Thai export recovery has stalled, yet growth in 2024 is expected to remain positive, driven by global trade dynamics, while imports of capital and consumer goods accelerated.

SCB EIC views that exports should continue to improve by 3.1% in 2024, albeit at a slower rate compared to the previous forecast of 3.7%.

The signal of Thai export recovery slowed in the short term.

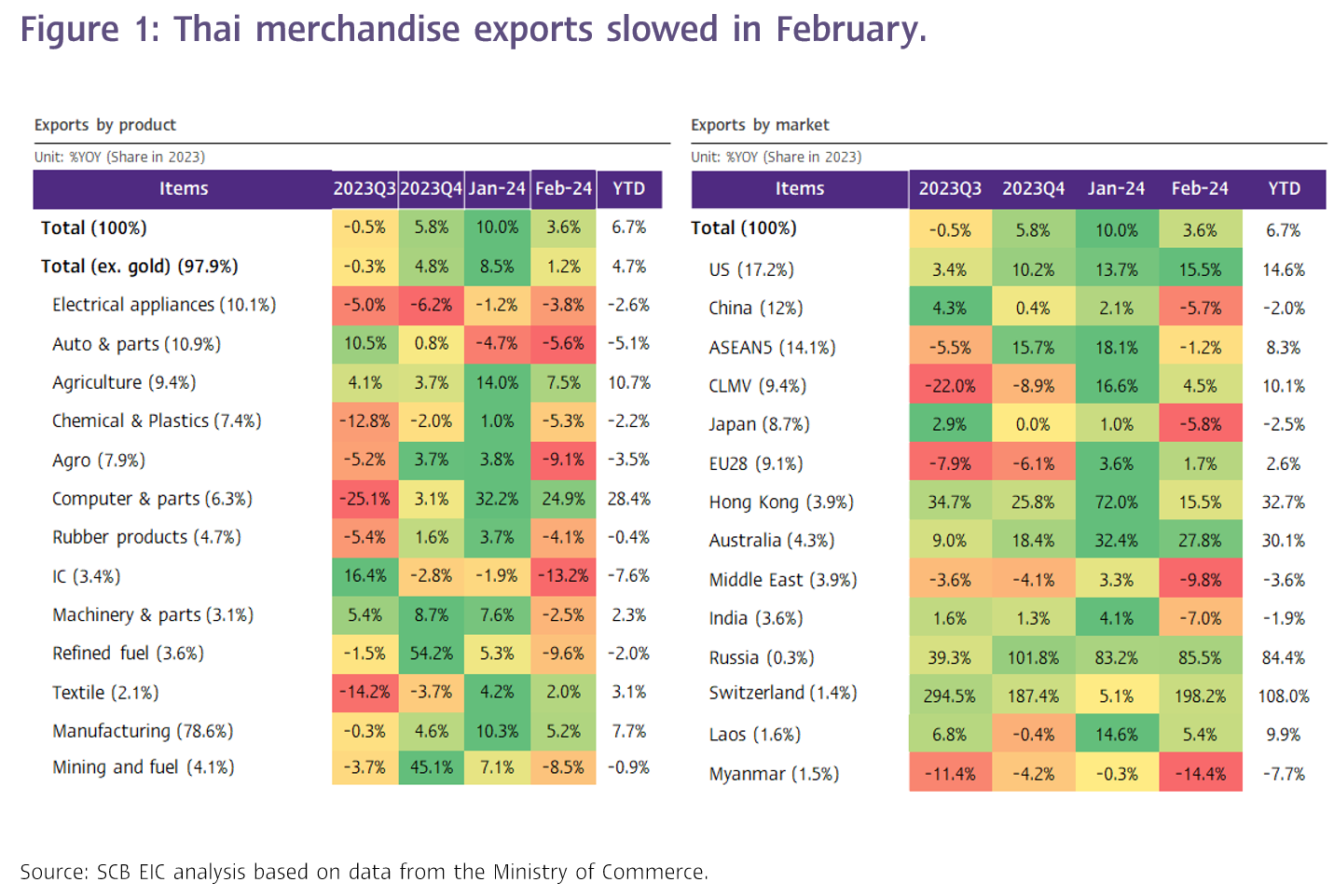

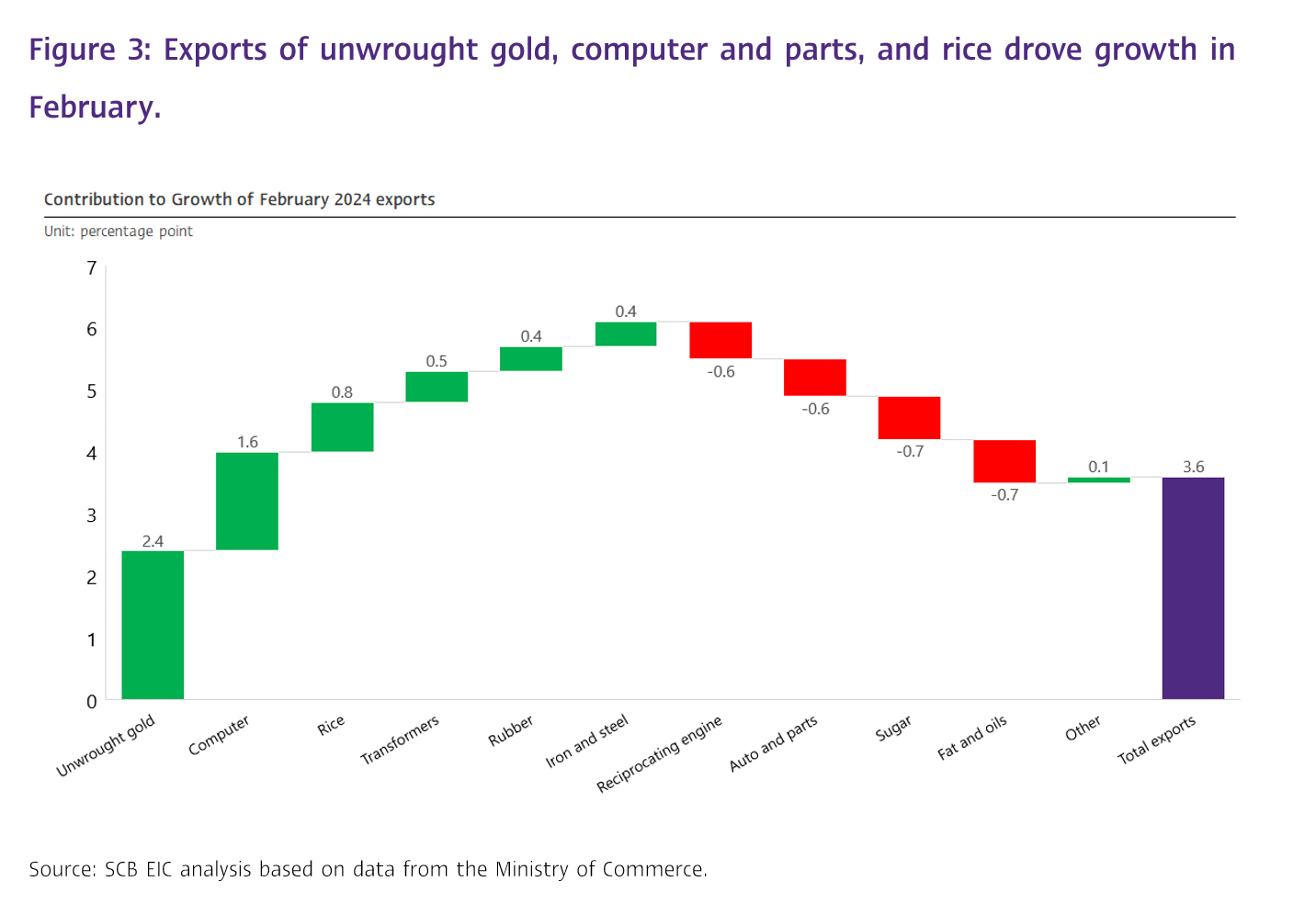

The value of Thai exports in February 2024 stood at USD 23,384.9 million, increasing by only 3.6%YOY (compared to February 2023). Such a growth slowed considerably from 10% in the prior month. On a month-on-month seasonally adjusted basis, Thai exports contracted by -2% MOM_sa (compared to January 2024). Moreover, growth in February was partly driven by a substantial surge in gold exports by as much as 309.5%YOY (contribution to %YOY growth = 2.4%), which does not reflect actual export conditions. Excluding gold, Thai exports in February grew by only 1.2%YOY while contracting by -2.1%MOM_SA, indicating signs of a slowing short-term recovery.

Exports of agricultural and manufacturing products stalled while exports of agro-industrial and mining and fuel products contracted.

In the big picture, exports improved in some key product categories, in which (1) Exports of agricultural products increased by 7.5%, dropping from the 14% growth in the previous month. Notable contributors to this growth were exports of rice and rubber whereas exports of cassava dragged growth. (2) Exports of manufacturing products improved by 5.2%, decreasing from 10.3% in the prior month. Key products driving this growth included electrical transformers and components, and iron, steel, and products. However, exports of automotive, components, and parts contracted. (3) Exports of agro-industrial products reverted to a -9.1% contraction, marking the first decline in 6 months after expanding by 3.8% in the prior month. Exports of canned and processed fruits and beverages supported growth while exports of sugar contracted. Meanwhile, (4) Exports of mining and fuel products contracted by -8.5%, representing the first decline in 7 months after expanding by 7.1% in the prior month (Figure 1 and 3).

Exports to key destinations showed uneven growth this month.

