Thai exports in May performed better than anticipated, yet concerns loom over slowing Chinese economic recovery in the periods ahead.

SCB EIC cuts its Thai 2023 export forecast to 0.5% as support from China slowed faster than anticipated with rising global economic downside risks.

Thai exports in May contracted at a lower-than-anticipated rate.

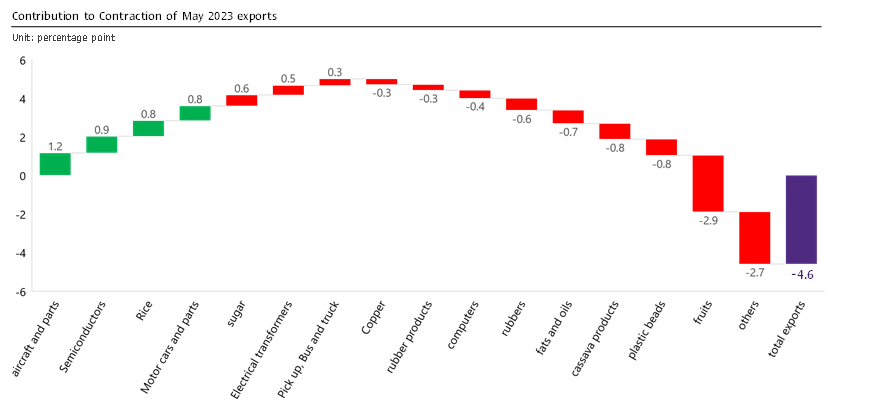

The value of Thai exports in May 2023 stood at USD 24,340.9 million, marking an 8 consecutive months contraction at -4.6%YOY. Such a drop stalled from -7.6%YOY in the prior month and also performed better than market estimates (Reuters poll reported -8% contraction). Excluding gold (a product that does not reflect actual international trade conditions), exports dropped by a similar rate of -4.6%YOY, compared to -9.3%YOY in April. Moreover, in terms of the seasonally adjusted month-on-month growth, exports in May grew by 3.0%MOM_sa, reflecting a more positive outlook.

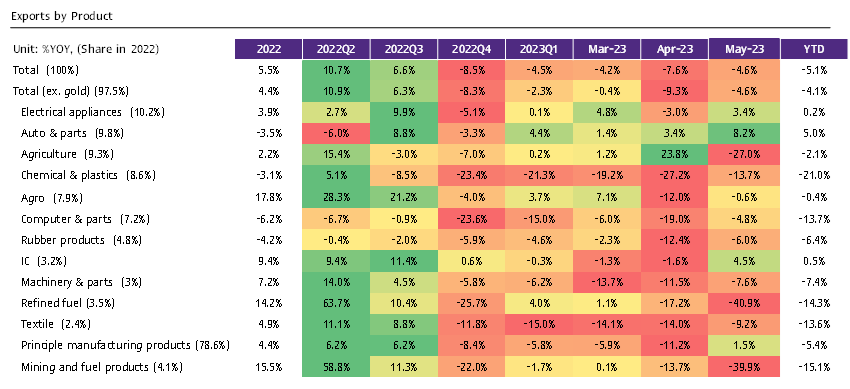

Exports of agricultural products contracted for the first time in 4 months. while, exports of manufacturing products expanded for the first time in 8 months.

Exports of most key merchandise contracted in May, in which (1) Exports of agricultural products shrank considerably by -27%YOY, a first contraction in 4 months, after expanding by 23.8% prior. Notable drags included exports of fresh/ chilled/ frozen/ dried fruits, tapioca (cassava) products, and rubber with contractions of -54.8%, -41.7%, and -37.2%, respectively, partly due to slowing exports to China. (2) Exports of agro-industrial products continued to fall for 2 consecutive months with a drop of -0.6%. However, such a drop slowed from the -12.0% contraction in the prior month. Exports of animal or vegetable fats and oil particularly slowed growth with a contraction of -63%, worsening from -34.3% in the prior month. (3) Exports of mining and fuel products plunged by -39.9%, deteriorating from -13.7% in the prior month, due to refined fuel exports that dropped by -40.9% compared to -17.2% in April; and (4) Exports of principle manufacturing products (account for 78.6% of total exports in 2022) reverted to a first expansion in 8 months at 1.5% following exports of aircraft, spacecraft and parts that expanded by 524.5%, partly due to the low base. Excluding gold, weaponry, and aircraft, which are products that do not reflect actual international trade conditions, exports of principle manufacturing products stood at 0%. Nevertheless, exports of semiconductor devices, transistors, and diodes continued to improve by 87.8%, marking an 11 consecutive months growth. While, exports of plastic beads plummeted by -21.4%, representing an 11 consecutive months decline.

