Exports slightly contracted in 2023 but poised for a hopeful recovery to welcome the year of the dragon, though close monitoring on risks in the Red Sea is still necessary.

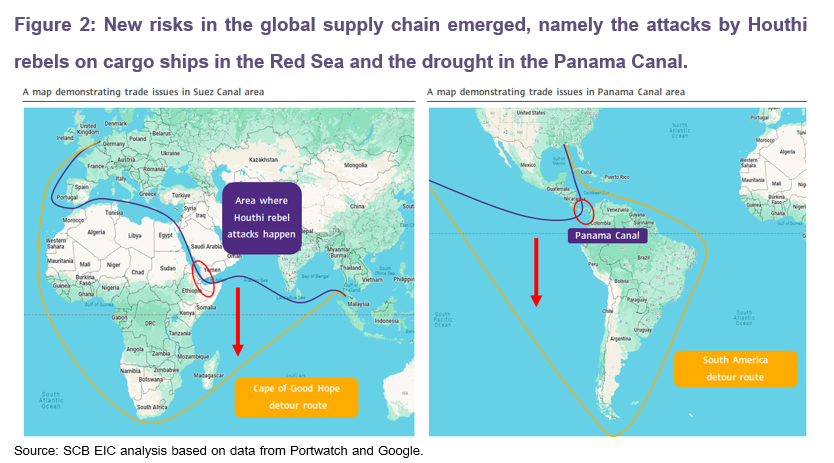

SCB EIC views that Thai exports should continue to recover in 2024 with 3.7% growth following support from various factors

Thai exports showed signs of recovery, albeit with an unclear trajectory due to special factors.

The value of Thai exports in December 2023 stood at USD 22,791.6 million, indicating 5 consecutive months of growth, with a 4.7%YOY increase (compared with Dec 2022) and a 1.6%MOM_sa (compared with Nov 2023, seasonally adjusted). Gold exports notably contributed to this performance, with considerable growth at 787.6% (contribution to %YOY growth = 1.7%). However, excluding gold, Thai export growth dropped to 3%YOY and 0.4%MOM_sa, which reflects an unclear recovery in Thai merchandise exports since, similar to previous months, the export growth is attributed to special factors, including the low base, gold exports, and special-use automotive exports that do not reflect actual export conditions. As such, Thai exports (customs basis) in 2023 totaled USD 284,561.8 million, registering a slight decline of -1.0%YOY.

Exports in various categories expanded in December, except agricultural products.

In the big picture, exports of most key product categories improved, in which (1) Exports of mining and fuel products continued to surge by 32.4% continuing from 42.4% in the prior month. (2) Exports of manufacturing products continued to grow by 5% from 3.4% in the prior month. Key products with notable growth in the month included iron, steel, and products, and wood and wood products. (3) Exports of agro-industrial products improved by 3.6%, continuing from 1.7% in the prior month driven by exports of sugar. Meanwhile, (4) Exports of agricultural products reverted to a first contraction in 5 months at -8.3%, weakening from a 7.7% expansion in the prior month, with exports of fresh/ chilled/ frozen/ dried fruits and cassava dragging growth. On the contrary, exports of rice supported growth.

Exports to some key destinations shrank in December, with exports to Europe seeing growing risks from attacks by Houthi rebels.

Exports to some key destinations contracted, in which (1) Exports to Europe tumbled by -8.4%, worsening from -6.6% in the previous month. However, it was not clear whether such a worsened performance in December was due to the attacks by Houthi rebels in the Red Sea that have increased the delivery time from Thai to Europe and freight costs, as exports to Europe prior to the event already contracted for 7 consecutive months due to economic conditions in Europe. Such impact of the attacks on Thai exports to Europe should be more pronounced in January 2024. (2) Exports to Switzerland expanded by 567.6% driven by exports of jewelry and precious stones (especially gold) with a surge of 3,487.2%. (3) Exports to the US stalled to 0.3% from 17.5% in the prior month. Exports of computers, components, and parts dragged such growth with a -17.4% contraction. Meanwhile, (4) Exports to China reverted to a 2% expansion after weakening by -3.9% in the prior month.

