Thai exports started to show signs of recovery in August. SCB EIC foresees a reversal towards expansion in 2024

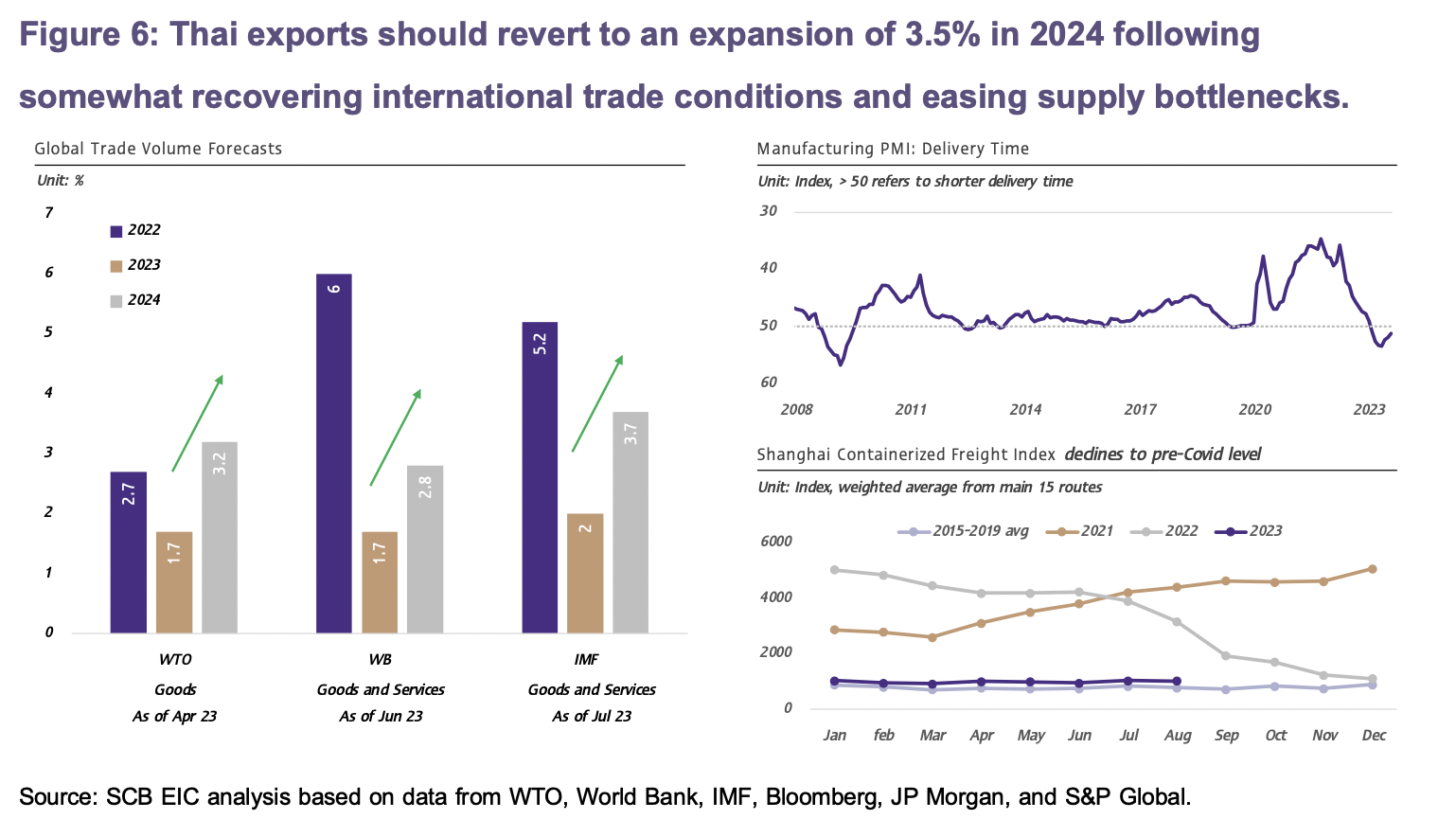

Thai exports should revert to an expansion of 3.5% in 2024 following somewhat recovering international trade conditions and easing supply bottlenecks

Thai exports in August expanded for the first time in 11 months.