Exports to nearly all key destinations improved, in which (1) Exports to the US experienced a robust expansion of 15.5%, continuing from 13.7% in the previous month. Growth was even across key product categories, with 12 out of the top 15 imports in the US market expanding, particularly electrical transformers and components (78.5%) and semiconductors, transistors, and diodes (63.8%). (2) Exports to Switzerland surged substantially by 198.2%, compared to 5.1% in the prior month, driven by a significant increase in exports of jewelry and precious stones, expanding by as much as 688.1%, potentially gold. (3) Exports to Europe grew by 1.7%, declining from 3.6% in the prior month. However, (4) Exports to China, Japan, and the Middle East contracted by -5.7%, -5.8%, and -9.8%, respectively (Figure 1).

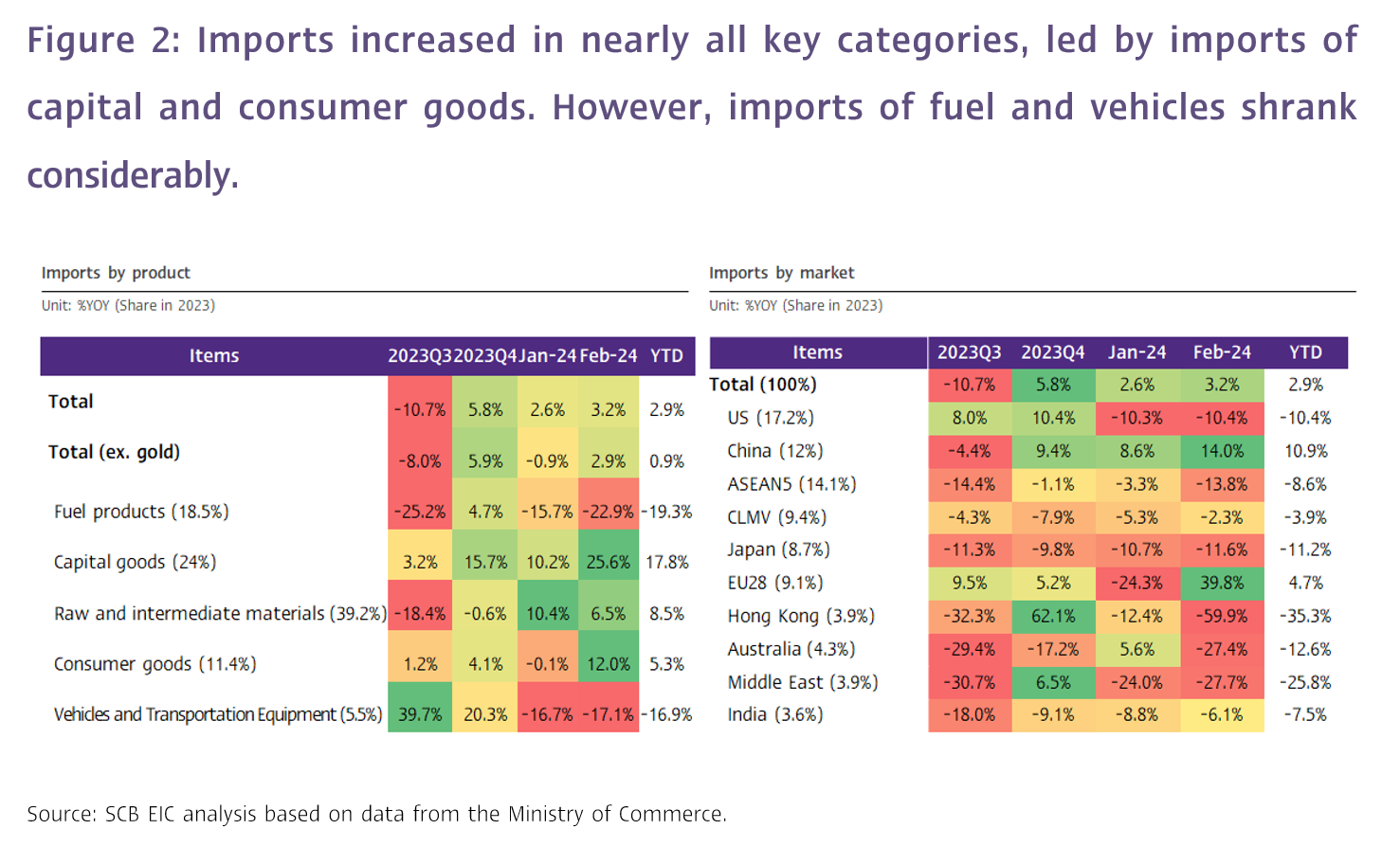

Thai trade deficit persisted as imports of capital and consumer goods increased. Imports also surge mainly from China and Europe.

