The MPC maintained the policy rate at 1.5%. SCB EIC expects one more policy rate cut in December, bringing the rate down to 1.25%.

SCB EIC maintains its assessment that the policy rate will be lowered to 1.25% in the December meeting and further reduced to 1.0% in early 2026.

The MPC voted 5 to 2 to maintain the policy rate at 1.50%, while two members voted to lower the rate to 1.25%.

· The majority deemed the current monetary policy stance to be accommodative, emphasizing the importance of timing and policy effectiveness amid limited policy space.

· The minority judged that monetary policy could be further eased to support economic recovery and alleviate liquidity problems and debt burdens among vulnerable groups.

The Thai economy should slow in the second half of 2025, as the export sector begins to feel the impact of Trump’s tariffs.

· The economy in Q3 is expected to slow, weighed down by the export sector, which has begun to be affected by U.S. tariff measures, while industrial production has also weakened due to temporary factors. The MPC projects that Thai GDP growth in the second half of 2025 will be below 2%YoY.

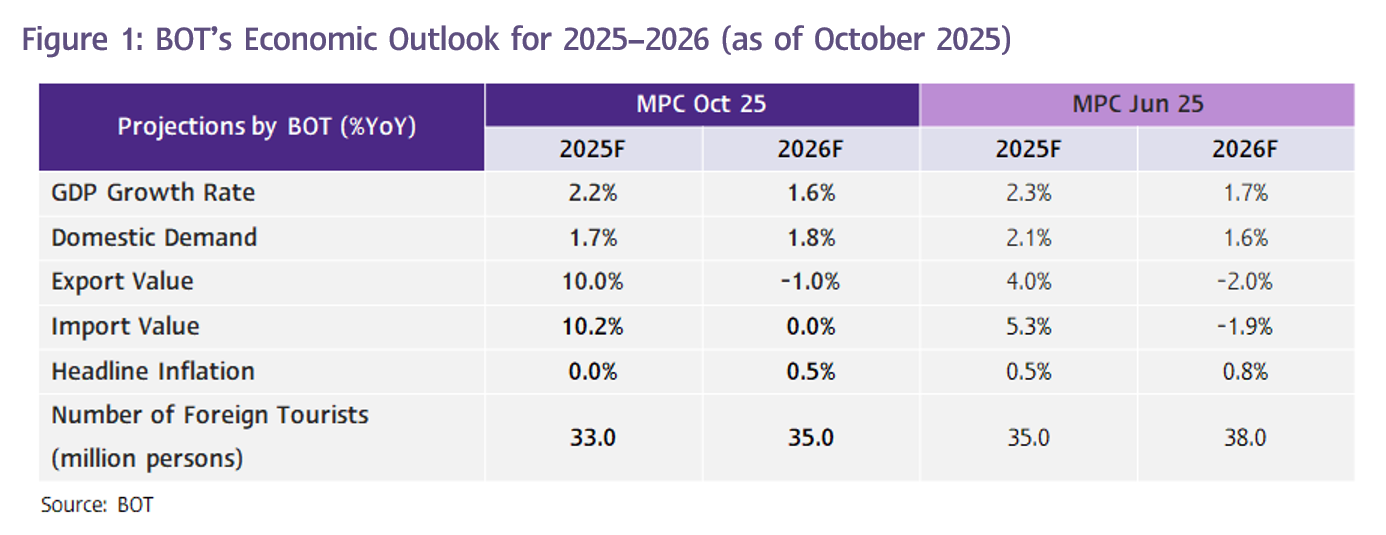

· The MPC revised up its export growth forecast for this year significantly to 10%YoY (from 4.0%YoY in the June meeting), in line with actual data. However, the positive impact on the overall economy is limited, as the import growth forecast was also raised substantially to 10.2%YoY (from 5.3%YoY in the June meeting).

· The MPC assessed that the tourism sector and domestic demand have already slowed. Accordingly, it revised down its projection for foreign tourist arrivals in 2025 from 35 million in the June meeting to 33 million (Figure 1) and lowered its forecast for domestic demand growth from 2.1%YoY to 1.7%YoY. Nevertheless, the MPC expects both drivers to gradually improve going forward and has already incorporated the government’s new economic stimulus measures, scheduled for implementation in Q4, into this economic projection.

· The overall outlook for the Thai economy remains broadly unchanged from the June meeting. The MPC slightly revised down its GDP growth projections from 2.3%YoY and 1.7%YoY in the June meeting to 2.2%YoY and 1.6%YoY in 2025 and 2026, respectively.

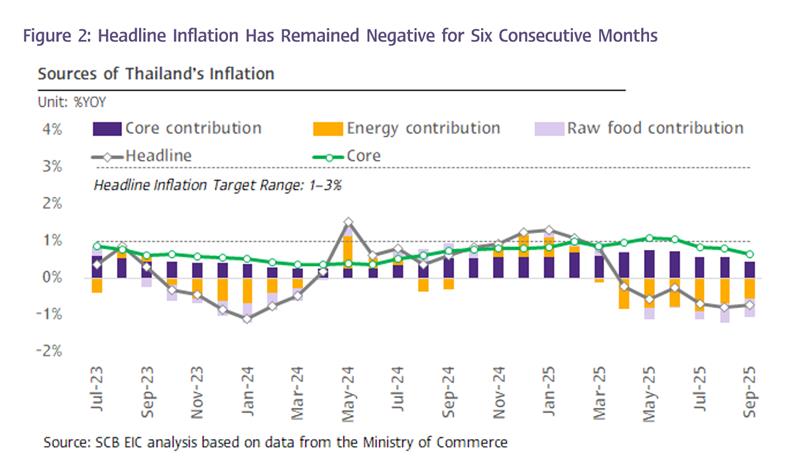

The MPC revised down its inflation forecast for this year to 0% and expects inflation to remain below the target range throughout 2026. The committee will closely monitor the risk of deflation.

· The MPC significantly revised down its headline inflation forecasts for 2025 and 2026, expecting inflation to decline to 0.0% and 0.5%, respectively. This marks a downward revision from the June meeting’s projections of 0.5% and 0.8%, respectively, reflecting supply-side factors such as lower energy and raw food prices (Figure 2).

· The MPC expects headline inflation to remain below the target range throughout next year while expects the headline inflation to return to the lower bound of the target range at 1% in early 2027, in line with global crude oil prices, which are projected to stabilize after a period of continuous decline.

· The MPC affirmed that Thailand has not yet entered a deflationary state but will monitor the risk more closely. The committee judges that Thailand is not in a deflationary state because (1) core inflation has not declined sharply or rapidly, with projections of 0.9% for both 2025 and 2026; (2) majority of the product prices have not fallen; and (3) long-term inflation expectations remain within the target range.

Overall financial conditions remain tight, while financial conditions for SMEs continue to be a concern.

· Thailand’s overall financial conditions remain tight. Credits continue to contract slightly, partly due to weaker credit demand and debt repayments by large corporates, while overall credit quality has not deteriorated significantly.

· SMEs continue to face tight financial conditions, as reflected by both domestic and external indicators. Domestically, SME loans have contracted, and credit quality has deteriorated, evidenced by a continued rise in the NPL ratio. Externally, export-oriented SMEs have been affected by the appreciation of the baht, which has reduced their revenue in baht terms. The impact is particularly severe among SME exporters, as (1) over 80% of them do not hedge against exchange rate risks, and (2) SME exporters already operate with relatively low profit margins.

· The MPC affirmed that monetary policy needs to be “accommodative,” but emphasized the importance of timing and the effectiveness of monetary policy transmission amid limited policy space and heightened future uncertainties.