Thai exports welcomed 2024, the year of the dragon, with signs of recovery.

The value of Thai exports in January 2024 stood at USD 22,649.9 million, up by 10%YOY.

Thai export conditions signaled recovery, with growth reaching a 19-month high in January.

The value of Thai exports in January 2024 stood at USD 22,649.9 million, up by 10%YOY. Such a growth marked a 19-month high rate, driven in part by a substantial surge in gold exports by as much as 194.2%YOY (contribution to %YOY growth = 1.5%), in addition to the low base. Even when excluding the extraordinary contribution of gold exports, Thai exports still expanded by a commendable 8.5%YOY. Additionally, on the month-on-month seasonally adjusted term, Thai exports exclude gold remained relatively stable at -0.3%MOM_SA, indicating somewhat clearer signs of recovery despite challenges from maritime transport stemming from war conflicts.

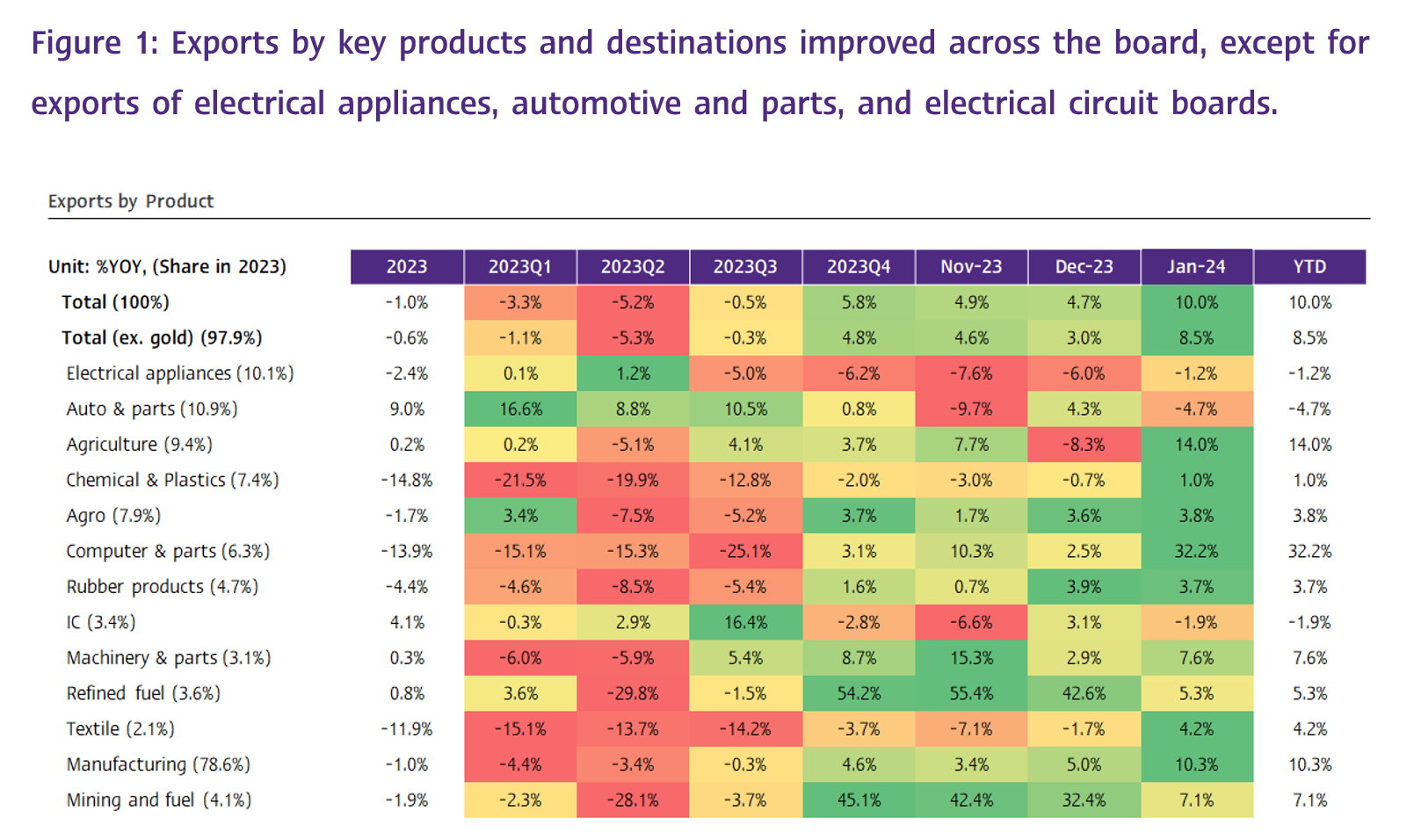

Exports across all key product categories improved in January 2024.