The value of imports in February stood at USD 23,938.9 million, expanding by 3.2%YOY compared to 2.6% in the prior month. Imports saw improvements across all key categories, including imports of capital goods with an accelerated growth of 25.6%, imports of consumer goods with a robust growth of 12%, and imports of raw materials and intermediate raw materials with a growth of 6.5%. However, imports of vehicles and logistics equipment contracted by -17.1%, while imports of fuel products dropped significantly by -22.9%. In terms of imports by destinations, imports surged mainly from 2 destinations, namely (1) Imports from Europe, which saw growth rebounding to 39.8%, driven by imports of aeroplanes, gliders, instruments and parts by 2,793.7% and imports of ships, boats and floating structures by 1179.1% and (2) Imports from China, which saw growth accelerating to 14%, particularly from imports of household articles and furniture with 92% growth and imports of machinery and parts with 56.6% growth.

The customs basis trade balance in February showed a slight deficit of USD -554 million, compared to a deficit of USD -2,757.9 million in January 2024. With such regards, the trade balance during the first 2 months of 2024 stood at a deficit of USD -3,311.9 million (Figure 2).

In March, exports may contract considerably due to the high base effect, but exports of weaponry for overseas military drills could help mitigate a sharp decline.

SCB EIC anticipates a substantial decline in merchandise exports in March 2024 in %YOY terms due to the high base effect, despite the recovery in global manufacturing and trade conditions. Such a decline is mainly influenced by the exceptionally high value of gold exports in March 2023, reaching USD 1,568.7 million, well above the usual rate. According to a press release from the Trade Policy and Strategy Office, Ministry of Commerce, exports in March 2024 are expected to range between 25,500 – 26,500, representing a contraction of -5.4% to -8.9%. However, the Cobra Gold military drill, which may involve the movement of weaponry and equipment , could partially support Thailand’s customs basis export figures in March and prevent a steep decline. Nevertheless, exports of both previously mentioned products do not reflect actual export conditions. Moreover, exports of weaponry related to the Cobra Gold military drill will not be included in the balance of payments export figures.

SCB EIC views that exports should continue to improve by 3.1% in 2024, albeit at a slower rate compared to the previous forecast of 3.7%.

