FLASH

29 September 2025

The U.S. tariff barriers are becoming more apparent, leading to a significant slowdown in exports in August

SCB EIC Foresees Risk of Export Contraction in the Remainder of the Year Due to US Reciprocal Tariffs and Potential Additional Specific Tariffs

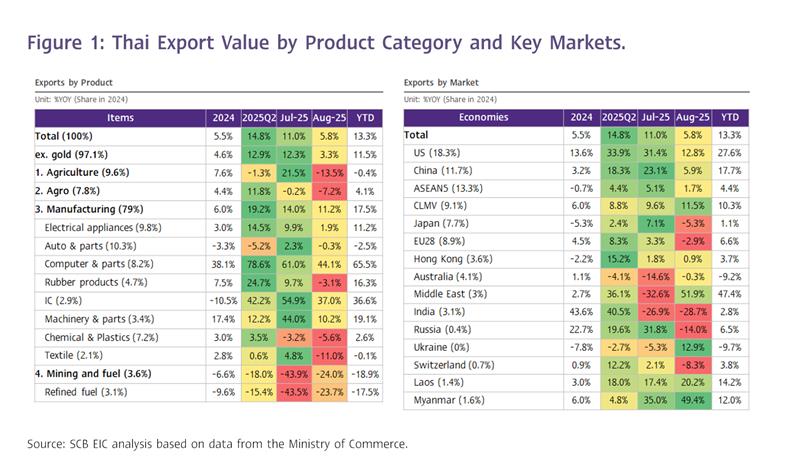

The export value in August 2025 stood at USD 27,743.19 million, with growth slowing to 5.8%, down considerably from 11.0% YoY in the previous month and falling short of expectations (SCB EIC and the median Reuters Poll had estimated 9.5%). The seasonally adjusted data showed a contraction of -0.1% MoM, continuing from a -1.6% MoM drop in July. Overall, the export value for the first eight months of the year still showed strong growth at 13.3%, driven by front-loading during the first seven months of the previous year before the U.S. began imposing retaliatory tariffs (Figures 1 and 2).

Exports of electronics to the United States and gold to Switzerland and some ASEAN countries continue to support export growth.

1) Thai exports to the United States in August slowed to 12.8% YoY, down from strong growth rates of 42.1% and 31.4% in June and July, respectively. This slowdown began to reflect the impact of the U.S. import tariffs on Thai exports, which were set at 19% starting August 7, up from the 10% tariff the U.S. had imposed on all countries since April 2. Although overall exports to the U.S. slowed considerably this month, the export of electronics products, which is still exempt from the tariff before the imposition of specific tariffs on certain products, remained a key driver. This allowed Thai exports to the U.S. to continue growing. Notable products included computers, equipment, and components, which grew by 65.8%; teleprinters, telephone sets and parts, which grew by 17.5%; and electrical circuit boards, which grew by 34.6%. These exports to the U.S. contributed 2.4% YoY to the overall export growth of 5.8% YoY this month.

2) Gold remained a key driver of export growth this month. Exports of unwrought gold surged significantly by 144%, recovering from a -14.7% decline in the previous month. Exports of gold to Switzerland, Cambodia, Laos, and Singapore grew by 177.8%, 30.4%, 918.1%, and 238.3%, respectively, accounting for 95.5% of the total value of unwrought gold exports this month. This surge was partly due to global demand for gold as a hedge against rising risks, coupled with a significant increase in gold prices. Unwrought Gold exports contributed 2.5% YoY to Thailand's export growth this month (CTG), nearly half of the total export growth of 5.8% YoY.

Imports accelerated significantly and grew across all categories, leading to a high trade deficit in August.

