FLASH

03 November 2025

Exports in September surged to the highest growth in 42 months, with full-year performance expected to exceed earlier projections, while imports also expanded sharply.

The value of Thai merchandise exports in September 2025 stood at USD 30,970.7 million, expanding sharply by 19%YOY

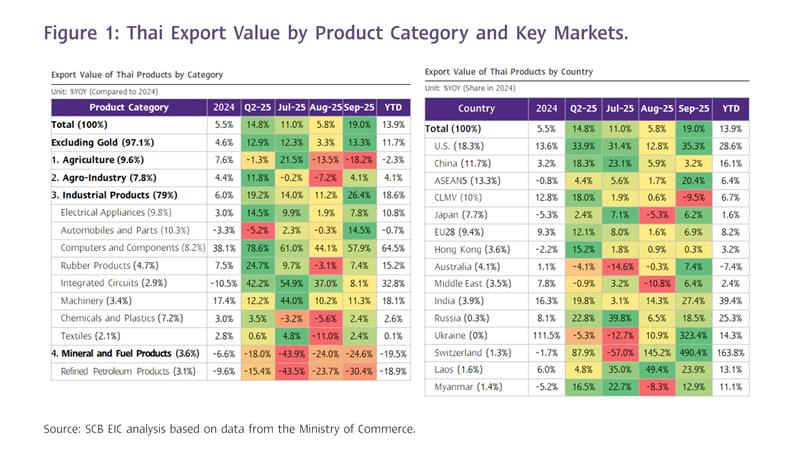

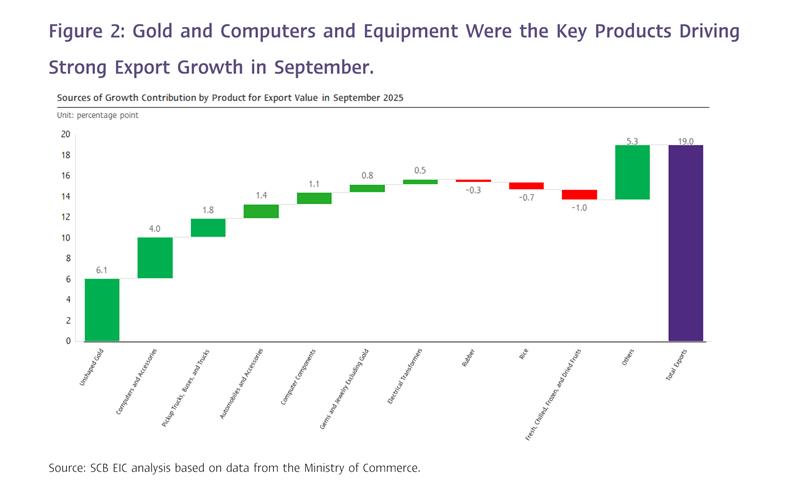

The value of Thai merchandise exports in September 2025 stood at USD 30,970.7 million, expanding sharply by 19%YOY, accelerating from 5.8%YOY in the previous month. This marked the highest growth in three and a half years and considerably exceeded earlier projections (SCB EIC estimated 3.5%, while the Reuters Poll median forecasted 7%). On a seasonally adjusted basis, exports rose strongly by 3.8%MOM_SA, up from 0.1%MOM_SA in August. Overall, Thailand’s export value in the first three quarters of 2025 expanded robustly by 13.9% (Figure 1 and Figure 2).

Exports of electronic products and unwrought gold remained the key drivers of export growth this month.

1) Exports of electronic products continued to expand strongly, driven by accelerated shipments to the United States, where certain electronic products remain exempted from import tariffs. The ongoing upcycle in the electronics sector, coupled with the global expansion of investment in the electronics and data center industries, also contributed to this growth. This was reflected in robust export expansion of electronic goods to the United States, China, Singapore, Mexico, and Malaysia, which grew by 67.1%, 32%, 97.1%, 100.1%, and 64%, respectively. Exports to the United States accounted for 47.7% of Thailand’s total electronic export value this month. Overall, electronic exports contributed 8.1 percentage points to Thailand’s total export growth in September, representing nearly half of the total 19% expansion.

