Thai exports remain strong, supported by a boost from the upturn in the electronics product cycle.

SCB EIC estimates that the value of Thai exports will grow by 2.6% in 2024 (as of September, balance of payments basis).

The value of Thai exports in August 2024 continued to expand robustly at 7%YOY.

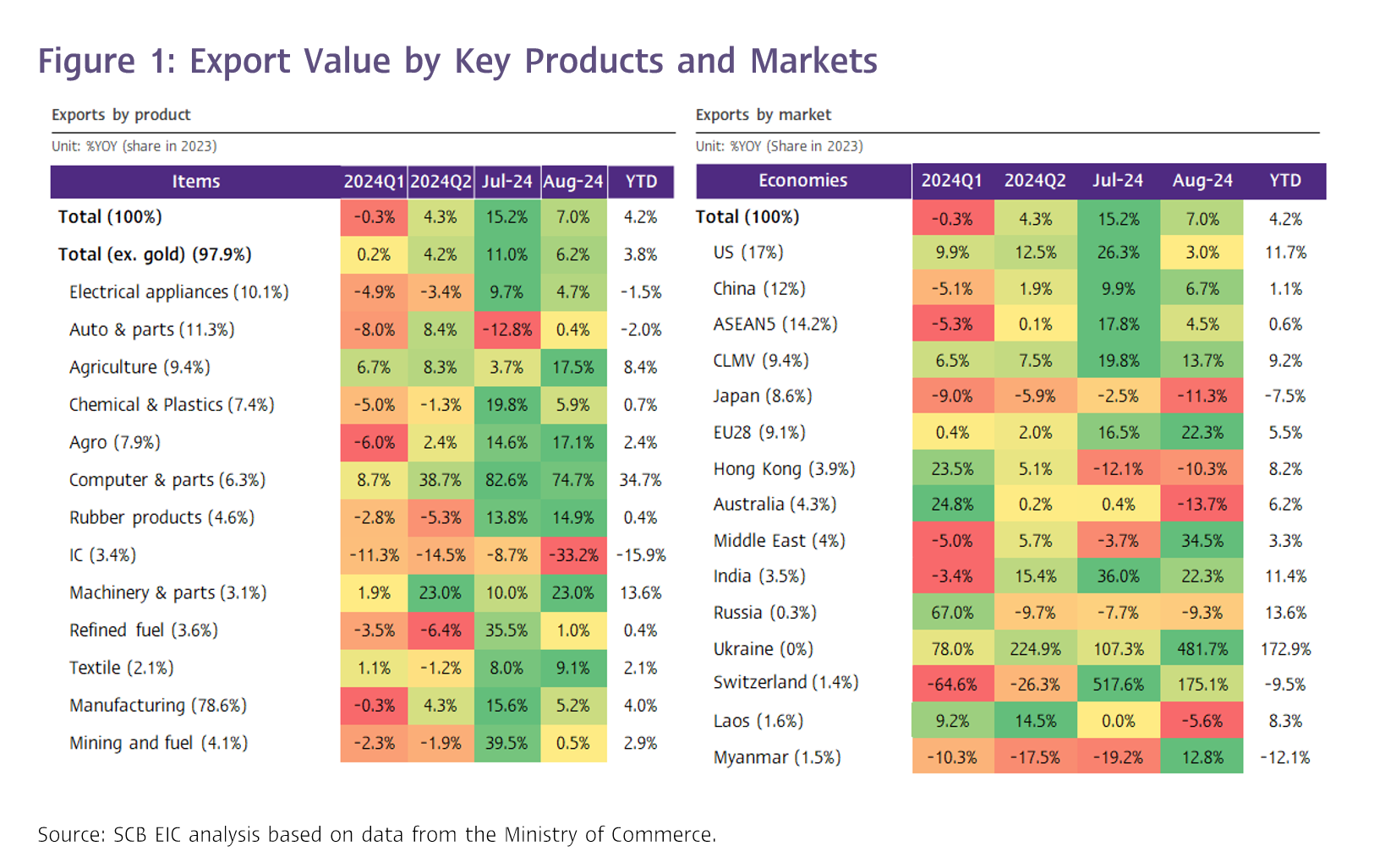

The value of Thai exports in August 2024 stood at USD 26,182.3 million, expanding robustly by 7%YOY (compared to the same period last year) and exceeding analysts' expectations. SCB EIC had forecasted 5.9% growth, while the median of the Reuter Poll was at 5.8%. This follows a 15.2%YOY expansion in July, bringing the total export value for the first eight months of this year to USD 197,192.8 million, representing a 4.2% growth (customs basis) (Figure 1).

