Thai exports showed continued resilience in October. SCB EIC expects positive growth in Q4/2023

Thai exports should return to growth in Q4/2023 given that export prices are still favorable (such as agricultural products)

Thai export growth in October reached a 16 months high.

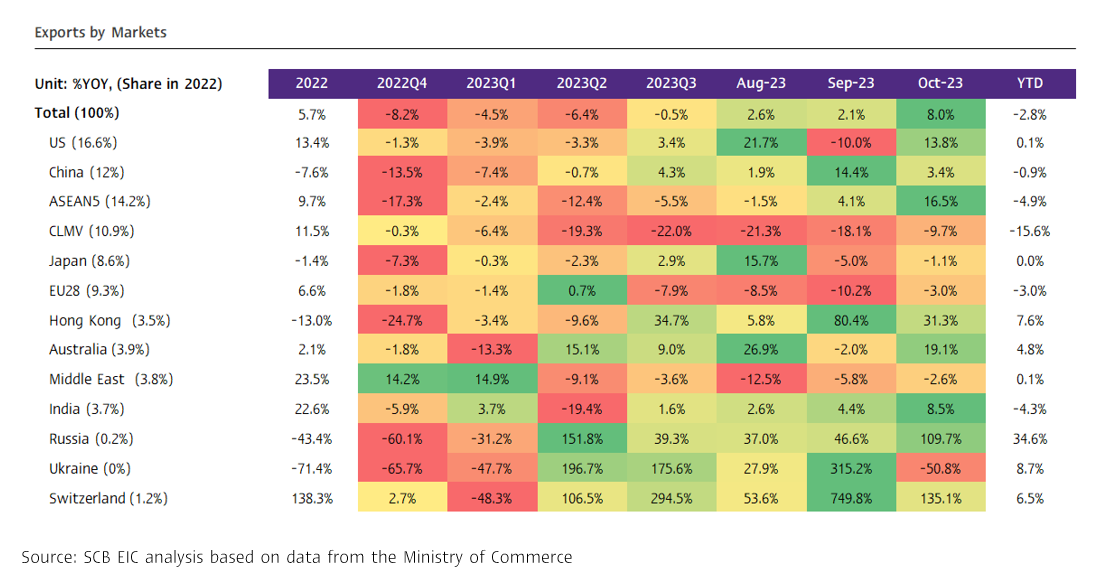

The value of Thai exports in October 2023 stood at USD 23,578.8 million, showcasing 3 consecutive months growth, with an 8%YOY increase. Such a recovery observed in October could be attributed to several factors, including (1) a favorable low-base effect, (2) a sustained increase in prices of export products at 1.6%YOY, and (3) a notable surge in gold exports by 59.8% (contribution to growth 1.4% - highest growth category) (Figure 2). As such, during the first 10 months of 2023, Thai exports totaled USD 236,648.2 million, registering a decline of -2.7%.

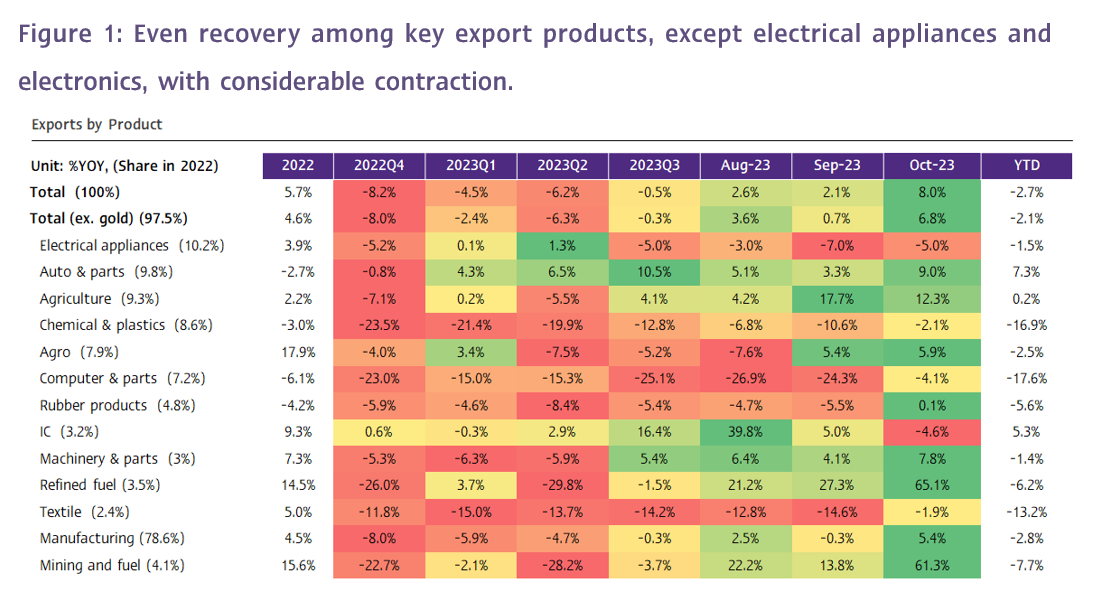

Exports by key products increased across the board in October.

