Thai Exports in May 2025 Surged Beyond Expectations, Reaching a Record High. SCB EIC anticipates that the impacts of international trade tensions will intensify and become more apparent starting from the second half of 2025

SCB EIC has revised its full-year forecast for Thai exports upward to -0.1%, from the previous estimate of -0.4%.

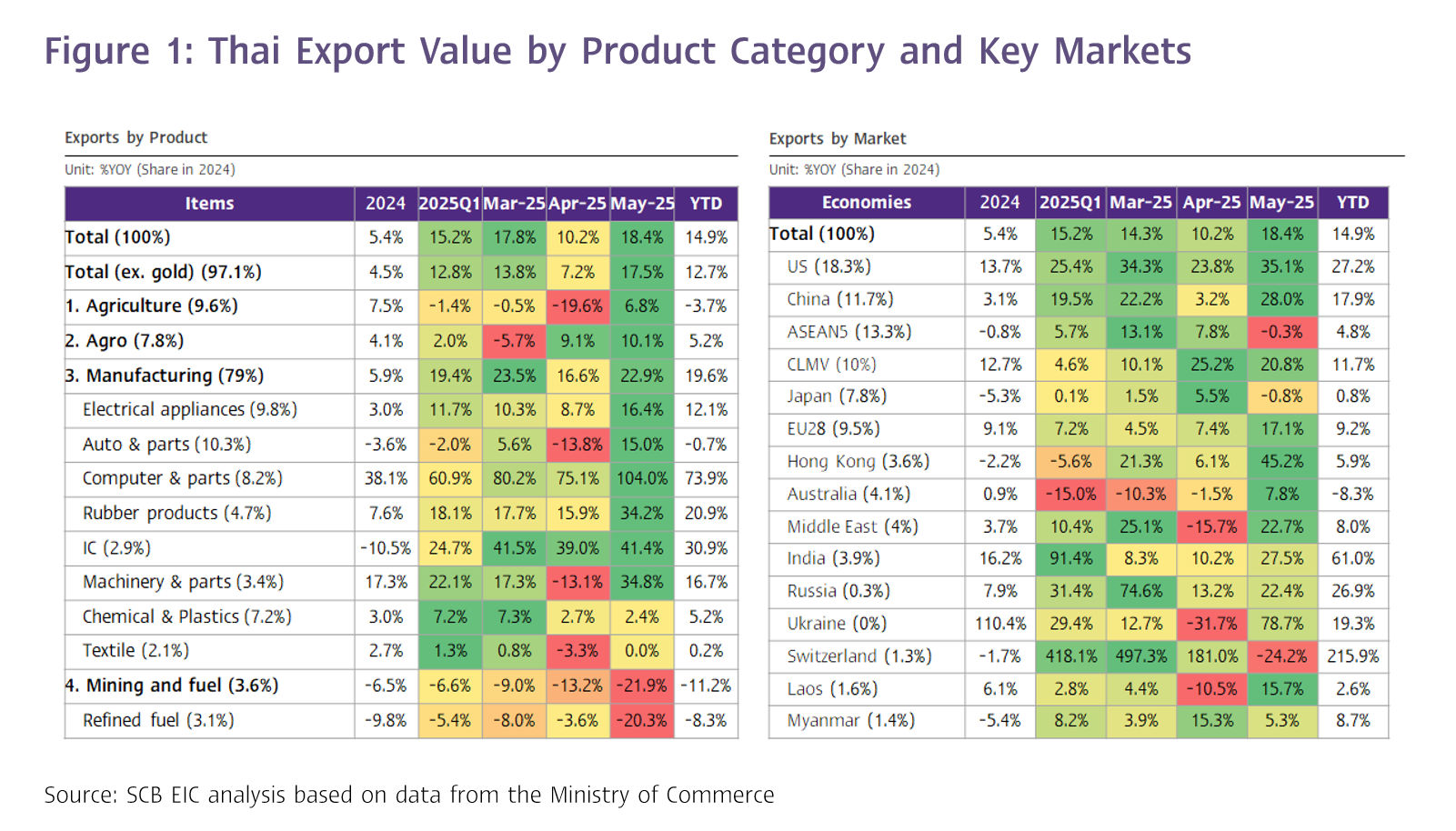

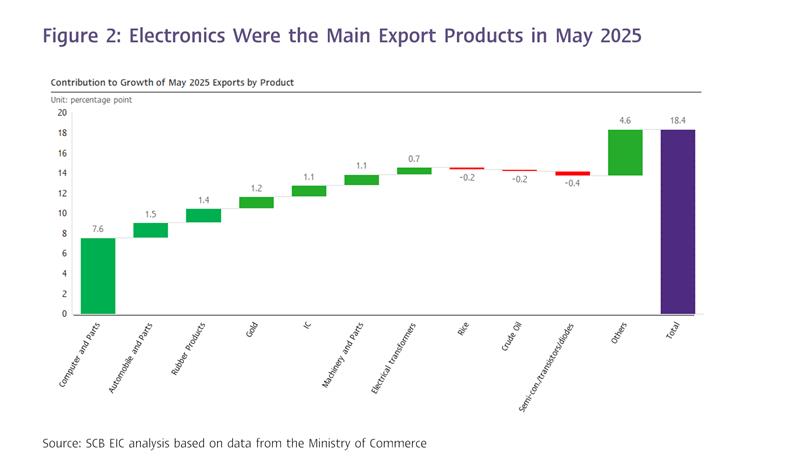

The value of Thai merchandise exports in May 2025 expanded by 18.4%YOY to USD 31,044.58 million—marking the highest level on record. This figure considerably exceeded expectations (SCB EIC estimated 9.0%, while the Reuters Poll median was 6.7%) and represented a notable acceleration from the 10.2% growth recorded in April. As a result, the overall export value for the first five months of 2025 expanded by 14.9%. On a seasonally adjusted basis, exports grew by 8.4%MOM_SA, reflecting a clear acceleration from the previous month (Figure 1 and Figure 2).

SCB EIC assesses that Thai exports this month continued to benefit from front-loaded shipments of electronic goods. Although the United States began imposing a universal tariff of 10% on nearly all countries on April 9, along with specific tariffs—25% on automobiles and 50% on steel and aluminum—most electronic products have not yet been subjected to tariff barriers. This has led to an acceleration in Thai electronic exports to the U.S. ahead of the full implementation of the entire tariff package.

Thai exports to the United States in May expanded considerably by 35.1%, accelerating from 23.8%YOY in the previous month. Electronics exports, in particular, surged by 50.0%, nearly doubling from the 29.9% growth seen in the prior month. Exports of automatic data processing machines and parts (computer and parts) rose sharply by 88.3%. Additionally, exports to China and Hong Kong also performed well, growing by 28.0% and 45.2%, respectively. The key driver was a sharp increase in electronics exports—up by 217.8% to China and 70.9% to Hong Kong. Combined, exports of electronics to the U.S., China, and Hong Kong accounted for 67.4% of Thailand’s total electronics export value in May.

Gold remained a key contributor to export growth this month, although the momentum from the special gold-related factor that had previously boosted Thai exports has diminished substantially. Exports of unwrought gold continued to expand strongly by 57.1%, though this marked a deceleration from 256.0% in the previous month. The growth was primarily driven by exports to Cambodia, Lao PDR, and the United Arab Emirates, which surged by 136.4%, 637.0%, and 100.0%, respectively—together accounting for 80.5% of Thailand’s total unwrought gold export value in May. This may reflect increased global demand for gold as a hedge against rising risks, along with a substantial increase in gold prices.