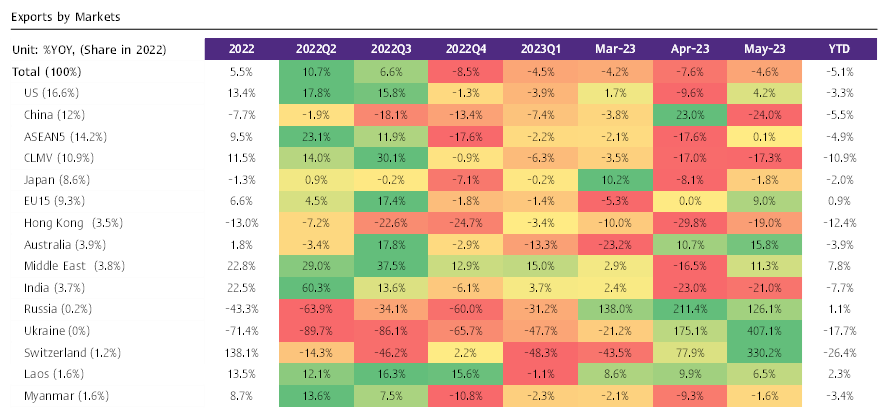

Exports to most key destinations improved, thus helping offset the weakening export momentum to China.

Exports to nearly all key trading partner markets reverted to an expansion in May after contracting in the prior month. However, the momentum from China contracted considerably, in which (1) Exports to the US expanded by 4.2% after falling by -9.6% in the prior month, (2) Exports to EU28 increased by 9% compared to the stabilizing growth in the previous month, (3) Exports to the Middle East improved to 11.3% after seeing the first contraction in over 12 months at -16.5% in the prior month, (4) Exports to ASEAN5 remained stable at 0.1% after plummeting by -17.6% in the prior month. Meanwhile, exports to CLMV continued to fall by -17.3%, a rate similar to the prior month. (5) Exports to Japan stalled to -1.8%, improving from -8.1% in the prior month; and (6) However, exports to China contracted by -24% after robustly expanding by 23% in the prior month. Such a decline was due to the high base (the value of Thai exports to China in May 2022 was at a historic high since data collection in 2010) and slowing Chinese demand as reflected by the value of exports to China in May (seasonally adjusted) that was lowest since the beginning of 2023.

Thai trade remained at a deficit for the second consecutive month as exports saw a sharper contraction than imports.

The value of imports in May stood at USD 26,190.2 million, declining by -3.4%, continuing from the -7.3%YOY contraction in the prior month. Excluding gold (a product that does not reflect actual international trade conditions), imports weakened by -1.7%, contracted less than the prior month of -7.3% . Imports of refined fuel (-13.1%) and raw materials and intermediate products (-11.9%YOY) led the decline. Meanwhile, imports of capital goods expanded for the first time in 3 months (17.6%YOY). As the value of exports saw a sharper contraction than imports, the customs basis trade balance remained at a deficit for the second consecutive month at USD -1,849.32 million in May, more deficit than USD -1,471.7 million in the prior month.

SCB EIC cuts its Thai 2023 export forecast to 0.5% (from 1.2%) as support from China slowed faster than anticipated with rising global economic downside risks.

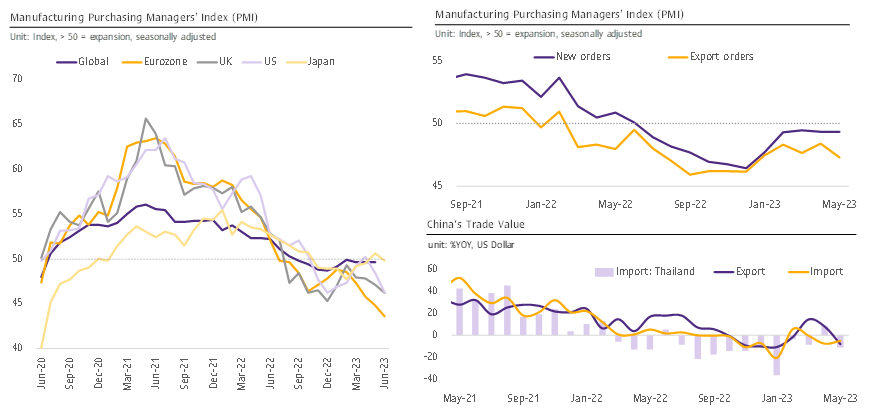

SCB EIC views that Thai merchandise exports may experience more challenges than previously anticipated in the remaining months of 2023, in which (1) Support from China showed no clear signs of recovery. In May, China’s imports from Thailand plummeted again by -11.2% after increasing for the first time in 10 months at 8.2% in April. Such a condition was in line with the continually declining in overall Chinese imports. Similarly, exports from China dropped by -8%, the first contraction in 3 months following weak global demand, and (2) The reading of the Flash Manufacturing PMI1 in June for key trading partner markets remained in the contraction zone following weak merchandise demand. Indicators from key markets included the US Manufacturing PMI, in which the reading dropped to 46.3 (from 48.4 in May), the Eurozone Manufacturing PMI that fell to a 37 months low at 43.6, the UK Manufacturing PMI that weakened to 46.2, and the Japan Manufacturing PMI that dropped to 48.4 after expanding to 50.8 in May – the first increase since October 2022.

