The downward spiral in Thai exports persists in July; SCB EIC considers cutting Thailand’s 2023 export outlook.

Looking ahead, Thai export conditions remain worrisome and may be worse than anticipated due to sluggish economic growth in China.

Thai exports in July continued to decline for the tenth consecutive month.

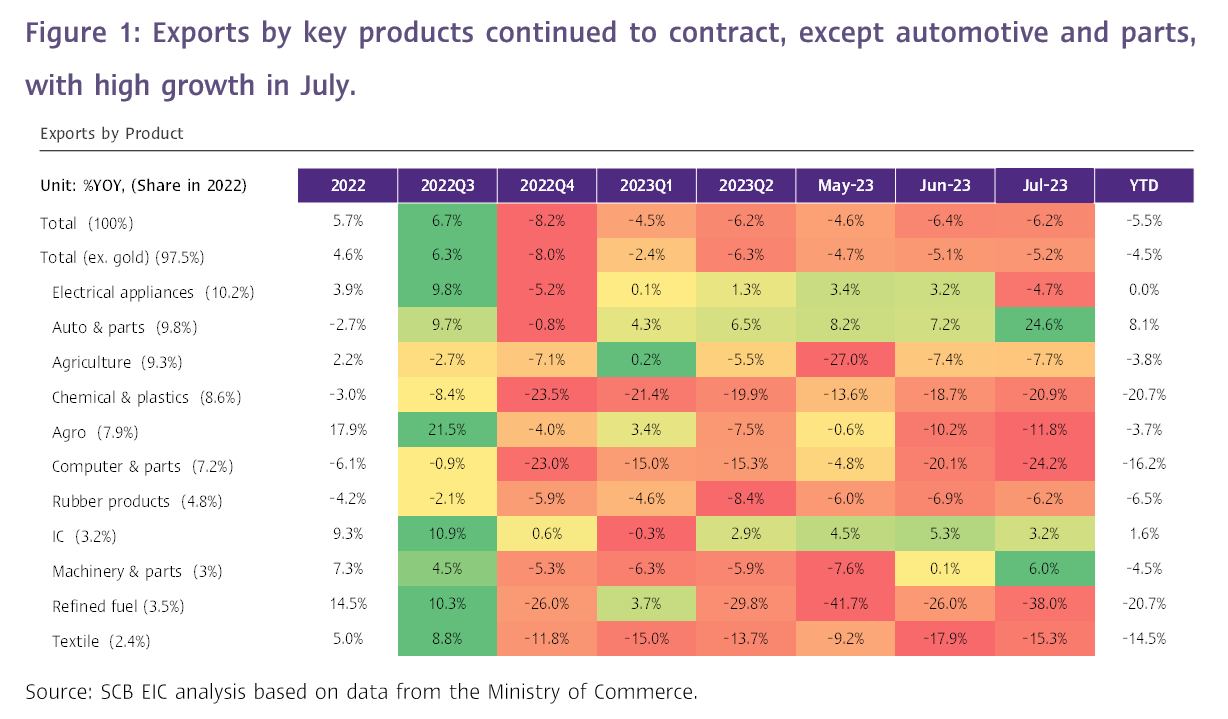

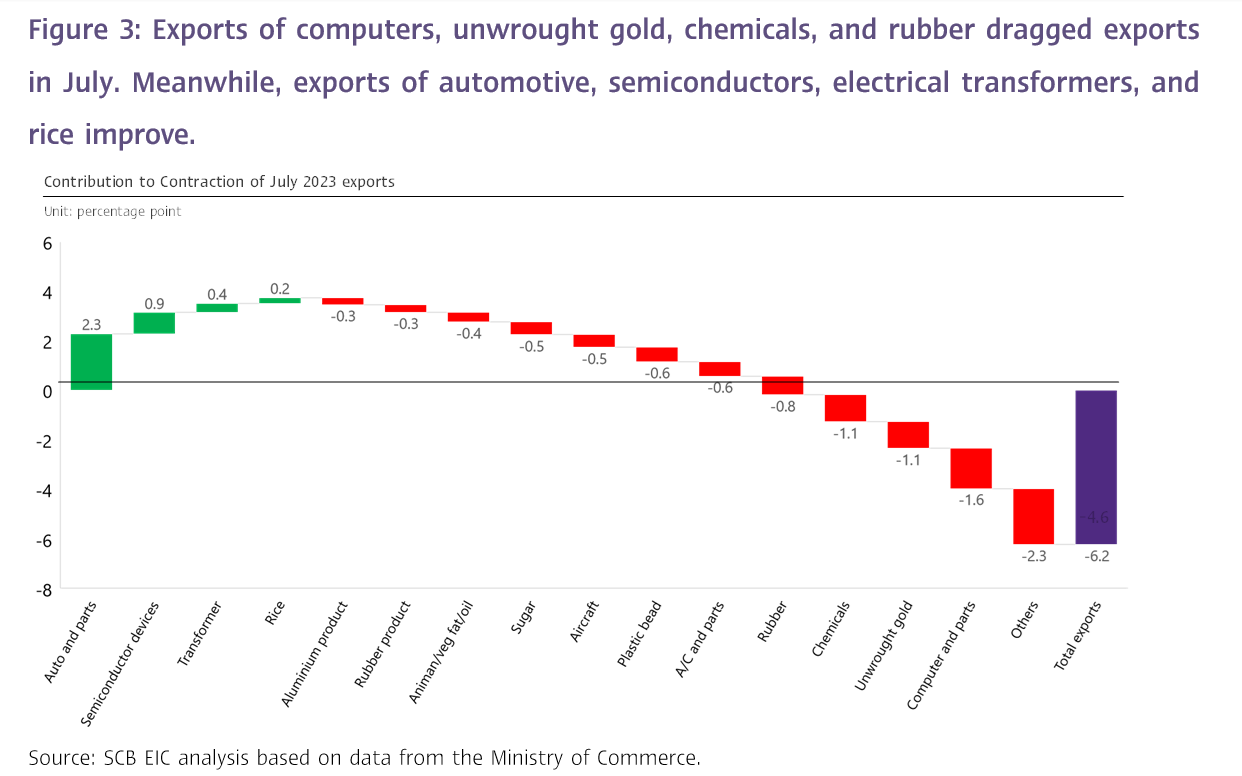

The value of Thai exports in July 2023 stood at USD 22,143.2 million, dropping by -6.2%YOY comparable to the drop in the prior month at -6.4%YOY. As such, during the first 7 months of 2023, the value of exports stood at USD 163,313.5 million, contracting by -5.5%YOY.

Exports contracted across all key product categories.

In the big picture, exports continued to contract across all key product categories in July, in which (1) Exports of agricultural products shrank by -7.7%YOY, worsening from the -7.4% drop in the prior month. Notably, exports of rubber faced a 12 consecutive months decline, contracting by -37.8% in July. On the other hand, exports of fresh/ chilled/ frozen fruits continued to grow robustly for 2 consecutive months by 14.2% (June) and 5.3% (July), after tumbling in May, following higher production from the Southern provinces. Meanwhile, exports of rice returned to an 18.8% growth in July after observing its first contraction in 6 months in June. (2) Exports of agro-industrial products continued to fall by -11.8%YOY, after dropping by -10.2% in the prior month. Exports of sugar significantly weakened by -30.3%, after growing considerably during the past 2 months. Similarly, exports of animal or vegetable fats and oil saw a sharp contraction of -62.7%. Such a decline continued from the harsh drops during the past 2 months. (3) Exports of manufacturing products continued to fall by -3.4%YOY after expanding for the first time in 8 months. Exports of computer and parts continued to shrink for 10 consecutive months, with a contraction of -31.8% in July. However, excluding gold, weaponry, and aircraft, which are products that do not reflect actual international trade conditions, exports of manufacturing products shrank by only -1.3%, a rate similar to the prior month; and (4) Exports of mining and fuel products also fell considerably by -35.7%YOY compared to -25.5% in the prior month. Crude oil contributed to this decline, contracting by -38%.