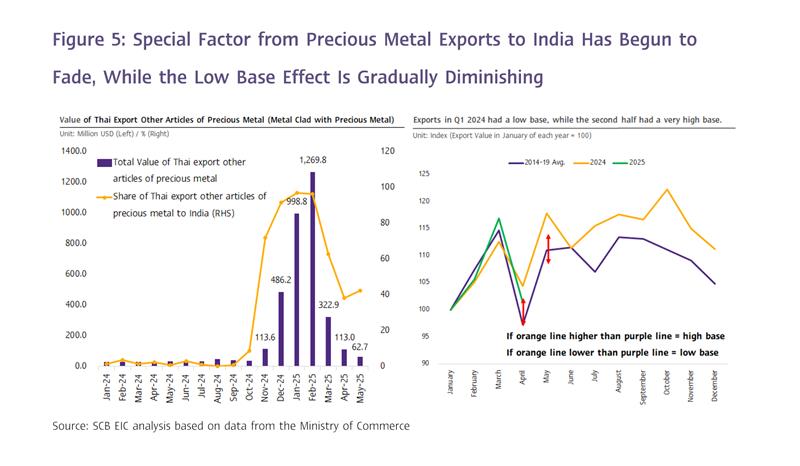

As for the special momentum from exports of "precious metals and articles clad with precious metals"—which SCB EIC assesses to be almost entirely exports of gold alloyed with a small proportion of platinum to the Indian market for tax advantages—this special factor showed a clear sign of weakening. The export value dropped to just USD 64.5 million, down from USD 113 million in the previous month and considerably lower than the peak of USD 1,269.8 million recorded in February (Figure 4).

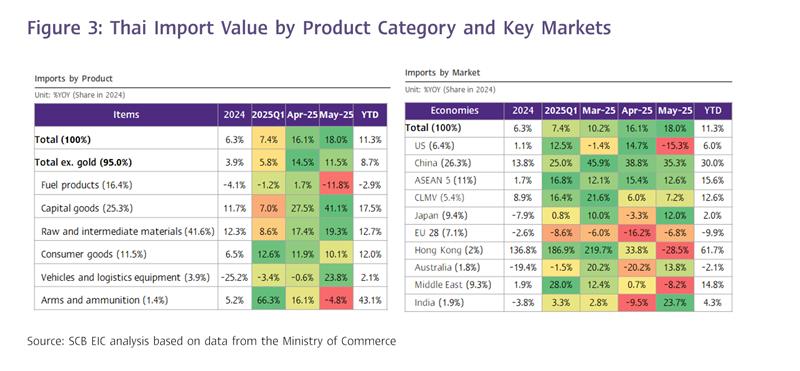

The value of Thai merchandise imports expanded strongly, particularly from China and Taiwan. However, Thailand’s trade balance returned to expansion after two consecutive months of contraction, following the acceleration in exports.

The value of Thai merchandise imports in May stood at USD 29,928.1 million, expanding by 18.0%, which exceeded expectations (SCB EIC estimated 13.1%, and the Reuters Poll median was 13.1%) and accelerated from 16.1% in the previous month. This marked the 11th consecutive month of import growth. Imports excluding gold also posted a solid expansion of 11.5%. Capital goods were the main driver, expanding substantially by 41.1%, particularly imports from China and Taiwan, which grew by 35.3% and 61.7%, respectively. Meanwhile, imports of vehicles and transportation equipment, raw materials and intermediate goods (including gold), and consumer goods grew by 23.8%, 19.3%, and 10.1%, respectively. In contrast, imports of fuel products and arms and military supplies contracted by -11.8% and -4.8%, respectively. Thailand’s trade balance (customs basis) posted a surplus of USD 1,116.4 million in May, resulting in a cumulative trade deficit for the first five months of 2025 of USD -1,123.9 million (Figure 3).

SCB EIC expects Thai exports to slow down and contract in the second half of the year.

SCB EIC has revised its full-year forecast for Thai exports upward to -0.1%, from the previous estimate of -0.4%, as the impacts of international trade tensions are expected to intensify and become more evident from the second half of 2025 onward. This follows accelerated production and exports by many countries ahead of the imposition of U.S. import tariffs. SCB EIC also anticipates that trade negotiations between the United States and its trading partners may be prolonged and unlikely to conclude within the expected timeframe. Moreover, the ongoing legal process in the U.S. concerning the President’s authority to implement import tariff policies will further contribute to a high level of policy uncertainty in the second half of the year.

