Thai exports in September maintained a 2 consecutive months growth, with expectations of continued momentum in Q4/2023

SCB EIC views that the Israeli war should have a limited impact on Thai exports

Thai exports in September continued to improve, marking 2 consecutive months of growth.

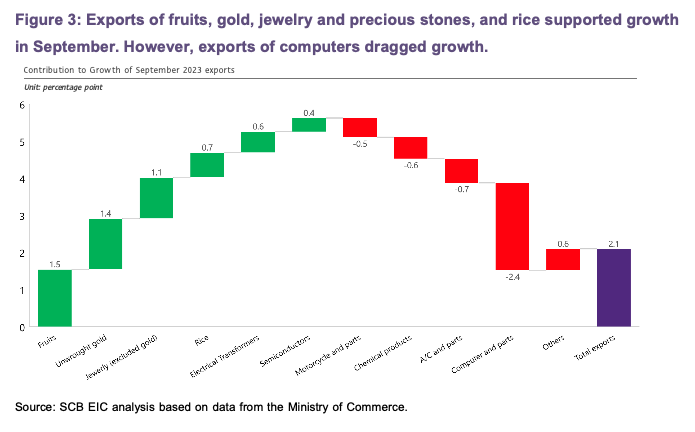

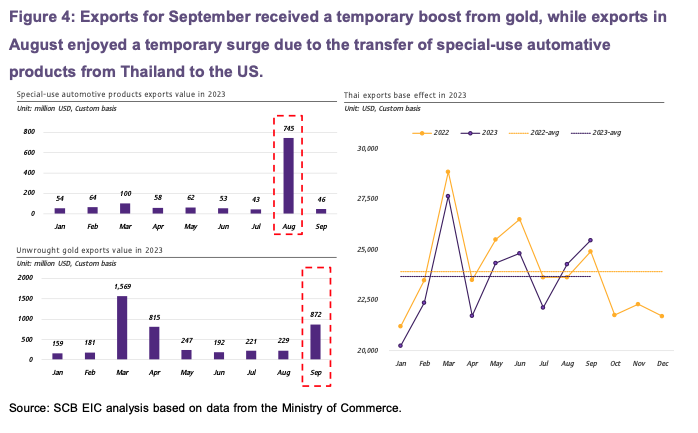

The value of Thai exports in September 2023 reached USD 25,476.3 million, demonstrating continued expansion from the previous month, with a 2.1%YOY increase. Such a resurgence in September could be attributed to several factors, including (1) a substantial surge in unwrought gold exports (64.8%YOY, 1.4%CTG) (Figure 3 and Figure 4), (2) a slight improvement in China’s economic conditions, and (3) the increase in prices of oil-related export products, influenced by global economic conditions, the extension of OPEC+ production reduction period, and accelerated imports of agricultural and agro-industrial products due to drought-induced food security concerns. As such, during the first 3 quarters of 2023, Thai exports totaled USD 213,069.4 million, registering a decline of -3.8%.

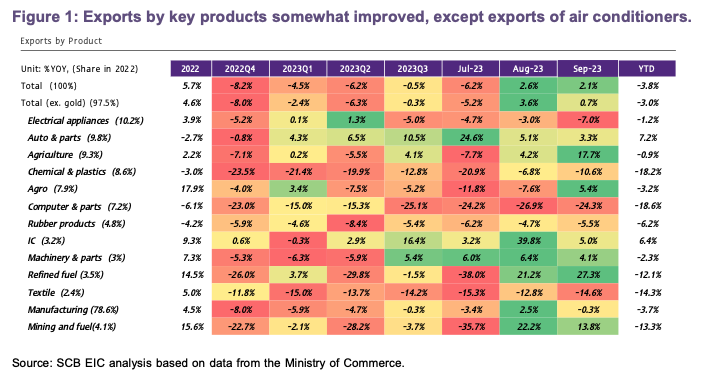

Exports in September exhibited diverse trends, with exports of agricultural and mining and fuel products continuing to increase. In contrast, exports of agro-industrial products returned to an expansion, while exports of manufacturing products reverted to a contraction.

In the big picture, exports improved across various product categories in September, in which (1) Exports of agricultural products expanded by 17.7%, continuing from 4.2% in the prior month, led by exports of fresh/ chilled/ frozen/ dried fruits as well as rice. However, exports of rubber, one of the main agricultural product, dropped. (2) Exports of agro-industrial products returned to an expansion at 5.4%, improving from the considerable drop of -7.6% in the prior month. Such an increase was driven by several factors, including the urgency of various countries in importing agricultural and agro-industrial products due to drought-induced food security concerns and agricultural export restrictions in certain countries, such as India. (3) Exports of mining and fuel products also surged by 13.8%YOY, partly attributed to rising prices. Meanwhile, (4) Exports of manufacturing products returned to a -0.3% contraction, after expanding by 2.5% in the previous month with support from special-use automative products transfer. Key products with notable growth included jewelry and precious stones (excluding gold), electrical transformers and components, semiconductors, transistors and diodes, and aircraft, spacecraft and parts. On the other hand, exports of computer and parts, chemical products, and motorcycle and parts dragged export growth.