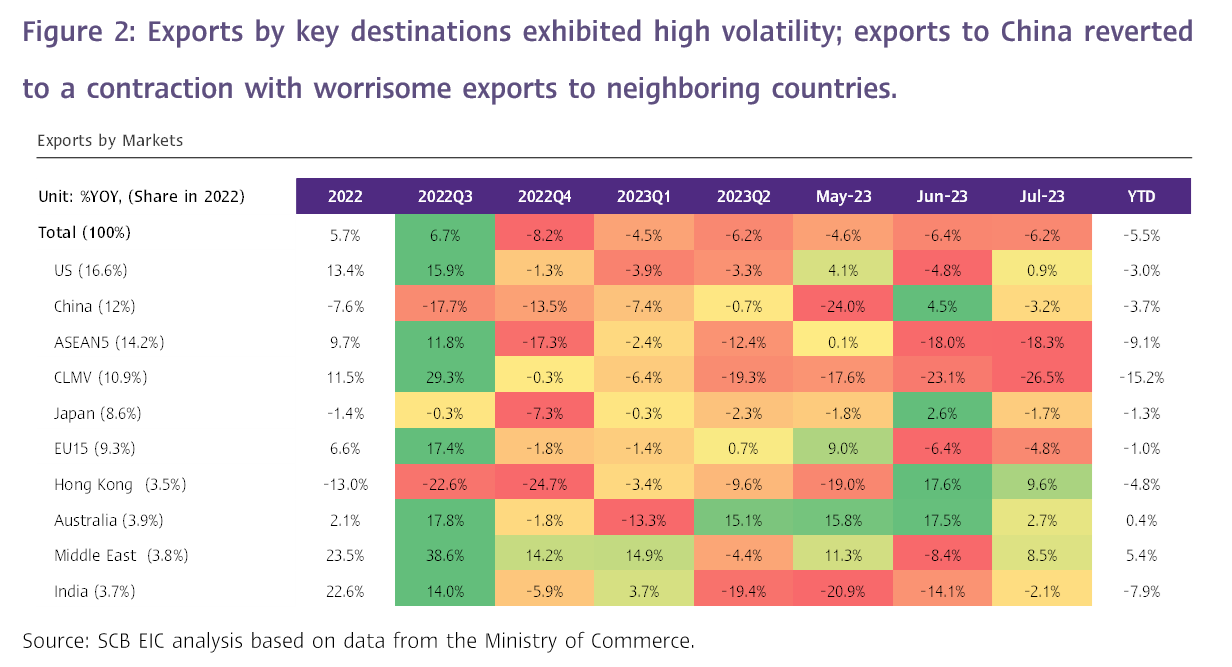

Exports by key destinations continued to exhibit high volatility; exports to China reverted to a contraction with worrisome exports to neighboring countries.

Exports by key destinations continued to see volatile growth, in which (1) Exports to China reverted to a -3.2%YOY drop after increasing by 4.5% in the prior month. The drop was primarily driven by exports of rubber products (-36.1%), plastic beads (-14%), and computer, parts, and components (-29.6%) while exports of fresh/ chilled/ frozen/ dried fruits (largest key export products to China) continued to expand by 6.7%. (2) Exports to ASEAN5 and CLMV continued to tumble by -18.3% and -26.5%, respectively. Of the 10 key product categories exported to ASEAN, 8 of such categories contracted, including refined fuel, electronic integrated circuits, plastic beads, chemicals, machinery and machinery parts, sugar, beverages, and computer, parts, and components. Meanwhile, exports of the remaining 2 categories, including automotive, parts, and components, and iron, steel, and products, were the only 2 key product categories with growth; and (3) Other key markets with growth in July included Hong Kong (9.6%), the Middle East (8.5%), Australia (2.7%), and the US (0.9%).

Thai trade balance returned to a deficit, despite imports contracting considerably.

The value of imports in July stood at USD 24,121 million, declining by -11.1% and worsening from the

-10.3% contraction in the prior month. Excluding gold, a product that does not reflect actual international trade conditions, imports weakened by -7.8%, improving from -11.4% in the prior month. The decline in imports were primarily driven by imports of raw materials and intermediate products (-24.4%YOY, CTG -11.1%) and refined fuel (-27.2%YOY, CTG -5.7%). On the other hand, imports of capital goods (5.8%YOY, CTG 1.2%) and consumer goods (6.8%YOY, CTG 0.6%) returned to growth. Meanwhile, imports of vehicles and transportation equipment continued to improve for 6 consecutive months, with growth reaching 25 months high at 93%YOY or CTG 3.2%. Nevertheless, the customs basis trade balance returned to a deficit of USD -1,977.8 million in July, after gaining a slight surplus of USD 57.7 million in the prior month. With such regards, the trade balance during the first 7 months of 2023 stood at

a deficit of USD -8,285.3 million.

Looking ahead, Thai export conditions remain worrisome and may be worse than anticipated due to sluggish economic growth in China.

