Thai exports grew in November, albeit at a slower pace than imports.

SCB EIC views that exports in December should continue to improve. However, such a performance should still not reflect better export conditions

Thai exports continued to improve during the month. Nevertheless, such growth does not reflect a genuine recovery in export conditions, primarily owing to the low base effect.

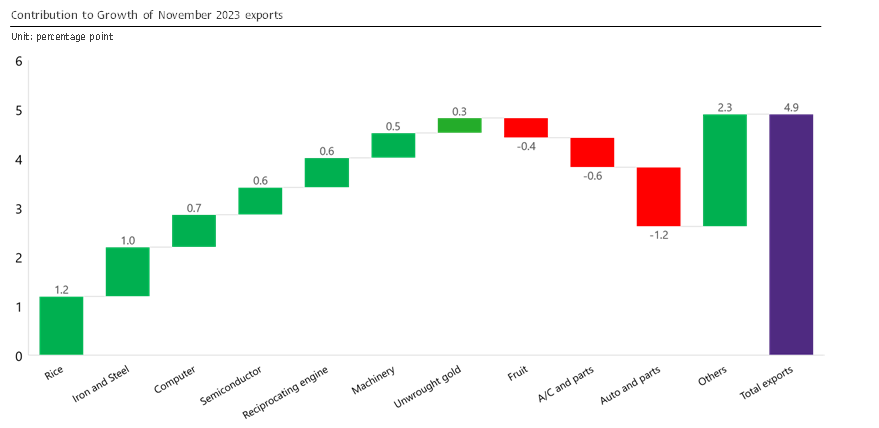

The value of Thai exports in November 2023 stood at USD 24,379.7 million, marking growth for the fourth consecutive monthh, with a 4.9%YOY increase. Such a result was on par with the rate economists forecasted in the Bloomberg poll at 5%. However, the growth does not imply a true recovery in Thai exports as the growth was mainly influenced by the low base, in which exports in November 2022 contracted by as low as -5.6%. Excluding such factor that do not reflect actual export conditions, Thai exports declined by -2.7% compared to the prior month after a seasonal adjustment (%MOM_SA)1. Moreover, gold exports contributed to the upward trajectory, with considerable growth at 64.8% (contribution to total export growth = 0.3%). The contraction suggested that Thai export conditions remained sluggish, in line with the reading of the global Purchasing Manager Index (PMI) for overall manufacturing, output, and export orders that somewhat improved though remained in the contraction zone (Figure 3). As such, during the first 11 months of 2023, Thai exports totaled USD 261,770.3 million, registering a decline of -1.5%YOY.

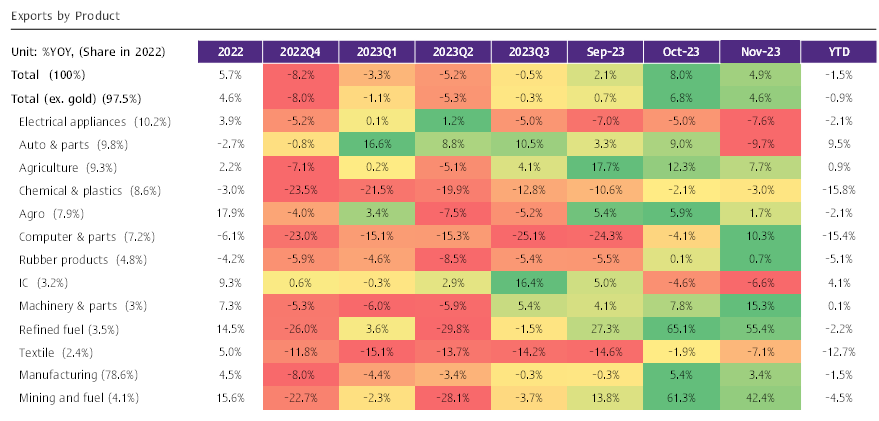

Exports by key products improved across the board in November.