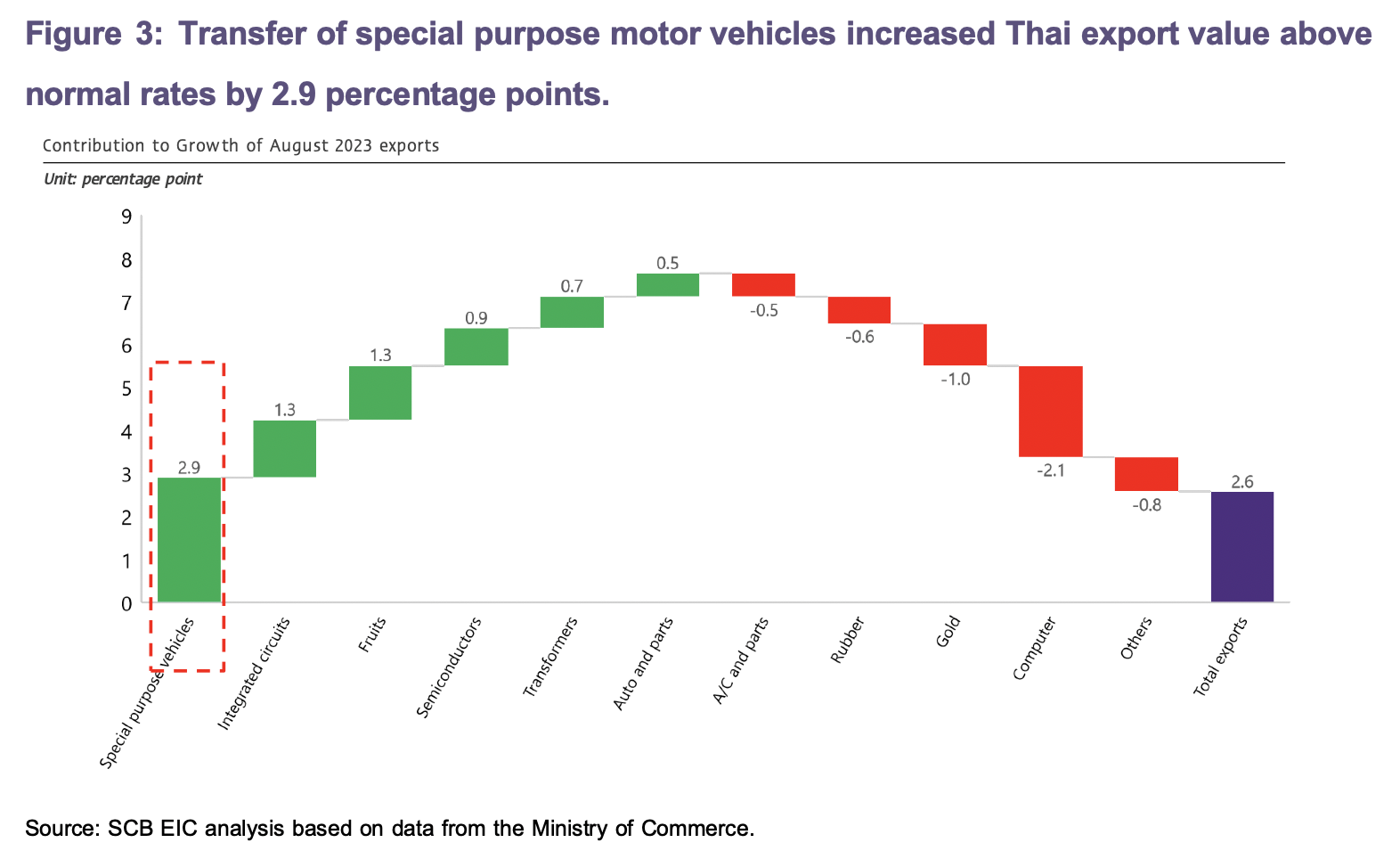

The value of Thai exports in August 2023 stood at USD 24,279.6 million, reverting to an expansion of 2.6%YOY after continuing to contract significantly for 10 months. As such, during 8M2023, the value of Thai exports amounted to USD 187,593.1 million, contracting by -4.5%. This resurgence in August could be attributed to several factors, including (1) higher export prices, (2) lower base of calculation, and (3) special factors from the transfer of special purpose motor vehicles from Thailand to the United States. As per preliminary estimates, SCB EIC views such special purpose motor vehicles transfer were for military purposes. Notably, these special purpose