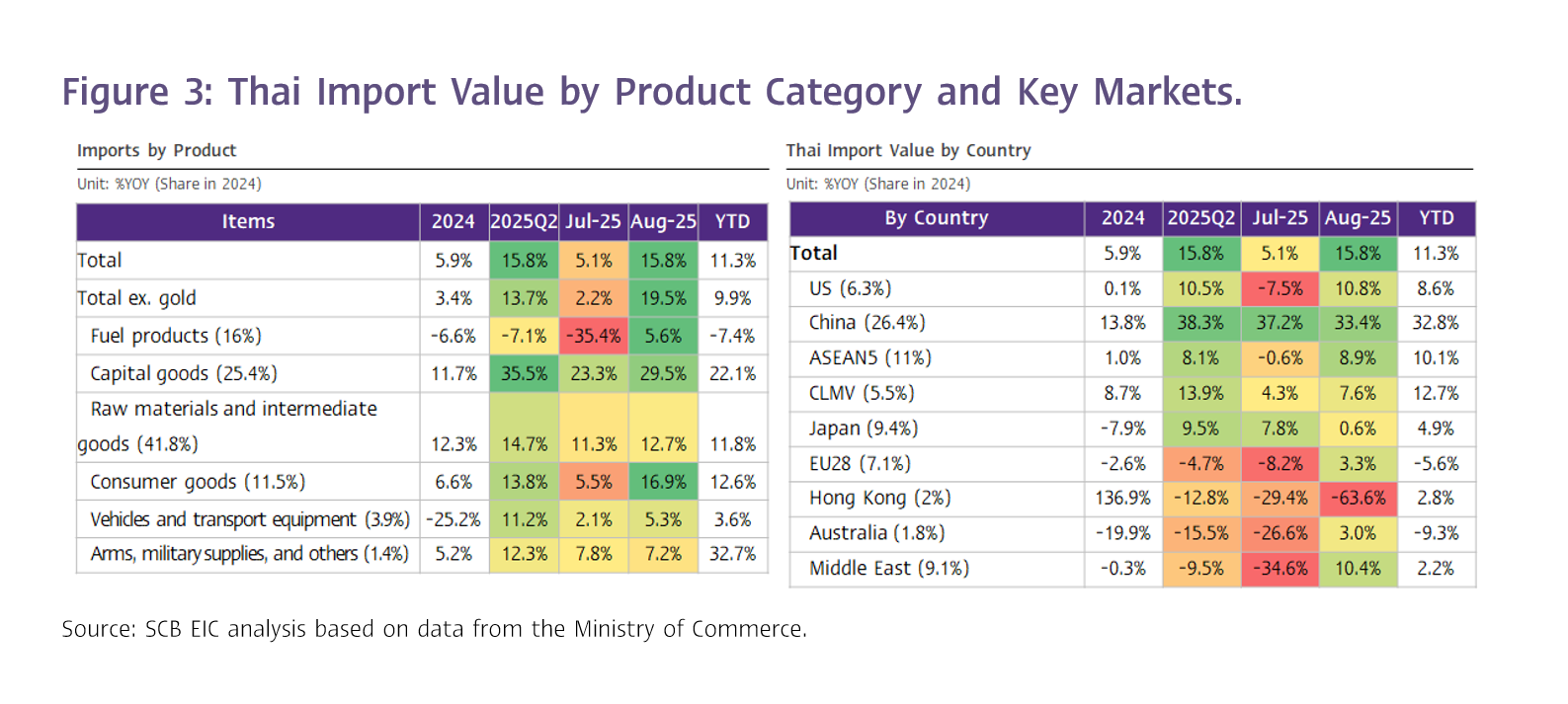

The value of merchandise imports in August stood at USD 29,707.6 million, growing by 15.8%, a considerably acceleration from 5.1% in July and exceeding expectations (SCB EIC and the median Reuters Poll had estimated 9.2%). For the first eight months of the year, imports grew by 13.3%. Imports in nearly every category showed strong growth compared to the previous month, including:

1) Capital goods grew by 29.5%, continuing from 23.3% in the previous month, particularly driven by a 53.5% increase in capital goods imports from China, which accounted for nearly half (49.2%) of total capital goods imports this month.

