Exports in November Remain Strong, but SCB EIC Foresees Trade War Pressures Impacting Thai Exports in the latter half of 2025

SCB EIC Projects Thai Exports Could Exceed 4% Growth for 2024 if December Figures Remain Strong

Exports in November Continue to Grow by 8.2%, marking the fifth consecutive month of expansion.

In November, the value of Thai exports reached USD 25.6 billion, growing by 8.2% year-on-year (YOY), exceeding SCB EIC's earlier forecast of 6.5%. Excluding gold, exports still expanded by 6.4%. For the first 11 months of 2024, total Thai exports amounted to USD 275.8 billion, reflecting a growth of 5.1% based on customs data.

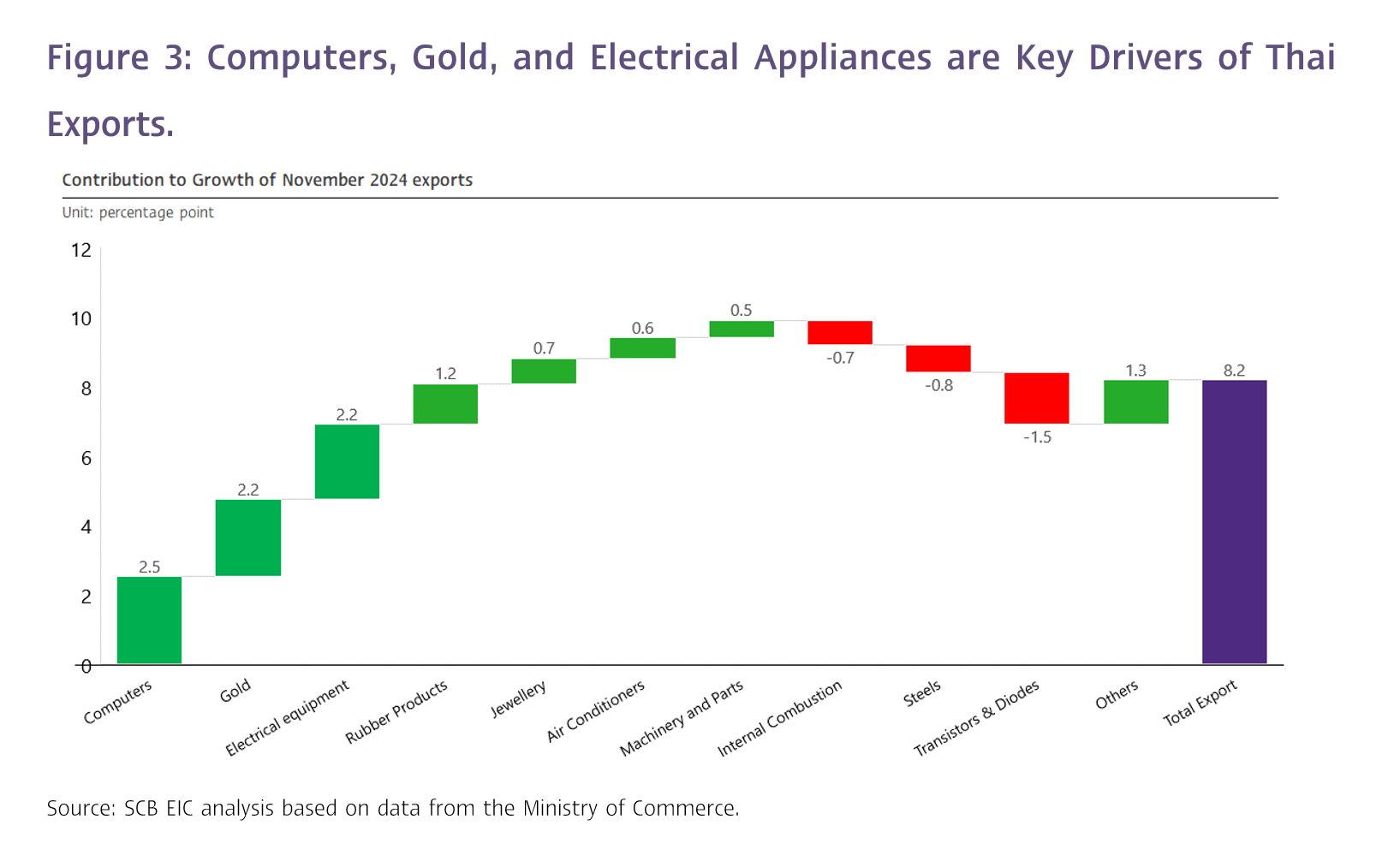

Overall export growth in November remained strong, despite a slight seasonal adjustment decline of -0.5% MOM_SA. Key factors contributing to November's strong export performance include:

(1) Upward Cycle in Electronics Demand – Exports of computer and parts showed double-digit growth for consecutive months, contributing 2.5% to the total export growth this month.

(2) High Gold Export Growth – Gold exports added 2.2% to the total export growth, driven by high gold prices and increased demand for gold as a geopolitical risk hedge.

(3) Recovery in Certain Manufacturing-Related Exports – Products like vehicles and parts saw a 4.8% rebound in growth after contracting for 3-4 consecutive months.

