Exports in June contracted slightly as drought slowed fruit exports to China. Looking ahead, exports in July are expected to recover.

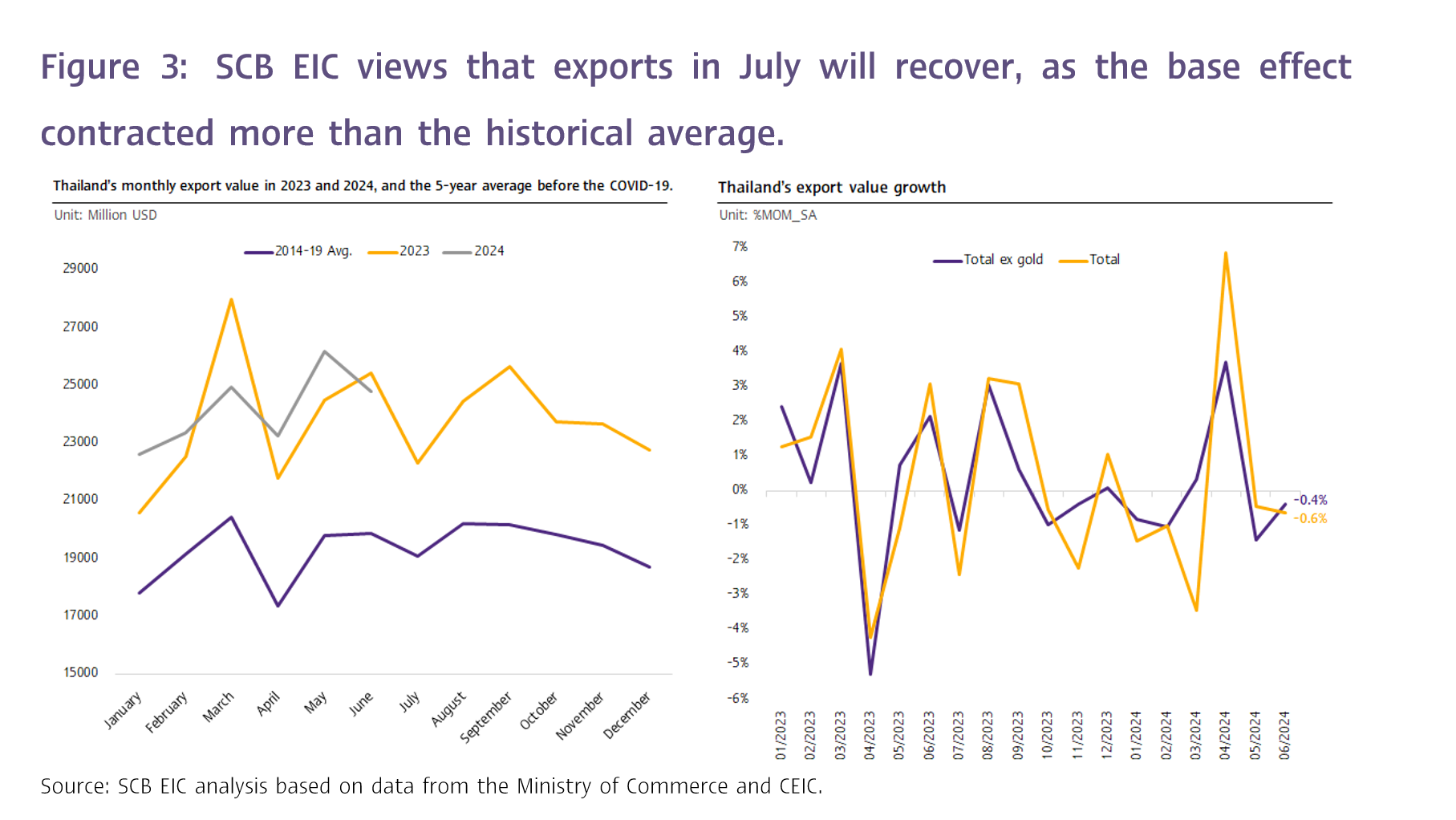

SCB EIC expects a return to growth in July, driven by the low base effect (Figure 3) from July 2023, when exports plunged by -10.3%.

Exports contracted in June, due to a slowdown in fruits exports to China.