motor vehicles transfer increased Thai exports by approximately 2.9 percentage points (Figure 3). However, excluding products that do not reflect actual international trade conditions (gold, weaponry, and special-use automotive products), exports still managed a slight growth of 0.7%. Such 0.7% growth is equivalent to the seasonally adjusted month-on-month growth of 5.4%MOM_sa, reflecting satisfactory growth during the month whether or not considering the boosts from temporary and technical factors.

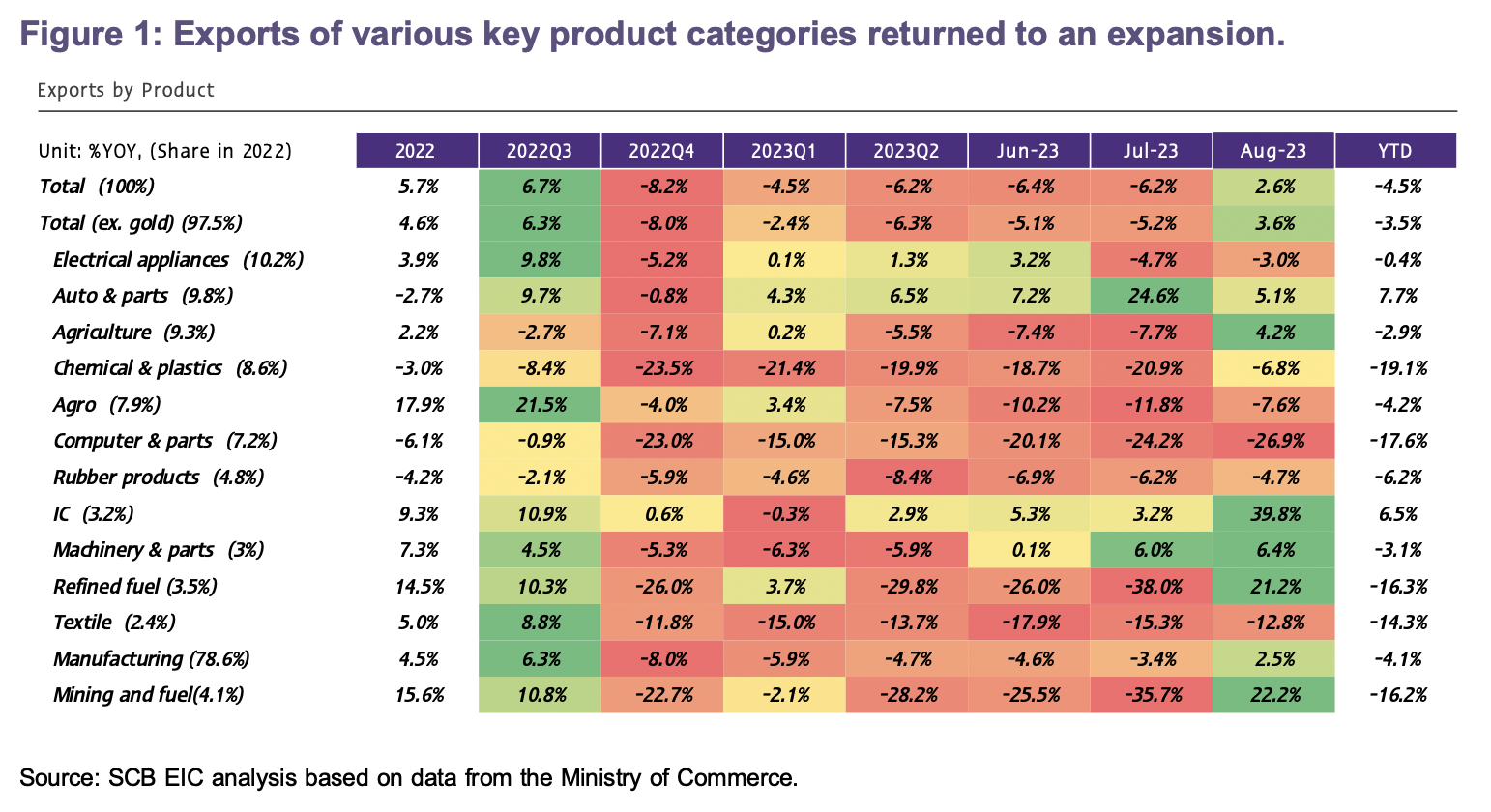

Exports of agricultural, manufacturing, and mining and fuel products returned

to an expansion. However, exports of agro-industrial products continued to drop.