November Exports Driven by All Categories Except Mining and Fuel Products

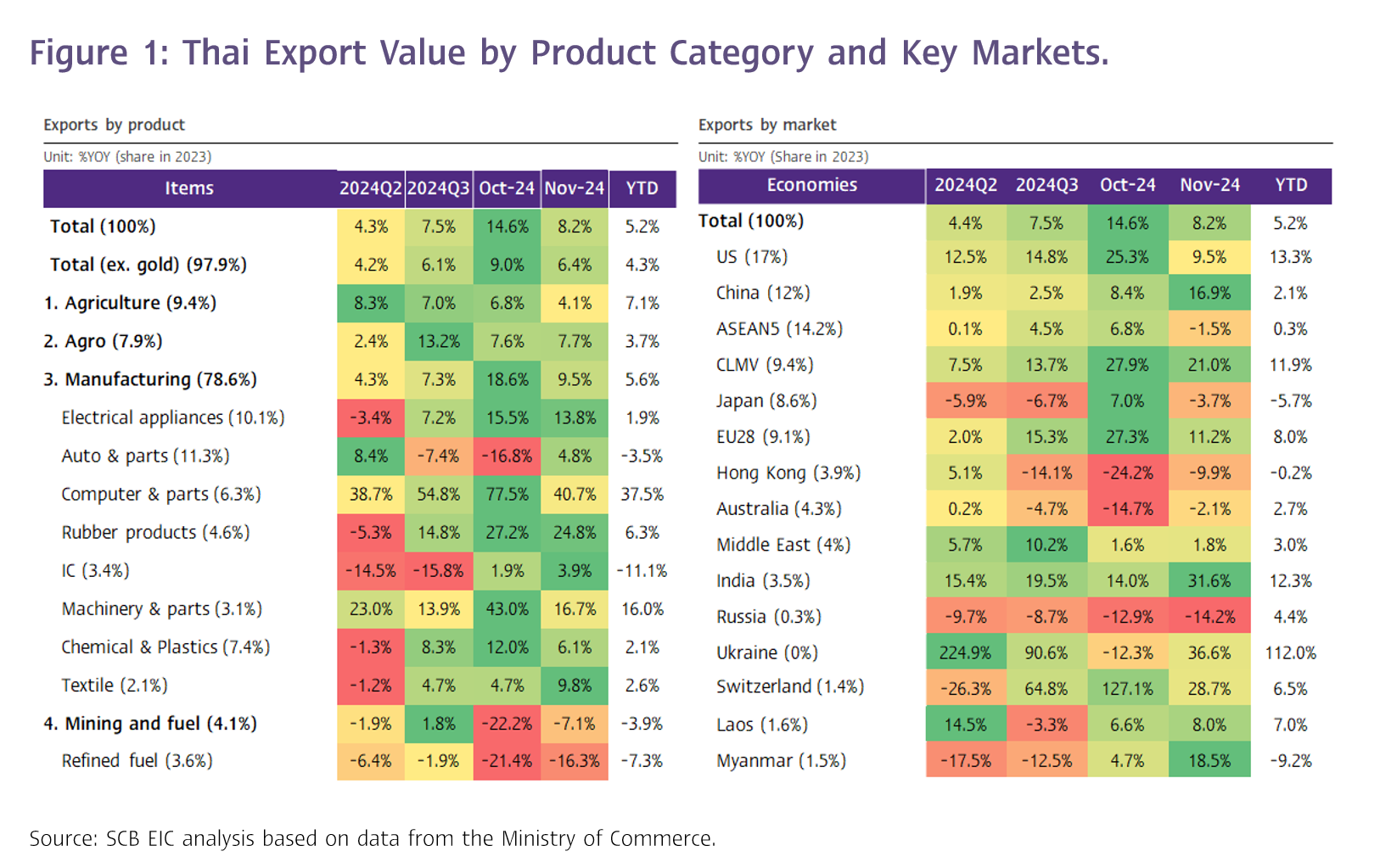

Considering the breakdown by product category:

(1) Industrial Products grew by 9.5%, slowing from 18.6% in the previous month. Key contributors included unwrought gold, computers and parts, electrical appliances and components, machinery and parts, air conditioners, and rubber products. On the other hand, major products that contracted included steel, internal combustion engines, semiconductors, transistors, and diodes.

(2) Agro-Industrial Products continued to expand by 7.7%, similar to the previous month. Significant contributors to growth were pet food, canned and processed fruits, and beverages, while major declining items included Animal or vegetable fats and oils and sugar.

(3) Agricultural Products grew at a slower pace of 4.1%, down from 6.8% in the previous month, though maintaining growth for the fifth consecutive month. Key drivers were Fresh, frozen and dried fruit, as well as rubber. However, rice and cassava products were significant items that contracted.

(4) Mining and Fuel Products continued to contract, recording a decline of -7.1%, although the contraction eased compared to -22.2% in the previous month. This was mainly due to a -16.3% drop in exports of refined oil. (Figure 1 and 2)

Exports to China Expanded Considerably, While Most Major Export Markets Slowed Down

Examining key export markets reveals the following: (1) exports to China grew by 16.9%, doubling the previous month's growth, driven by computers and parts (+126.8%), rubber products (+94.6%), and chemicals (+59.9%). (2) The United States saw growth slow to 9.5% from 25.3% in the prior month, with only 12 out of 15 major export items continuing to expand (compared to 14 in the previous month), and exports of Teleprinters, telephone sets and parts contracting by -13.5%, marking their first decline this year. (3) In Europe, growth decelerated to 11.2% from 27.3% previously, led by vehicles and parts reversing to a contraction of -37.2%, while electronic integrated circuits continued to decline throughout the year. (4) Exports to Japan reversed to a contraction of -3.7%, with over half (8 out of 15) of the major export items to Japan experiencing declines. (5) Growth in Switzerland slowed sharply to 28.7% from 127.1%, mainly due to a slowdown in gold exports, which grew by 63.1% compared to 164.4% previously. (6) Lastly, growth in the CLMV markets eased slightly to 21.0% from 27.9%, primarily due to a slowdown in exports to Cambodia, while exports to Vietnam, Myanmar, and Laos continued to expand steadily.