2) Consumer goods expanded by 16.9%, up from 5.5% in the previous month, with notable increases in imports from China, Vietnam, and the U.S. at 24.3%, 26%, and 73.7%, respectively, compared to 11.9%, 4.3%, and -9.4% in the previous month. Precious stones and jewellery imports from the U.S. saw a significant increase of 274.9%.

3) Raw and intermediate materials (including gold) grew by 169.1% and 24.4% from Taiwan and China, respectively, accounting for 45.9% of total imports in this category.

4) Vehicles and logistics equipment saw an increase of 29.8% and 38.2% from the U.S. and Indonesia, reversing the previous month's contraction.

5) Fuel products imports grew by 5.6%, following three consecutive months of contraction, with crude oil and refined oil imports increasing by 14.1% and 33%, respectively.

6) Arms and ammunition saw a slight slowdown, growing by 7.2%, compared to 7.8% in the previous month.

As a result of this rapid increase in imports across all categories, the trade balance for the month shifted to a significant deficit.

SCB EIC identified two interesting points in the import data for August:

(1) Thailand's imports of precious stones and jewellery (consumer goods) surged by 74.2%, up from 25.1% in the previous month. Notably, imports from the United States rose by 279.4%, compared to 24.1% in the previous month, accounting for 42.6% of the total value of precious stones and jewellery imports to Thailand in August.

(2) Thailand's imports of electrical circuit boards (raw materials and semi-finished goods) increased significantly by 122.9%, compared to 5.1% in the previous month, reaching a record high of USD 3,727.8 million. This was particularly driven by imports from Taiwan, which rose by 246.2%, reversing the -31.6% decline in the previous month. Imports from Taiwan accounted for 60.1% of the total value of electrical circuit boards imported to Thailand in August.

This month, the trade balance (customs basis) returned to a deficit of USD -1,964.4 million, after having recorded a surplus for three consecutive months. This outcome was contrary to expectations, which had forecasted a continued surplus (SCB EIC and the median Reuters Poll had projected a surplus of USD 700 million). The higher-than-expected imports were the main contributor to this deficit. As of the first eight months of 2025, the cumulative trade balance shows a deficit of USD -1,704.5 million.

SCB EIC Foresees Risk of Export Contraction in the Remainder of the Year Due to US Reciprocal Tariffs and Potential Additional Specific Tariffs

SCB EIC Forecasts Thai Export Value to Contract in the Remaining Four Months of the Year Due to US Reciprocal Tariffs and Potential Additional Specific Tariffs

