SCB EIC expects the MPC to cut policy rate 2 times this year starting at the June Meeting

SCB EIC still expects the MPC to cut policy rate 2 times this year. Although the MPC voted to maintain the policy rate at 2.50% at this meeting

The MPC voted 5 to 2 to maintain the policy rate at 2.50%, while two members voted to cut the policy rate by 0.25%.

The majority of the MPC deems that the current policy rate is conducive to safeguarding macro-financial stability, while also expressing concern on elevated household debt and recognizing the importance of debt deleveraging, which will help mitigate vulnerabilities in the macro and financial system in the long term. Meanwhile, two members voted to cut the policy rate to reflect Thailand’s lower potential growth as a result of structural challenges and to partly alleviate debt-servicing burden of borrowers.

The MPC projects the Thai economy to grow at a higher rate than the previous year at 2.6% and 3.0% in 2024 and 2025, respectively.

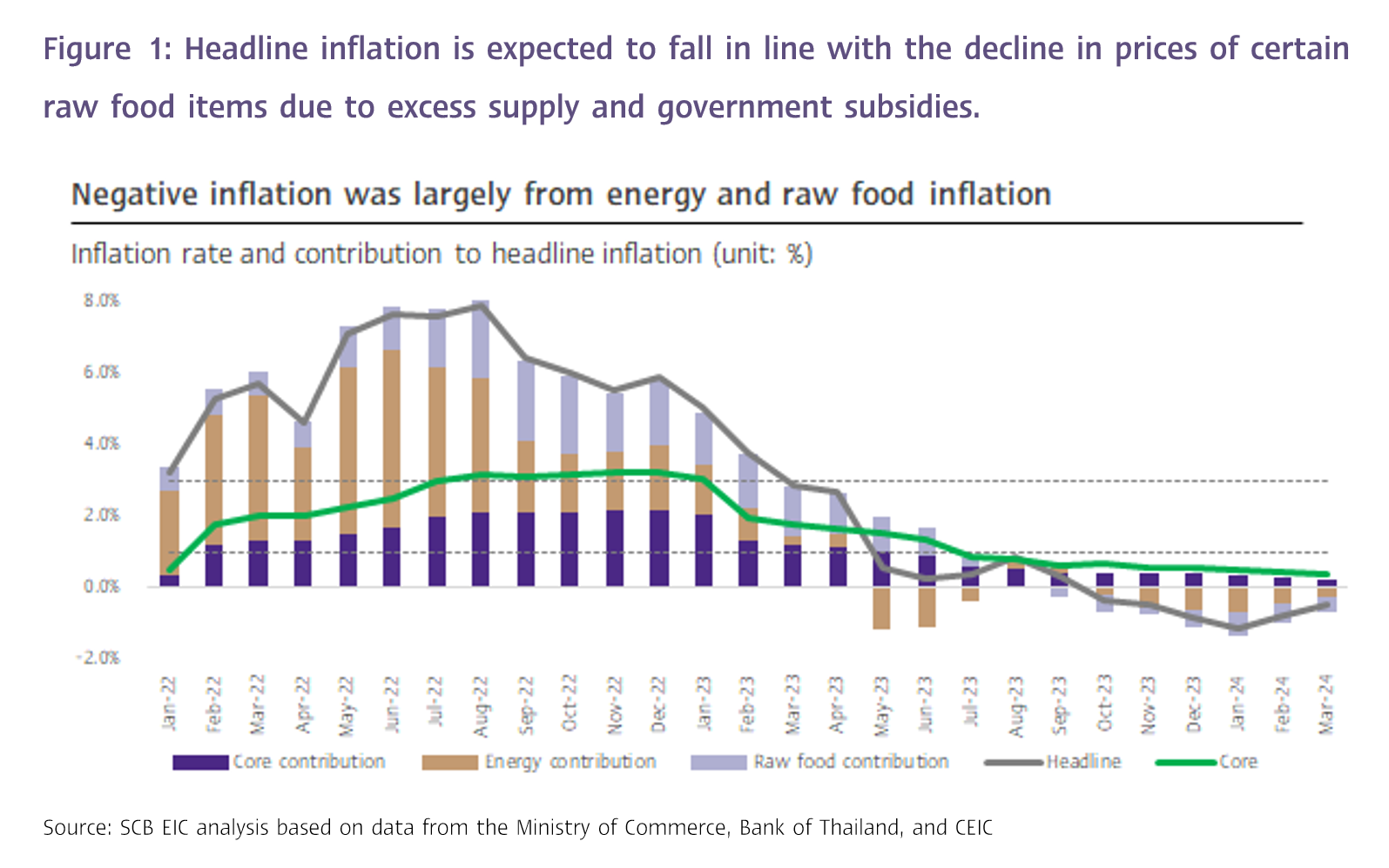

The MPC states clearly that the decline in Thai economic growth after the COVID-19 pandemic reflects the impact of structural headwinds of the economy’s potential. On inflation, the MPC projects headline inflation at 0.6% and 1.3% in 2024 and 2025, respectively, in line with the decline in raw food prices and government subsidies (Figure 1). Headline inflation is expected to gradually increase towards the target range by the end of 2024. Moreover, the MPC assesses that the overall financial conditions remain stable, whereas some groups of SMEs and low-income households face tighter credit conditions. Looking ahead, the MPC expects uncertainties on the Thai economy to remain, particularly from export recovery, government budget disbursement, and fiscal stimulus measures, which should be closely monitored.