Thai exports continued to fall in April, with worrying prospects from slowing Chinese economic momentum.

Thai exports continued to fall in April, with worrying prospects from slowing Chinese economic momentum.

Thai exports in April continued to weaken to a 4 months low.

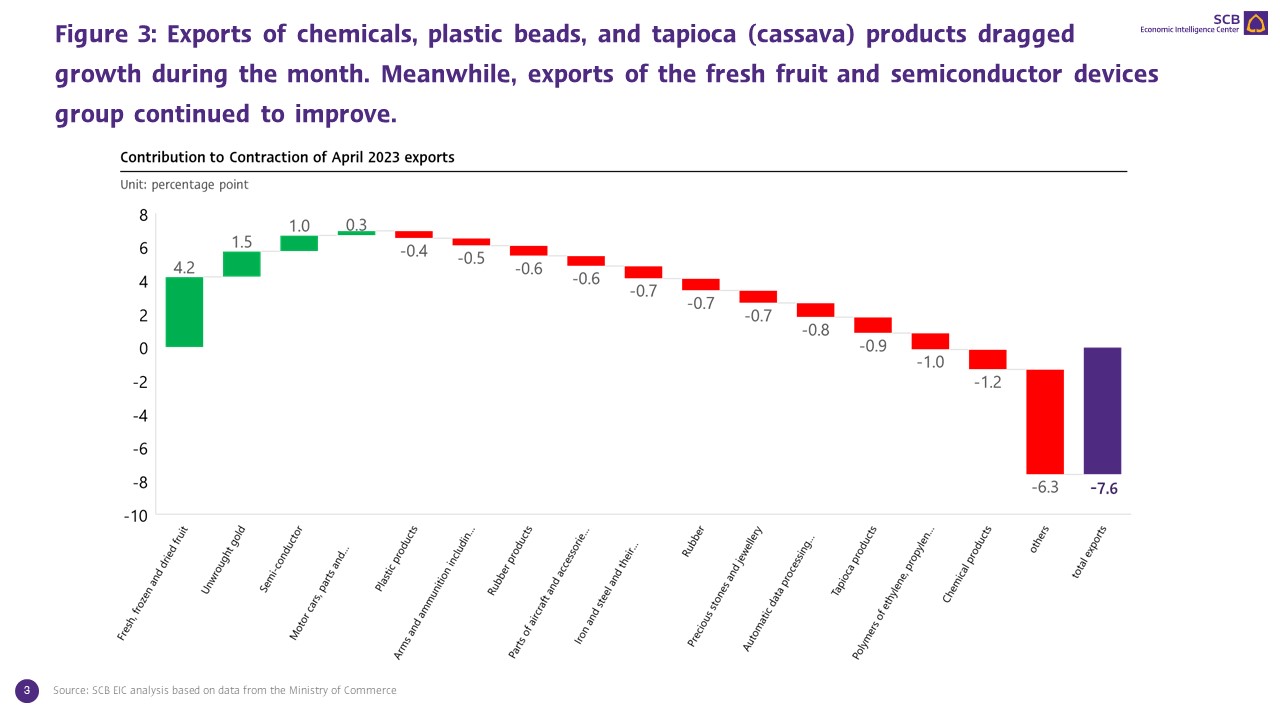

The value of Thai exports in April 2023 was at USD 21,723.2 million, equivalent to a -7.6%YOY contraction. Such a drop also worsened from the -4.2%YOY decline in the prior month. Nevertheless, excluding gold (a product that does not reflect actual international trade conditions), exports worsened by -9.3%YOY compared to -0.4%YOY in March. In terms of the seasonally adjusted month-on-month growth, exports in April contracted by -4.1%MOM_sa, marking the first %MOM drop in 3 months and reflecting a clearer signal of weakening.

Exports of most key products contracted. While exports of agricultural products continued to see strong growth.