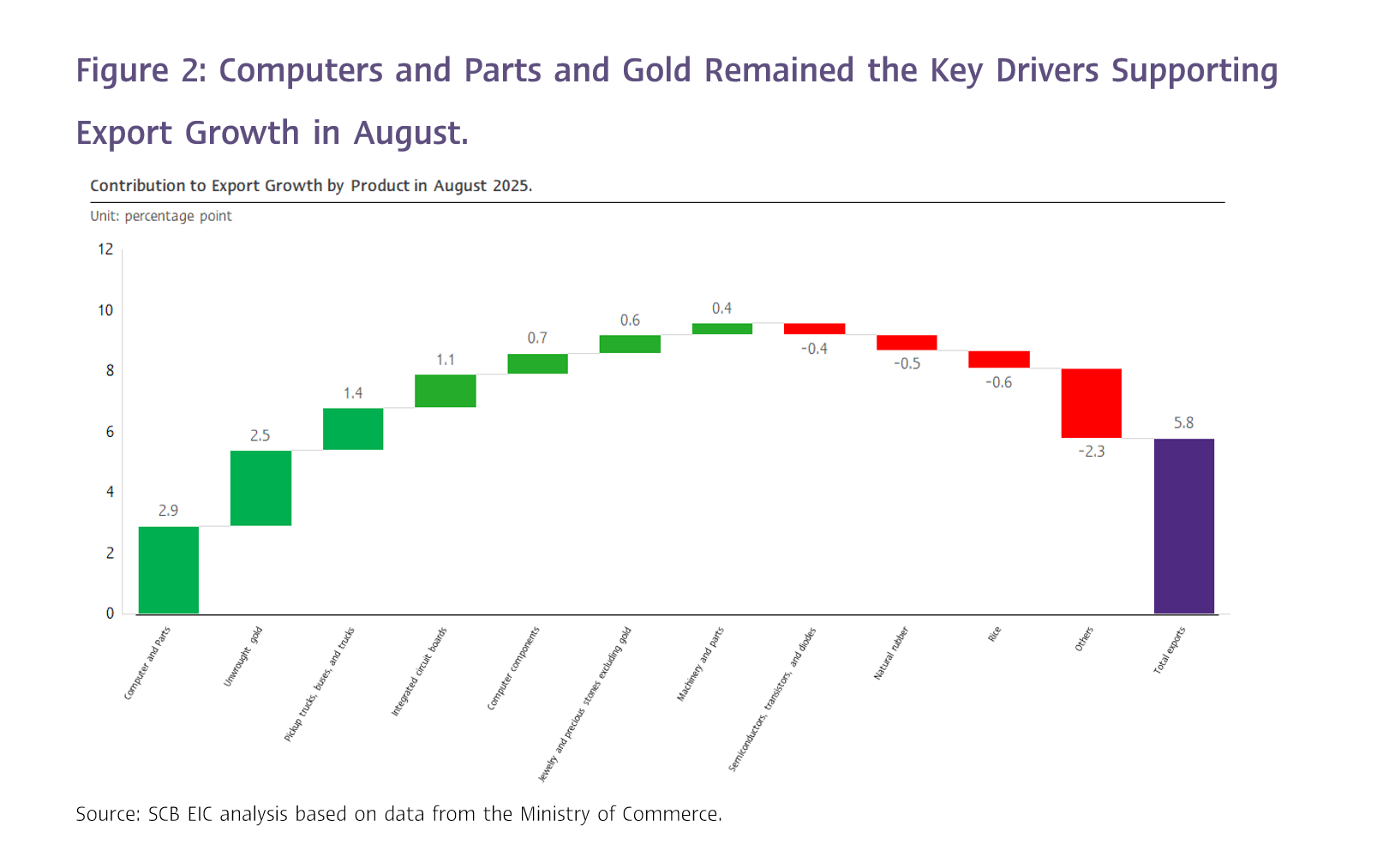

SCB EIC anticipates that Thai export value could face a contraction in the remaining four months of the year, as the effects of US reciprocal tariffs begin to be felt starting in August, along with the potential imposition of additional specific tariffs by the US. This is especially concerning for electronics products—Thailand's main export product to the US—which had shown strong growth in the first eight months of the previous year but is now facing risk of higher tariffs from the US. Figure 2 indicates that Thai exports in August grew due to temporary factors, including the acceleration of electronics and gold exports. Excluding these temporary factors, Thai exports in August might have shown no growth or even contracted.