In the big picture, exports of all key product categories improved, in which (1) Exports of mining and fuel products continued to surge by 42.4% continuing from 61.3% in the prior month. (2) Exports of agricultural products expanded by 7.7%, continuing from 12.3% in the prior month, led by exports of rice and rubber. However, exports of fresh/ chilled/ frozen/ dried fruits dragged growth. (3) Exports of manufacturing products continued to grow by 3.4%, continuing from 5.4% in the prior month. Key products with notable growth in the month included iron, steel, and products, semiconductors, transistors and diodes, and machinery and parts. However, products that underperformed were automotive, parts, and components, air conditioner and parts, plastic beads, and motorcycle and parts. Meanwhile, (4) Exports of agro-industrial products expanded by 1.7%, continuing from 5.9% in the prior month, with exports of condiments driving growth (Figures 1 and 2).

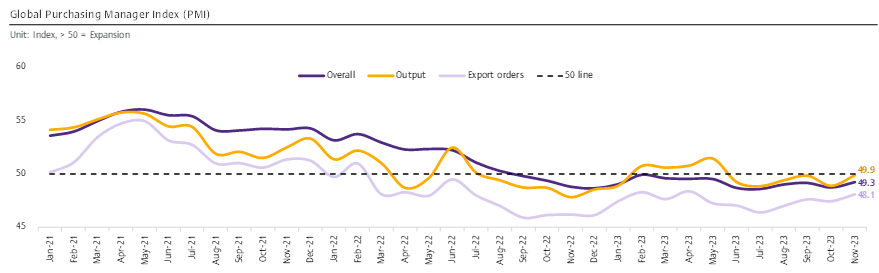

Similarly, exports to various key destinations improved in November.

Exports to various key destinations improved, in which (1) Exports to the US continued to expand by 17.5%, increasing from 13.8% in the prior month. Such growth was even, with 11 out of the top 15 imports in the US market expanded, led by electronics, such as computer, components and parts (34.9%), fax, telephone, components and parts (29.9%), and semiconductors, transistors, and diodes (128.3%). (2) Exports to China saw the first contraction in 4 months at -3.9%. Such a weak performance contradicted China’s gradually improving economic conditions as well as boosts from the low base impact (exports from Thailand to China contracted by as high as -10.8% in November 2022). Similarly, (3) Exports to India saw a first contraction in 4 months at -7.2%. It is important to note that although exports of the top 15 products to India, which accounted for nearly 70% of total exports to India, expanded by as high as 6.7%, exports of other products fell drastically by -28.6% (Figure 1).

Thai trade (customs basis) deficit continued as import growth outpaced exports.

The value of imports in November stood at USD 25,879.1 million, improving by 10%YOY, a rate similar to the prior month. The base effect did not influence import growth in November (imports in November 2022 and 2021 expanded by 4.9% and 19.3%, respectively). Moreover, such an even growth was attributed to imports of capital goods with 23.9% growth, imports of vehicles and logistics equipment with 21.5% growth, imports of fuel with 13% growth, and imports of consumer goods with 9.6% growth. However, imports of raw materials and intermediate raw materials expanded by merely 0.2% (-1.7% if excluding gold). As such, the customs basis trade balance in November recorded a deficit of USD -2,399.4 million, continuing from USD -832.3 million in the prior month. The overall trade balance during the first 11 months of 2023 stood at a deficit of USD

-6,165.3 million.

SCB EIC views that the value of exports will continue to improve in the periods ahead, led by exports of food, beverages, electronics, and electrical appliances.

SCB EIC views that exports in December should continue to improve. However, such a performance should still not reflect better export conditions due to the low base impact, as exports in December 2022 shrank considerably by -14.3%. Moreover, export growth during the year-end will not be able to offset the sharp contractions witnessed since the beginning of the year. As such, Thai exports, in the big picture, should see a slight contraction. Thus, SCB EIC maintains the view that the value of Thai 2023 exports (USD BOP basis) should drop by -1.5%YOY.