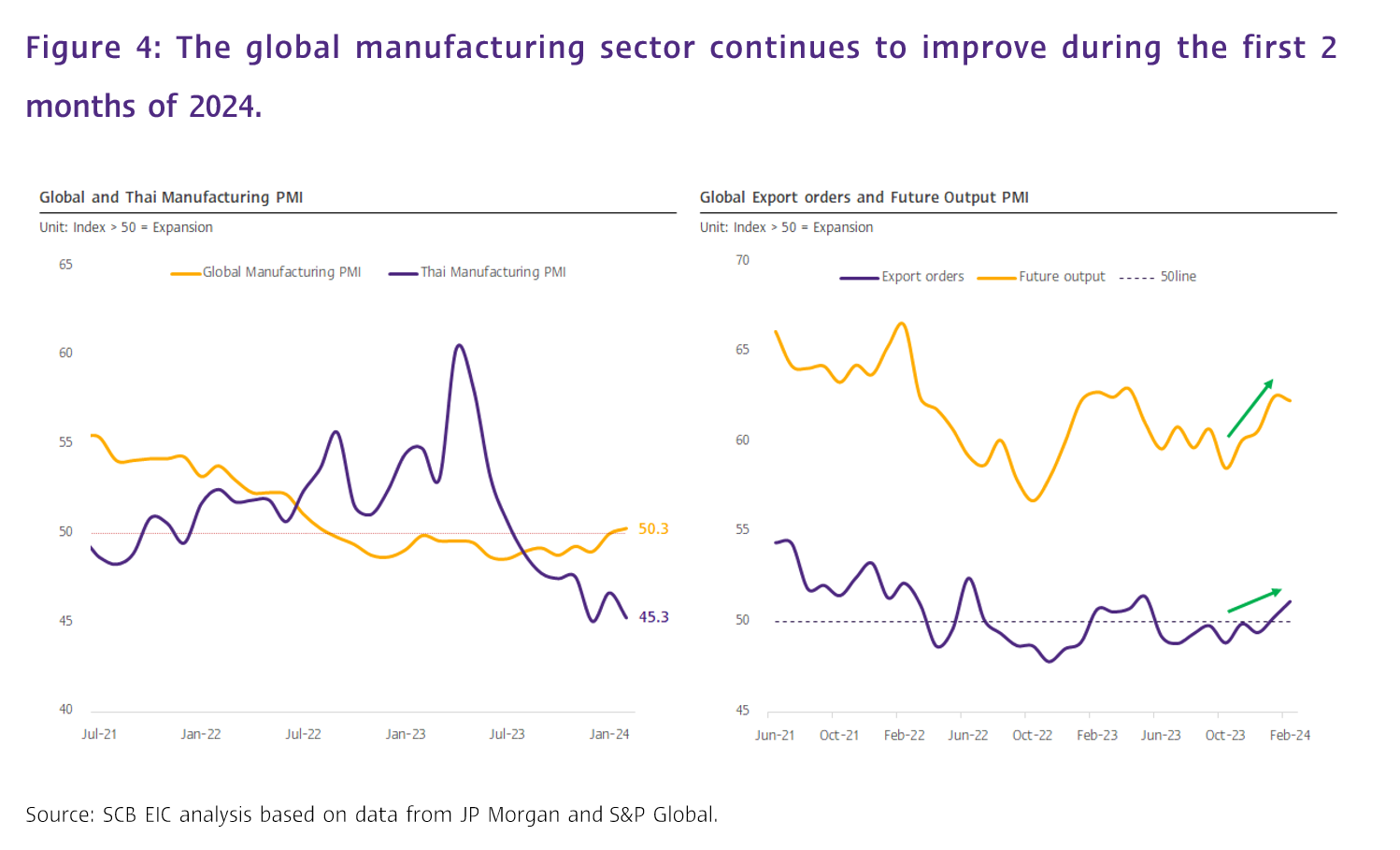

SCB EIC expects Thai export growth to turn positive in 2024. Factors supporting such a view include (1) Improving global trade volume, in line with the global economy, that should continue to recover by a similar rate observed last year. (2) The manufacturing sector related to international trade should play a greater role in driving the global economy in 2024. Such a condition is reflected in the Global Manufacturing Purchasing Managers Index (PMI) reading for February, which rose to 50.3, surpassing 50 for the first time in 18 months. Moreover, the export orders PMI and future output PMI readings have been improving since the end of 2023, indicating better manufacturing conditions in the coming periods (Figure 4). Morever, (3) the prices of export products are expected to remain high, including agricultural products, due to lower supply in the global market following droughts and policies by certain countries that limit agricultural exports.