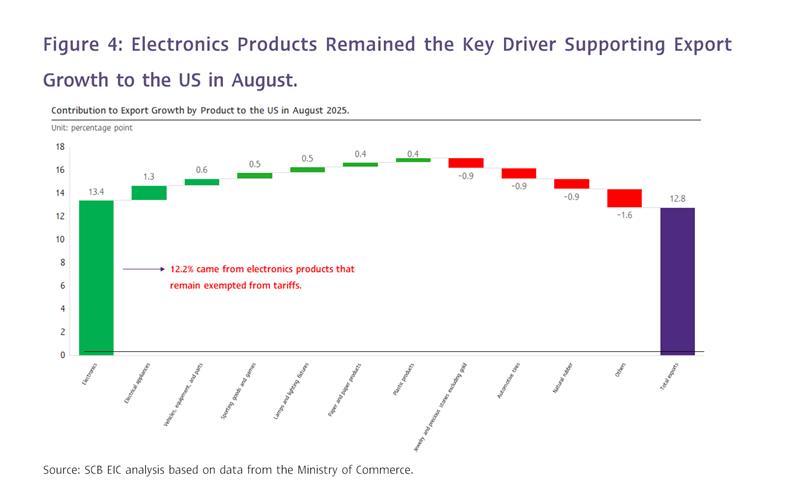

In addition, the 12.8% YoY growth in exports to the United States was primarily driven by electronic products, with a significant 13.4% YoY growth in the electronics category (CTG). Electronics products that are still exempt from US tariffs contributed to a 12.2% YoY growth in CTG. Figure 4 reflects that without the boost from electronics, Thai exports to the US might have contracted. Furthermore, Thai exports in the remaining months of this year face challenges from a high base effect and a stronger baht, which outperforms the regional currencies. These factors could put additional pressure on Thailand's export competitiveness, aside from the impact of US reciprocal tariffs.

Special topic :

Although Thailand has negotiated with the United States to reduce reciprocal tariffs to 19%, US tariffs policy remains uncertain and complex in its details. This could result in Thailand facing tariffs higher than the agreed-upon 19%.

1) US Counter-Tariffs Imposed in Addition to Regular Tariffs on General Trading Partners The United States will collect reciprocal tariffs stacked on top of the existing tariffs. The reciprocal tariffs rates announced in early August will be added to the original tariff rates under the Harmonized Tariff Schedule of the United States (HTSUS), or the Normal Trade Relations (NTR) / MFN Rate.

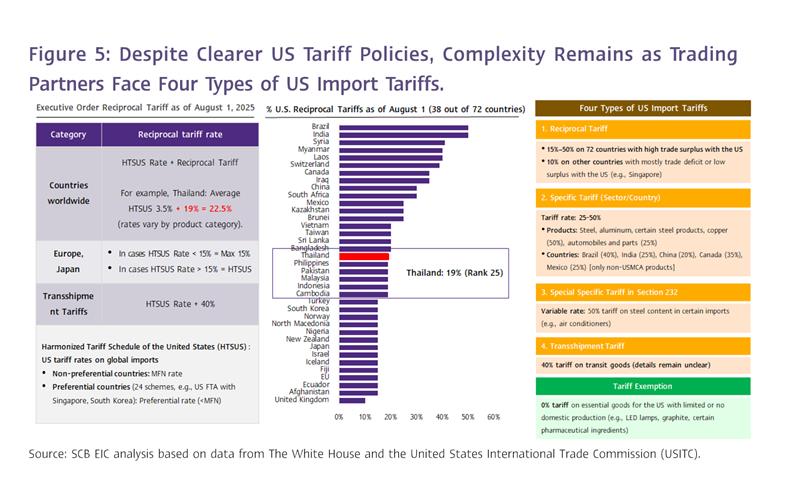

Countries without Free Trade Agreements (FTAs) with the US, such as South Korea and Singapore, will face new, higher import tariffs compared to the previous rates. For example, Thailand, which previously paid an average MFN Rate of 3.5%, will now face a combined tariff rate of 22.5% after the new 19% counter-tariff (Figure 5).

The US Agreed to Impose a 15% Reciprocal Tariffs on the European Union and Japan under a Non-Stack System 1) If the original import tariff rate (HTSUS) is lower than 15%, the import tariff for that product will be adjusted upward to a minimum of 15%. For example, Japanese automobiles, previously subject to a 2.5% tariff, will now be adjusted to 15% (not 2.5% + 15% = 17.5%). 2) If the original import tariff rate (HTSUS) is higher than 15%, the product will not be subject to any additional reciprocal tariffs (only the original tariff rate applies). For example, Japanese beef, which was subject to a 26.4% import tariff, will not be charged additional tariffs. As a result, products from the European Union and Japan gain a competitive advantage in the US market compared to general trading partners.

2) Countries Worldwide Will Face Four Types of US Import Tariffs, Which Remain Highly Complex and May Result in Higher Rates than the Negotiated Reciprocal Tariffs

At present, the US exempts import tariffs for certain products that it can produce only in limited quantities or cannot produce domestically, such as LED lamps, graphite, certain pharmaceutical ingredients, and various types of electronic products. As a result, many countries exporting these goods to the US, including Thailand, Vietnam, and Taiwan, have continued to experience strong export growth, particularly electronic products. SCB EIC’s assessment of Thailand’s top 16 export products to the US indicates that this product group accounts for nearly 30% of Thailand’s total export value to the US.