The Trade Balance Remains in Deficit for Two Consecutive Months

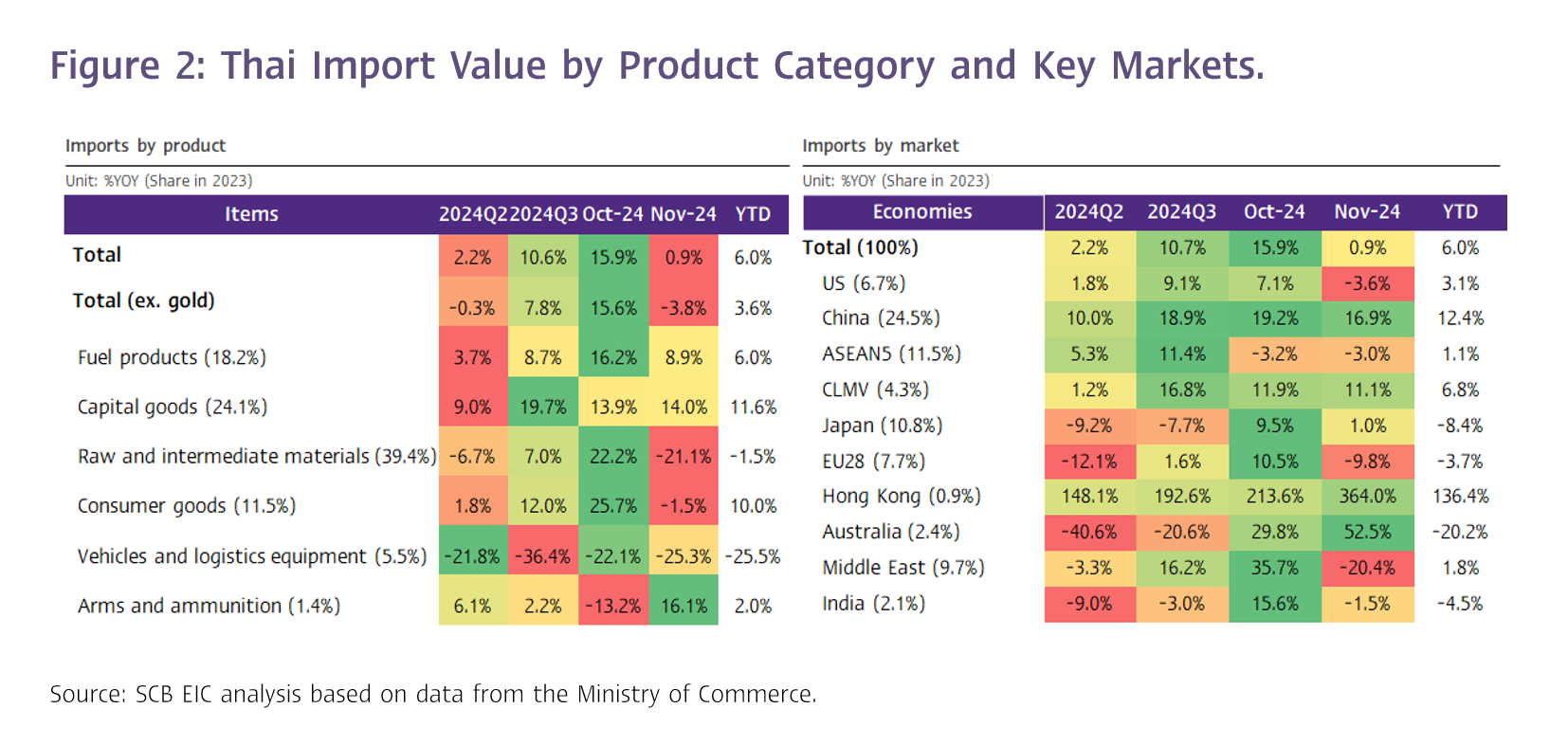

Thailand's import value in November stood at USD 25,832.5 million, slowing to 0.9% growth compared to 15.9% in the previous month. Imports have grown for six consecutive months, with a notable rebound in imports of arms and ammunition, which grew by 16.1% after a sharp contraction of -13.2% in the prior month. Additionally, imports of raw and intermediate materials, as well as consumer goods, continued to expand, growing by 14.0% and 8.9%, respectively. However, imports of vehicles and logistics equipment, fuel products, and capital goods contracted by -25.3%, -21.1%, and -1.5%, respectively. The customs-based trade balance for November recorded a deficit of USD -224.4 million. For the first 11 months of 2024, Thailand's trade balance registered a deficit of USD -6,269.8 million (customs-based data).

