Exports softened in October, but full-year growth remained firm on accumulated gains earlier in the year. Meanwhile, imports continued to accelerate, particularly for gold.

The value of Thai merchandise exports in October 2025 stood at USD 28,835 million, with growth slowing to 5.7%YOY

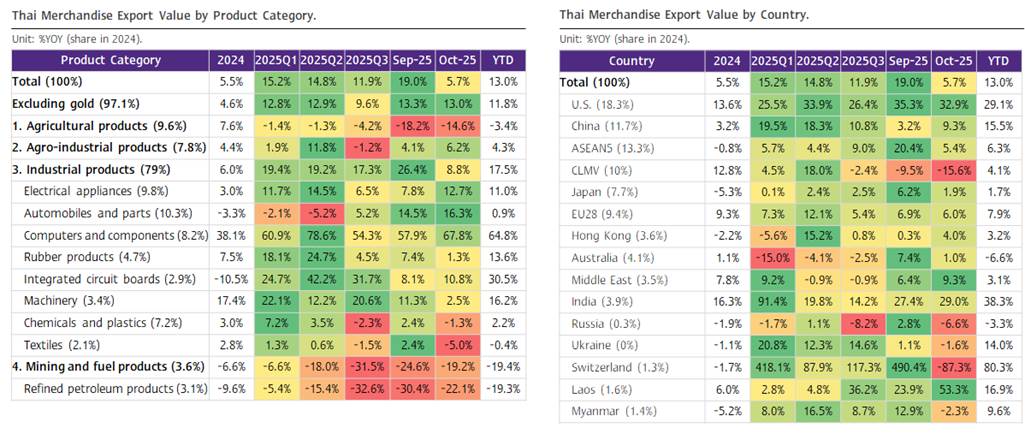

The value of Thai merchandise exports in October 2025 stood at USD 28,835 million, with growth slowing to 5.7%YOY from 19.0%YOY in the previous month and falling below expectations (SCB EIC estimated 9%). Seasonally adjusted figures showed a contraction of -1.9%MOM_SA, a sharp decline from 6.6%MOM_SA in September. Overall, export value during the first ten months of the year expanded strongly by 13.0% (Figure 1 and Figure 2).

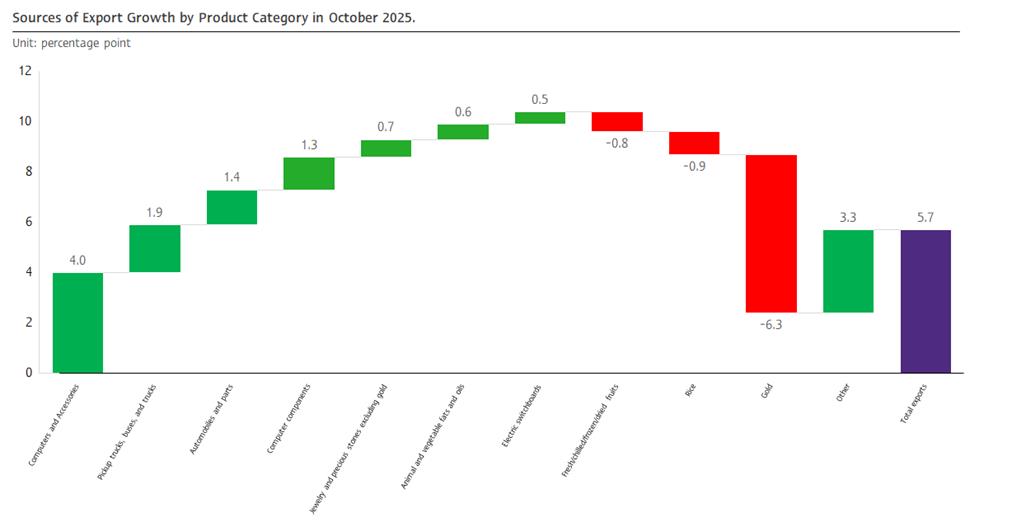

Electronics exports and shipments to the US remained the key supporting factors, while gold emerged as the main drag on overall export performance.

1) Thai exports to the US continued to expand strongly in October, even though many products have already been subjected to tariff measures. Exports to the US this month rose by 29.1%, though slightly moderating from 35.3% in the previous month. Excluding electronic products that remain exempt from US import tariffs, exports to the US still expanded at a high rate of 18.7%, reflecting strong US demand for Thai goods despite tariff barriers.