3) Uncertainty over US tariff policy remains high due to several key factors:

a. Ongoing reviews and announcements of additional specific tariffs on products such as pharmaceuticals and raw materials, semiconductors, heavy trucks, wood and wood products, and commercial aircraft and jet engines.

b. The potential re-escalation of US–China tensions once the temporary 90-day tariff reduction agreement (where US tariffs on China were reduced to 30%) expires on November 10.

c. US pressure on allied countries, such as the G-7, to raise import tariffs on China, India, or other countries engaged in trade with Russia.

d. If the US Supreme Court rules against Trump in the case concerning the use of presidential powers under the IEEPA to impose retaliatory tariffs, he may resort to alternative measures, including: i) Section 232 of the Trade Expansion Act of 1962, to broaden sectoral tariffs, ii) Section 122 of the Trade Act of 1974, to impose a universal tariff of 15% for up to 150 days, and iii) Section 301 of the Trade Act of 1974, to levy tariffs on countries engaged in unfair trade practices.

![trade-en-01.jpg]()

![trade-en-02.png]()

![trade-en-03.png]()

![trade-en-04.jpg]()

![trade-en-05.jpg]()

Exports of electronics to the United States and gold to Switzerland and some ASEAN countries continue to support export growth.

1) Thai exports to the United States in August slowed to 12.8% YoY, down from strong growth rates of 42.1% and 31.4% in June and July, respectively. This slowdown began to reflect the impact of the U.S. import tariffs on Thai exports, which were set at 19% starting August 7, up from the 10% tariff the U.S. had imposed on all countries since April 2. Although overall exports to the U.S. slowed considerably this month, the export of electronics products, which is still exempt from the tariff before the imposition of specific tariffs on certain products, remained a key driver. This allowed Thai exports to the U.S. to continue growing. Notable products included computers, equipment, and components, which grew by 65.8%; teleprinters, telephone sets and parts, which grew by 17.5%; and electrical circuit boards, which grew by 34.6%. These exports to the U.S. contributed 2.4% YoY to the overall export growth of 5.8% YoY this month.

2) Gold remained a key driver of export growth this month. Exports of unwrought gold surged significantly by 144%, recovering from a -14.7% decline in the previous month. Exports of gold to Switzerland, Cambodia, Laos, and Singapore grew by 177.8%, 30.4%, 918.1%, and 238.3%, respectively, accounting for 95.5% of the total value of unwrought gold exports this month. This surge was partly due to global demand for gold as a hedge against rising risks, coupled with a significant increase in gold prices. Unwrought Gold exports contributed 2.5% YoY to Thailand's export growth this month (CTG), nearly half of the total export growth of 5.8% YoY.

Imports accelerated significantly and grew across all categories, leading to a high trade deficit in August.

The value of merchandise imports in August stood at USD 29,707.6 million, growing by 15.8%, a considerably acceleration from 5.1% in July and exceeding expectations (SCB EIC and the median Reuters Poll had estimated 9.2%). For the first eight months of the year, imports grew by 13.3%. Imports in nearly every category showed strong growth compared to the previous month, including:

1) Capital goods grew by 29.5%, continuing from 23.3% in the previous month, particularly driven by a 53.5% increase in capital goods imports from China, which accounted for nearly half (49.2%) of total capital goods imports this month.

2) Consumer goods expanded by 16.9%, up from 5.5% in the previous month, with notable increases in imports from China, Vietnam, and the U.S. at 24.3%, 26%, and 73.7%, respectively, compared to 11.9%, 4.3%, and -9.4% in the previous month. Precious stones and jewellery imports from the U.S. saw a significant increase of 274.9%.

3) Raw and intermediate materials (including gold) grew by 169.1% and 24.4% from Taiwan and China, respectively, accounting for 45.9% of total imports in this category.