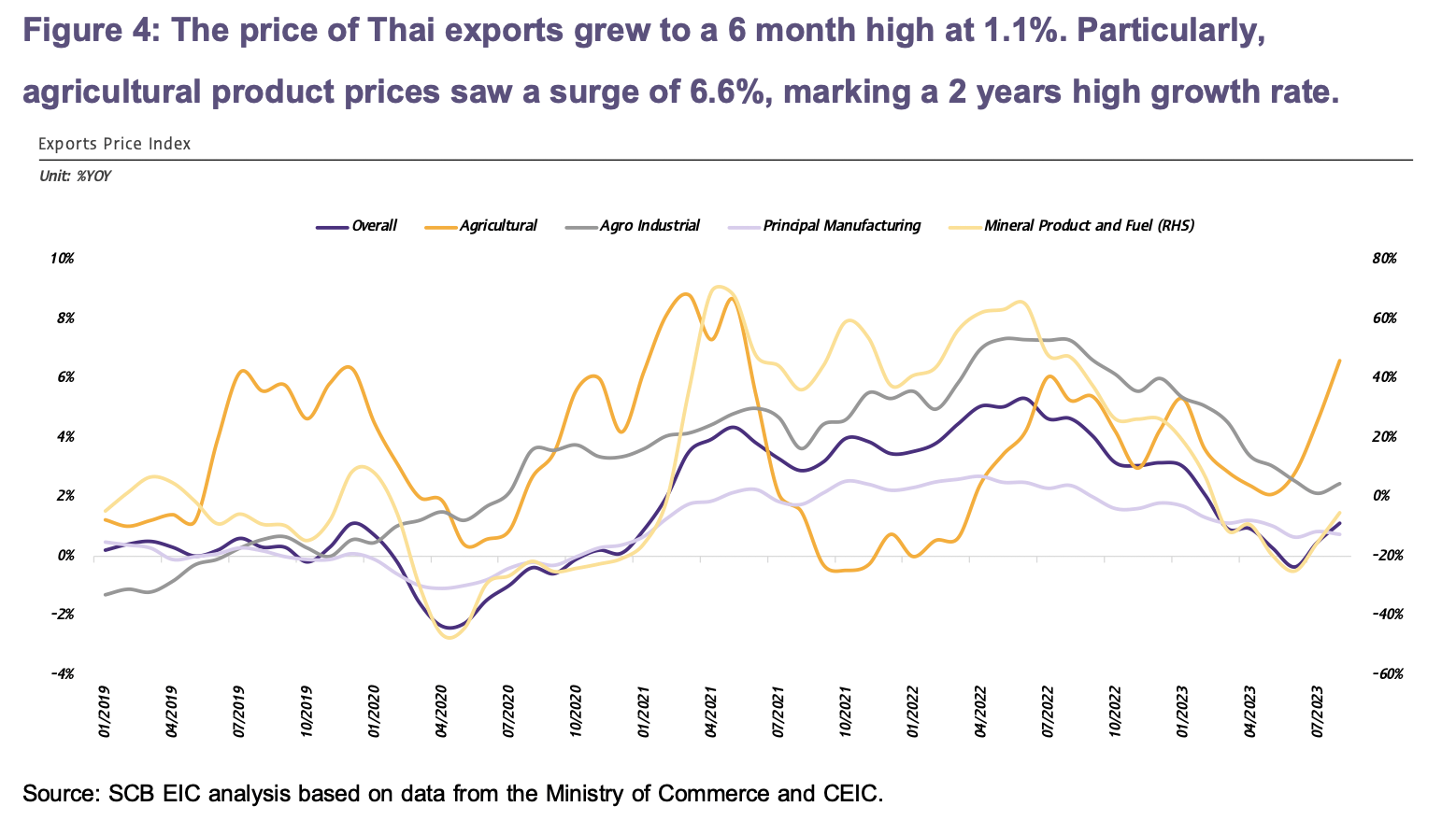

In the big picture, exports improved across various product categories in August, in which (1) Exports of agricultural products reverted to growth, marking a first expansion in 4 months at 4.2%, led by exports of fresh/ chilled/ frozen/ dried fruits as well as rice. However, exports of rubber, cassava products, and processed chicken dropped. The main factor that drove Thai agricultural export growth in August was the nearly 2-year high expansion of agricultural product prices, reaching 6.6% (Figure 4) following drought conditions in various countries around the globe and India’s rice export ban. (2) Exports of manufacturing products expanded by 2.5% after contracting for 2 consecutive months. Such an increase was partly due to special purpose motor vehicles transfer. Meanwhile, other products with satisfactory growth included electrical circuit boards, semiconductors, transistors and diodes, electrical transformers and components, automotive, parts and components, and airconditioner and parts. On the other hand, exports of computer and parts, as well as unwrought gold, dragged export growth. (3) Exports of mining and fuel products also surged by 22.2%YOY, after tumbling in the prior periods, partly due to stalling price declines; and (4) Exports of agro-industrial products continued to fall by -7.6%, improving from -11.8% in July. Such a drop was partly due to a slight increase in agro-industrial product prices at 2.5%. Meanwhile, exports of sugar, animal or vegetable fats and oil, and canned and processed seafood products declined.

