Stepping on Board Asia’s Shipbuilding Industry

Over the past few decades, the world’s shipbuilding and repairing industry has seen a significant shift in power. In the 1960s, European nations accounted for almost 70% of the world’s shipbuilders. Now, just 40 years later, over 80% of the world’s fleet originates from Far East Asia. As a result, Asia has become the world’s largest shipyard, with an increasing number of Southeast Asian countries joining the global top 10 rank. Nonetheless, despite their efforts, these countries may be far from peeling away market share from the top 3 players.

ผู้เขียน: EIC | Economic Intelligence Center

Over the past few decades, the world's shipbuilding and repairing industry has seen a significant shift in power. In the 1960s, European nations accounted for almost 70% of the world's shipbuilders. Now, just 40 years later, over 80% of the world's fleet originates from Far East Asia. As a result, Asia has become the world's largest shipyard, with an increasing number of Southeast Asian countries joining the global top 10 rank. Nonetheless, despite their efforts, these countries may be far from peeling away market share from the top 3 players.

Asia's path to dominance in the shipbuilding and repairing industry has taken several decades to achieve, and how each nation establishes and maintains its competitive advantage is truly interesting to consider.

China, South Korea, and Japan currently dominate the global shipbuilding and repairing industry, together accounting for 90% of all ships delivered in 2013. Studies of the industry have found that the foundations to all three countries' success are identical.

Their first key to success is the availability of raw materials, mainly steel. Rapid growth in steel production has helped foster the growth of Japan, South Korea, and China. Today, China manufactures half of the world's crude steel production, with over 80 million tons produced in the city of Hebei alone. On the other hand, South Korea and Japan play a significant part in delivering high value-added steel products to the global market.

The second fundamental input is skilled labor. Although the cost advantage from Asia's relatively cheap and abundant labor force was what precipitated the industry's unequivocal shift to the region, access to skilled labor is what helped shipyards deliver "quality and design" and gain competitiveness in this complex industry. For example, each of South Korea's largest shipyards has thousands of in-house designers and engineers. As a result, the nation has become the world leader in building "eco-ships". Moreover, with growing concerns for safety and fuel efficiency, shipbuilders are faced with a new challenge, which brings us to the third success component: technological know-how.

Technological knowledge is an important factor in building a nation's capability. In the late 20th century, South Korea and Japan were known for their superior technologies. However, with increasing investment, China has created an even footing for itself and surpassed both nations in the more complex shipbuilding segments. China is the current market leader in manufacturing ultra-large container ships, and has carved its own path into the fast-growing LNG segment.

The last success factor is government support. Although the level of government support may vary in each country, the key initiators all come down to capital injections, tax reductions, and/or revision of current regulations and restrictions.

EIC believes that of the three shipbuilding giants from Far East Asia, Japan is most likely to see gains in competitiveness. Recent sharp depreciation of the yen and appreciation of the won have diminished Japan's current labor cost gap with China and South Korea and spurred its cost advantage. In addition, a successful track record of fuel efficient and high quality bulk carriers will likely help Japan take away market share from Chinese shipyards. Nonetheless, aside from these three countries, the world has begun to see many other Southeast Asian shipbuilding nations emerge and earn their spot as one of the world's top 10 shipbuilding nations.