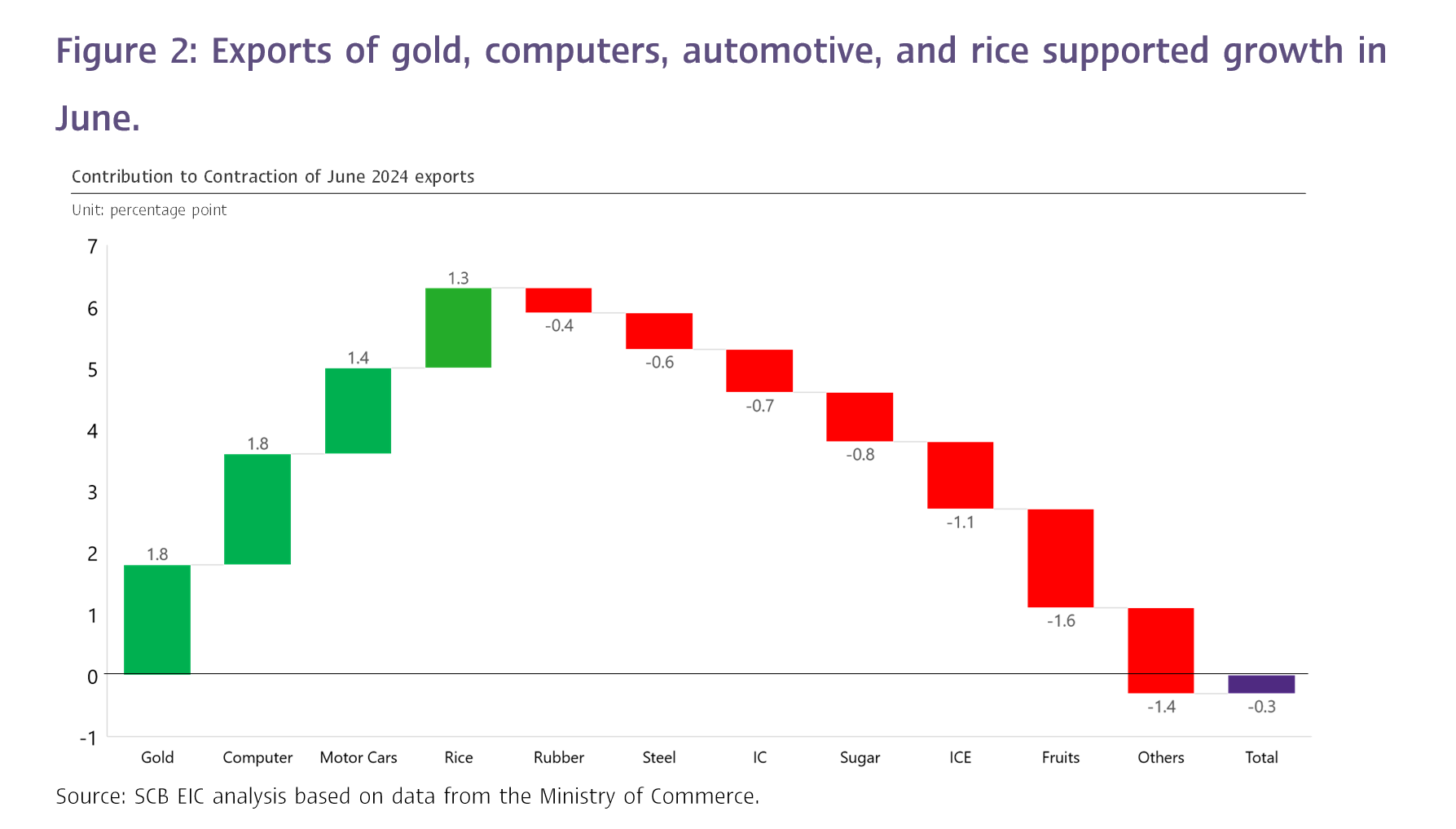

The value of Thai exports in June 2024 stood at USD 24,796.6 million, reverting to a slight contraction of -0.3%YOY (compared to the same period last year), a notable decline from the strong expansion of 6.9% in the prior month. Such a downturn was primarily prompted by the high base effect and lower exports of fruits to China, which contracted due to drought conditions (after a high expansion of 142.4% in May), despite a considerable boost from exports of gold at 184.1%. Nevertheless, excluding gold and the base effect, exports fell slightly by -0.4%MOM_SA (compared to the previous month, seasonally adjusted), indicating a similar trend to the prior month. As such, during the first half of 2024, Thai exports stood at USD 145,290 million, expanding by 2%YOY (customs basis).