4) Vehicles and logistics equipment saw an increase of 29.8% and 38.2% from the U.S. and Indonesia, reversing the previous month's contraction.

5) Fuel products imports grew by 5.6%, following three consecutive months of contraction, with crude oil and refined oil imports increasing by 14.1% and 33%, respectively.

6) Arms and ammunition saw a slight slowdown, growing by 7.2%, compared to 7.8% in the previous month.

As a result of this rapid increase in imports across all categories, the trade balance for the month shifted to a significant deficit.

SCB EIC identified two interesting points in the import data for August:

(1) Thailand's imports of precious stones and jewellery (consumer goods) surged by 74.2%, up from 25.1% in the previous month. Notably, imports from the United States rose by 279.4%, compared to 24.1% in the previous month, accounting for 42.6% of the total value of precious stones and jewellery imports to Thailand in August.

(2) Thailand's imports of electrical circuit boards (raw materials and semi-finished goods) increased significantly by 122.9%, compared to 5.1% in the previous month, reaching a record high of USD 3,727.8 million. This was particularly driven by imports from Taiwan, which rose by 246.2%, reversing the -31.6% decline in the previous month. Imports from Taiwan accounted for 60.1% of the total value of electrical circuit boards imported to Thailand in August.

This month, the trade balance (customs basis) returned to a deficit of USD -1,964.4 million, after having recorded a surplus for three consecutive months. This outcome was contrary to expectations, which had forecasted a continued surplus (SCB EIC and the median Reuters Poll had projected a surplus of USD 700 million). The higher-than-expected imports were the main contributor to this deficit. As of the first eight months of 2025, the cumulative trade balance shows a deficit of USD -1,704.5 million.

SCB EIC Foresees Risk of Export Contraction in the Remainder of the Year Due to US Reciprocal Tariffs and Potential Additional Specific Tariffs

SCB EIC Forecasts Thai Export Value to Contract in the Remaining Four Months of the Year Due to US Reciprocal Tariffs and Potential Additional Specific Tariffs

SCB EIC anticipates that Thai export value could face a contraction in the remaining four months of the year, as the effects of US reciprocal tariffs begin to be felt starting in August, along with the potential imposition of additional specific tariffs by the US. This is especially concerning for electronics products—Thailand's main export product to the US—which had shown strong growth in the first eight months of the previous year but is now facing risk of higher tariffs from the US. Figure 2 indicates that Thai exports in August grew due to temporary factors, including the acceleration of electronics and gold exports. Excluding these temporary factors, Thai exports in August might have shown no growth or even contracted.

In addition, the 12.8% YoY growth in exports to the United States was primarily driven by electronic products, with a significant 13.4% YoY growth in the electronics category (CTG). Electronics products that are still exempt from US tariffs contributed to a 12.2% YoY growth in CTG. Figure 4 reflects that without the boost from electronics, Thai exports to the US might have contracted. Furthermore, Thai exports in the remaining months of this year face challenges from a high base effect and a stronger baht, which outperforms the regional currencies. These factors could put additional pressure on Thailand's export competitiveness, aside from the impact of US reciprocal tariffs.

Special topic :

Although Thailand has negotiated with the United States to reduce reciprocal tariffs to 19%, US tariffs policy remains uncertain and complex in its details. This could result in Thailand facing tariffs higher than the agreed-upon 19%.

1) US Counter-Tariffs Imposed in Addition to Regular Tariffs on General Trading Partners The United States will collect reciprocal tariffs stacked on top of the existing tariffs. The reciprocal tariffs rates announced in early August will be added to the original tariff rates under the Harmonized Tariff Schedule of the United States (HTSUS), or the Normal Trade Relations (NTR) / MFN Rate.

Countries without Free Trade Agreements (FTAs) with the US, such as South Korea and Singapore, will face new, higher import tariffs compared to the previous rates. For example, Thailand, which previously paid an average MFN Rate of 3.5%, will now face a combined tariff rate of 22.5% after the new 19% counter-tariff (Figure 5).