The factors driving export growth this month include:

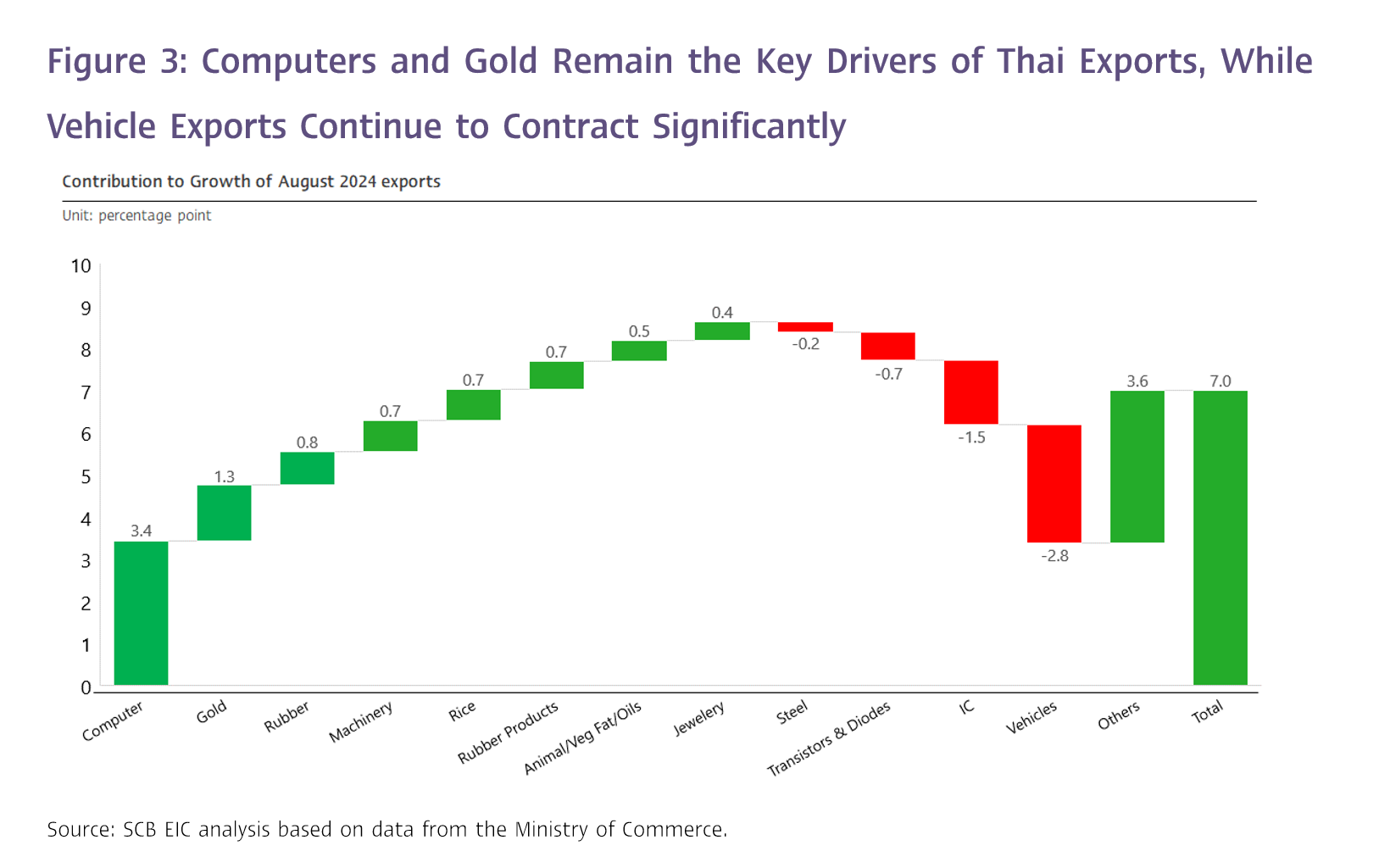

1. The export value of computers and parts surged by 74.7%, following an 82.6% growth in the previous month, driven by a recovery in global demand, which in line with the upturn in the electronics cycle. This factor contributed significantly to export growth, accounting for as high as 3.4% of the 7% expansion in August (Figure 3).