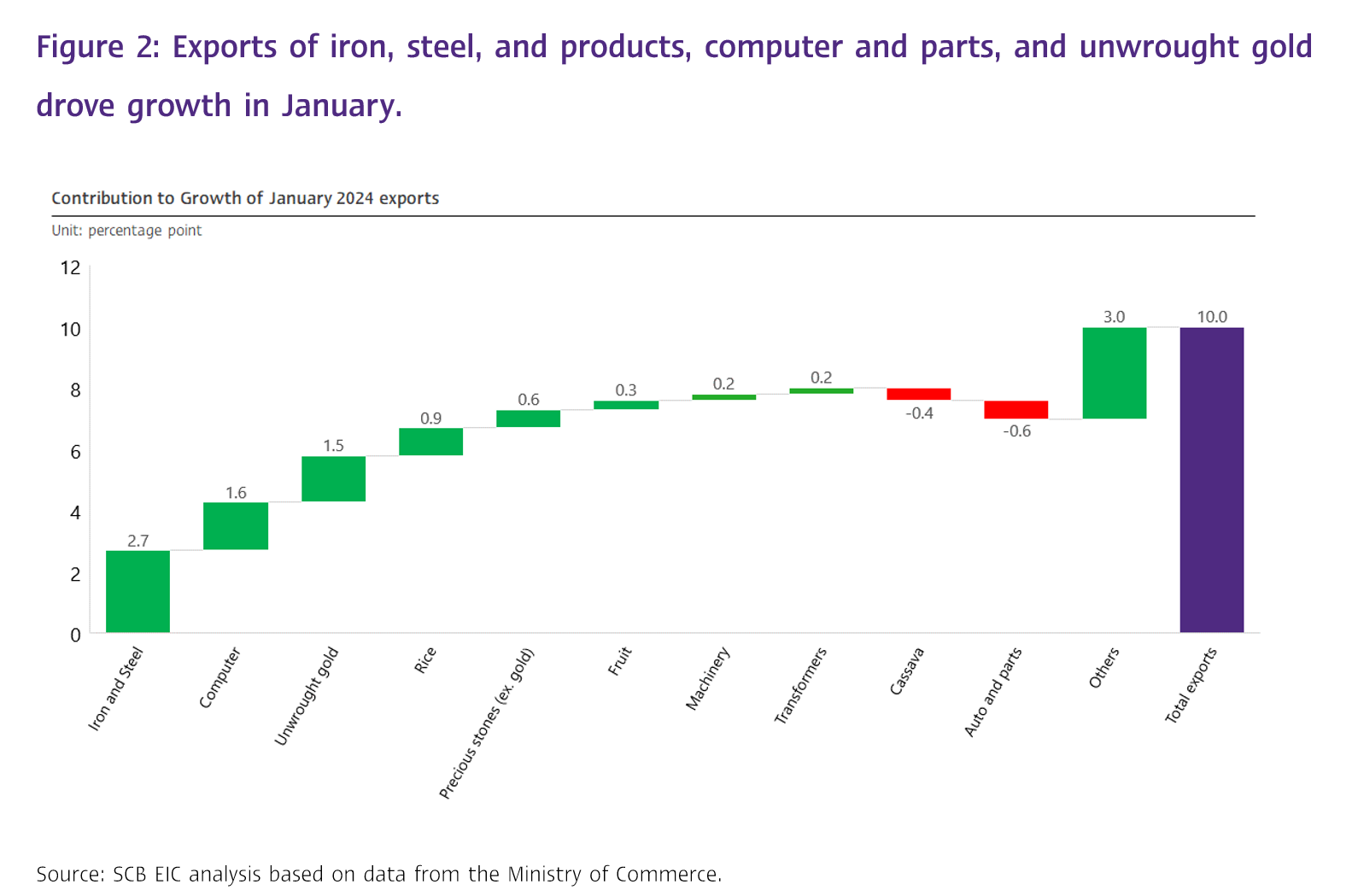

In the big picture, exports across all key product categories improved, in which (1) Exports of agricultural products rebounded with a significant expansion of 14%, reversing the -8.3% contraction observed in the previous month. Notable contributors to this growth were exports of rice, fresh/ chilled/ frozen/ dried fruits, and rubber. On the contrary, exports of cassava dragged growth. (2) Exports of manufacturing products improved by 10.3%, accelerating from 5% in the prior month. Key products driving this growth included iron, steel, and