SCB EIC Projects Thai Exports Could Exceed 4% Growth for 2024 if December Figures Remain Strong

SCB EIC views that Thai export value will continue its strong performance in the second half of the year, with the possibility of exceeding 4% growth for the entire 2024. Despite challenges faced earlier in the year, including a projected global economic slowdown and logistical obstacles in maritime transport, Thai exports were supported by several positive factors that became more pronounced in the second half. These include a global economic recovery with a soft landing, a significant surge in gold exports, an upward cycle in electronics demand, and accelerated foreign demand driven by concerns, particularly in the U.S., about potential tariff increases in 2025. Additionally, a low base in Q4 2023 contributed to the robust performance. As a result, Thai export value for the first 11 months of 2024 expanded by 5.2%, raising the likelihood that full-year export growth will exceed 4%, exceeding prior projections by SCB EIC and the Ministry of Commerce, which were 3.9% and 4%, respectively.

Thai Exports in 2025 May Face Challenges as Trade War Impacts Become More Evident in the latter half of 2025

Although Thai exports showed strong growth toward the end of 2024 and are expected to continue expanding into early 2025, SCB EIC projects that Thai exports will face mounting pressure from trade protectionist policies in the coming period, particularly in H2 2025. During this time, various trade barriers beyond those from China are expected to take effect. Thailand is highly vulnerable to policies such as increased U.S. import tariffs under Trump 2.0, with economic impacts likely to be felt primarily through trade channels, as reflected in the following factors:

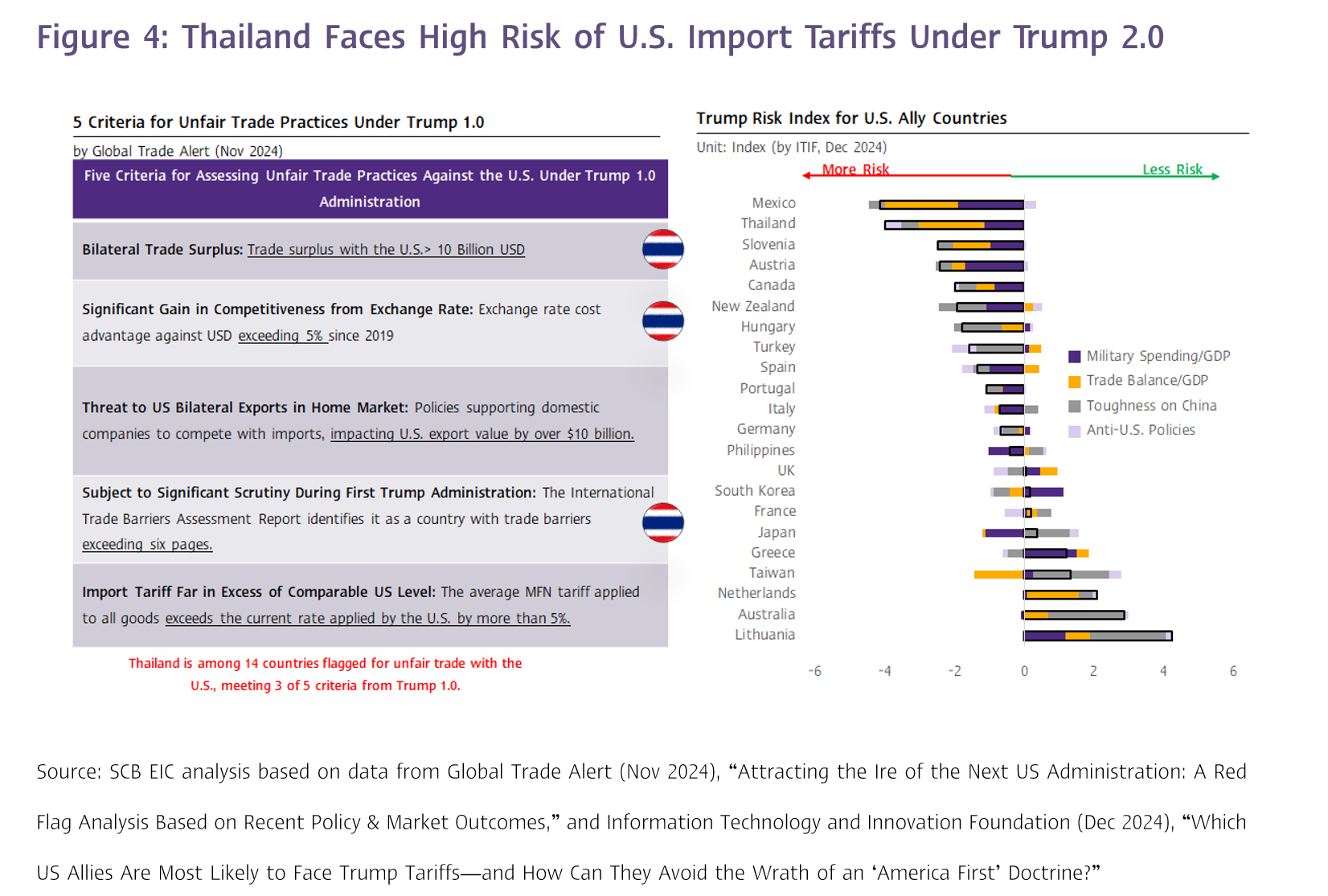

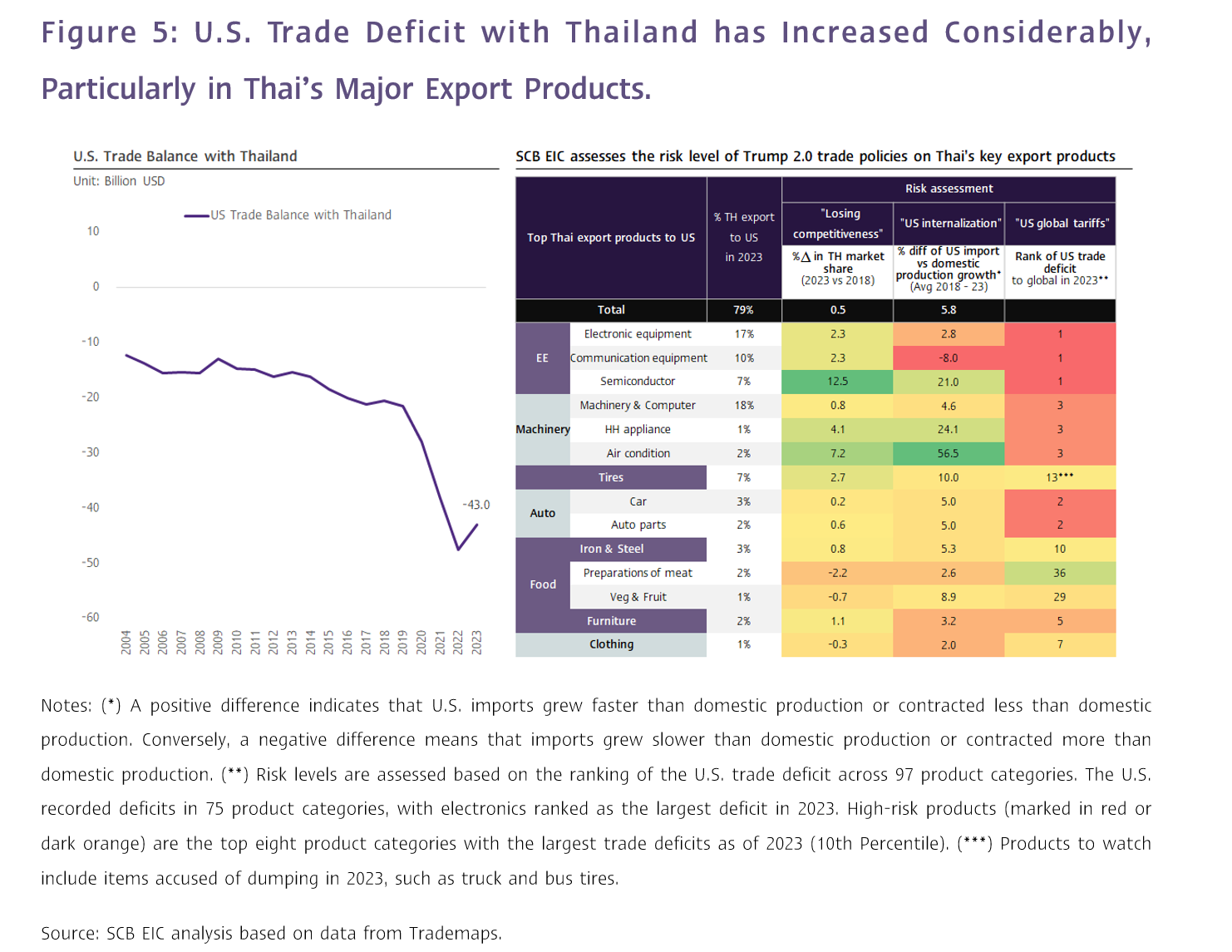

1. Widening U.S. Trade Deficit with Thailand Compared to Trump 1.0: While the U.S. has consistently run a trade deficit with Thailand, the deficit has surged considerably since 2021. The average annual U.S. trade deficit with Thailand nearly doubled, rising from USD -22.8 billion during 2017-2020 (Trump 1.0) to USD -43 billion in 2023. Thailand ranked as the 12th largest trade surplus partner among the 99 U.S. trading partners in 2023 (Figure 4, left).

2. Several studies suggest Thailand will be substantially impacted by Trump 2.0, as indicated by a high Trump Risk Index and potential classification as an "Unfair Trade" partner by the U.S.: According to a study by the Information Technology and Innovation Foundation (ITIF) (Figure 4, right), Thailand ranks 2nd globally, following Mexico, and 1st in Asia among 38 U.S. allies on the Trump Risk Index. Similarly, a study by Global Trade Alert (Nov 2024) shows that Thailand meets 3 out of 5 criteria for unfair trade practices, based on benchmarks previously used during Trump 1.0. Thailand is one of 14 U.S. trading partners likely to fall into this category (Figure 4, left).

3. High Tariff Risk for Key Thai Export Products: SCB EIC estimates that over 70% of Thailand's major export products fall into categories likely to be targeted by the U.S. to reduce its global trade deficit and promote local supply chains. These include electronics, automobiles and parts, machinery, and computers (Figure 5, right).