Among Thailand’s top 15 export products to the US, 11 recorded solid growth, particularly electronics and electrical appliances. Key items—such as computers, equipment and parts; machinery and mechanical appliances and parts; and electrical transformers and parts—expanded by 110.2%, 45.9%, and 22.2%, respectively.

Exports to the US contributed significantly to Thailand’s export performance in October, raising overall export growth by 6%YOY (CTG), which exceeded total export growth of 5.7%.

2) Exports of electronic products continued to expand at a high rate, supported by accelerated shipments to the US, which still benefits from exemption from import tariffs, the ongoing upcycle in the global electronics sector, and the rising trend of investment in the electronics and data center industries worldwide. Electronic exports grew by 38.8%, moderating slightly from 42.6% in the previous month.

By examining export markets, 12 out of the top 15 destinations for Thai electronic exports continued to expand, while 10 out of these 15 markets recorded growth above 30%. Notable markets included the US, China, Singapore, Mexico, and Malaysia, which expanded strongly by 52.8%, 36.4%, 87%, 40%, and 86.4%, respectively.

Electronic product exports contributed significantly to Thailand’s overall export expansion in October, raising total export growth by 6.9%YOY (CTG), exceeding the headline export growth of 5.7%.

3) Gold became the main drag on export performance. Exports of unwrought gold contracted sharply by -76.9%, reversing from exceptionally high growth of 212.6% and 144% in September and August, respectively. Major export markets—Switzerland, Singapore, and Cambodia—experienced steep declines of -92.4%, -96.3%, and -82%, respectively, partly reflecting the drop in global gold prices following reduced global uncertainty after the temporary trade agreement between China and the US.

Gold was the key product weighing down exports this month, contributing (CTG) -6.3%, compared with total export growth of 5.7%. This stands in sharp contrast to the first nine months of the year, during which gold helped raise Thailand’s export growth by over 2.5% out of the total export expansion of 13.9%.

Imports accelerated sharply, particularly in raw materials and intermediate goods such as gold, leading Thailand to record its highest trade deficit in nearly three years.

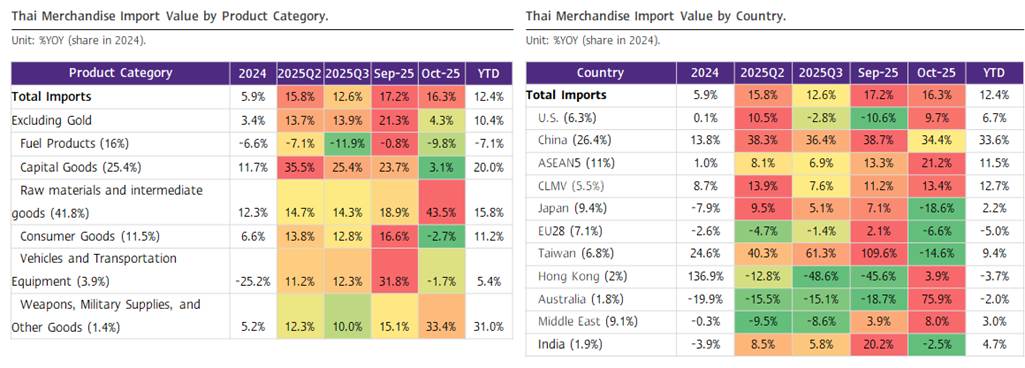

The value of merchandise imports in October stood at USD 32,272.5 million, expanding by 16.3%, following growth of 17.2% in the previous month, and considerably exceeding earlier expectations (SCB EIC estimated 10.1%). Overall, imports during the first ten months of the year expanded strongly by 12.4%. This month, imports of raw and intermediate materials (including gold), as well as arms and ammunition, accelerated sharply by 43.5% and 33.4%, respectively—more than double the growth rates of 18.9% and 15.1% recorded in September. In contrast, imports of capital goods, consumer goods, and vehicles and logistics equipment slowed markedly to 3.1%, -2.7%, and -1.7%, respectively (compared with strong growth of 23.7%, 16.6%, and 31.8% in the previous month). Fuel products imports were the only category that remain contracted—around -10%—compared with a mild contraction of -0.8% in the prior month (Figure 3).

Imports of raw and intermediate materials continued to expand at a high rate, partly because Thailand resumed importing gold at a very elevated level. Excluding gold, import growth stood at only 4.3%. In October, gold imports surged by as much as 315.3%, rebounding sharply from a -44.3% contraction in the previous month.