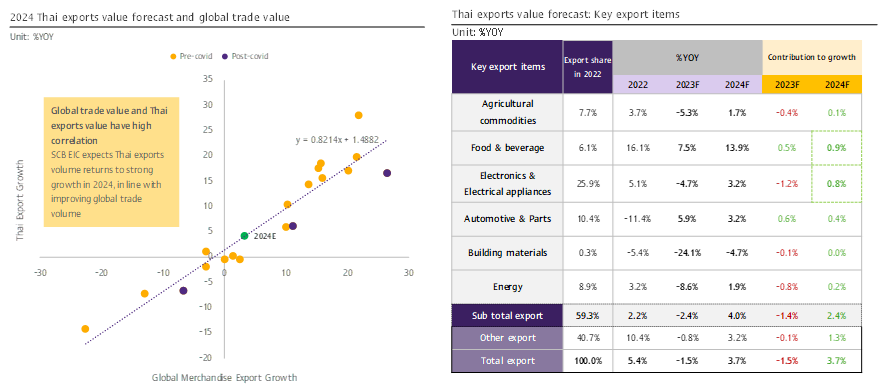

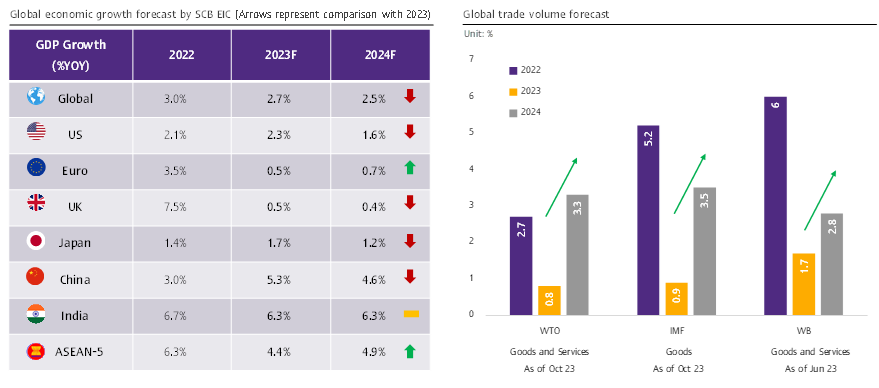

Looking forward to 2024, Thai exports should return to 3.7% growth following support from various factors, including (1) Improving global trade volume, in line with the global economy that should continue to recover, although at the slower rate of 2.5%. (2) Growth from the international trade-related manufacturing sector should play a greater role in driving the world economy in 2024, after the service sector, a sector with a lower correlation with international trade, was the main growth driver in 2023 (Figures 4 and 5). (3) The prices of export products should continue to remain high in 2024, especially agricultural product prices that should increase according to lower supply in the world market following the drought as well as policies by certain countries that limit agricultural exports. (4) Public and private sector efforts to promote Thai exports, including overseas market expansion, overseas trade shows, and the advancement of trade and economic agreements with various countries. (5) The low base effect.

The primary driving force for export growth in 2024 is exports of food, beverages, electronics, and electrical appliances. Exports of food and beverages should improve by 13.9% (contribution to export growth = 0.9%) increasing from 7.5% in 2023, and in line with global population and income per capita growth following the global economic recovery trend. Similarly, exports of electronics and electrical appliances should revert to 3.2% growth (contribution to export growth = 0.8%), after weakening by -4.7% in 2023, following global automotive sector growth, especially driven by electric vehicles (EV). Moreover, the development of artificial intelligence (AI) technologies should increase the demand for electronic parts. Also, the US still demands increasing import of electrical appliances from Thailand as a substitution for Chinese imports (Figure 4).