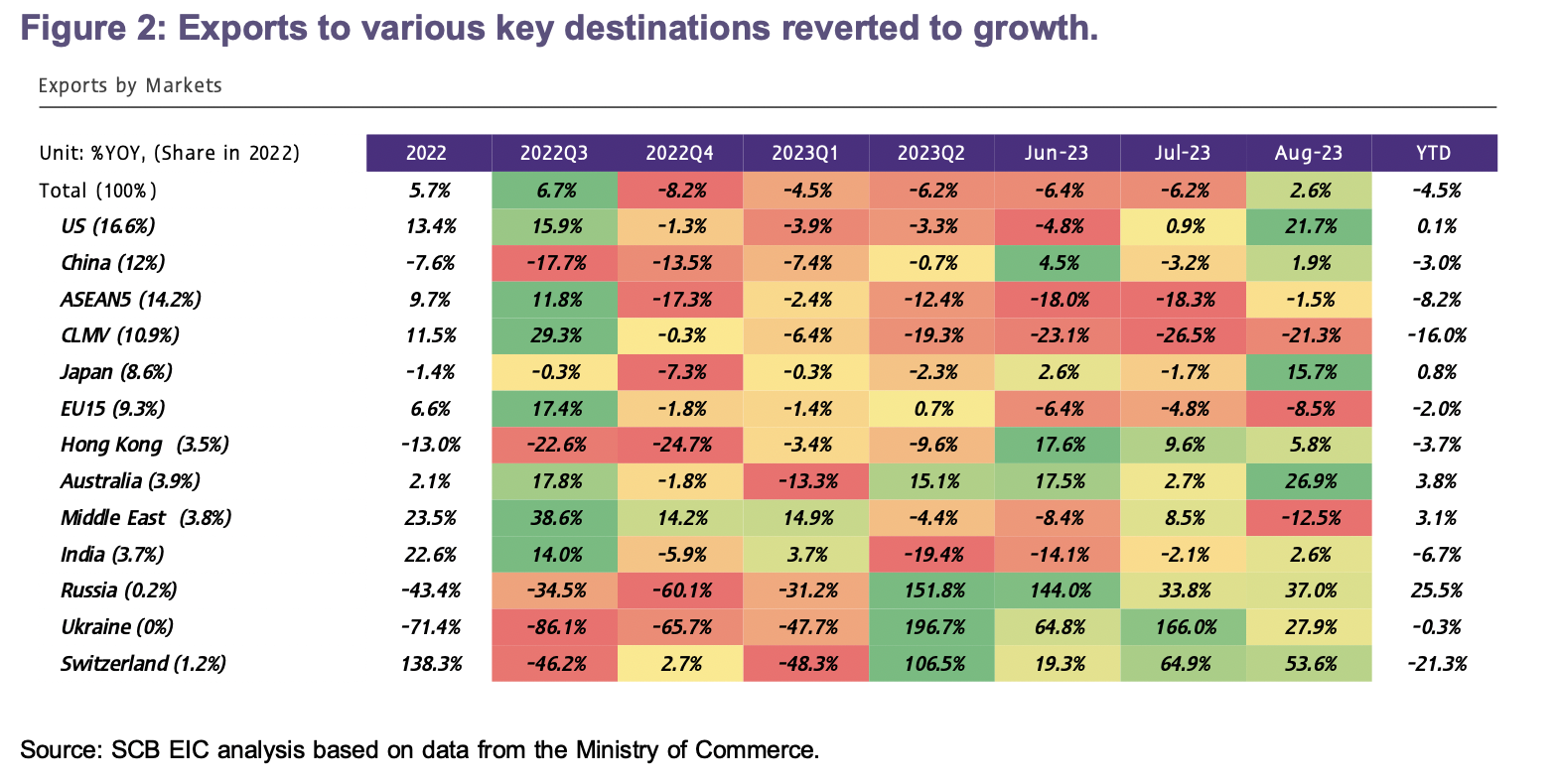

Exports to various key destinations returned to growth, including China.

Exports to key destinations remained volatile though with easing conditions, in which (1) Export to China continued to face volatilities but still improved by 1.9% in August. Key export products that drove growth included fresh/ chilled/ frozen/ dried fruits, which grew by a staggering 119.5%. (2) Exports to ASEAN dropped at a slowing rate, both for ASEAN5 and CLMV at -1.5% and -21.3%, respectively. (3) Exports to the US expanded by as high as 21.7% from transfer of special purpose motor vehicles from Thailand to the US.

Thai trade balance in August was mainly supported by the special purpose motor vehicles transfer from Thailand to the United States.

The value of imports in August stood at USD 23,919.7 million, declining by -12.8% and worsening from the -11% contraction in the prior month. The decline in imports was primarily driven by imports of refined fuel as well as raw materials and intermediate products at -35.1% and -13.2%, respectively. On the other hand, imports of capital goods was relatively unchanged at -0.7%. Meanwhile, imports of vehicles and transportation equipment, as well as consumer goods, improved by 9% and 1.8%, respectively. The customs basis trade balance in August stood at a slight surplus of USD 359.9 million, improving from the deficit of USD -1,977.76 million in July. However, excluding the transfer of special purpose motor vehicles from Thailand to the United States, the trade balance would return to a deficit within the range of USD 300-400 million. Overall trade balance during 8M2023 stood at a deficit of USD -7,925.4 million.

SCB EIC cuts the 2023 Thai export forecast to -1.5% (from 0.5%) following the continual export decline and slower-than-anticipated recovery.

SCB EIC views that exports will continue to gradually improve in the periods ahead, with clear growth during the year-end, given better global economic conditions in Q4, support from the low-base effect, and higher exports prices. However, expansion during the year-end may not offset the contractions experienced during the first 7 months of 2023. As such, SCB EIC revises down the 2023 Thai export forecast to -1.5% (USD BOP) from the previous estimation of an expansion of 0.5%.