The US Agreed to Impose a 15% Reciprocal Tariffs on the European Union and Japan under a Non-Stack System 1) If the original import tariff rate (HTSUS) is lower than 15%, the import tariff for that product will be adjusted upward to a minimum of 15%. For example, Japanese automobiles, previously subject to a 2.5% tariff, will now be adjusted to 15% (not 2.5% + 15% = 17.5%). 2) If the original import tariff rate (HTSUS) is higher than 15%, the product will not be subject to any additional reciprocal tariffs (only the original tariff rate applies). For example, Japanese beef, which was subject to a 26.4% import tariff, will not be charged additional tariffs. As a result, products from the European Union and Japan gain a competitive advantage in the US market compared to general trading partners.

2) Countries Worldwide Will Face Four Types of US Import Tariffs, Which Remain Highly Complex and May Result in Higher Rates than the Negotiated Reciprocal Tariffs

- Transshipment Tariff: A 40% tariff applied to products with low levels of local content or regional value content. However, the details of this tariff remain unclear. SCB EIC’s preliminary assessment indicates that currently, Thai export industries with a high proportion of import content account for around 40% of Thailand’s total export value to the US.

- Specific Tariff (Product-Specific Tariff): For example, steel and aluminum, with some steel products subject to tariffs of 25%–50%; copper at 50%; and automobiles and parts at 25%. SCB EIC’s assessment of Thailand’s top 16 export products to the US shows that 3 of the 16 items—namely vehicle tires, automobiles and parts, and iron and steel products—fall into this category, accounting for approximately 12% of Thailand’s total export value to the US.

- Special Specific Tariff under Section 232: A variable tariff will be applied by charging a 50% steel tariff based on the value of the steel content used in a product’s production, meaning the higher the steel content, the higher the tariff the product will face. For example, Air conditioners, which typically have around 50% of their production value in steel, would be subject to a 25% tariff under this measure, instead of the 19% reciprocal tariffs. SCB EIC’s assessment of Thailand’s top 16 export products to the US shows that 3 of the 16 items—namely refrigerators and parts, air conditioners and parts, and other electrical appliances and parts—fall into this category, accounting for approximately 7% of Thailand’s total export value to the US.

- Reciprocal Tariff: A 19% tariff under the trade agreement between Thailand and the United States in August. SCB EIC’s assessment of Thailand’s top 16 export products to the US shows that 6 of the 16 items fall into this category, accounting for approximately 16% of Thailand’s total export value to the US.

At present, the US exempts import tariffs for certain products that it can produce only in limited quantities or cannot produce domestically, such as LED lamps, graphite, certain pharmaceutical ingredients, and various types of electronic products. As a result, many countries exporting these goods to the US, including Thailand, Vietnam, and Taiwan, have continued to experience strong export growth, particularly electronic products. SCB EIC’s assessment of Thailand’s top 16 export products to the US indicates that this product group accounts for nearly 30% of Thailand’s total export value to the US.

3) Uncertainty over US tariff policy remains high due to several key factors:

a. Ongoing reviews and announcements of additional specific tariffs on products such as pharmaceuticals and raw materials, semiconductors, heavy trucks, wood and wood products, and commercial aircraft and jet engines.

b. The potential re-escalation of US–China tensions once the temporary 90-day tariff reduction agreement (where US tariffs on China were reduced to 30%) expires on November 10.

c. US pressure on allied countries, such as the G-7, to raise import tariffs on China, India, or other countries engaged in trade with Russia.

d. If the US Supreme Court rules against Trump in the case concerning the use of presidential powers under the IEEPA to impose retaliatory tariffs, he may resort to alternative measures, including: i) Section 232 of the Trade Expansion Act of 1962, to broaden sectoral tariffs, ii) Section 122 of the Trade Act of 1974, to impose a universal tariff of 15% for up to 150 days, and iii) Section 301 of the Trade Act of 1974, to levy tariffs on countries engaged in unfair trade practices.