2) Gold remained a key contributor to Thailand’s export growth. Exports of unwrought gold surged by 212.6%YOY, accelerating from 144% in the previous month. Exports to Switzerland, Singapore, and Lao PDR continued to expand strongly by 615.6%, 95.7%, and 437.1%, respectively, while exports to the United States soared dramatically by 185,737.4%. These four markets together accounted for approximately 95.9% of Thailand’s total gold export value. The increase partly reflected rising global demand for gold as a safe-haven asset amid heightened risk sentiment, along with a significant rise in global gold prices. Overall, gold exports contributed 6 percentage points to Thailand’s total export growth in September, accounting for nearly half of the total 19% expansion.

3) Thai exports to the United States continued to expand strongly in September, despite the imposition of tariffs on several products. Exports to the US grew by 35.3%YOY, accelerating from 12.8% in the previous month. Even when excluding electronic products, exports to the US still recorded solid growth of 14.2%. This was consistent with short-term indicators of US economic activity, which remained robust — such as the US Purchasing Managers’ Index (PMI), which stood at 53.9 in September and 54.8 in the preliminary reading for October (values above 50 indicate expansion). Overall, exports to the US contributed 6.8 percentage points to Thailand’s total export growth in September, accounting for a significant share of the overall 19% expansion.

Imports accelerated further across nearly all categories, particularly from China and Taiwan, while the trade balance returned to a surplus this month.

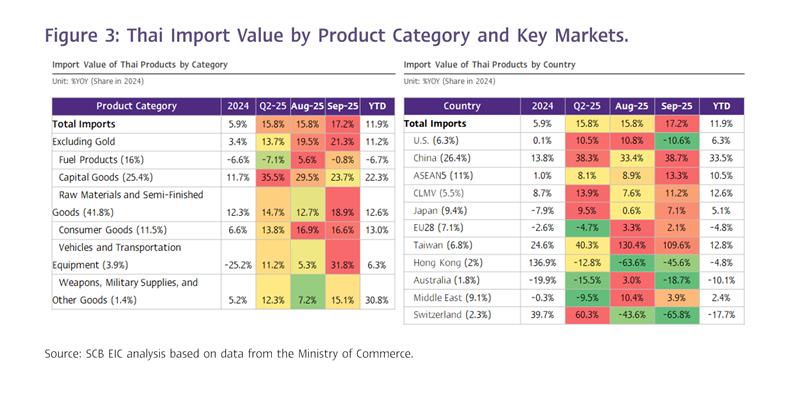

The value of Thai merchandise imports in September 2025 stood at USD 29,695.55 million, expanding by 17.2%YOY — accelerating from 15.8% in August and exceeding earlier projections (SCB EIC and the Reuters Poll median both estimated 10.6%). Overall, during the first nine months of 2025, imports expanded by a robust 11.9%. In September, imports of vehicles and logistics equipment, raw and intermediate materials, and arms and ammunition increased sharply by 31.8%, 18.9%, and 15.1%, respectively — up from 5.3%, 12.7%, and 7.2% in the previous month. Meanwhile, imports of capital goods and consumer goods continued to expand strongly by 23.7% and 16.6%, respectively. Fuel products were the only category that returned to contraction at -0.8%, following 5.6% growth in the prior month (Figure 3).

Additionally, when considering imports by country, the data indicate that imports from China and Taiwan were the main contributors to Thailand’s import growth this month, together accounting for a 16.8 percentage point contribution to total import growth (China 10.4%, Taiwan 6.4%) out of the overall 17.2%YOY increase.

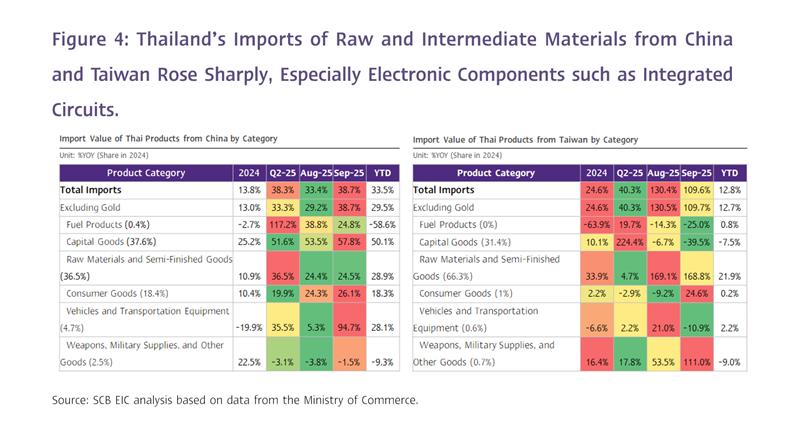

1. China: Thailand’s imports from China expanded sharply by 38.7% in September, accelerating from 33.4% in the previous month. As a result, during the first nine months of 2025, imports from China rose by a strong 33.5%, with growth seen across all major product categories.