Thai trade (customs basis) reverted to a surplus in December, though the overall 2023 trade balance remained at a strong deficit.

The value of imports in December stood at USD 21,818.8 million, declining for the first time in 3 months by -3.1%YOY. Such a condition was attributed to imports of consumer goods, raw materials and intermediate raw materials, and fuel that shrank by -7.3%, -5.9%, and -2.2%, respectively. On the other hand, imports of vehicles and logistics equipment and capital goods improved by 5.8% and 1%, respectively. As such, the customs basis trade balance in December reverted to a surplus of USD 972.8 million, up from USD -2,399.4 million in the prior month, causing the overall trade balance in 2023 to stand at a deficit of USD -5,192.5 million.

SCB EIC anticipates that exports should continue to improve in 2024.

SCB EIC views that Thai exports should continue to recover in 2024 with 3.7% growth following support from various factors, including (1) Improving global trade volume, in line with the global economy that should continue to recover, although at the slower rate of 2.5% (Figure 1). (2) Growth from the international trade-related manufacturing sector should play a greater role in driving the global economy in 2024 (Figure 1). (3) The prices of export products should continue to remain high in 2024, especially agricultural product prices that should increase according to lower supply in the global market following the drought as well as policies by certain countries that limit agricultural exports. (4) Public and private sector efforts to promote Thai exports, including the establishment of a Free Trade Agreement (FTA) with Sri Lanka, which will be signed off early this year, as well as FTAs with the European Free Trade Association (EFTA), South Korea, and the United Arab Emirates, with plans to successfully negotiate within 2024.

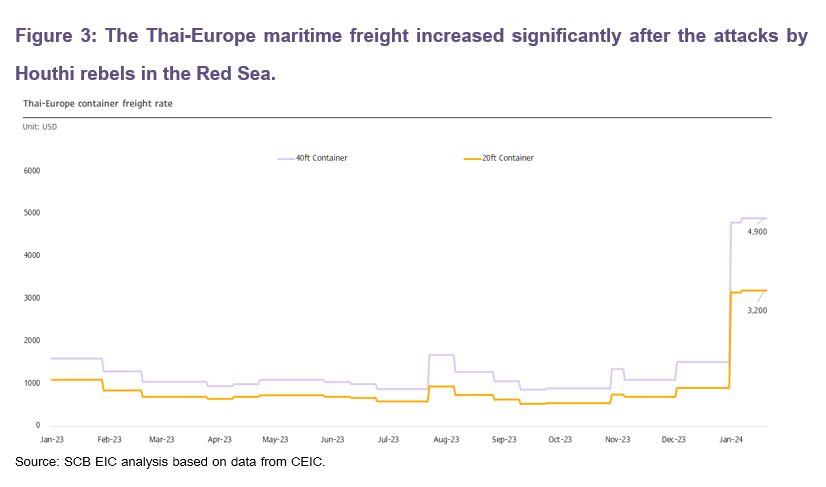

Nevertheless, risks from global supply chain disruptions could re-emerge, due to 1) The attacks by Houthi rebels on cargo ships in the Red Sea (Suez Canal). In December 2023, the Houthi rebels, formed during the 1980 – 1990s with a base in Yemen, attacked cargo ships in the Red Sea area, which is a gateway to Suez Canal and regarded as an important maritime route between Europe and Asia, representing nearly 12% of the total global maritime trade volume. The attacks were claimed by the Houthis as a demonstration of support for Hamas following the Israel-Hamas conflict since October 2023. Consequently, major companies have opted to avoid the Suez Canal route for transporting goods between Europe and Asia. Instead, the companies choose to detour around the Cape of Good Hope in South Africa (Figure 2), adding 10 to 15 days to shipping time. Moreover, the attacks also burden Asian exporters with higher freight costs and maritime insurance fees.