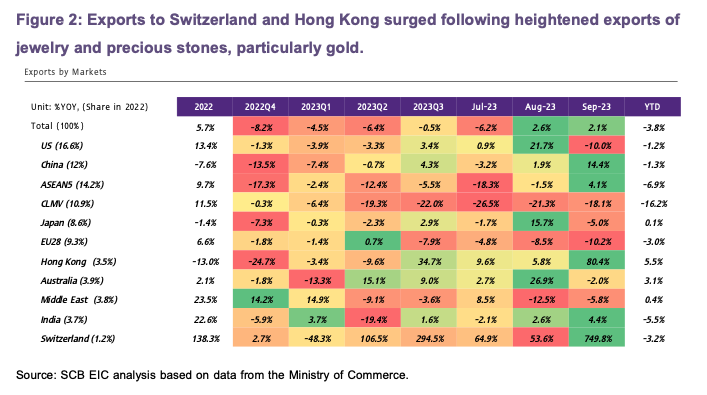

Exports to various key destinations returned to growth, including China.

Analysis of exports by key destinations in September revealed that (1) Exports to the US dropped significantly by -10%, following a remarkable 21.7% increase in the previous month, attributed to the transfer of special-use automative products from Thailand to the US. (2) Exports to China expanded by as much as 14.4%, marking the highest growth in 5 months. Such an increase followed a 1.9% growth in the previous month as economic conditions in China somewhat improved. (3) Exports to Hong Kong and Switzerland surged primarily due to gold exports, a key export product from Thailand to such markets. Exports to Hong Kong and Switzerland increased by 80.4% and 749.8%, respectively, influenced by exports of jewelry and precious stones (including gold) to the 2 markets which soared by 359.6% and 3,769.9%, respectively.

Thai trade surplus (customs basis) reached as high as USD 2,092.7 million in September, backed by high gold export growth at 64.8%. Meanwhile, imports of gold shrank drastically by -89.4%.

The value of imports in September stood at USD 23,383.5 million, improving to -8.3% from -12.8% in the prior month. The decline in imports in September was primarily driven by imports of gold that tumbled by -89.4%. Excluding gold, imports weakened by only -3.2%, marking the smallest decline in 4 months. As such, the customs basis trade balance in September stood at a slight surplus of USD 2,092.7 million, the highest surplus in 6 months. Such a surplus continued from the USD 359.9 million surplus in August, which was supported by special-use automative products transfer from Thailand to the US. Nonetheless, the overall trade balance (customs basis) during the first 3 quarters of 2023 stood at

a deficit of USD -5,832.7 million.

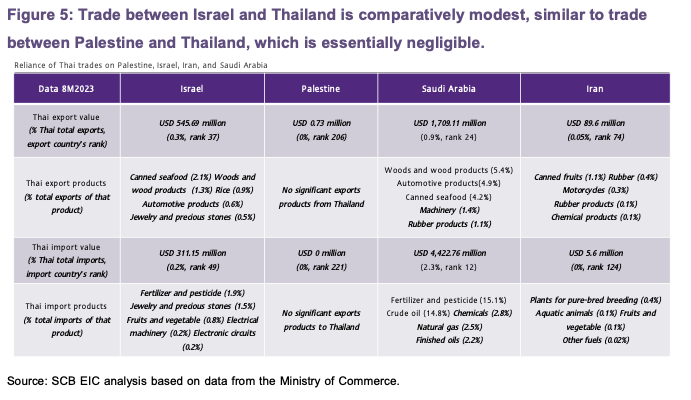

SCB EIC views that in the base case, the Israeli war will have a limited impact on Thai trade

as direct trade between Israel and Thailand is comparatively modest, similar to trade between Palestine and Thailand, which is essentially negligible. Moreover, Thailand’s export and import sectors do not have substantial reliance on either Israel or Palestine (Figure 5). Nonetheless, if the war were to persist and escalate, the conflicts would inevitably have repercussions on the global economy. This, in turn, may indirectly impact Thai exports through fluctuations in world oil prices and volatile global financial market conditions. Additionally, the potential for a more violent conflict in the Middle East may have enduring implications for Thailand's export prospects in the long run, particularly in light of the nation’s recent efforts to strengthen diplomatic ties with Saudi Arabia. The Thai government has placed a strong emphasis on fostering trade relationships with the Middle East, including initiatives such as the establishment of a Free Trade Agreement (FTA) with the Gulf Cooperation Council (GCC) countries, comprising Saudi Arabia, Kuwait, the United Arab Emirates, Qatar, Bahrain and Oman, as well as the Comprehensive Economic Partnership Agreement (CEPA) with the United Arab Emirates. Furthermore, various countries in the region have expressed interest in pursuing additional FTAs or CEPAs with Thailand. In addition, the Thai government’s strategic vision extends to using the Middle East market as a gateway for expanding export opportunities into the African market.

Going forward, Thai trade conditions should continue to improve,

export prices as well as the favorable low base effect in Q4/2023. However, export growth during the last quarter may not fully offset the strong contractions witnessed since the beginning of the year. As a result, SCB EIC expects that the value of exports in 2023 (balance of payments basis) should weaken by -1.5%. On a positive note, growth should return in 2024 at 3.5%, given support from anticipated improvements in global trade volumes for 2024, the easing of supply chain constraints, the continuation of high export prices, and the low base impact in 2023. However, factors that warrant monitoring include more stringent monetary policies being adopted by developed economies, which could exert pressure on the global economic recovery, weaker-than-anticipated Chinese economic conditions, drought in many areas throughout Thailand that may affect export volumes despite elevated prices, and geopolitical conflicts, such as the Israeli war, which is considered as a new risk that needs monitoring.