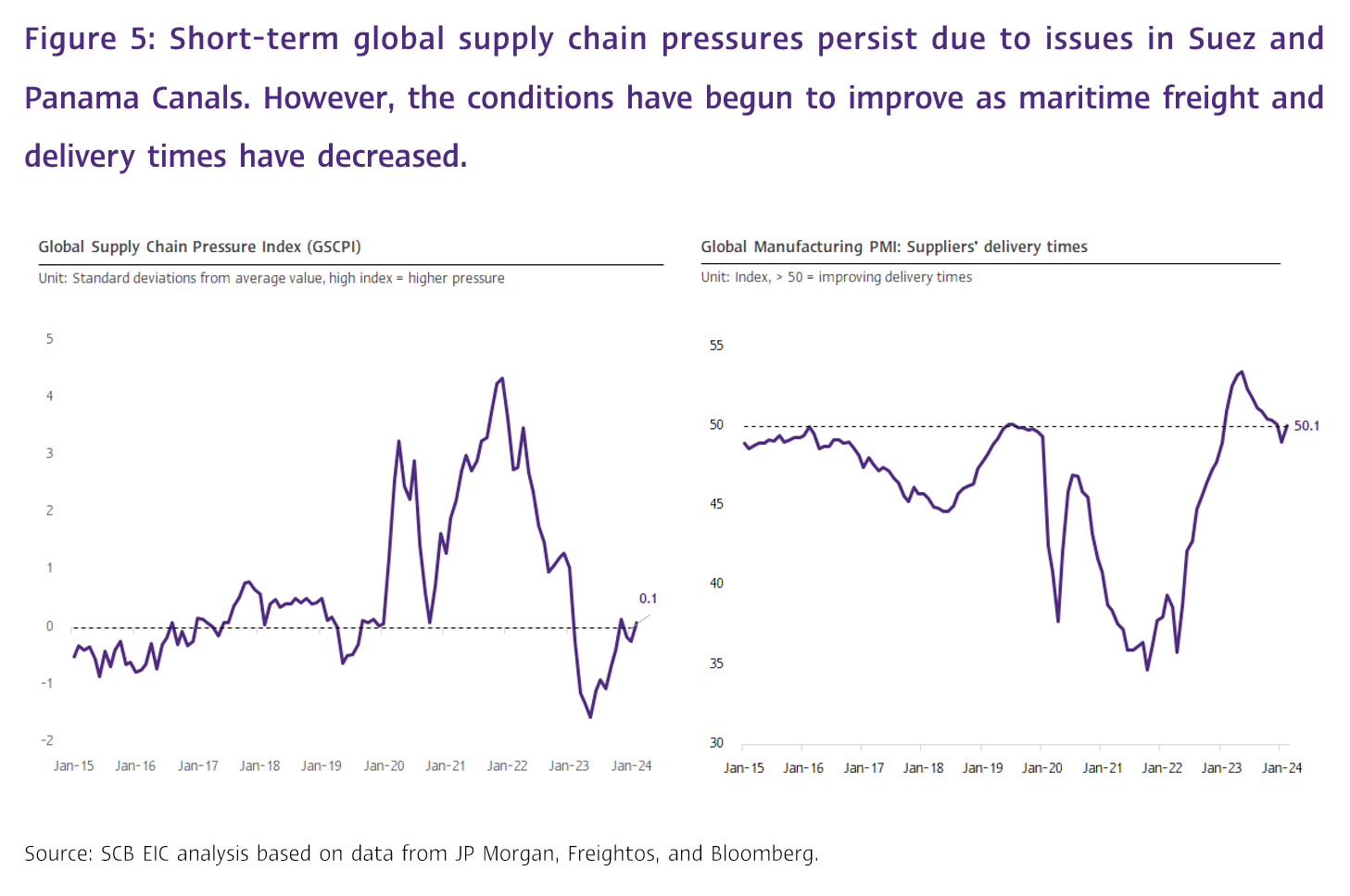

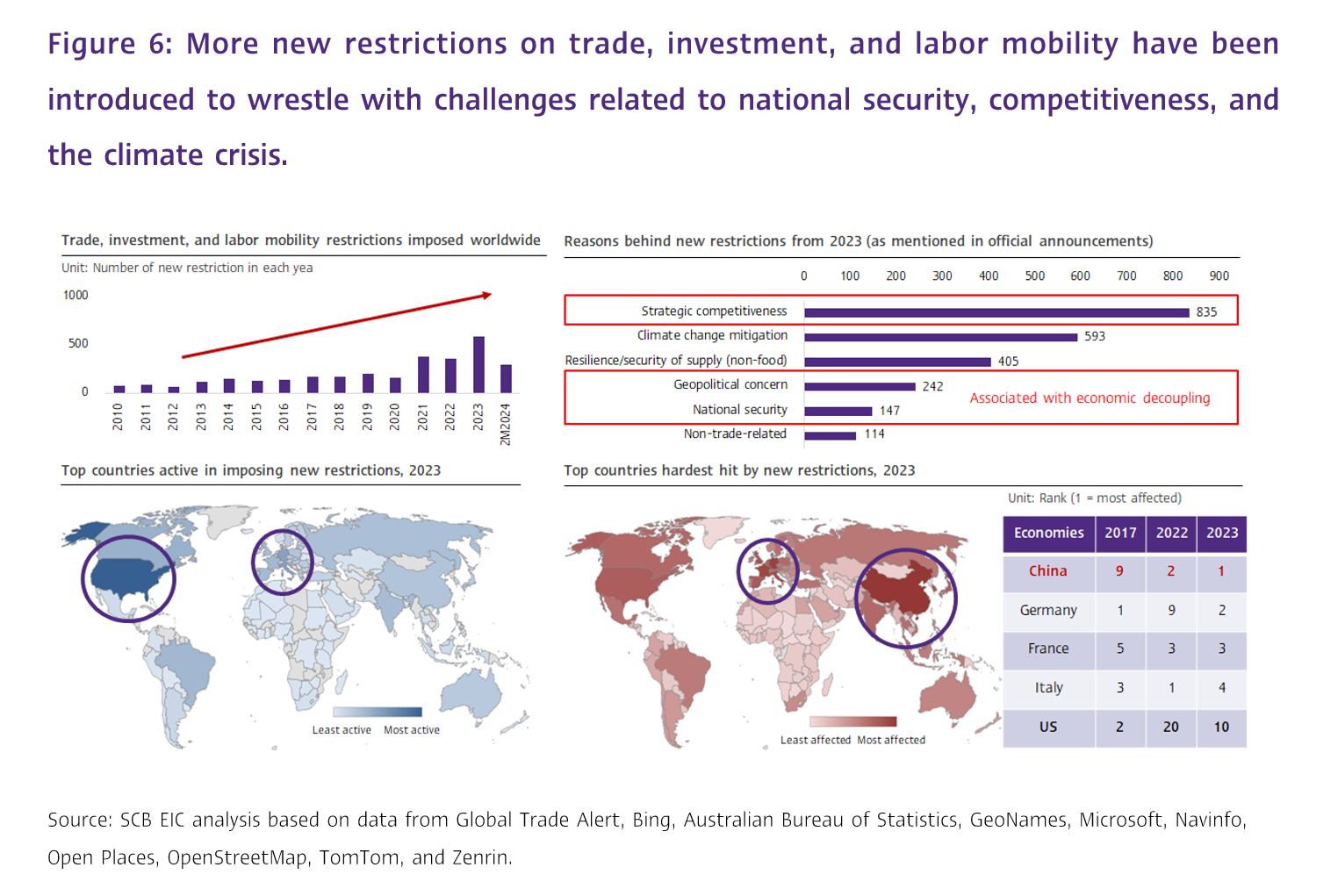

Nevertheless, SCB EIC has revised down the forecast for Thai merchandise exports in 2024 to 3.1% (from 3.7%) (balance of payments basis) following the slower-than-expected recovery of world trade volume this year, resulting from attacks from Houthi rebels and drought in the Panama Canal (Figure 5), economic polarization, and the implementation of recently added trade protectionist measures (Figure 6). Moreover, recent strong performance in Thai exports can be partly attributed to special factors, such as gold export, which is not a reliable indicator of Thai export recovery.