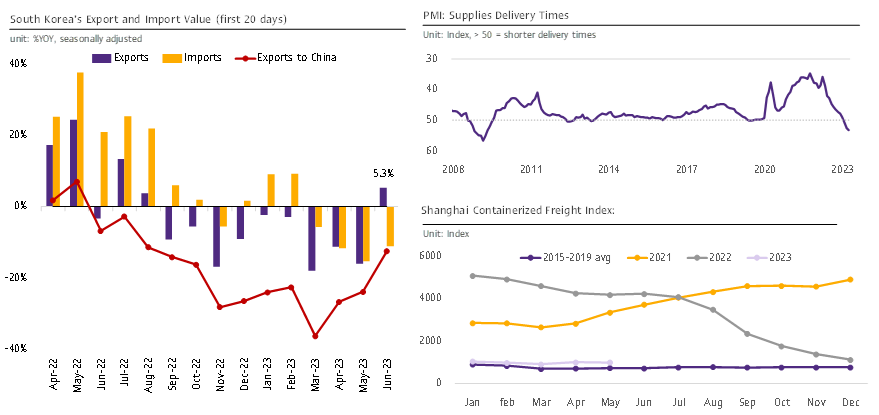

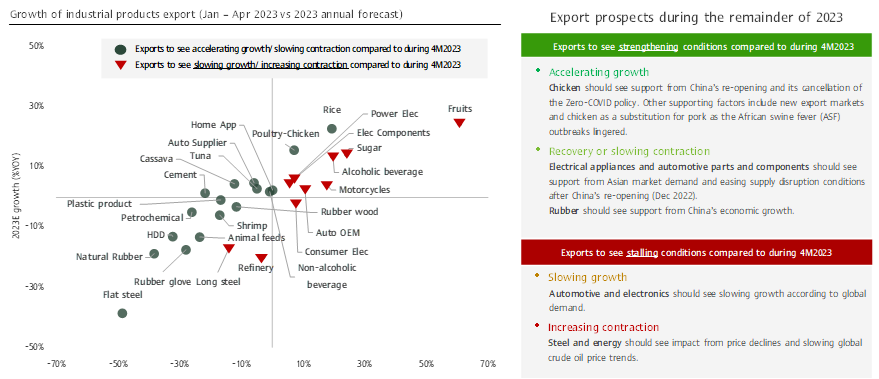

Nevertheless, indicators supporting Thai export growth in the periods ahead include (1) Early estimates ofthe first 20 days South Korea’s export data in June expanded for the first time in 10 months by 5.3%. Such growth was partly due to the low base. Furthermore, growth during the prior month saw a sharp contraction at -16.1%YOY due to the high base (the export value in May 2022 was ranked second highest since data collection). In terms of the seasonally adjusted month-on-month growth, such exports during the first 20 days in June expanded by 1.5%MOM_sa. Moreover, South Korea’s exports to China continued to improve for 4 consecutive months, with the latest figure reported at -11.2%, and (2) Supply bottlenecks recovering and approaching pre-COVID levels, reflected by lower logistic barriers, alleviating container shortage conditions, faster shipment delivery time – a first since the COVID-19 outbreak, and freight charges dropping and approaching the average rate before COVID-19. Going forward, Thai exports should continue to see uneven recovery, in which products that rely on the Chinese market should continue to recover despite some products exported to other markets seeing slowing momentum.

In conclusion, SCB EIC cuts its Thai 2023 export forecast (customs basis) from 1.2% to 0.5% as manufacturing activities, on a global scale, continue to be in the contraction zone, China still experiencing an unclear economic recovery, while risks from the war in Russia might elevate and heighten global commodity prices and inflation once again. Furthermore, climate change (El Nino) may lower Thai agricultural output, triggering shortages in the periods ahead.

1 Early estimates of the PMI index is based on approximately 85% to 90% of total PMI survey responses each month.

Figure 1: Exports of agricultural products contracted for the first time in 4 months. Meanwhile, exports of manufacturing products expanded for the first time in 8 months.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 2: Exports to most key destinations improved in May, thus helping offset the weakening exports momentum to China.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 3: Exports of fruits, which used to see robust growth, became a major drag, while exports of semiconductors, rice, and automotive improved.

Source: SCB EIC analysis based on data from the Ministry of Commerce.

Figure 4: Going forward, Thai exports may experience more challenges than previously anticipated following unclear Chinese economic recovery and weak global manufacturing activities.

Source: SCB EIC analysis based on data from the Ministry of Commerce, China Customs, Bloomberg, JP Morgan, S&P Global, and CEIC.

Figure 5: Some indicators supporting Thai export growth include South Korea’s export performance during the first 20 days in June that expanded for the first time in 10 months and supply bottlenecks recovering and approaching pre-COVID levels.

Source: SCB EIC analysis based on data from South Korea Customs, Bloomberg, JP Morgan, and CEIC.

Figure 6: Going forward, Thai exports should continue to see uneven recovery. Products that rely on the Chinese market should continue to recover despite some products exported to other markets seeing slowing momentum.

Note: * Industrial products included in the forecast account for 55.6% of total export value

** Export prospects evaluated from growth during Jan – Apr 2023 compared to overall 2023 growth

Source: SCB EIC analysis based on data from the Ministry of Commerce.