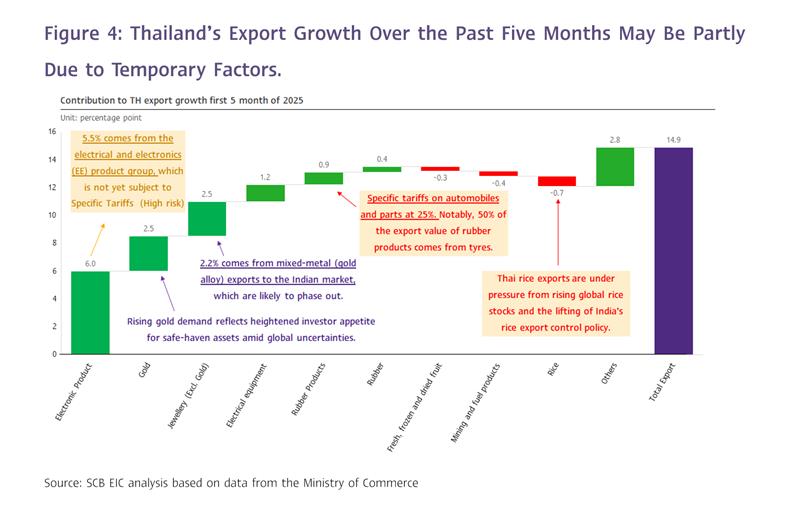

It is worth noting that the strong export growth observed over the past five months may have been partly driven by temporary factors, which pose a risk of gradually fading during the remainder of the year. This is reflected in Figure 4, which illustrates the sources of Thailand’s 14.9% export growth during the first five months, with the following key observations.

1. Front-loaded exports of products not yet subject to tariffs: Most electronic products have not yet been affected by tariff barriers, leading to accelerated exports of these goods to the U.S. This category alone contributed 5.5 percentage points to Thailand’s total 14.9% export growth during the first five months. However, this momentum is expected to slow due to rising risks of these products being subjected to specific tariffs in the near future and a diminishing front-loading effect.

2. Temporary special gold export factor to India: The temporary boost from special gold exports to India—stemming from a legal loophole in Indian regulations that began to take effect in late 2024—contributed 2.2 percentage points to Thailand’s export growth during the first five months. However, this support has started to fade following India's regulatory amendment in March, as illustrated in Figure 5 (left).

3. Low base effect in Q1 2024: The strong export growth in Q1 this year was partly driven by a relatively low base in the previous year, as Thai exports contracted by -0.6% in Q1/2024. This provided an early-year boost. However, the base in the second half of 2024 is relatively high, with export growth of 7.5% and 10.5% in Q3 and Q4, respectively. This suggests that

the positive base effect will diminish in the latter half of this year (Figure 5, right).

4. Rice export value is expected to continue declining: The value of rice exports is likely to decline steadily over the remainder of 2025 due to falling rice prices, driven by rising global rice stocks and the lifting of India’s rice export control policy. In addition, the volume of rice exports is also expected to decrease as Thailand loses global market share back to India and import demand from trading partners weakens.

SCB EIC views that during the remainder of the year, Thai exports will face additional downside risks from the following factors:

1) International trade policy, particularly U.S. import tariff policy, remains highly uncertain. There is a possibility of additional specific tariffs, especially on electronic products, which could impact a large portion of Thailand’s exports. SCB EIC finds that among Thailand’s top 20 export products to the U.S.—accounting for 77.2% of total Thai exports to the U.S.—4 out of 20 products (representing 33.8% of exports to the U.S.; primarily electronics) fall into the high-risk group for being subjected to specific tariffs. Another 3 products (9.8% of exports to the U.S.; primarily steel and automobiles) are already subject to specific tariffs. Additionally, 14 out of the top 20 products show high export concentration in the U.S. market, with more than 20% of their total export value reliant on the U.S. (Figure 6).

2) The Israel–Iran conflict, if it escalates into a broader regional confrontation or becomes severe enough to result in the closure of the Strait of Hormuz, could impact global energy prices and significantly raise production costs worldwide. This would heighten inflation risks and further strain the global economy, which is already under pressure from U.S. import tariff measures. In addition, transportation routes could be disrupted, potentially leading to a further slowdown in global trade.