Exports of agro-industrial and agricultural products reverted to contraction, particularly exports of fruits to China.

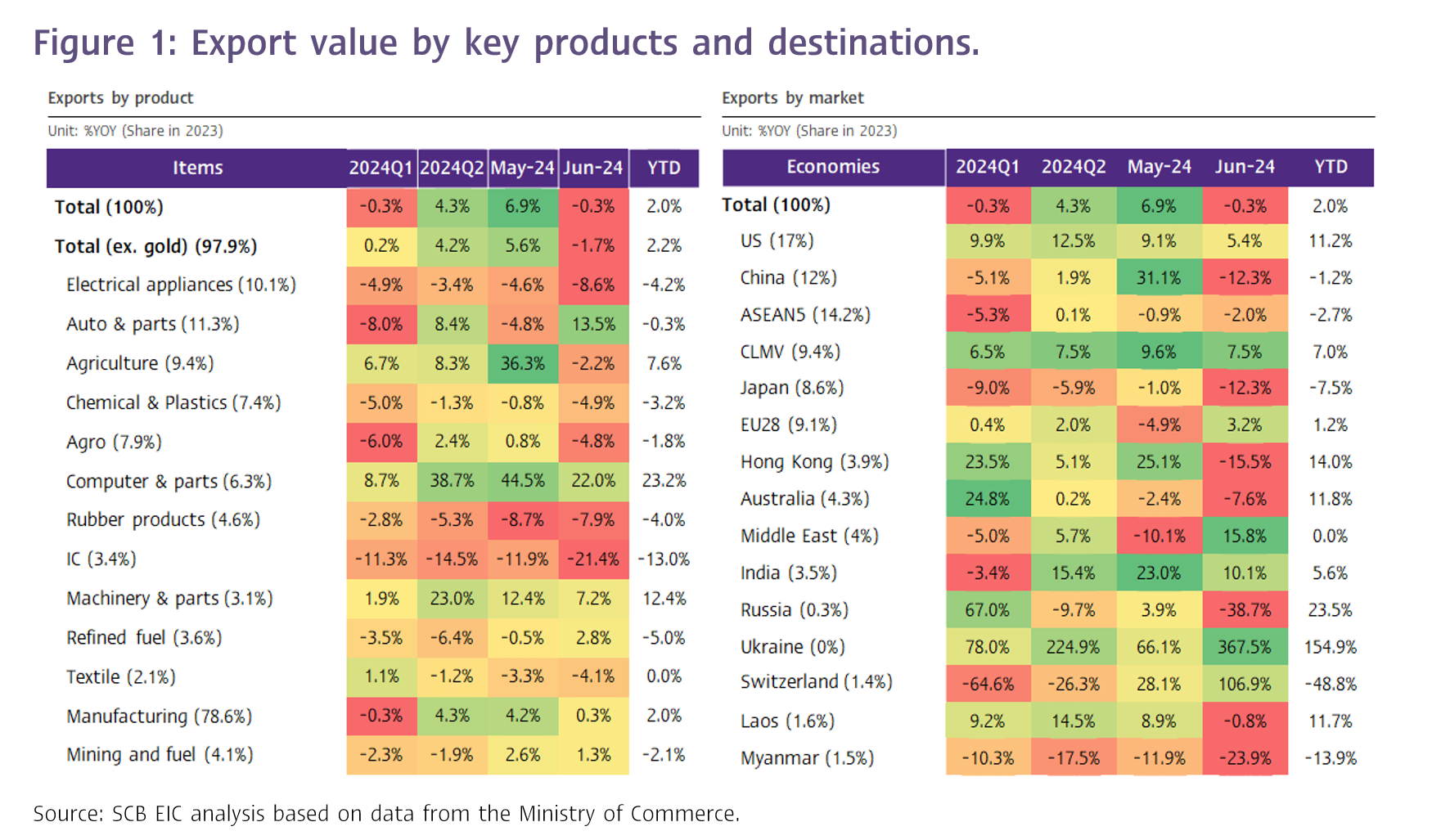

The data revealed that (1) Exports of agro-industrial products weakened by -4.8%, down from the 0.8% growth in the prior month. Exports of animal or vegetable fats and oils and pet food supported growth, while exports of sugar dragged growth. (2) Exports of agricultural products also contracted by -2.2%, after improving considerably by 36.3% in the prior month. A key contributor was the sharp decline of -37.8% in exports of fresh/ chilled/ frozen/ dried fruits, after a strong expansion of 128% in the prior month due to drought. Specifically, exports of fruits to China fell by -40.2%, reverting from a 142.4% surge in the prior month (accounting for approximately 90% of Thailand’s total exports of fresh/ chilled/ frozen/ dried fruits). This decline in fruit exports dragged overall Thai export growth in June by -1.4%, compared to the total export contraction of -0.3%. On the contrary, exports of rice and rubber expanded well. (3) Exports of manufacturing products increased by 0.3%, slowing from 4.2% in the prior month, with growth supported by exports of computer and parts and automotive, parts, and components. However, exports of internal combustion piston engines and parts, electric circuit boards, iron, steel, and products, and rubber products dragged growth. Meanwhile, (4) Exports of mining and fuel products stalled to 1.3%, after expanding by 2.6% in the prior month (Figure 1 and 2).

Exports by key partners showed mixed results, heavily influenced by unwrought gold.

Analysis of exports by key destinations revealed that (1) Exports to Hong Kong reverted to a -15.5% contraction after improving by 25.1% in the previous month. Exports of all three key products to Hong Kong contracted, including precious stones and jewellery by -14.2% (especially gold, which fell by -95.6%), computer, parts, and components by -12.9%, and electric circuit boards by -16.9%. (2) Exports to Japan fell by -12.3%, weakening considerably from -1% in the prior month. The decline was relatively even across key product categories, with 12 out of the top 15 exports to the market declining, such a condition continued from the prior month when all 15 products shrank. (3) Exports to China also reverted to a -12.3% contraction after expanding by as high as 31.2% in the prior month, with double-digit declines in various key products, particularly fresh/ frozen/ chilled/ dried fruits (-40.2%), plastic beads(-19.8%), and rubber products (-17%). (4) Exports to the US and India performed well in June and the first half of 2024. Furthermore, such markets potentially continue to be the key markets for Thai exports during the second half of 2024. (5) Exports to Switzerland surged by 106.9%, driven by a sharp increase in exports of gold, which rose by 1,641.7%. Meanwhile, (6) Exports to CLMV expanded by 7.5%, with robust export growth to Cambodia at 44.2%, particularly from exports of gold to Cambodia, which increased by 648.6%. However, excluding gold, export growth dropped to -4.1%. On the other hand, exports to Laos fell by -0.8%, exports to Myanmar shrank by -24% (due to unrest in Myanmar), and exports to Vietnam expanded by 2.6% (Figure 1).

Thai trade balance recorded a slight surplus in June, although the overall trade balance in 1H/2024 remained at a deficit.

The value of imports in June stood at USD 24,578.5 million, returning to an expansion of 0.3% after contracting by -1.6% in the prior month. Imports of raw materials and intermediate raw materials saw an expansion of 6.3%, while imports of consumer goods slowed down to 1.3%. On the other hand, imports of vehicles and logistics equipment, fuel products, and capital goods shrank by -22.2%, -3.8%, and -2%, respectively. As such, the customs basis trade balance in June returned to a slight surplus of USD 656.1 million, continuing from the surplus of 656.2 million in May. Nevertheless, the Thai trade balance during the first half of 2024 remained in deficit at USD -5,242.7 million.

SCB EIC anticipates that Thai exports will improve in July and the second half of the year.