2) Panama Canal drought: The Panama Canal is a route that connects the Atlantic and Pacific oceans and one of the main shipping routes between Asia and the United States, representing 5% of the global maritime trade volume. Since 2023, Panama has experienced persistent droughts and low rainfall, leading to a substantial drop in the water level of the canal. To cope with this challenge, the Panama Canal Authority has implemented restrictions, limiting the number of ships permitted to pass through the Panama Canal each day. Currently, the limit is set at 24 ships per day, significantly lower than the normal allowance of 38 ships per day. Such a restriction means that cargo ships from Asia will encounter prolonged waiting times to travel through the Panama Canal to reach the United States. However, if the cargo ships are unwilling to wait, they can choose to pay an additional fee to expedite passage through the canal or take a detour around South America instead (Figure 2).

If such events disrupt the global supply chain, Thai exports may be impacted. The drought in the Panama Canal may cause the cargo ships from Thailand that need to travel through this route to face longer travel times, due to prolonged waiting times, and higher transportation costs. However, the impact on Thai exports should be limited, given that a substantial portion of merchandise exports from Asia to the US is directed to ports on the US West Coast, bypassing the Panama Canal. Consequently, Thai exports may not experience direct repercussions from the canal's drought-related challenges.

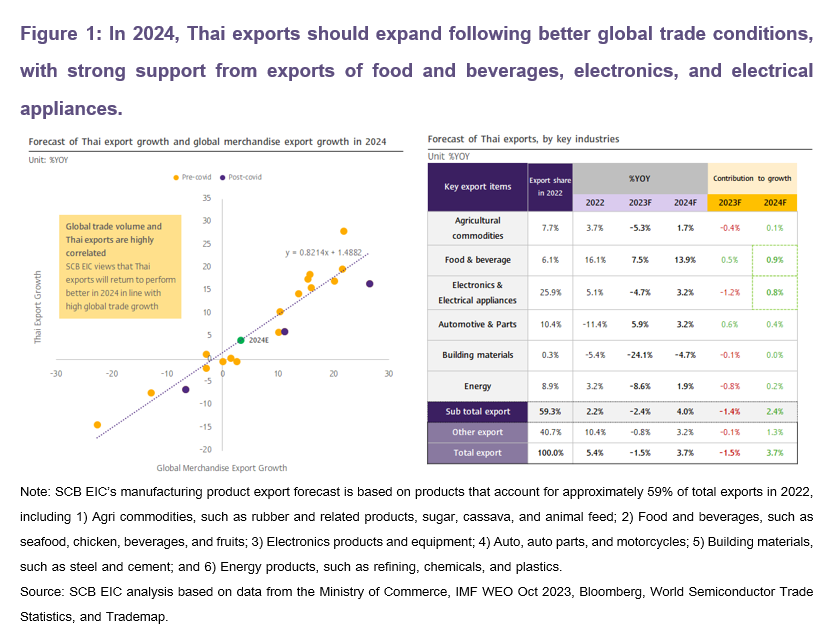

In addition, longer transportation times may lower the availability of cargo ships, causing insufficient ship supply in other routes. Therefore, Thai exporters may be burdened with significantly higher maritime freight costs. Notably, on the Thai-Europe route, freight rates for 20-foot and 40-foot cargo ships have already risen to USD 3,200 and USD 4,900, respectively, equivalent to a threefold increase from 2023 (data as of 24 January 2024) (Figure 3). Nevertheless, the current rates remain notably below the post-COVID-19 highs for 20-foot and 40-foot cargo ships, which reached USD 8,200 and USD 14,300, respectively.

Similarly, the maritime freight rates for products shipped from Thailand to the US also increased significantly after the rebel attacks. Rates for 20-foot and 40-foot cargo ships on the Thai-US West Coast route rose to USD 3,600 and USD 4,500, respectively, while on the Thai-US East Coast route soared to USD 6,200 and USD 6,900, respectively, — a threefold increase from 2023 (data as of 24 January 2024). With the Houthi rebel attacks expected to persist, vigilant monitoring of unfolding events is crucial to assess the impact on Thai exports in the future.