Thai exports may not fully capitalize on the recovery of global manufacturing activities, as long-term shifts in global demand patterns are underway.

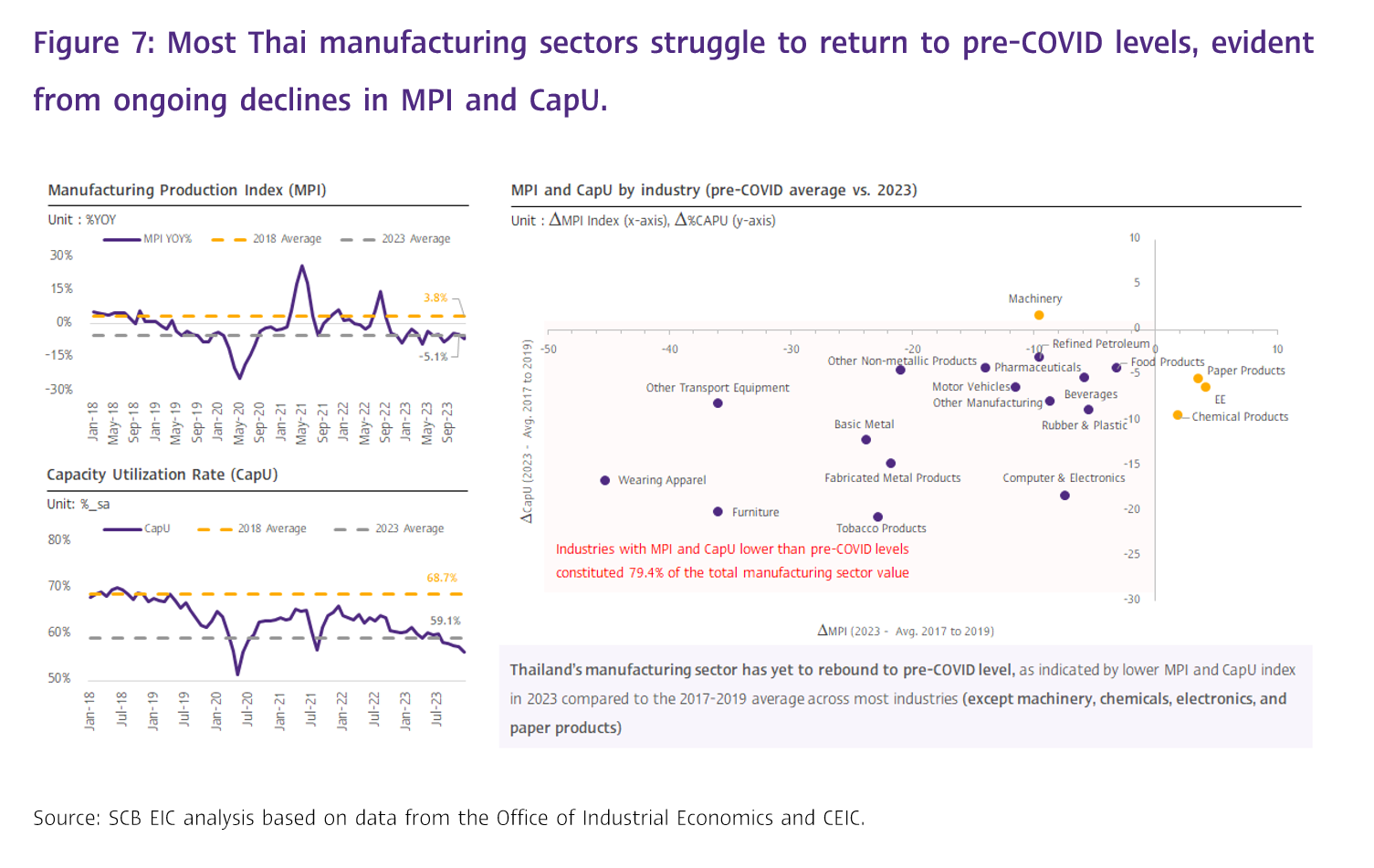

Although global manufacturing sectors have rebounded from COVID, Thailand's export-oriented manufacturing sectors have yet to return to pre-pandemic levels, reflected by 1) the manufacturing production Index and capacity utilization rates in 2023 remaining below the 2017-2019 average. 2) Nearly all manufacturing sectors (almost 80% of total manufacturing sector value add), except machinery, chemicals, and electronics, have not fully recovered (Figure 7). 3) The Thai Manufacturing Purchasing Managers Index is expected to continue worsening, unlike the Global Manufacturing Purchasing Managers Index which is improving (Figure 4).