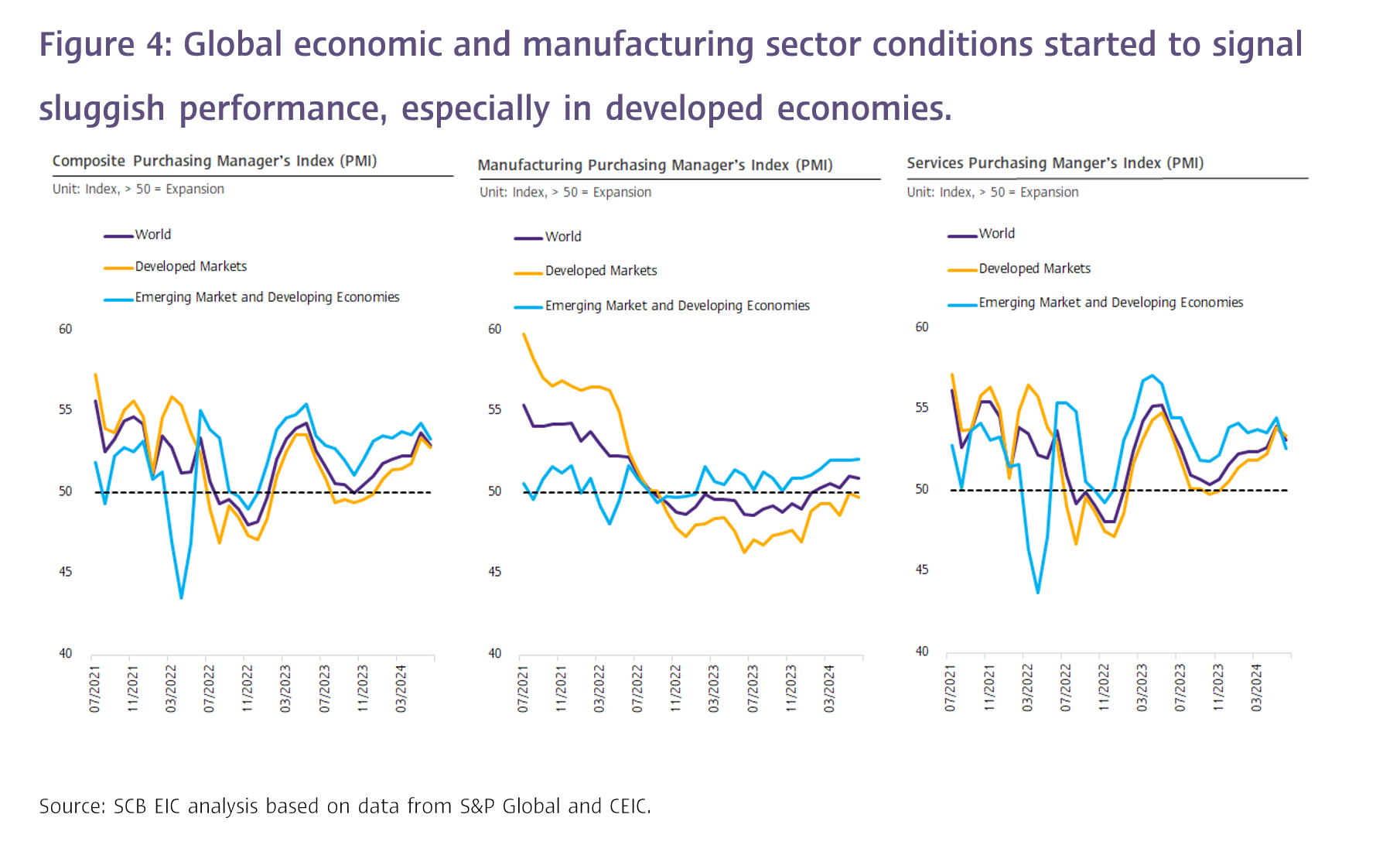

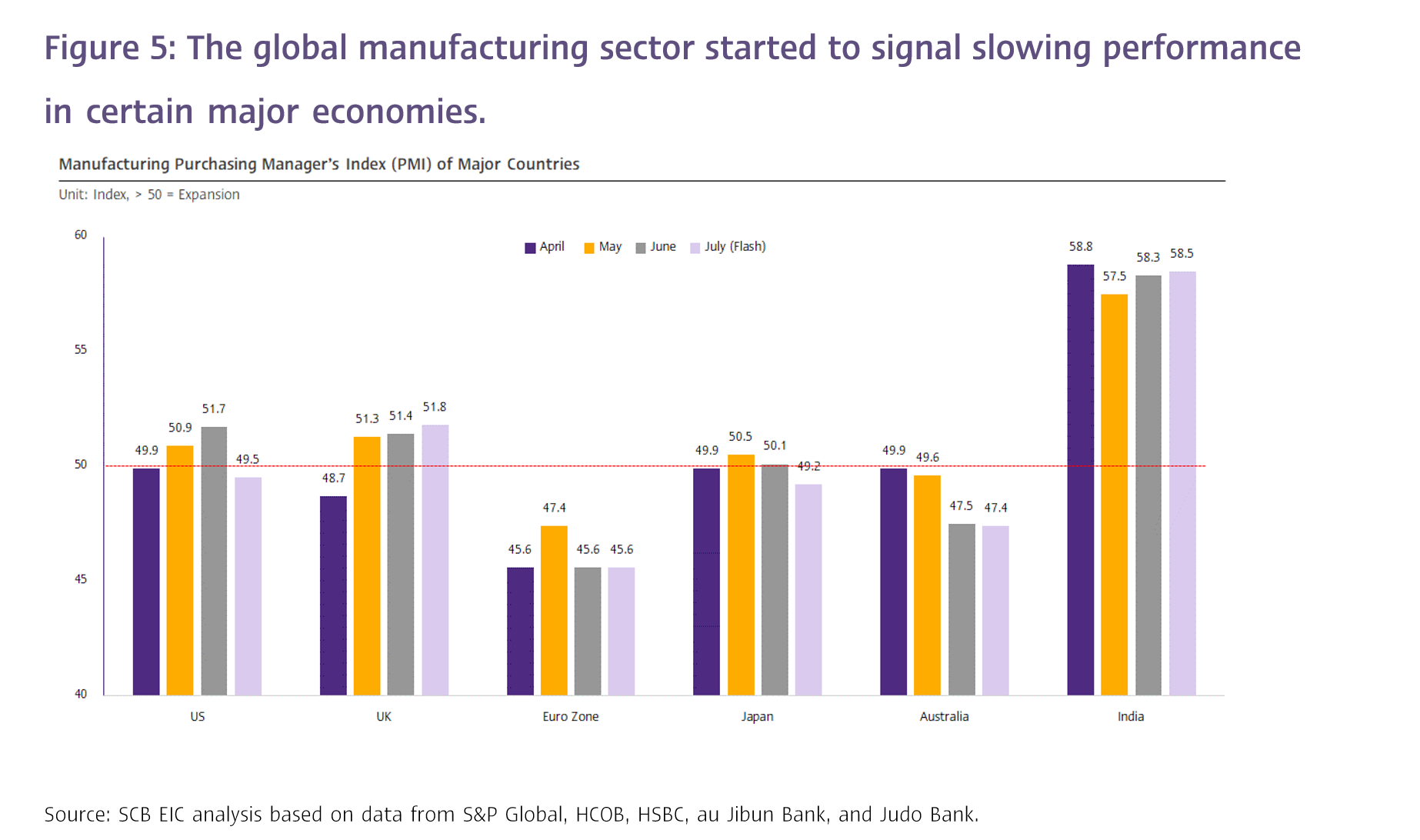

SCB EIC expects a return to growth in July, driven by the low base effect (Figure 3) from July 2023, when exports plunged by -10.3% due to gloomy global economic conditions at the time and a significant decline in gold exports by -53.7%. Moreover, global economic and manufacturing indicators suggest a recovery in Thai exports, as reflected by the global Purchasing Manager’s Index, which remained above 50 (Figure 4), despite the indicator dropping below 50 in developed economies in the latest month (Figure 5). With such regards, SCB EIC projects a 2.6% expansion in Thai exports for 2024 (balance of payments basis and outlook as of June 2024), based on current global economic trends, world manufacturing conditions, and with export prices that should surpass prior estimates.

Looking ahead to 2025, Thai exports are expected to grow at a similar rate to 2024, following global economic conditions that should grow at a similar rate to this year and higher trade volume compared to 2024 from higher demand for manufacturing products. However, several factors could constrain growth, including structural issues within Thailand’s export sector, which struggles to fully adapt to changing global market demands, and increasing use of protectionism trade barriers by major trading partners following election playouts in various key economies, especially the US and EU. Additionally, China’s overcapacity remains a concern that must be monitored, as it makes it more difficult for Thai products to compete on price with Chinese products in the global market. SCB EIC is currently revising the Thai export forecasts for 2024 and 2025, with the update expected to be published in late August.