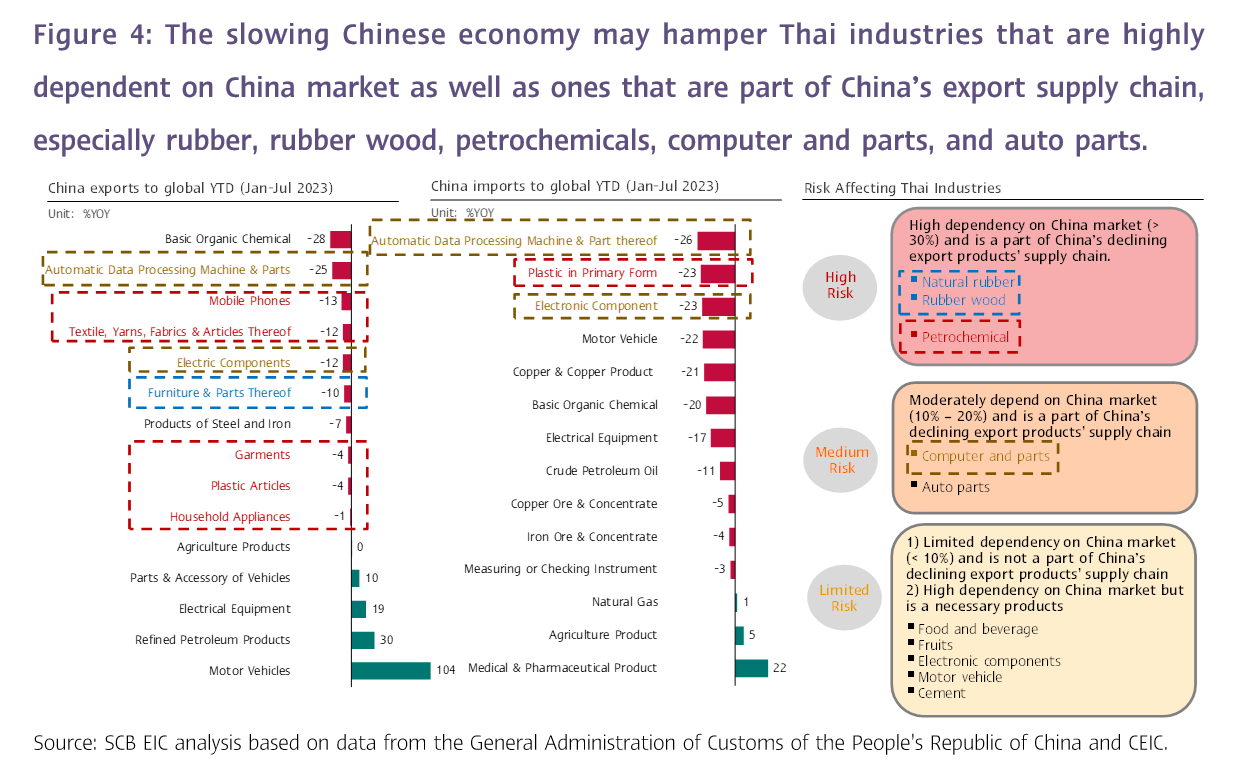

Even though SCB EIC views that the global economy in 2023 should improve by 2.4% (from the previous forecast at 2.1%) following better than anticipated US and Japan economic results, the expansion is considered low in comparison to the prior year. Moreover, the global economic conditions in 2H2023 may slow further from 1H2023, with growing downside risks from slowing Chinese economic recovery. Such conditions should hamper Thai exports in the periods ahead. Additionally, the Flash Manufacturing PMI in August for key trading partners continued to weaken. Indicators from key markets included the Eurozone Manufacturing PMI, in which the reading stabilized at a low level of 43.7, the UK Manufacturing PMI that weakened to 42.5 (from 45.3 in July), the US Manufacturing PMI that fell to 47.0 (from 49.0 in July).

In the meantime, China’s economic recovery continued to slow, reflected by the Purchasing Managers Index (PMI) readings that dropped both for manufacturing and service activities, amidst new risks from real estate companies and large financial institutions default, which could hamper investor confidence and suppress Thai export growth in various categories, especially products in industries that are highly dependent on the Chinese market and are part of China’s export supply chain, such as rubber, rubber wood, petrochemicals, computer and parts, and auto parts (Figure 4).

Amid high downside risks from sluggish global economic conditions, including China’s, SCB EIC still views that Thailand’s export conditions should expand during the year-end due to the low base. Exports should improve, particularly during the year-end, as the Thai merchandise export value in Q4/2022 averaged at USD 22,000 million per month, a value that is lower than the 7M2023 average. Furthermore, prices of commodities should increase, such as rice, following India’s rice export suspension and weather conditions that should push global rice prices upwards in the periods ahead. Nevertheless, SCB EIC is closely monitoring export conditions and will publish the revised forecast again in September.