a. Capital goods expanded significantly by 57.8%, led by electrical machinery and parts (+95.4%), machinery and parts (+40.9%), and computers, parts and accessories (+11.9%). Imports of capital goods from China accounted for 51.6% of Thailand’s total capital goods imports this month.

b. Raw and intermediate materials grew by 24.6%, driven by key items such as electronic integrated circuits (+32.8%), diodes, transistors, and semiconductor devices (+23.8%), and printed circuits (+41.0%). Imports of raw materials and intermediate goods from China accounted for 24.5% of Thailand’s total in this category.

c. Consumer goods rose by 26.1%, led by electrical household appliances (+23.0%), miscellaneous manufactured articles (+31.2%), and household articles and furniture (+25.4%). Imports of consumer goods from China represented 46.6% of Thailand’s total consumer goods import value this month (Figure 4, left).

2. Taiwan: Thailand’s imports from Taiwan continued to expand significantly for the second consecutive month, expanding by 109.6% in September and 130.4% in August. Approximately 90% of Thailand’s total import value from Taiwan this month consisted of raw and intermediate materials. By product category, imports of electronic integrated circuits from Taiwan rose sharply by 223.3% in September and 246.2% in August, accounting for 91.0% and 88.7% of Thailand’s total imports of raw materials and intermediate goods from Taiwan, respectively (Figure 4, right).

Import data indicate that (1) most of Thailand’s key import items are components used in electronic product manufacturing, consistent with the continued strong expansion of Thai electronic exports amid the global electronics upcycle, particularly in segments related to artificial intelligence (AI) technology and data centers. Given Thailand’s limited upstream and midstream production capacity, the country relies heavily on imports of electronic parts from major producers such as China and Taiwan to meet rising global demand for electronic goods. Moreover, the ongoing expansion of investment in Thailand’s electronics and data center industries has been another key factor supporting the exceptionally strong growth in imports of these products.

(2) The sharp rise in consumer goods imports from China continues to reflect the influx of low-priced Chinese products into Thailand. This trend stems from several factors:

a) China’s sluggish economic conditions, driven by persistently weak domestic confidence and ongoing problems in the property sector.

b) The high U.S. import tariffs imposed on Chinese goods relative to those on competing countries, prompting China to redirect more of its low-cost exports toward Southeast Asia; and

c) Thailand’s slowing domestic economy and elevated household debt levels, which have led consumers to increasingly favor lower-priced products imported from China.

The trade balance (customs basis) returned to a surplus of USD 1,275.2 million in September, following a large deficit of USD -1,964.4 million in the previous month. The trade surplus this month was slightly higher than expected (SCB EIC estimated USD 770 million, while the Reuters Poll median forecasted USD 100 million), driven by export growth that exceeded projections. Cumulatively, during the first three quarters of 2025, Thailand recorded a small trade deficit of USD -429.3 million, indicating that both exports and imports have grown at nearly comparable levels so far this year.

SCB EIC maintains the view that exports will weaken toward the end of 2025. However, overall export performance for the full year is expected to be better than previously anticipated, while the outlook for 2026 carries a risk of contraction.

Based on export data for the first nine months of 2025, which continued to outperform expectations, and the strong 19%YOY growth recorded in September, Thailand’s total export value for 2025 is likely to expand at a rate higher than SCB EIC’s previous forecast of 5.3%. Although exports are expected to weaken in Q4/2025, the overall annual performance will likely surpass earlier projections. Previously, the Ministry of Commerce had set a modest export growth target of 2–3% for the year. However, in its latest announcement this month, the Ministry revised its outlook, indicating that export growth for 2025 could reach as high as 10.4%. Nonetheless, SCB EIC assesses that despite the headline export figures showing a much stronger acceleration than last year, Thailand’s net benefits may be limited. This is because gold—a key export item this year—has contributed disproportionately to total export growth, while imports have also expanded sharply in parallel with exports.