In the big picture, exports by key products demonstrated across-the-board improvements, in which (1) Exports of agricultural products expanded by 12.3%, continuing from 17.7% in the prior month, led by exports of fresh/ chilled/ frozen/ dried fruits as well as rice. However, exports of rubber dropped. (2) Exports of agro-industrial products continued to grow by 5.9%, improving from 5.4% in the prior month. Such an increase in agricultural and agro-industrial exports during the month was driven by several factors, including sustainably high agricultural prices and the urgency of various countries in importing agricultural and agro-industrial products due to drought-induced food security concerns and agricultural export restrictions in certain countries, such as India. (3) Exports of mining and fuel products surged by 61.3%, continuing from 13.8% in the previous month despite the export prices of these products dropping by -1.5%. Meanwhile, (4) Exports of manufacturing products returned to expansion at 5.4%, after contracting by -0.3% in the previous month. Key products with notable growth in the month included electrical transformers and components, semiconductors, transistors and diodes, and jewelry and precious stones (excluding gold). On the other hand, exports of air conditioner and parts, and motorcycle and parts dragged growth during the month (Figure 1 and 2).

Similarly, exports to various key destinations improved during the month.

Exports to various key destinations improved, in which (1) Exports to the US returned to growth of 13.8%, rebounding from -10% in the previous month. Such growth was even, with 9 out of the top 10 imports in the US market expanded, except for electrical appliances and parts. (2) Exports to China slowed to 3.4% after accelerating in the prior month by 14.4%. This growth is comparatively low considering the somewhat favorable economic conditions in China and the low base effect (exports to China contracted as high as -8.6% in October 2022). (3) Exports to Switzerland expanded considerably by 135.1% driven by exports of precious stones and jewelry (including gold) which grows 180.9%.

Thai trade (customs basis) returned to a deficit due to a sharp increase in imports.

The value of imports in October stood at USD 24,411.1 million, improving by 10.2% from -8.3% in the prior month. Such an even growth was influenced by imports of vehicles and parts with 33.4% growth, imports of capital goods with 21.3% growth, and imports of consumer goods with a return of 10.2% growth. As such, the customs basis trade balance in October recorded a deficit of USD -832.3 million, after registering a surplus of USD 2,092.7 million in the prior month. Theoverall trade balance during the first 10 months of 2023 stood at a deficit of USD -6,665 million.

SCB EIC evaluates that exports in 2023 should revert to an expansion in Q4/2023.