Exports of most key merchandise contracted in April, in which (1) Exports of agro-industrial products dropped for the first time in 3 months at -12.0%YOY. Exports of animal or vegetable fats and oil, animal feed, and canned and processed seafood continued to drag growth with a contraction of -34.3% -33.6%, and -17.1%, respectively. (2) Exports of principle manufacturing products shrank by -11.2%, declining from the previous month with a contraction of -5.9% following exports of chemicals product and plastic beads that fell by -30.4% and -24.3%, respectively. Furthermore, exports of steel, iron and products dropped by -27.1%. On the other hand, exports of semiconductor devices, transistors, and diodes improved for 10 consecutive months, with a growth of 107.8% in April. Similarly, exports of motor cars, parts and accessories grew by 3.4%. (3) Exports of mining and fuel products tumbled by -13.7% as exports of refined fuel shrank by -17.2% after slightly improving in March; and (4) Nevertheless, exports of agricultural products continued with robust growth at 23.8%. Such an expansion marked a 3 consecutive months growth driven by exports of fresh/ chilled/ frozen/ dried fruits that soared by 142.8%, surpassing the 94.5% expansion in the previous month. Notable support included the recovery of demand from China, a sizable market, and easing supply bottlenecks at distribution checkpoints that expedited product shipments. Other key drivers included exports of fresh/ chilled/ frozen chicken that expanded by 38.9%, slightly declining from 47.9% in the prior month, and exports of rice with 3.5% growth. Conversely, exports of tapioca (cassava) products shrank by -44.1%, the first drop in 3 months.

Considering by destination, exports to nearly all key markets returned to a sharp contraction in April.

Exports to nearly all key trading partner markets returned to a contraction, in which (1) Exports to the US fell by -9.6%YOY after expanding by 1.7% in the prior month. (2) Exports to ASEAN 5 and CLMV worsened to -17.6% and -17.0%, respectively. (3) Exports to the Middle East shrank by -16.5%, marking the first contraction in 15 months. (4) Exports to Japan also returned to a -8.1% decline after expanding by 10.2% in the prior month. (5) Exports to EU28 stabilized compared to the prior month, which saw a contraction of -5.3%; and (6) However, only exports to China saw strong growth at 23.0%. Such a growth was the first increase in 11 months, partly due to the low base. Meanwhile, exports to Hong Kong plummeted by -29.8% compared to -10% in March.

Thai trade returned to a deficit once again following a sharp decline in exports.

The value of imports in April stood at USD 23,195.0 million, declining by -7.3%YOY, continuing from the -7.1% contraction in the prior month. Excluding gold (a product that does not reflect actual international trade conditions), imports weakened by -7.3%, a slight drop from the prior month. From analysis, imports of raw materials and intermediate products (-10.8%YOY) and capital goods (-9.5%YOY) led the decline. Meanwhile, the value of exports saw a sharper contraction than imports. As such, the customs basis trade balance returned to a deficit of USD -1,471.7 million in April after registering a surplus of USD 2,718.8 million in the prior month.