The main sources of Thailand’s gold imports were Switzerland, the United Arab Emirates, China, Australia, Singapore, and Hong Kong, which recorded exceptionally high growth rates of 745.7%, 516.1%, 1,436.9%, 327.8%, 779.3%, and 7.1%, respectively—together accounting for around 93% of total gold import value this month. Part of the sharp increase may be attributed to declining global gold prices.

The trade balance (customs basis) returned to a large deficit this month, standing at USD -3,436.9 million — the highest in 31 months and significantly worse than expected (SCB EIC estimated a deficit of USD -800 million). This outcome reflected a clear slowdown in exports, while imports continued to accelerate sharply. As a result, the cumulative trade balance for the first ten months of 2025 recorded a deficit of USD -3,866.2 million.

SCB EIC revised up Thai export growth forecast in 2025 to 10.7%, in line with the stronger-than-expected performance during the first nine months. For 2026, Thailand’s export outlook is projected to contract by -1.5%.

SCB EIC revised up Thailand’s export growth in 2025 to 10.7%, from the previous projection of 5.3% (balance of payments basis, outlook as of November 2025). This adjustment was made despite October export figures coming in considerably below expectations, as exports in Q3 continued to perform well during the initial phase of the US tariff hikes. For the remaining two months of the year, export growth is expected to be modest due to a high base effect. The upward revision of this year’s export forecast is driven by four key factors:

1) The global economy and global trade in 2025 expanded more strongly than previously expected at the beginning of the year, due largely to a considerable easing of trade war tensions, especially between China and the US. The actual US tariff rates implemented were significantly lower than the initially announced levels, following negotiations that resulted in an agreement acceptable to the US. In addition, front-loading of exports prior to the US tariff implementation in early August supported export momentum.

As a result, Thailand’s exports to major trading partners expanded well, particularly to China, ASEAN-5, and the European Union, which grew by 15.5%, 6.3%, and 7.9%, respectively.

2) The US postponed the start of its reciprocal tariff measures from 2 April to 8 August, enabling Thailand to accelerate exports to the US to a significant extent. As a result, Thai exports during the first seven months of the year expanded by as high as 14.4%.

3) Thailand successfully negotiated with the US to reduce reciprocal tariff rates by nearly half, from 36% to 19%, bringing the rate closer to that faced by regional competitors. This allowed Thai export products to maintain their competitiveness in the US market.

4) Exports of electronic products and gold expanded very strongly by 35.6% and 104.8%, respectively, during the first nine months of the year. These product groups contributed (CTG) 8.7% to Thailand’s export growth over the same period—more than half of the total export growth rate of 13.9% (CTG).

The Ministry of Commerce also revised its outlook significantly upward, estimating that Thailand’s export value this year will expand by 10.7%–11.4%.

However, SCB EIC assesses that Thailand’s export value in 2026 is likely to return to contraction at -1.5%, mainly due to the following factors:

1. The global economy and global trade volume in 2026 are expected to slow significantly, as the full impact of US tariff measures under the Trump administration will begin to materialize more clearly and comprehensively after the enforcement delay this year. The World Trade Organization (WTO) recently revised down its forecast for global trade volume in 2026 to only 0.5% (a sharp slowdown from 2.4% in 2025). Similarly, the International Monetary Fund (IMF) lowered its forecast for global trade in goods and services to 2.3% in 2026 (down from 3.6% in 2025).

2. The high base effect, particularly during the first seven months of 2025 when exports expanded by as much as 14.4%.

3. Chinese products are expected to become more competitive in the US market under the China–US trade agreement reached on 30 October, whereby the US agreed to reduce import tariffs on Chinese goods to 20% (from the previous 30%) for a period of one year. This tariff rate is now much closer to that applied to Thai products, thereby narrowing Thailand’s relative competitiveness.

In addition, Thailand’s exports will continue to face several heightened risks in 2026, including (1) additional US import tariffs, particularly product-specific tariffs and the 40% transshipment tariff, and (2) geopolitical uncertainties, should tensions between the US and China intensify once again.

Figure 1: Thai Export Value by Product Category and Key Markets.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 2: Computers and Equipment, Pickup Trucks, and Automobiles and Parts Supported Exports in October, While Gold Exports Began to Contract Sharply.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 3: Thai Import Value by Product Category and Key Markets.

Source: SCB EIC analysis based on data from the Ministry of Commerce.