2. Rubber and rice exports continued to grow strongly at 64.6% and 46.7%, respectively. The rise in rice export value resulted from India's policy to restrict its rice exports, coupled with increased demand from rice importers, which led to both higher export volumes and prices. Meanwhile, rubber export value increased due to rising prices amid higher consumption demand, while rubber production in Thailand and Indonesia—two of the world's main exporters—declined. These factors contributed 1.5% to the overall export growth in August.

3. Gold exports surged by as high as 99%, contributing 1.3% to the total export growth in August (Figure 3).

Preliminary analysis reveals that, by export category, export of agricultural products expanded significantly by 17.5%, driven mainly by rice and rubber. Agro-industrial product exports grew by 17.1%, especially from animal and vegetable fats and oils. Meanwhile, industrial product exports (including Mining and fuel) rose by 5.2%, with strong contributions from computers and parts, gold, machinery and parts, rubber products, as well as precious stones and jewelry (excluding gold).1

For key export partners, Switzerland saw a remarkable expansion of 175.1% (SCB EIC's preliminary assessment suggests this was driven by gold exports, as gold prices have surged significantly in recent months). The Middle East expanded by 34.6%, and the European Union by 26.4%, followed by South Asia, Africa, Latin America, CLMV, Russia and CIS, China, and ASEAN-5, respectively.

Thailand’s trade balance unexpectedly turned positive, surpassing analysts’ expectations due to stronger-than-expected export growth, while imports expanded at a slower rate than anticipated.