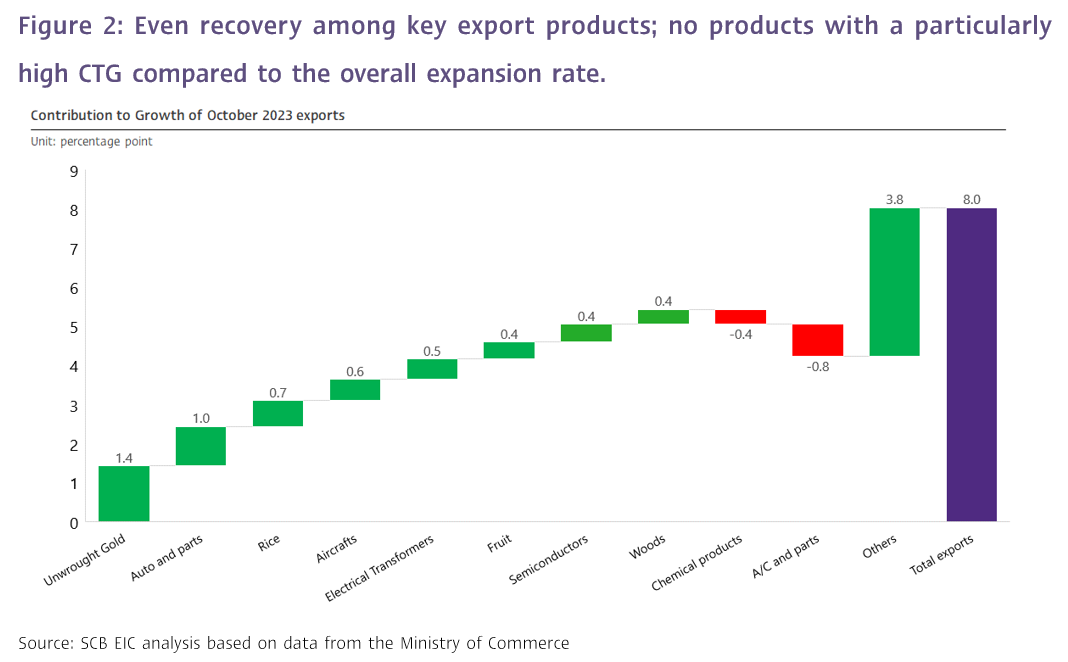

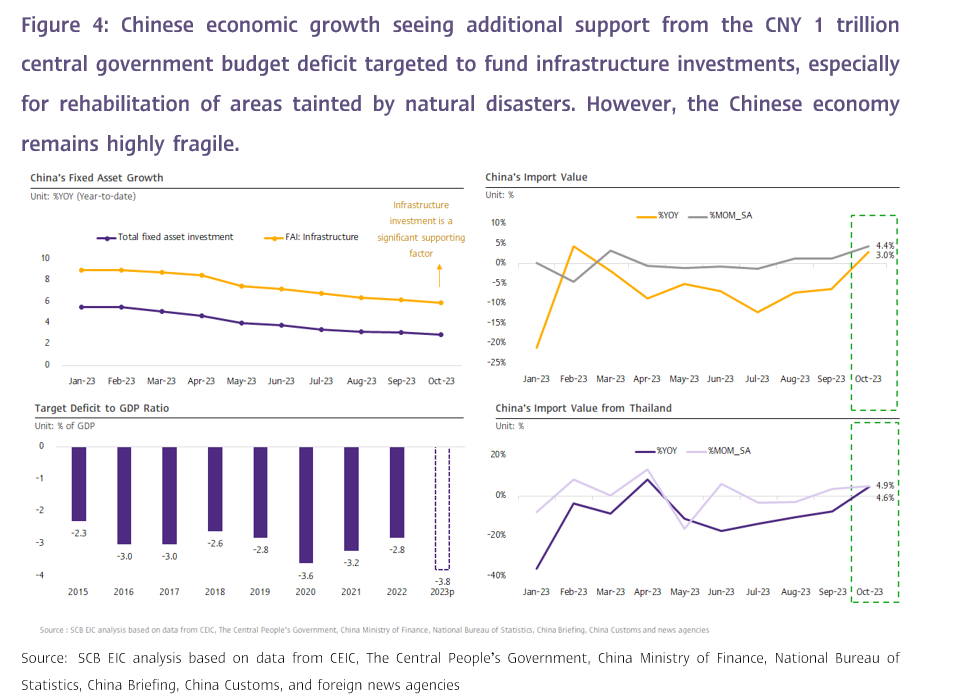

Thai exports should return to growth in Q4/2023 given that export prices are still favorable (such as agricultural products), global economic conditions are performing better than anticipated towards the end of 2023, particularly in Thailand’s key trading partners (such as USA and China), and the low base during the remainder of the year. Other key drivers include the Chinese government’s decision to increase the fiscal deficit ceiling to 3.8% of GDP through the issuance of additional central government bonds worth CNY 1 trillion. Half of the funding is earmarked for infrastructure investments and domestic demand stimulus in Q4/2023. Such a condition should heighten imports from Thailand (Figure 4). However, while the value of exports in the last quarter may mark the first expansion in 5 quarters, such an expansion at the year-end may not fully offset the severe contractions witnedssed since the beginning of the year. As a result, the value of merchandise exports in 2023 is likely to contract slightly. SCB EIC maintains the estimate for Thai merchandise export growth in 2023 at -1.5%YOY (USD BOP).

SCB EIC expects Thai exports in 2024 to expand by 3.7%, accelerating from 2023.

The value of exports in 2024 should expand by 3.7% following support from various factors, including (1) Better-than-anticipated global economic performance. SCB EIC forecasts that the global economy should expand by 2.5%, surpassing the previous estimate of 2.3%, which should supporta better external demand compared to the earlier forecast (Figure 3), resulting in a significant increase in global trade volumes in 2024 (Figure 5). (2) Export prices are likely to remain high in 2024, including prices of agricultural products that should remain elevated as the volume of the products in the world market should decrease due to drought and policies that restrict agricultural exports in some countries. (3) Alleviation of global supply disruption, allowing the production of products for export and the export process to proceed as usual, reflected by freight rates normalization and decreased delivery times (Figure 5). (4) Government and private initiatives to promote Thai exports, such as via the improvement and amendment of laws to facilitate international trade, as well as the establishment of Free Trade Agreements (FTA) and Comprehensive Economic Partnership Agreements (CEPA). Agreements with countries and groups, such as the European Free Trade Association (EFTA), the Gulf Cooperation Council (GCC), the United Arab Emirates, and Sri Lanka, are underway, with some expected to be completed and take effect in 2024. (5) Exports in 2023 should drop by -1.5%, causing growth in 2024 to heighten from the low base.

Nevertheless, even if the value of Thai exports in 2024 returns to growth, such an expansion is deemed low in comparison to the 10 years average rate before COVID at 5.2% (USD, BOP). Moreover, various downside risks remain, including the impact of climate change in various areas throughout Thailand, potential pressure from tighter-than-expected monetary policy stance in advanced economies, and the possibility of the recovery of China economy being slower and more fragile than expected. Additionally, geopolitical risks loom, particularly the Israel-Hamas war, which may escalate and prolong, and the China-Taiwan-US dispute, which could intensify following the Taiwan presidential election in January 2024. As such, SCB EIC estimates that in 2024, the value of Thai exports will return to an expansion of 3.7% (USD BOP).