Thai exports in 2024 should return to a 3.5% expansion,

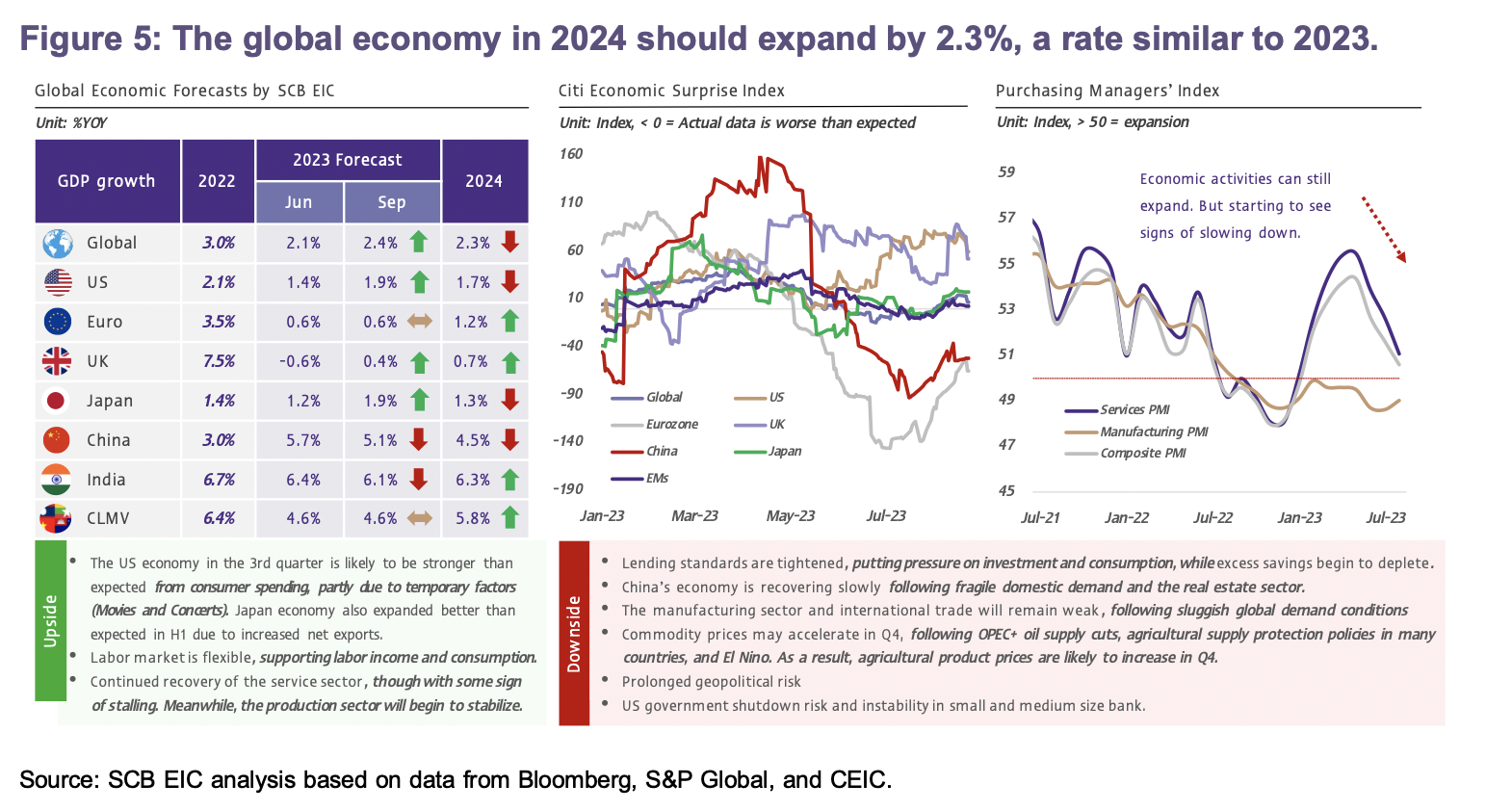

following (1) Global trade volume in 2024 that is expected to expand at a higher rate than in 2023 (Figure 6), in addition, the global economy in 2024 should expand at a similar rate to 2023 at 2.3% (Figure 5) with particular support from the manufacturing sector, which is expected to gradually improve from this year. (2) Easing supply chain conditions in tandem with freights returning to normal rates (Figure 6). (3) Increasing oil prices as global economic conditions in 2024 should improve at a similar rate to 2023. In addition, the OPEC+ countries extended cuts in oil output. As such, the price of oil-related exports should increase; and (4) Policies to limit agricultural exports from some certain countries will cause agricultural product prices to increase. One example is India’s policy to control rice exports that partly increased rice prices in the global market.

