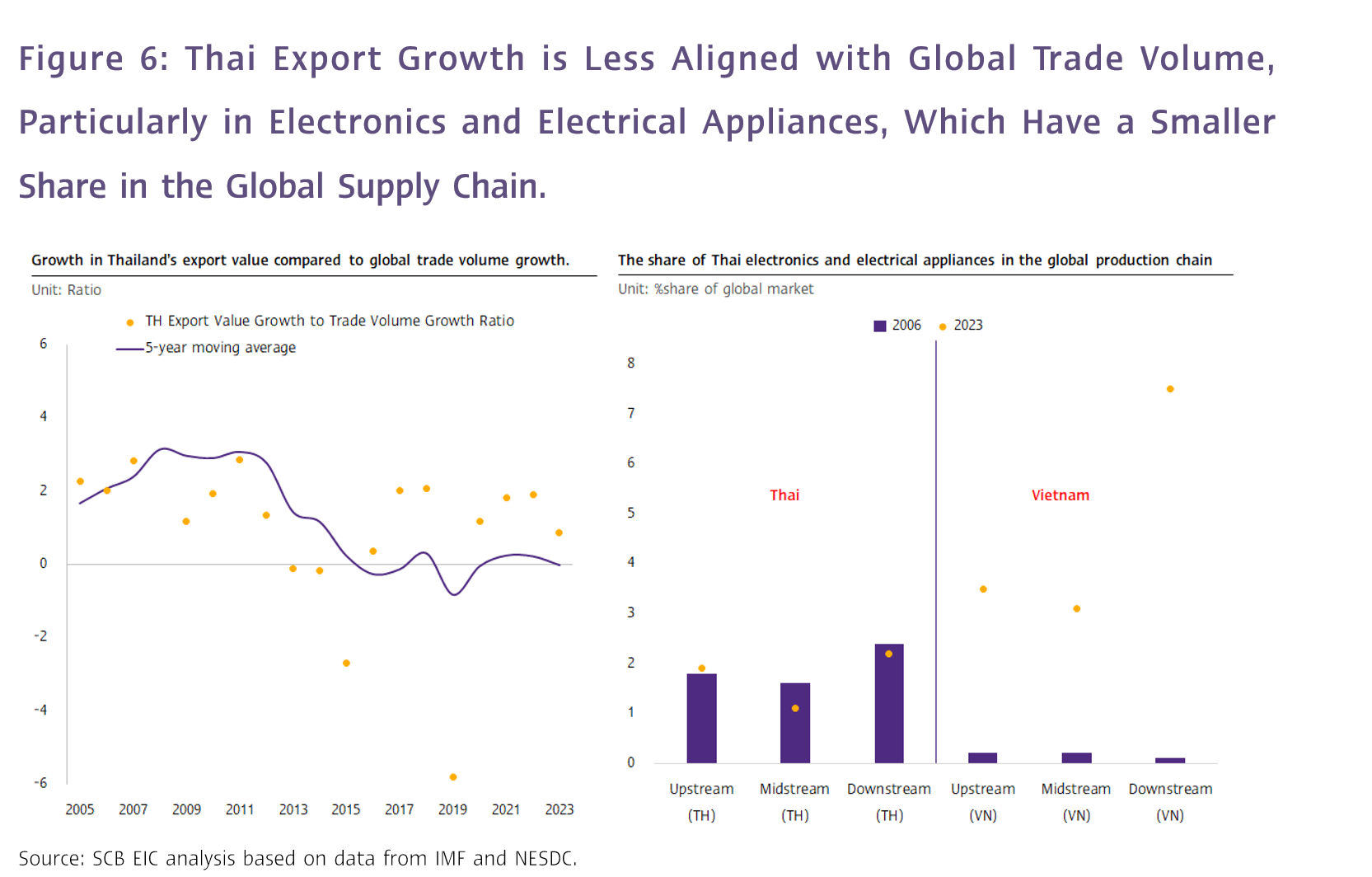

1. Thai exports may benefit less from the global trade recovery, as recent trends show that Thai export recovery has become less aligned with global trade volume (Figure 7, left). This is partly due to a loss of competitiveness and reduced demand for Thai products in global markets.

2. Thailand is likely to face La Nina conditions, potentially leading to additional heavy rainfall and flooding, which could impact specific regions and agricultural supply chains.

3. In the future, global economic and trade conditions will face increasing negative pressures, such as (1) uncertainties in geopolitical issues and economic decoupling, (2) prolonged and intensifying conflicts, particularly after Ukraine's first incursion into Russian territory, and the potential escalation of the Israel-Hamas conflict into a regional war if Iran becomes more involved, moving beyond its role as a proxy.

4. Freight rates may rise again due to frequent and escalating conflicts, along with a shortage of shipping vessels and containers.

5. China's overcapacity problem could lead to an increase in Chinese exports to global markets, while domestic demand in China remains weak. This may result in a continued rise in China's trade surplus, prompting more countries to adopt trade barriers against Chinese imports.

6. The election outcomes in the U.S. and Europe are likely to favor protectionism, with increased use of trade barriers to maintain the competitiveness of domestic manufacturing sectors, particularly if Trump wins the US election, where he may implement additional tariffs on all imported goods from all countries, as he campaigned.

Note: SCB EIC's forecast of 2.6% growth in Thai export value for 2024 was made before the July export data was released, so there may be an upside if export figures in the remaining months continue to exceed monthly forecasts significantly.