products, and machinery and machinery components. Meanwhile, exports of automotive, components, and parts contracted. (3) Exports of agro-industrial products grew by 3.8%, continuing from 3.6% in the prior month, driven by exports of canned and processed fruits and beverages. On the contrary, exports of sugar dropped. Meanwhile, (4) Exports of mining and fuel products continued to improve by 7.1%, albeit weakening from 32.4% in the prior month (Figures 1 and 2).

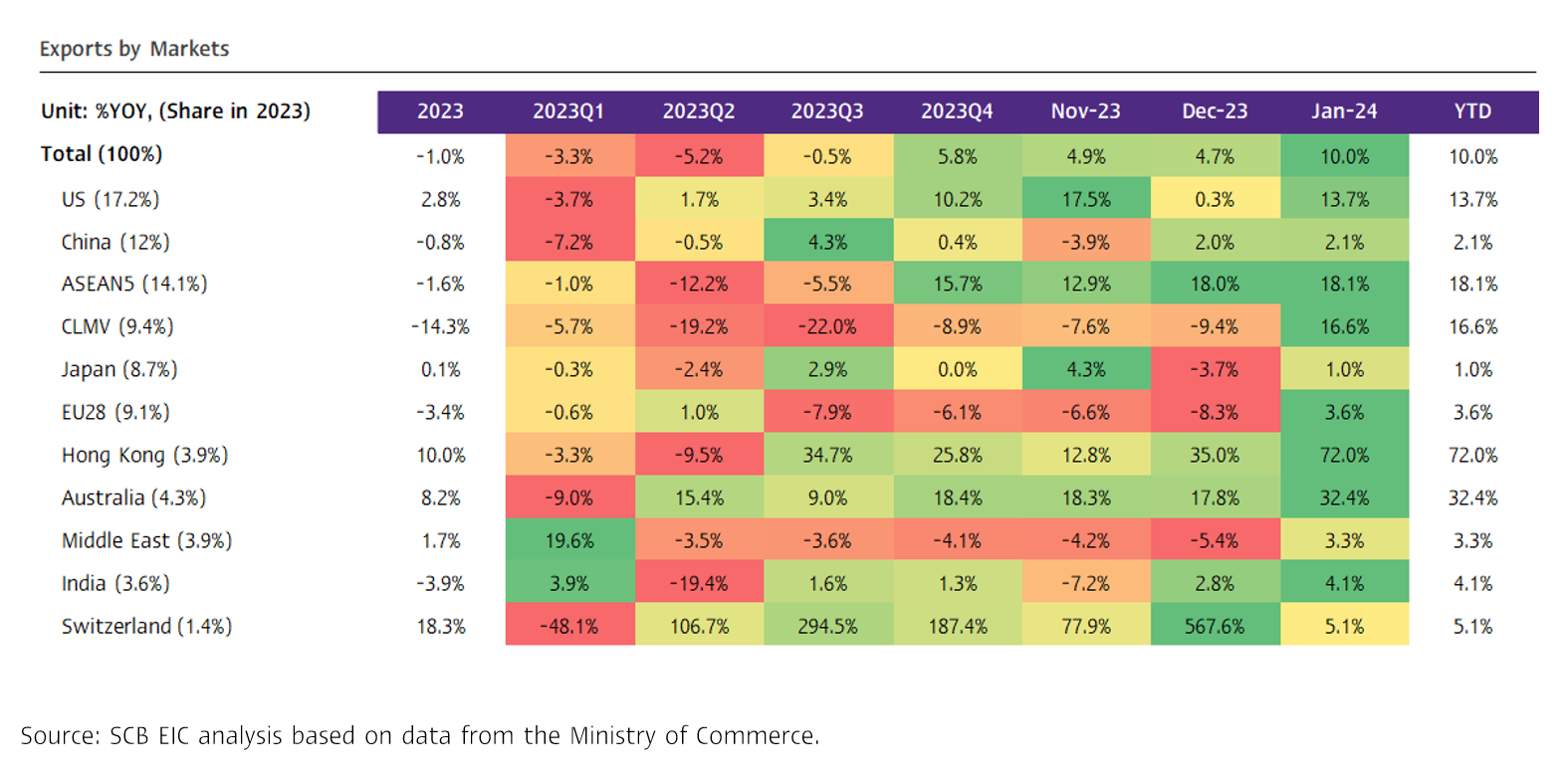

Similarly, exports to all key destinations improved in January 2024.