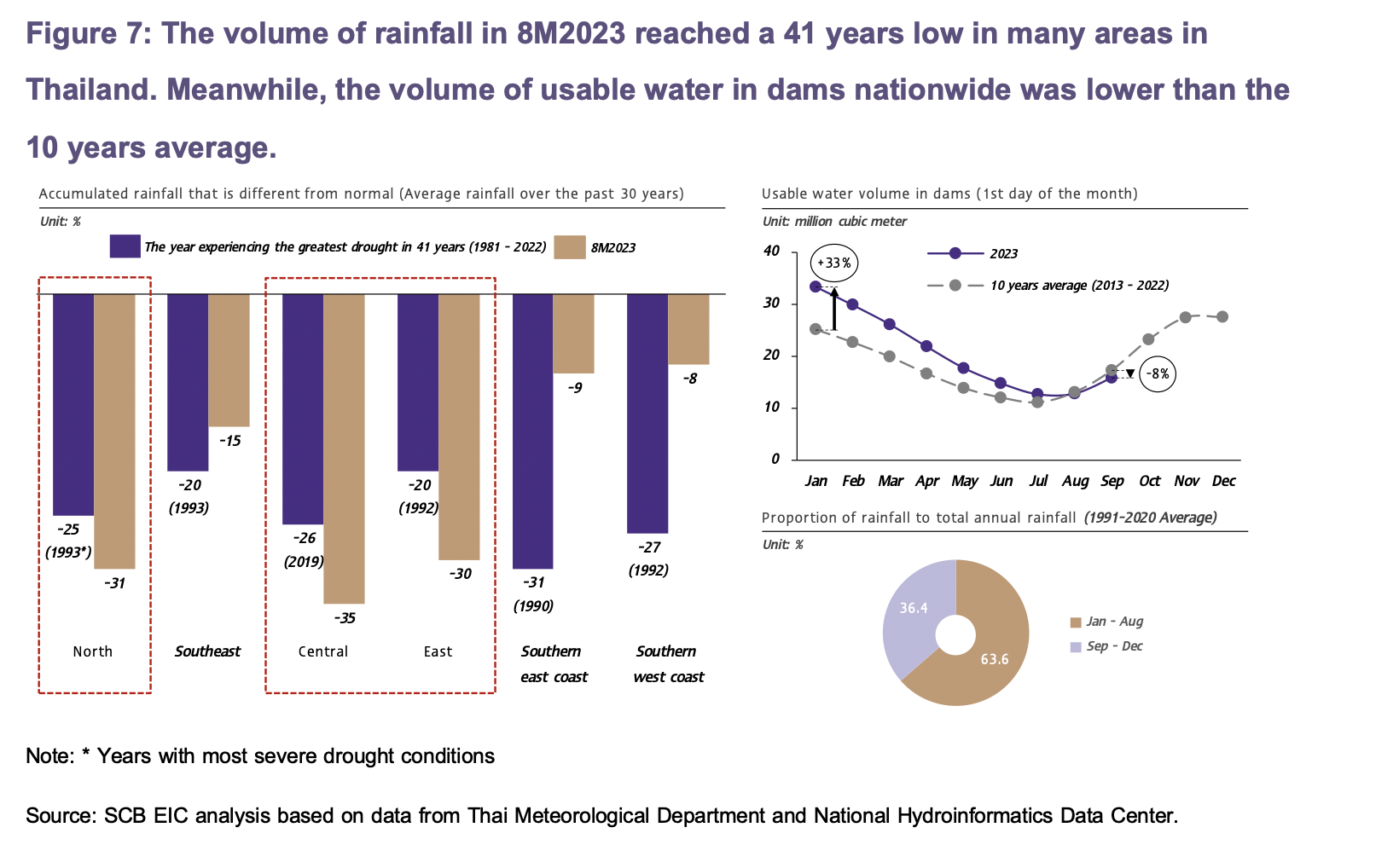

However, various factors will continue to undermine Thai exports, including (1) Tightened-than-expected monetary policy stance in advanced countries, causing a slowdown in trading partners’ economies. (2) China's economy expanding at a slower pace, partly due to structural issues. Such conditions will affect a group of Thai exports that are highly dependent on the Chinese market or are part of China’s supply chain, such as rubber, rubber wood, petrochemicals, computer and parts, and automotive parts; and (3) Drought conditions in many areas around the world, including Thailand. The amount of rainfall during the first 8 months of 2023 reached a 41-year low in many areas of Thailand, causing lower output from many agricultural products due to damaged production, especially rice, sugarcane, and palm oil (Figure 7).