For 2026, SCB EIC projects that Thai exports will contract by -1.9% (as of early October 2025), pressured by multiple factors. These include the likelihood of the United States imposing additional tariff measures—both on specific products (particularly electronics, which have performed strongly in recent periods) and on transshipment products which subject to a 40% preferential-tariff adjustment—as well as a broader global economic slowdown and persistently high trade uncertainty. Other headwinds include a high base effect from 2025 and the potential appreciation of the Thai baht relative to regional currencies. These factors align with the views of several international organizations, which also anticipate a slowdown in global trade volumes in 2026 compared to 2025. The IMF projects that global trade volume in goods and services will expand by only 2.3% in 2026, down from 3.6% in 2025, while the WTO expects global merchandise trade volume growth to slow to just 0.5% in 2026, compared with 2.4% in 2025.

SCB EIC is currently monitoring developments and reviewing its economic projections, with an updated forecast expected to be released in November 2025.

![trade1.jpg]()

![trade2.jpg]()

![trade3.jpg]()

![trade4.jpg]()

Exports of electronic products and unwrought gold remained the key drivers of export growth this month.

1) Exports of electronic products continued to expand strongly, driven by accelerated shipments to the United States, where certain electronic products remain exempted from import tariffs. The ongoing upcycle in the electronics sector, coupled with the global expansion of investment in the electronics and data center industries, also contributed to this growth. This was reflected in robust export expansion of electronic goods to the United States, China, Singapore, Mexico, and Malaysia, which grew by 67.1%, 32%, 97.1%, 100.1%, and 64%, respectively. Exports to the United States accounted for 47.7% of Thailand’s total electronic export value this month. Overall, electronic exports contributed 8.1 percentage points to Thailand’s total export growth in September, representing nearly half of the total 19% expansion.

2) Gold remained a key contributor to Thailand’s export growth. Exports of unwrought gold surged by 212.6%YOY, accelerating from 144% in the previous month. Exports to Switzerland, Singapore, and Lao PDR continued to expand strongly by 615.6%, 95.7%, and 437.1%, respectively, while exports to the United States soared dramatically by 185,737.4%. These four markets together accounted for approximately 95.9% of Thailand’s total gold export value. The increase partly reflected rising global demand for gold as a safe-haven asset amid heightened risk sentiment, along with a significant rise in global gold prices. Overall, gold exports contributed 6 percentage points to Thailand’s total export growth in September, accounting for nearly half of the total 19% expansion.

3) Thai exports to the United States continued to expand strongly in September, despite the imposition of tariffs on several products. Exports to the US grew by 35.3%YOY, accelerating from 12.8% in the previous month. Even when excluding electronic products, exports to the US still recorded solid growth of 14.2%. This was consistent with short-term indicators of US economic activity, which remained robust — such as the US Purchasing Managers’ Index (PMI), which stood at 53.9 in September and 54.8 in the preliminary reading for October (values above 50 indicate expansion). Overall, exports to the US contributed 6.8 percentage points to Thailand’s total export growth in September, accounting for a significant share of the overall 19% expansion.

Imports accelerated further across nearly all categories, particularly from China and Taiwan, while the trade balance returned to a surplus this month.

The value of Thai merchandise imports in September 2025 stood at USD 29,695.55 million, expanding by 17.2%YOY — accelerating from 15.8% in August and exceeding earlier projections (SCB EIC and the Reuters Poll median both estimated 10.6%). Overall, during the first nine months of 2025, imports expanded by a robust 11.9%. In September, imports of vehicles and logistics equipment, raw and intermediate materials, and arms and ammunition increased sharply by 31.8%, 18.9%, and 15.1%, respectively — up from 5.3%, 12.7%, and 7.2% in the previous month. Meanwhile, imports of capital goods and consumer goods continued to expand strongly by 23.7% and 16.6%, respectively. Fuel products were the only category that returned to contraction at -0.8%, following 5.6% growth in the prior month (Figure 3).

Additionally, when considering imports by country, the data indicate that imports from China and Taiwan were the main contributors to Thailand’s import growth this month, together accounting for a 16.8 percentage point contribution to total import growth (China 10.4%, Taiwan 6.4%) out of the overall 17.2%YOY increase.

1. China: Thailand’s imports from China expanded sharply by 38.7% in September, accelerating from 33.4% in the previous month. As a result, during the first nine months of 2025, imports from China rose by a strong 33.5%, with growth seen across all major product categories.

a. Capital goods expanded significantly by 57.8%, led by electrical machinery and parts (+95.4%), machinery and parts (+40.9%), and computers, parts and accessories (+11.9%). Imports of capital goods from China accounted for 51.6% of Thailand’s total capital goods imports this month.

b. Raw and intermediate materials grew by 24.6%, driven by key items such as electronic integrated circuits (+32.8%), diodes, transistors, and semiconductor devices (+23.8%), and printed circuits (+41.0%). Imports of raw materials and intermediate goods from China accounted for 24.5% of Thailand’s total in this category.

c. Consumer goods rose by 26.1%, led by electrical household appliances (+23.0%), miscellaneous manufactured articles (+31.2%), and household articles and furniture (+25.4%). Imports of consumer goods from China represented 46.6% of Thailand’s total consumer goods import value this month (Figure 4, left).