Exports to key destinations improved across the board, in which (1) Exports to Europe grew for the first time in 8 months by 3.6%YOY, compared to the contraction of -8.4%YOY in the previous month. Various product categories continued to expand, despite challenges in Asia-Europe maritime transportation via the Red Sea. Notably, 10 out of the top 15 exported products showed improvements, with significant contributions from fax machines, telephones, components, and parts (85.4%), and rubber (55.8%). (2) Exports to the US saw a robust expansion of 13.7%, accelerating significantly from 0.3% in the previous month with even growth among key products, especially computer, components, and parts (62%) and fax machines, telephones, components, and parts (50.4%). (3) Exports to Hong Kong experienced strong growth, surging by 72%, a significant acceleration from 35% in the previous month. Key products driving this growth included gemstones and jewelry (314.2%) and piston internal combustion engines and components (24,775.9%). Meanwhile, (4) Exports to China continued to improve by 2.1%, a rate similar to 2% in the previous month.

However, the trade balance (customs basis) reverted to a deficit as imports for production and investments increased.

The value of imports in January stood at USD 25,407.8 million, reverting to an expansion at 2.6%YOY. Such a condition was attributed to imports of raw materials and intermediate raw materials and imports of capital goods at approximately 10%. However, imports of vehicles and logistics equipment contracted for the first time in 13 months at -16.7%. Imports of fuel products plunged to -15.7%, and imports of consumer goods dropped slightly by -0.1%. As such, the customs basis trade balance in January reverted to a deficit of USD -2,757.9 million, compared to the surplus of USD 972.8 million in December 2023.

SCB EIC views that merchandise exports will continue to expand this year.