Trump 2.0 Policies Likely to Impact Thai Exports Both Directly and Indirectly

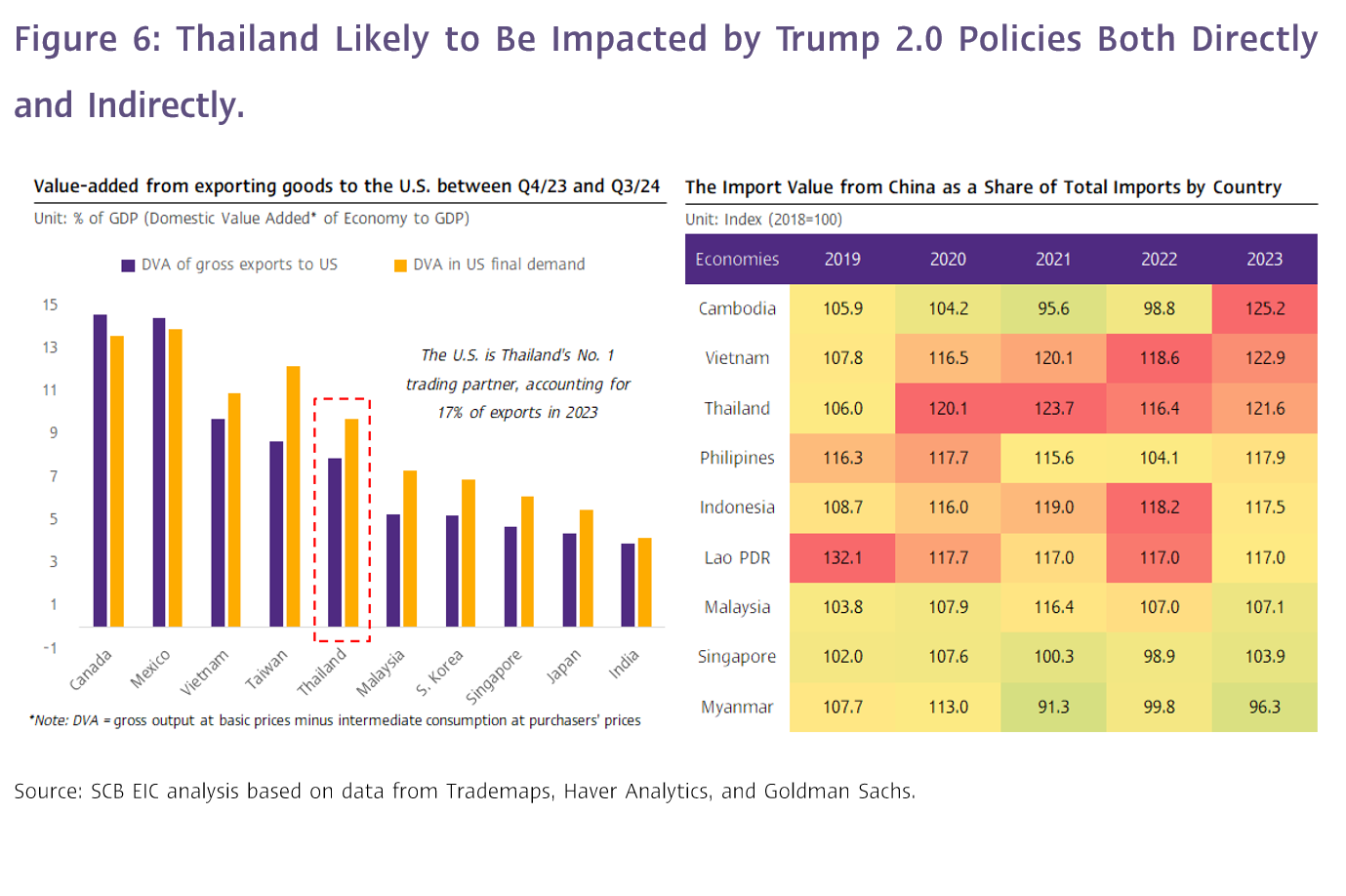

1. Direct Impacts: The U.S. is Thailand’s largest trading partner, accounting for 17% of Thailand’s total export value. Moreover, the value added from exports to the U.S. constitutes a significant share of Thailand’s GDP (Figure 5, left). These factors suggest that Thai exports may be directly affected by Trump 2.0’s import tariff policies. However, the impact may be limited for certain product groups, as the U.S. continues to rely on imports of some goods from Thailand due to insufficient domestic production.

2. Indirect Impacts: Demand for intermediate goods exported by Thailand to China, which are used to produce final goods, may decline, particularly for products that China exports to the U.S. Additionally, China’s overcapacity problem is expected to intensify, especially in the ASEAN region (Figure 6, right), putting further pressure on the competitiveness of Thai products in both domestic and international markets. This will likely lead to a slowdown in Thai exports, compounding the challenges faced by the industrial manufacturing sector, which has yet to recover.

2025 Likely to Be Challenging for Thai Exports Amid Increasing External Pressures

SCB EIC projects Thai export value to grow by approximately 2% in 2025 (balance of payments basis),

a significant slowdown compared to over 4% growth in 2024. To prepare for rapidly changing conditions,

the government must establish strategies for negotiations with the U.S. to mitigate risks from Trump 2.0’s import tariff policies, particularly regarding the trade surplus with the U.S. Additionally, measures to enhance the competitiveness of Thailand’s manufacturing and export sectors should be implemented ahead of the expected intensification of the trade war, likely in H2 2025.