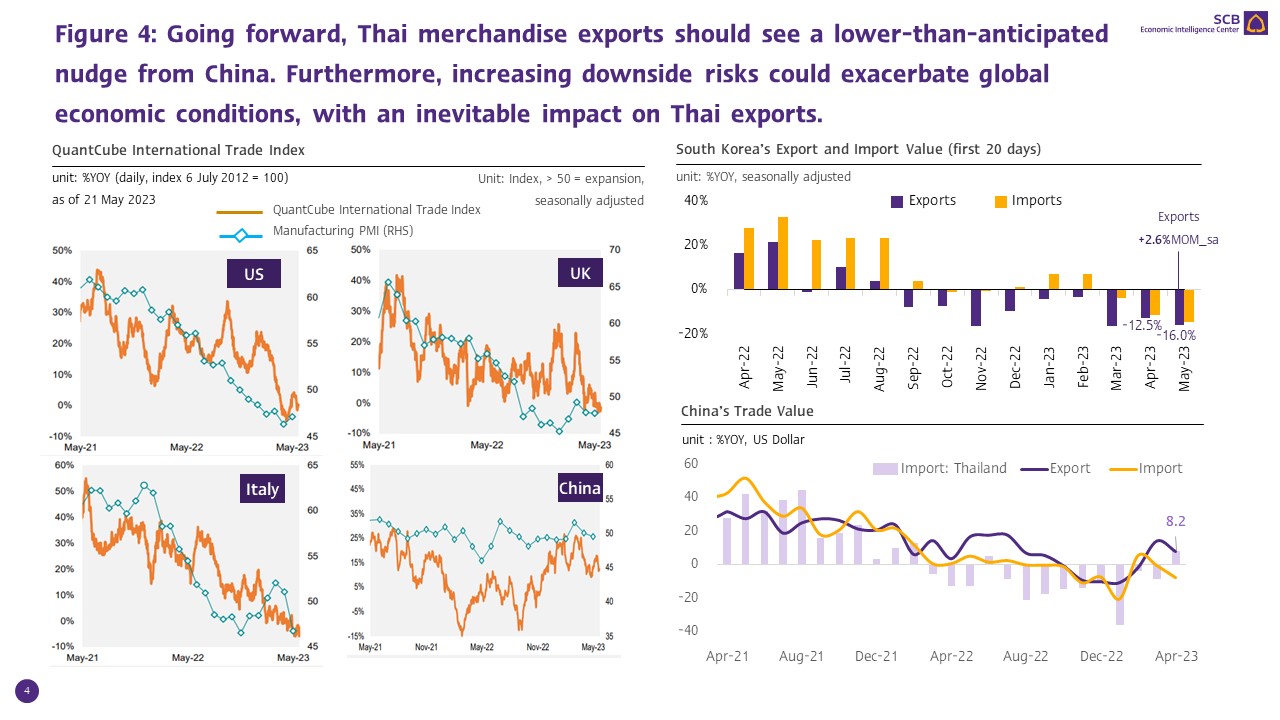

Going forward, SCB EIC views that merchandise exports may face an inevitable impact from a lower-than-anticipated nudge from China and increasing downside risks in global economic conditions

Thai merchandise exports may experience more challenges than previously anticipated in the remaining months of 2023, in which (1) Support from China may soften faster than anticipated. In April, China’s imports from Thailand increased for the first time in 10 months, with growth at 8.2%YOY, thus, allowing Thai exports to China in April to return to satisfying growth, partly due to the low base. However, in the big picture, China’s import conditions reverted to a contraction. Furthermore, although the reading of the Economic Surprise Index for China continued to expand, the reading fell considerably in Q2/2023. Similarly, the reading of a fast data for China in May, QuantCube International Trade Index, indicated that China’s international trade conditions have not yet pass its peak in 2023. Such conditions suggested that demand from China should still be weak, with negative implications on Thai exports in the periods ahead. (2) Clearer signals of slowdowns in global economic activities. The Economic Surprise Index by Citi Group indicated that the real global economic figures released for Q2/2023 started to fall below estimates, reflecting a bleak economic prospect in the periods ahead. (3) The reading of the Flash Manufacturing PMI1 in May for key trading partner markets remained in the contraction zone as demand for goods has not yet returned to an expansion. Indicators from key markets included the Flash US Manufacturing PMI, in which the reading dropped to 48.5 from 50.2 in April, the Flash Eurozone Manufacturing PMI that fell to a 36 months low at 44.6, and the Flash UK Manufacturing PMI that weakened to a 5 months low at 46.9. On the contrary, the reading of the Flash Japan Manufacturing PMI expanded for the first time since October 2022 to 50.8, thus representing the only country in the G82 group with manufacturing growth. (4) The QuantCube International Trade Index indicated that global trade conditions should continue to slow led by international trade conditions in the US, the UK, and Italy that already entered a contraction in late Q1/2023. (5) Fast data from South Korea’s export performance during the first 20 days in May fell by -16%YOY, worsening from -12.5% in the prior month, partly due to the high base as the export value during the same period in the prior year was ranked second highest since data collection.

Nevertheless, SCB EIC views that the Thai export value (customs basis) in 2023 should see 1.2%YOY growth (as of March). SCB EIC will continue to monitor and analyze economic impacts in various dimensions, including the impact from El Nino that may hamper Thai agricultural exports, before publishing the updated forecasts again in June.

1 Early estimates of the PMI index is based on approximately 85% to 90% of total PMI survey responses each month.

2 Only G8 countires with released Flash PMI results, including the US, the UK, Germany, France, and Japan