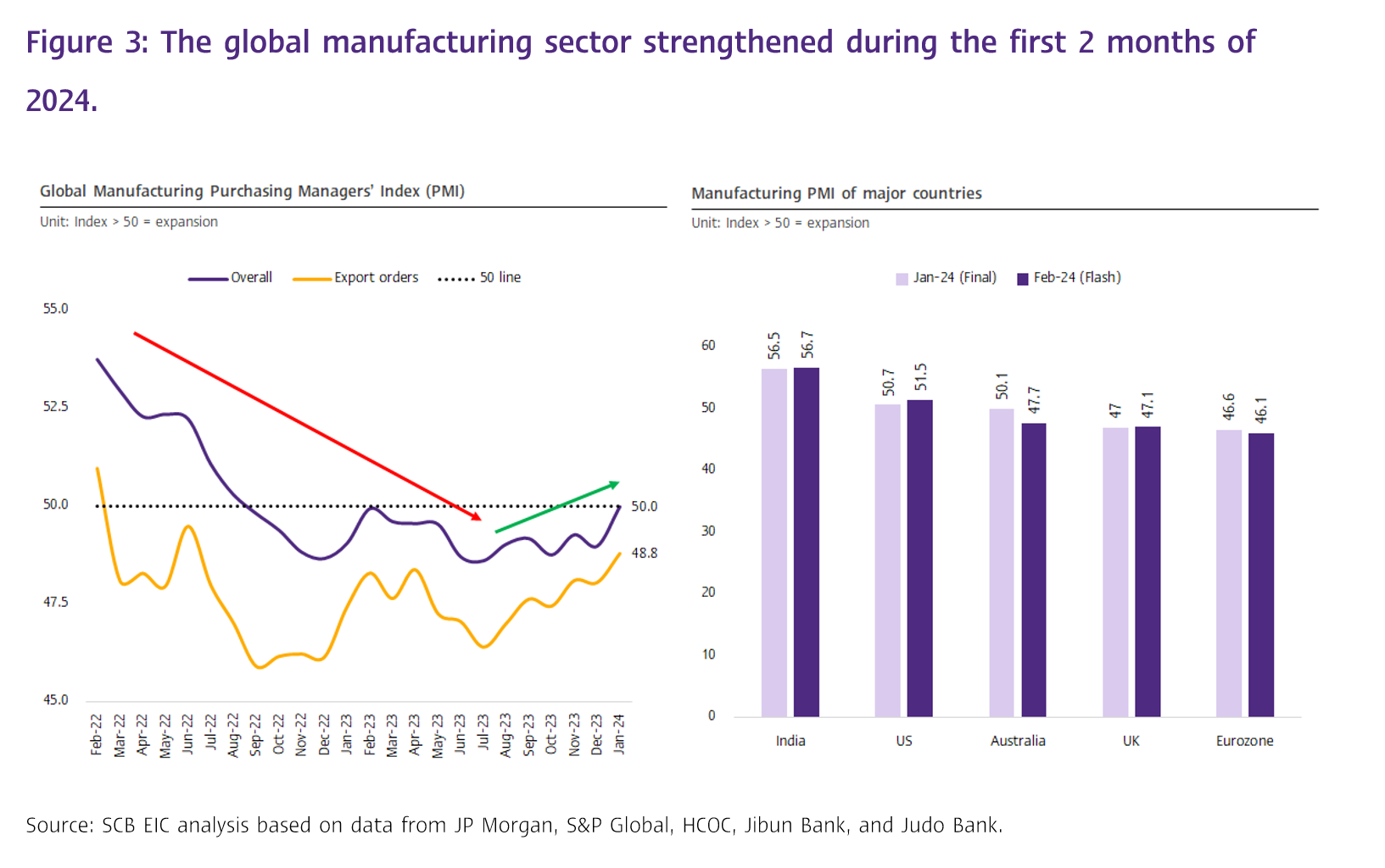

SCB EIC expects that the value of Thai exports will turn positive in 2024. Factors supporting such a view, include (1) Improving global trade volume, in line with the global economy that should continue to recover. While the pace of global economic growth may be slower, the growth is anticipated to be comparable to the rate observed last year. (2) The manufacturing sector that related to international trade should play a greater role in driving the global economy in 2024. Such condition is reflected upon the reading of the Global Manufacturing Purchasing Managers' Index (PMI) in January rising to 50 for the first time in 17 months. Moreover, the reading of the Manufacturing PMI in February of the US, which holds significance for Thailand as a key export destination, strengthens to a 17-month high while the manufacturing sector in various countries experience stagnation (Figure 3). (3) The prices of export products should continue to remain high, especially agricultural products’ prices that should increase according to lower supply in the global market following the drought and policies by certain countries that limit agricultural exports.

Nevertheless, merchandise export growth in the form of %YOY should decrease during the remainder of 2024, particularly in March, which can be attributed to the considerable value of gold exports of USD 1,568.7 million in March 2023. Additionally, several key risks that can potentially impact the merchandise export outlook still remain, including maritime transportation challenges via the Red Sea and the Panama Canal, the global supply chain polarization, a greater implementation of import taxes and regulations related to trade barriers, and the uncertain recovery of import demand from importing countries.

Concerns regarding the issues in the Red Sea (Suez Canal) and drought in the Panama Canal have started to subside, although close monitoring is still warranted for potential spread and prolonged war conditions.