2. Taiwan: Thailand’s imports from Taiwan continued to expand significantly for the second consecutive month, expanding by 109.6% in September and 130.4% in August. Approximately 90% of Thailand’s total import value from Taiwan this month consisted of raw and intermediate materials. By product category, imports of electronic integrated circuits from Taiwan rose sharply by 223.3% in September and 246.2% in August, accounting for 91.0% and 88.7% of Thailand’s total imports of raw materials and intermediate goods from Taiwan, respectively (Figure 4, right).

Import data indicate that (1) most of Thailand’s key import items are components used in electronic product manufacturing, consistent with the continued strong expansion of Thai electronic exports amid the global electronics upcycle, particularly in segments related to artificial intelligence (AI) technology and data centers. Given Thailand’s limited upstream and midstream production capacity, the country relies heavily on imports of electronic parts from major producers such as China and Taiwan to meet rising global demand for electronic goods. Moreover, the ongoing expansion of investment in Thailand’s electronics and data center industries has been another key factor supporting the exceptionally strong growth in imports of these products.

(2) The sharp rise in consumer goods imports from China continues to reflect the influx of low-priced Chinese products into Thailand. This trend stems from several factors:

a) China’s sluggish economic conditions, driven by persistently weak domestic confidence and ongoing problems in the property sector.

b) The high U.S. import tariffs imposed on Chinese goods relative to those on competing countries, prompting China to redirect more of its low-cost exports toward Southeast Asia; and

c) Thailand’s slowing domestic economy and elevated household debt levels, which have led consumers to increasingly favor lower-priced products imported from China.

The trade balance (customs basis) returned to a surplus of USD 1,275.2 million in September, following a large deficit of USD -1,964.4 million in the previous month. The trade surplus this month was slightly higher than expected (SCB EIC estimated USD 770 million, while the Reuters Poll median forecasted USD 100 million), driven by export growth that exceeded projections. Cumulatively, during the first three quarters of 2025, Thailand recorded a small trade deficit of USD -429.3 million, indicating that both exports and imports have grown at nearly comparable levels so far this year.

SCB EIC maintains the view that exports will weaken toward the end of 2025. However, overall export performance for the full year is expected to be better than previously anticipated, while the outlook for 2026 carries a risk of contraction.

Based on export data for the first nine months of 2025, which continued to outperform expectations, and the strong 19%YOY growth recorded in September, Thailand’s total export value for 2025 is likely to expand at a rate higher than SCB EIC’s previous forecast of 5.3%. Although exports are expected to weaken in Q4/2025, the overall annual performance will likely surpass earlier projections. Previously, the Ministry of Commerce had set a modest export growth target of 2–3% for the year. However, in its latest announcement this month, the Ministry revised its outlook, indicating that export growth for 2025 could reach as high as 10.4%. Nonetheless, SCB EIC assesses that despite the headline export figures showing a much stronger acceleration than last year, Thailand’s net benefits may be limited. This is because gold—a key export item this year—has contributed disproportionately to total export growth, while imports have also expanded sharply in parallel with exports.

For 2026, SCB EIC projects that Thai exports will contract by -1.9% (as of early October 2025), pressured by multiple factors. These include the likelihood of the United States imposing additional tariff measures—both on specific products (particularly electronics, which have performed strongly in recent periods) and on transshipment products which subject to a 40% preferential-tariff adjustment—as well as a broader global economic slowdown and persistently high trade uncertainty. Other headwinds include a high base effect from 2025 and the potential appreciation of the Thai baht relative to regional currencies. These factors align with the views of several international organizations, which also anticipate a slowdown in global trade volumes in 2026 compared to 2025. The IMF projects that global trade volume in goods and services will expand by only 2.3% in 2026, down from 3.6% in 2025, while the WTO expects global merchandise trade volume growth to slow to just 0.5% in 2026, compared with 2.4% in 2025.

SCB EIC is currently monitoring developments and reviewing its economic projections, with an updated forecast expected to be released in November 2025.