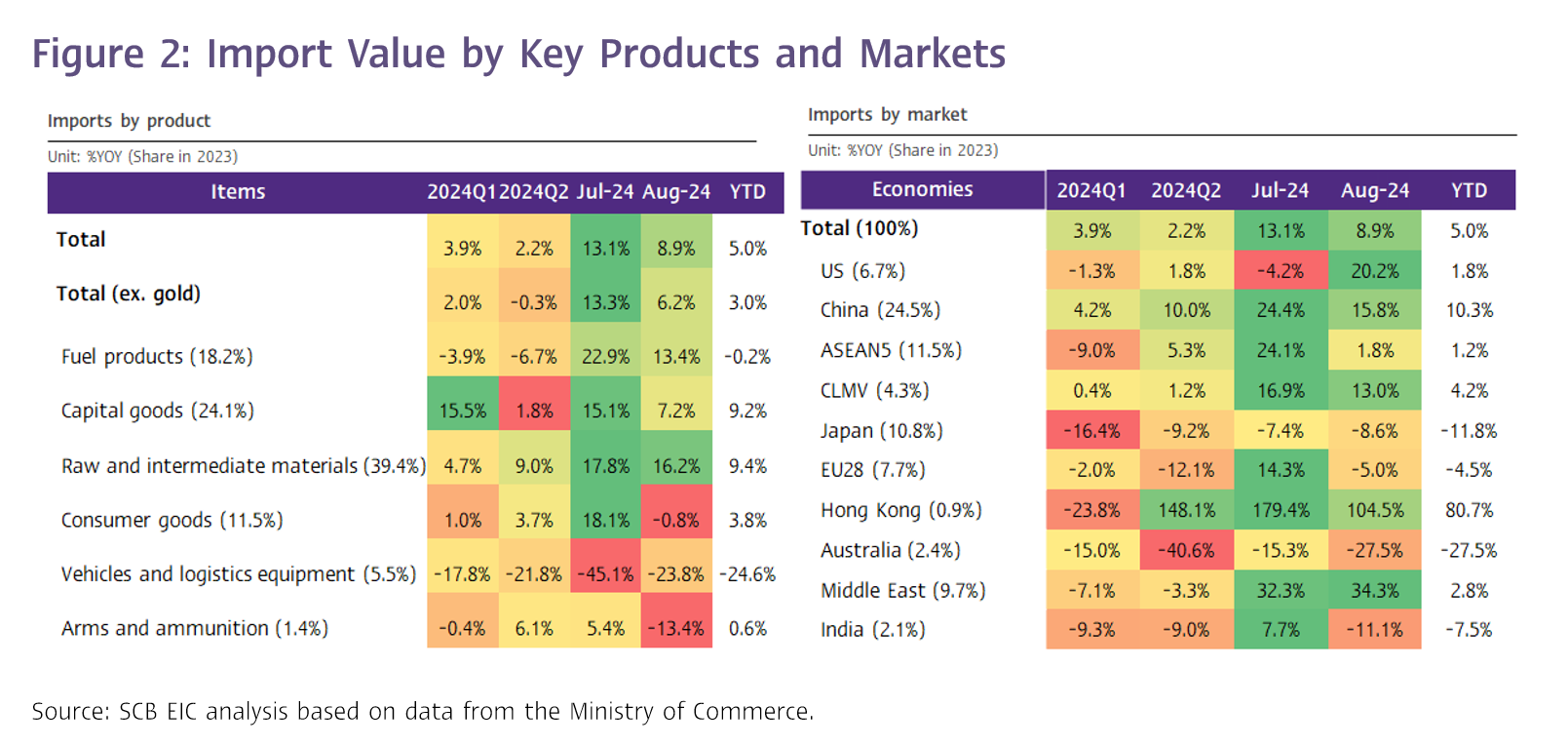

The value of imports in August stood at USD 25,917.4 million, expanding by 8.9% (compared to SCB EIC's forecast of 10.5% and the median of Reuter Poll at 7.3%). Imports of Raw and intermediate materials , fuel products, and capital goods grew robustly at 16.2%, 13.4%, and 7.2%, respectively. Meanwhile, the contraction in Vehicles and logistics equipment imports eased to -23.8% from -45.1% in the previous month. However, consumer goods imports reversed to a contraction of -0.8% (Figure 2). As a result, the customs basis trade balance registered a surplus of USD 264.9 million this month, defying analyst expectations of a deficit (SCB EIC estimated -380 million USD, while Reuter Poll had a median forecast of -70 million USD) due to stronger-than-expected export growth and lower-than-expected import growth. For the first eight months of 2024, Thailand's trade balance remained in a deficit of -6,351 million USD.

SCB EIC forecasts that exports will continue to expand for the remainder of the year.