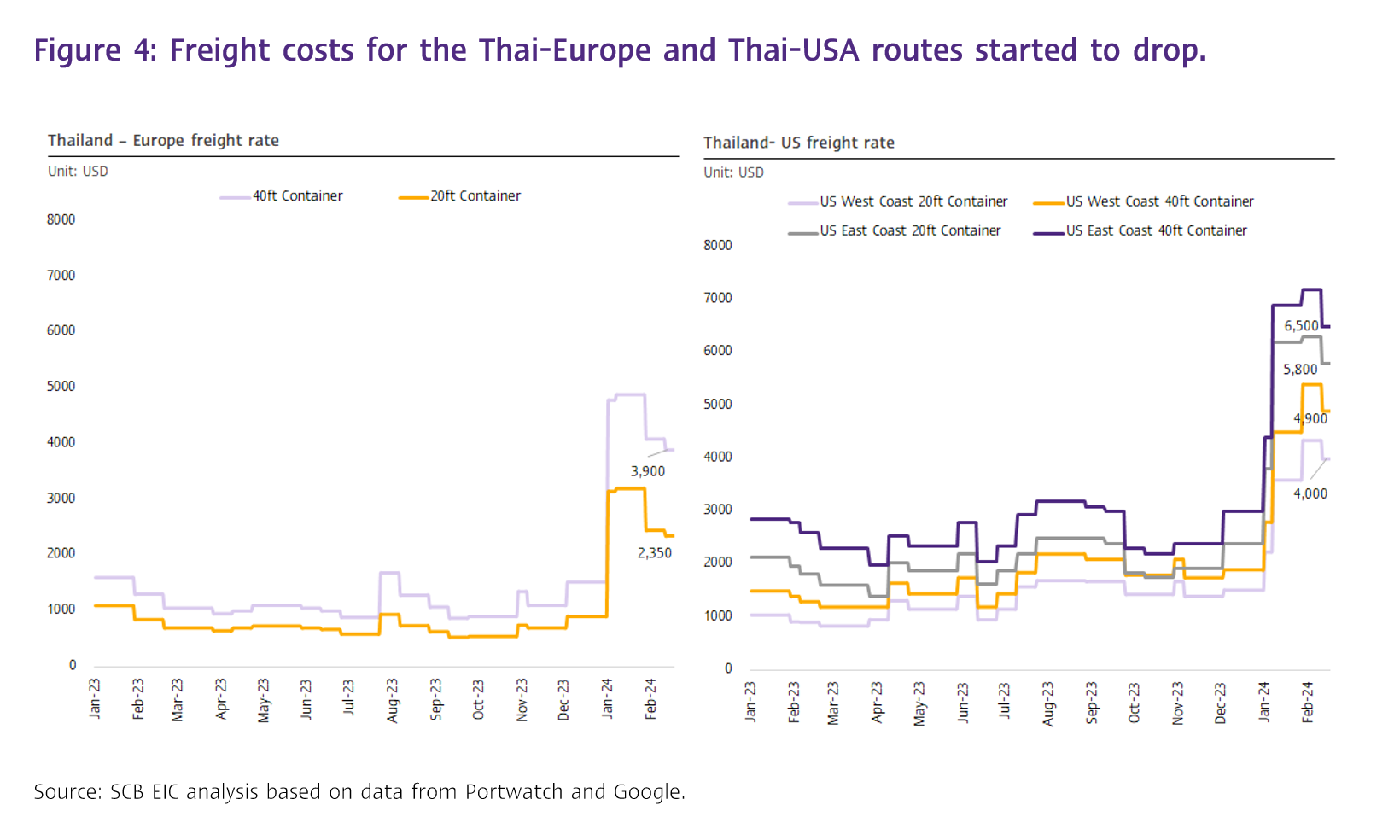

The attacks by Houthi rebels on cargo ships in the Red Sea (Suez Canal) and the drought in the Panama Canal, both of which are major global maritime transportation routes, significantly heightened freight costs and transportation times. The impact of these challenges was evident from the considerable rise in freight costs for transportation between Thailand and key destinations. As of February 17, 2024, freight costs for maritime transportation between Thailand and Europe surged to as high as USD 4,900 (4 times higher than the rate in November 2023). Similarly, the freight cost for maritime transportation between Thailand and the United States increased to USD 7,200 (3 times higher than the rate in November 2023). These escalated costs have raised concerns about the potential impacts on Thai merchandise exports in early 2024, particularly to Europe, which heavily relies on shipping through the Suez Canal.

Recently, concerns have started to subside following the limited impact on the value of Thai exports in the first month of 2024. In January, Thai exports continued to expand by a substantial 10%YOY (excluding gold, the growth stood at 8.5%YOY), although stable compared to the previous month on a seasonally adjusted basis at -0.3%MOM_SA. Notably, exports to Europe displayed robust improvement, growing by 3.6%. Furthermore, freight rates, which had previously peaked, have started to drop. As of the latest observations, rates for the Thailand-Europe and Thailand-US routes reduced to USD 3,900 and USD 6,500 (3 and 2.5 times higher than the rate in November 2023), respectively. However, SCB EIC will continue to monitor the situation closely as the potential for further spread and prolonged war conditions pose a continued risk to Thai exports.

SCB EIC is closely monitoring the situation and re-assessing the Thai merchandise exports forecasts (balance of payment basis) in 2024. The updated forecasts, reflecting the latest developments, are scheduled to be published in March.