FLASH

23 December 2025

MPC Cuts Rate as Expected; SCB EIC Forecasts Another Cut in H1 Next Year

The MPC unanimously voted to cut the policy rate from 1.50% to 1.25%. SCB EIC forecasts one more policy rate cut in H1 2026

The MPC unanimously voted to cut the policy rate from 1.50% to 1.25% to ease financial conditions amid a clear economic slowdown and rising risks. The rate cut also aims to alleviate debt burdens among vulnerable groups and enhance the effectiveness of financial measures. Looking ahead, the MPC stands ready to adjust monetary policy as appropriate in response to evolving economic and inflation outlooks, while taking into account long-term financial stability and limited policy space. Regarding the outlook for the economy, inflation, and financial conditions (Figure 1), the MPC assesses that:

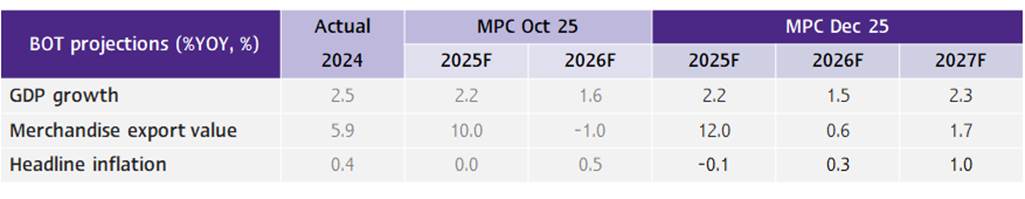

Figure 1: Thailand’s Economic Outlook for 2025–2027 by BOT (as of Dec 2025)

![image001.jpg]()

Source: SCB EIC analysis based on data from BOT

· The economy is expected to slow markedly, driven by a moderation in private consumption in line with income growth, while exports are set to be adversely affected by U.S. tariffs. Additional downside factors and risks include: (1) flooding in the south, which is expected to continue weighing on economic activity into early next year, and (2) political uncertainty, which could delay the enactment of the FY2027 budget.

· Headline inflation this year is expected to average in negative territory and remain below the target range next year, largely due to lower energy prices in line with global energy price movements, as well as government subsidy measures. Nonetheless, the risk of deflation remains limited.

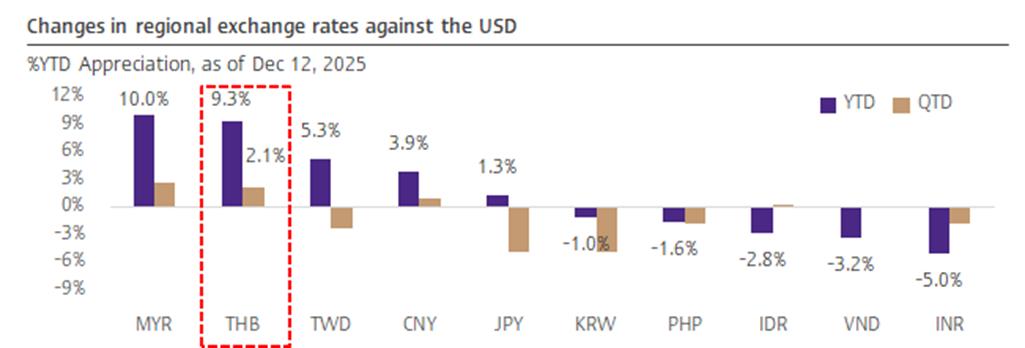

· Credit continues to contract, reflecting both weaker loan demand in line with the slowdown in domestic demand and continued tight lending standards. Meanwhile, the Thai baht has appreciated more than regional currencies (Figure 2), in line with the U.S. monetary policy outlook and Thailand-specific factors.

· Three key factors that the MPC will closely monitor include:

1) potential additional U.S. import tariff measures,

2) credit growth developments and the appreciation of the Thai baht, and

3) deflationary risks.

Figure 2: The Thai baht has appreciated against almost all regional currencies

![image002.jpg]()

Source: SCB EIC analysis based on data from Bloomberg

SCB EIC views the MPC’s communication in this meeting as diverging from previous communications in several key aspects, including:

1) The MPC judges the economic slowdown next year as “apparent”, placing greater emphasis on communicating downside factors and near-term economic risks, rather than highlighting the relatively strong recent economic and export outturns. The MPC also provided additional views on the 2027 economic outlook, noting that while the economy is expected to recover, growth will remain below potential. This reflects a more cautious forward-looking assessment, with the economy in 2027 projected to expand by only 2.3%YOY.

2) The MPC will “closely” monitor deflationary risks, and for the first time explicitly communicated demand-side pressures within the domestic economy. This represents a shift from previous meetings, which emphasized that deflation risks were limited and gave limited attention to demand-side factors. In this meeting, the MPC highlighted that domestic demand pressure is playing a diminishing role in supporting headline inflation.

3) The MPC is concerned about the Thai baht’s appreciation relative to regional currencies and signaled that it is considering measures to alleviate appreciation pressures. This marks an unusual shift in communication, as the MPC typically does not refer to baht management measures in its policy statement.

Overall, the statement adopts a more dovish tone than in previous communications, placing clearer emphasis on downside economic risks and the tightness of financial conditions.

Figure 1: Thailand’s Economic Outlook for 2025–2027 by BOT (as of Dec 2025)

Source: SCB EIC analysis based on data from BOT

· The economy is expected to slow markedly, driven by a moderation in private consumption in line with income growth, while exports are set to be adversely affected by U.S. tariffs. Additional downside factors and risks include: (1) flooding in the south, which is expected to continue weighing on economic activity into early next year, and (2) political uncertainty, which could delay the enactment of the FY2027 budget.

· Headline inflation this year is expected to average in negative territory and remain below the target range next year, largely due to lower energy prices in line with global energy price movements, as well as government subsidy measures. Nonetheless, the risk of deflation remains limited.

· Credit continues to contract, reflecting both weaker loan demand in line with the slowdown in domestic demand and continued tight lending standards. Meanwhile, the Thai baht has appreciated more than regional currencies (Figure 2), in line with the U.S. monetary policy outlook and Thailand-specific factors.

· Three key factors that the MPC will closely monitor include:

1) potential additional U.S. import tariff measures,

2) credit growth developments and the appreciation of the Thai baht, and

3) deflationary risks.

Figure 2: The Thai baht has appreciated against almost all regional currencies

Source: SCB EIC analysis based on data from Bloomberg

SCB EIC views the MPC’s communication in this meeting as diverging from previous communications in several key aspects, including:

1) The MPC judges the economic slowdown next year as “apparent”, placing greater emphasis on communicating downside factors and near-term economic risks, rather than highlighting the relatively strong recent economic and export outturns. The MPC also provided additional views on the 2027 economic outlook, noting that while the economy is expected to recover, growth will remain below potential. This reflects a more cautious forward-looking assessment, with the economy in 2027 projected to expand by only 2.3%YOY.

2) The MPC will “closely” monitor deflationary risks, and for the first time explicitly communicated demand-side pressures within the domestic economy. This represents a shift from previous meetings, which emphasized that deflation risks were limited and gave limited attention to demand-side factors. In this meeting, the MPC highlighted that domestic demand pressure is playing a diminishing role in supporting headline inflation.

3) The MPC is concerned about the Thai baht’s appreciation relative to regional currencies and signaled that it is considering measures to alleviate appreciation pressures. This marks an unusual shift in communication, as the MPC typically does not refer to baht management measures in its policy statement.

Overall, the statement adopts a more dovish tone than in previous communications, placing clearer emphasis on downside economic risks and the tightness of financial conditions.