The main reason is that Thai exports have limited adaptability to changing global product demand patterns and long-term supply chain dynamics. Indicators for such limited adaptability include the weak readings of the adaptation effect index and the relative change of world market share, published by the International Trade Centre, with negative readings in many of Thailand’s key industries, especially electronics and automotive.

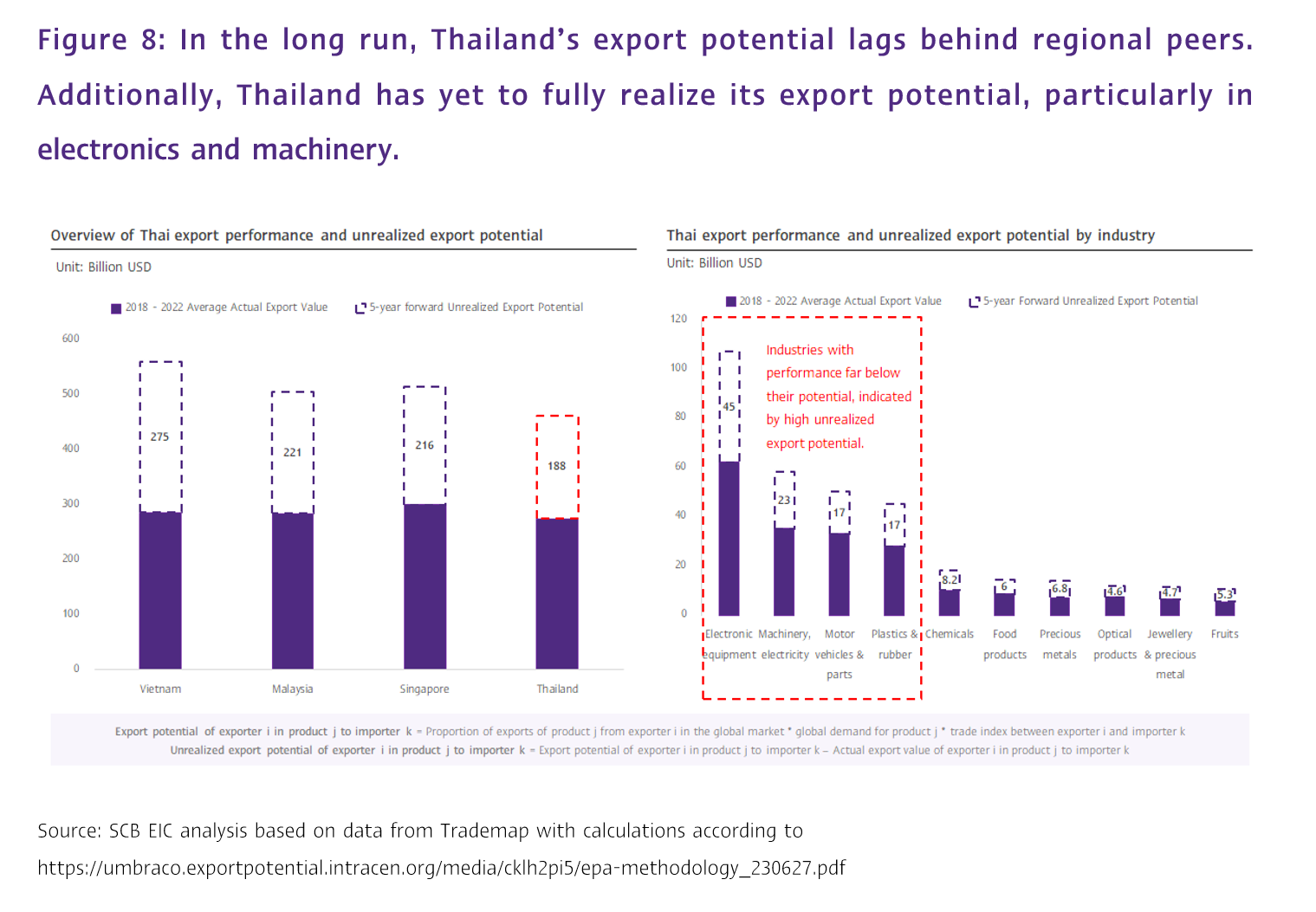

Changing global product demand patterns significantly contributes to Thailand's relatively low export potential compared to its regional peers. Data on export potential, published by the International Trade Centre, indicates that Thailand's export potential over the next five years will be lower than that of regional peers, particularly Vietnam, Malaysia, and Singapore. Furthermore, upon closer examination of specific industries, Thai industries with lowest exports relative to their potential include electronic equipment, electrical machinery, motor vehicels, and plastic and rubber products (Figure 8). As such, Thailand's manufacturing sector needs to expedite its adaptation to align with changing global product demand patterns and enhance Thai competitiveness in the global market.