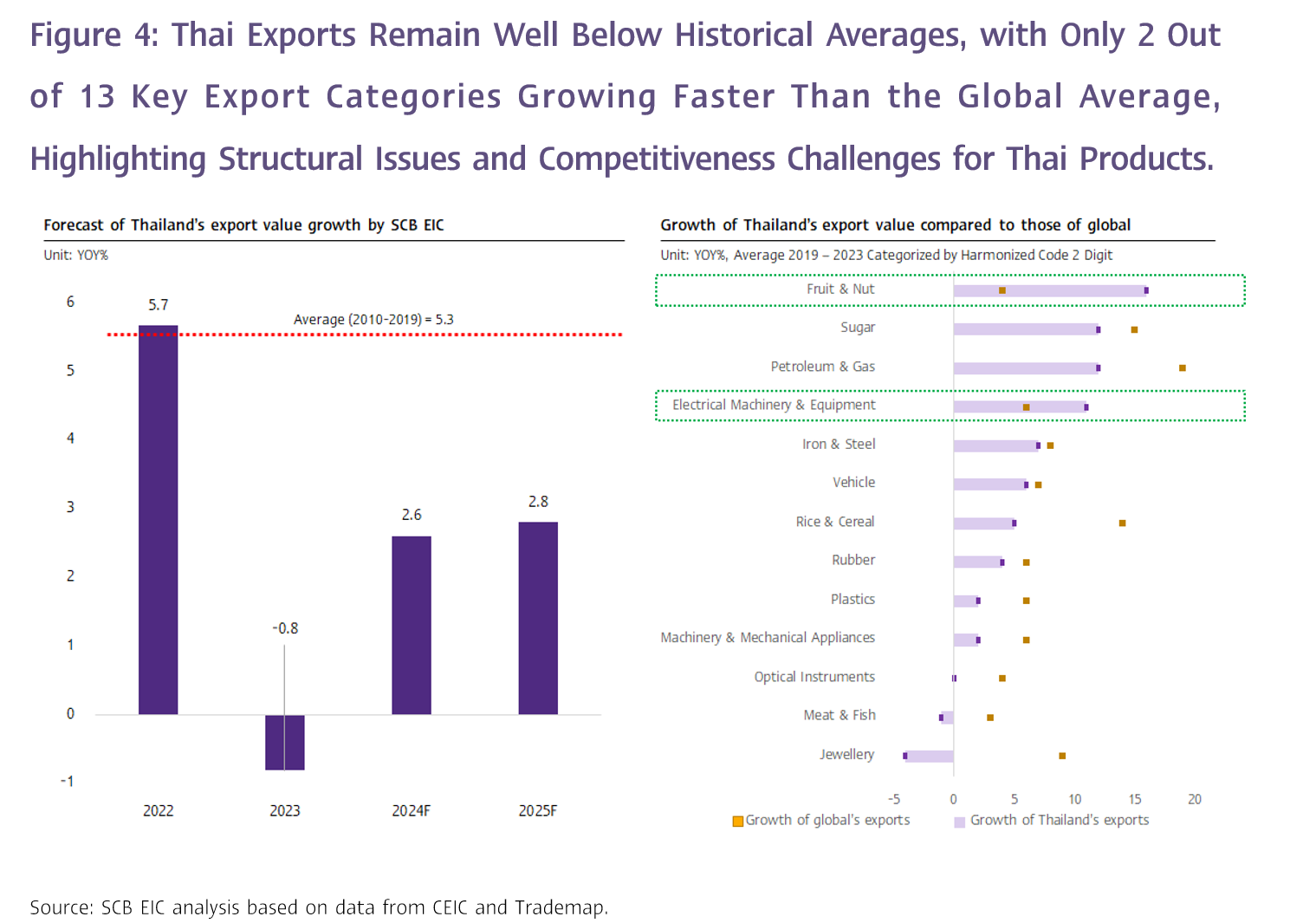

SCB EIC estimates that the value of Thai exports will grow by 2.6% in 2024 (as of September, balance of payments basis). However, export values in July and August showed stronger-than-expected growth, exceeding both SCB EIC's forecasts and market expectations.2 Moreover, Thai exports are likely to continue expanding in the coming period, supported by overall global economic growth, despite slowdowns in certain countries. Additional factors include the ongoing upturn in the electronics cycle and easing pressure from freight rates. These conditions suggest that the 2024 export growth may surpass the initial forecast of 2.6%. Nevertheless, potential risks to monitor include the impact of widespread flooding in many areas of Thailand, the strengthening of the Thai baht, and the lifting of India’s rice export restrictions.

In the short term, export values may expand better than expected; however, growth next year is likely to be modest.

Export growth rates of 2.6% and 2.8% in 2024 and 2025, respectively, are still considered modest compared to the average growth rate of 5.3% during 2010-2019 (Figure 4, left), reflecting ongoing challenges in revitalizing Thailand’s export momentum due to declining competitiveness and structural issues. An analysis of 13 key export products, accounting for 76% of total exports, shows that only 2 categories (electronics and machinery, and fruits) outpaced global average growth during 2019-2023, while the remaining 11 categories lagged behind (Figure 4, right). Additionally, external challenges that may pressure Thai exports include: (1) Geopolitical risks from prolonged conflicts, intensified economic polarization, and increased trade barriers, (2) China’s overcapacity issue, which could further erode Thailand’s price competitiveness against Chinese products, (3) Potential resurgence of higher freight costs due to frequent and intensifying conflicts, as well as shortages in shipping vessels and containers, and (4) Uncertainty in U.S. election outcomes, which could result in additional import tariffs on all goods from all countries.

1This month, SCB EIC could not conduct a detailed analysis of export data by product categories and markets due to updates in Ministry of Commerce’s database.