Thai retailers positioned to grow in ASEAN markets

Modern trade is a star industry that has good prospects for penetrating Southeast Asian markets. Many leading foreign retail chains have aggressively expanded their branches in the region during recent decades. Now is the right time for Thailand’s own store operators to find opportunities abroad, benefiting from market liberalization within the ASEAN Economic Community and tapping the region’s rising middle-class. The key questions are which countries here are worth investing in and which segments are attractive?

ผู้เขียน: SCB EIC | Economic Intelligence Center

Thai retailers positioned to grow in ASEAN markets

Modern trade is a star industry that has good prospects for penetrating Southeast Asian markets. Many leading foreign retail chains have aggressively expanded their branches in the region during recent decades. Now is the right time for Thailand's own store operators to find opportunities abroad, benefiting from market liberalization within the ASEAN Economic Community and tapping the region's rising middle-class. The key questions are which countries here are worth investing in and which segments are attractive?

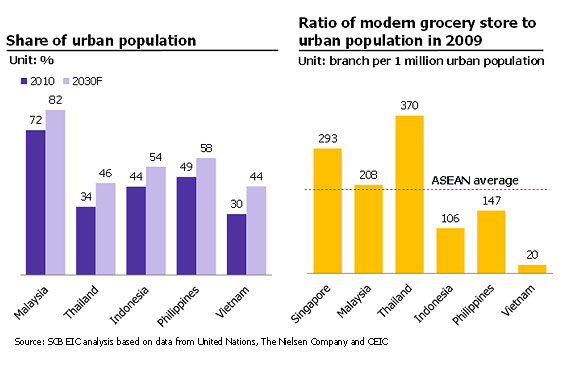

Malaysia, Vietnam and Indonesia are the most attractive markets for retail business investment. Malaysia possesses high purchasing power due to growth in the middle-to-high-income consumer segment, which has doubled in the last 10 years, accounting for two-thirds of the population in 2010. Malaysia's retail sales per-capita grew four times faster than Thailand's. While Vietnam and Indonesia may not have per-capita levels of retail sales as high as Malaysia's, their rapid urbanization and growth in purchasing power have translated into retail sales growing at a compound annual rate of 15% during the last five years. Modern trade has huge potential to grow; it now stands at just 30% of total retail trade. Vietnam and Indonesia have an average of 50 modern trade stores per 1 million urban population, which is very low compared to 300 stores per million in Thailand, Malaysia and Singapore. It is clear that growth in modern trade stores lags behind urban population growth and that these stores have yet to expand into second-tier cities. In Indonesia, some retailers have started to open new branches in major cities beyond Jakarta, in particular cities that have high economic growth, but there is still a small presence of modern trade stores in cities like Tangerang, Solo, and Malang.

Despite rapid expansion by foreign chains, grocery retailing still has good potential for growth. Modern grocery stores in the form of hypermarkets and convenience stores have led the expansion, mostly by such foreign chains as Tesco, Casino and Carrefour. The number of modern grocery store branches has grown by 15% per year from 2006 to 2009. Despite fierce competition in this format, there is still some room for other players to enter, particularly in Vietnam, which still has quite low penetration by modern groceries, at 10% of all groceries. Although it has 1.2 times the population of Thailand, Vietnam has 50 times fewer hypermarkets per capita. Hypermarkets are well suited to markets where commercial space is readily available, where real estate costs are low, and where low retail prices are especially attractive to consumers. On the other hand, smaller formats such as supermarkets and convenience stores have better growth potential in the more developed modern markets, like Malaysia. This is due to hypermarket saturation, limited availability of commercial space, and a consumer preference for shopping at the most convenient location.

Increasing numbers of middle-income consumers translate into increasing demand for diverse products beyond food and everyday necessities, which translates into good potential for non-grocery stores, particularly shopping malls and specialty stores. Even though hypermarkets do provide such items as electrical appliances and clothes, stealing some market share, non-grocery stores can compete by offering greater variety to better meet specific consumer preferences. As a result, shopping malls and specialty stores continue to experience good growth. In particular, clothing, shoes, leisure goods, personal care products, electronics and home and gardening items have large growth potential. In Malaysia, rising affluence has driven demand for sophisticated and premium products. As a result, Malaysia has stores specializing in high-end household appliances, for example. Vietnam, despite its rapid economic development in recent years, still has only one shopping mall per million people, compared to an average of ten per million in developed countries. So there are plenty of opportunities available to get into the Vietnamese retail market.

But businesses must differentiate their products and target middle-to-high-income markets in order to compete. Middle-to-high-income consumers have increased significantly, especially in the ASEAN-6 countries, where this segment is expected to reach 50% of the population within the next ten years. These consumers have not only strong purchasing power but also a strong appetite for shopping. Yet only a few stores target the middle-to-high-income category. The number of highly affluent household in Indonesia is projected to rise 30% per year within the next few years, and they seek more premium products, particularly clothes and cosmetics. Retailers focusing on premium foreign brands typically enjoy strong profits. In Vietnam, upper-middle-class consumers want more sophisticated non-grocery products. The number of debit card and mobile phone users in Vietnam went up 30-fold during 2003-2009 in tandem with increasing popularity of imported brand-name and luxury goods. Sales in the clothing, jewelry and luxury categories have grown 20% per annum during 2004-2009.

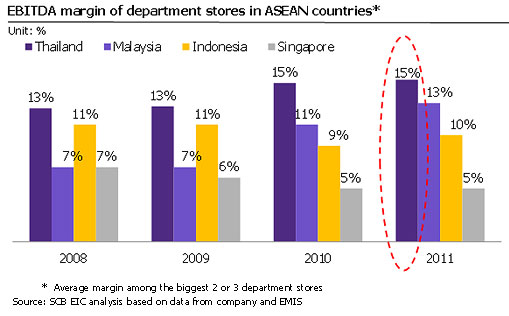

Thai retailers are in a strong position to capture these growth opportunities thanks to their depth of experience and strong performance. In terms of experience in management, Thai entrepreneurs have a good understanding of ASEAN consumers' behavior and tastes. They adapt to the changing business environment such as by introducing new varieties of products to match the demands of different consumer segments, by changing business models to suit location and target customers, and by managing costs. As a result, Thai retail businesses have always performed well. In the case of shopping malls, the Thai players' average EBITDA margin has grown and consistently stood in the double digits, around 15%, compared to just 5-10% among Malaysian and Singaporean malls.

To capture the arising ASEAN market growth opportunities, Thai retail entrepreneurs need to carefully study the markets when expanding into other ASEAN countries. Some strategic and business models might have to be adjusted to suit different business environments and the restrictive domestic regulations. At the same time, Thai manufacturers and service providers should take a ride on this growth expectation by exploring partnerships with international, local or Thai retailers as well as distributors to expand businesses beyond Thailand.