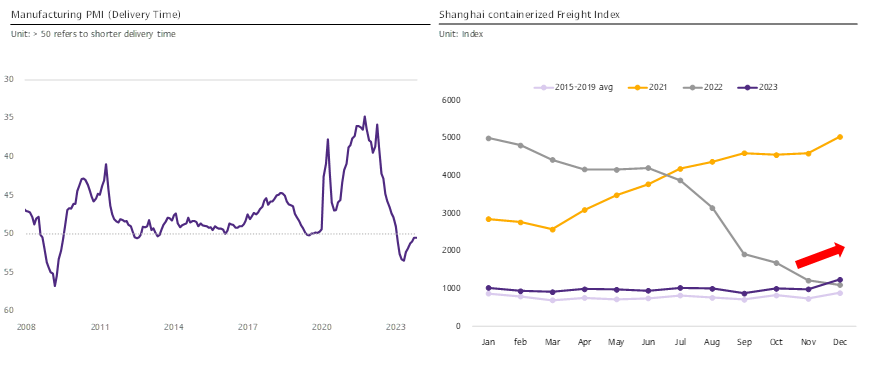

Nevertheless, risks from global supply chain disruptions could re-emerge as evident from the attacks by Houthi rebels on ships in the Red Sea (Suez Canal) and the lower-than-usual water levels in the Panama Canal. The risks are detrimental to international trade as the mentioned areas mark important maritime routes for nearly 17% of the total global trade volume. Thus, such new risks should be closely monitored. According to the latest analysis, Thai exports to the European market will be mostly affected by these events as exports to Europe need to travel via the mentioned route. However, exports to the European market only account for approximately 10% of total Thai exports, thus having a limited impact on overall Thai exports.

Figure 1: Exports expanded in nearly all key product categories, except electrical appliances, automotive, and electric circuit boards.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

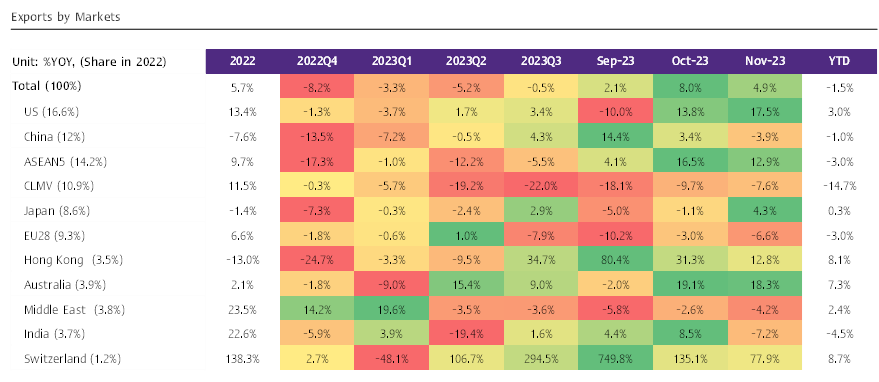

Figure 2: Exports of rice, steel, and computers drove growth in November, though exports of automotive, air conditioner, and fruits saw considerable contractions.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 3: The reading of the global Purchasing Manager Index (PMI) improved slightly, though remained in the contraction zone.

Source: SCB EIC analysis based on data from J.P. Morgan.

Figure 4: In 2024, Thai exports should strengthen following better global trade conditions, with a particular drive from exports of food, beverages, electronics, and electrical appliances.

Note: SCB EIC’s manufacturing product export forecast is based on products that account for approximately 59% of total exports in 2022, including 1) Agri commodities, such as rubber and related products, sugar, cassava, sugar, and animal feed; 2) Food and beverages, such as seafood, chicken, beverages, and fruits; 3) Electronics products and equipment; 4) Auto, auto parts, and motorcycles; 5) Building materials, such as steel and cement; and 6) Energy products, such as refining, chemicals, and plastics.

Source: SCB EIC analysis based on data from the Ministry of Commerce, IMF WEO Oct 2023, Bloomberg, World Semiconductor Trade Statistics, and Trademap.

Figure 5: In 2024, the global economy should continue to recover, albeit at a slowing rate, following all rounded downside risks and uncertainties. Meanwhile, global trade volumes should strengthen in 2024.

Source: SCB EIC analysis based on data from WTO, World Bank, IMF WEO Oct 2023, and Bloomberg.

Figure 6: The global supply chain faces new risks from the attacks by Houthi rebels on ships in the Red Sea and the lower-than-usual water levels in the Panama Canal.

Source: SCB EIC analysis based on data from Shanghai Shipping Exchange and J.P. Morgan.

1Calculated via the X13ARIMA method with additional holiday adjustments