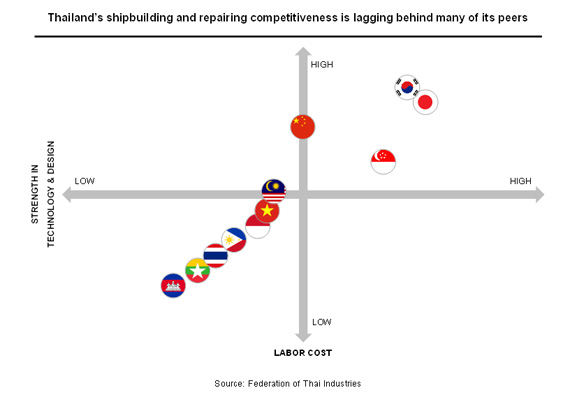

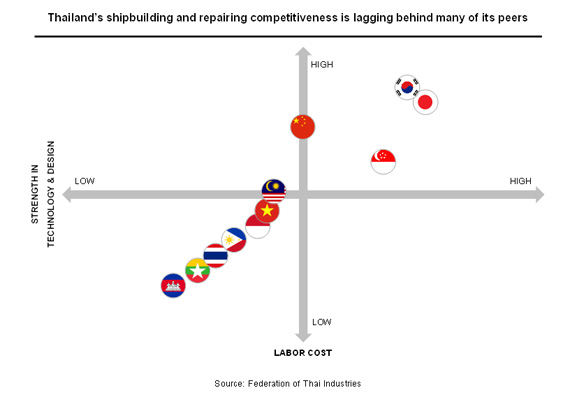

Currently, several Southeast Asian countries, including the Philippines, Indonesia, Vietnam, Malaysia, and Thailand, are considered to be in the developing stage for shipbuilding and repairing according to a study done by the Office of Industrial Economics (OIE). While each country has its own advantage in ship manufacturing, all of them share similar drawbacks. Such drawbacks includes a lack of advanced technology to cope with complex vessels, a limited source of steel /iron ore, and the inability to produce equipment such as ship engines and electronic and communication devices. However, these countries have started to develop their own niches in order to gain a competitive advantage in global shipbuilding and repairing.

Vietnam kickstarted its shipbuilding industry in 1996 through the establishment of a joint venture with Hyundai, Korea's leading shipbuilder. From then on, the Vietnamese government has identified the maritime industry as one of the country's key industries and aims to become one of world's prime ship exporters. Today, Vietnam is the world's fifth largest shipbuilding country, with high capability in manufacturing and repairing various types of vessels ranging from 30,000 deadweight tons (DWT) to 100,000 DWT due to its access to specialists, technology transfers, and foreign investments.

Indonesia has approximately 200 shipyards capable of building and repairing ships up to 50,000 and 70,000 DWT, respectively. As a major oil exporter, its Industry Minister prioritizes building oil tankers as the nation's key ship export, increasing Indonesia's capability to 70,000 DWT. The local government has also provided further support by allowing 100% foreign ownership of shipbuilding companies, adding VAT for ship repairing, and setting up the Ship Financing Corporation to provide financial support. This level of government support, coupled with growing domestic demand for new ships, has allowed Indonesia's shipbuilding and repairing industry to flourish.

Malaysia's shipbuilding business began in 1912 with the arrival of Brooked Dockyard in Sarawak. The country is competent in near coastal vessels, such as barges and tugboats. Despite the number of new built vessels remaining very consistent at 160-180 a year, the total Gross Registered Tonnage (GRT) of new built ship shot up from approximately 120,000 GRT during 2007-2010 to about 180,000 GRT in 2011. This indicates that Malaysia is stepping up to larger and more complex vessels.

Out of these aforementioned Southeast Asia nations, Vietnam and Indonesia are most likely to enjoy growth in the medium term due to their high level of government support. Based on their current shipbuilding capabilities, Indonesia will likely compete in more complex vessels alongside Vietnam, while Malaysia could potentially compete in the more technology and design oriented segments. Nevertheless, all three countries are likely to gain long-term growth due to their accumulative know-how and access to the sea.

Despite its current market position, EIC believes that the Thai shipbuilding and repairing industry still has the potential to grow. Although the country may not be able to compete head to head with the industry's top three key players, Thailand can start to gain a foothold in the shipbuilding and repairing market by leveraging its domestic demand and establishing a niche for itself. This will be a platform to gain global competitiveness in the longer term.

In terms of shipbuilding capabilities, Thailand's still falls behind many of its competitors due to its current capacity being limited to building ships up to only 4,000-5,000 Gross Tonnage (GT) in size. Therefore, EIC believes that there are three key areas in which Thailand could start to develop its shipbuilding and repairing industry. First, we believe Thailand should focus on ship repairing, rather than shipbuilding itself due to the country's high levels of craftsmanship and already established capability in this field. Second, if Thailand would still like to play in the shipbuilding arena, then it should gear towards the building of specialized vessels, such as offshore support vessels (OSV) or coastal tankers. These specialized vessels are mainly used in oil and gas well exploration-the country's key activities in the Gulf of Thailand. Lastly, Thailand could also build ships used to support inland water transport, since Thailand has an abundance of rivers flowing from the Northern to the Central part of the country. These ships would be relatively smaller in size, and therefore more in line with Thailand's current capabilities. However, some level of alterations to current Thai river beds and bridges will be required in order allow larger ships to pass through and further ease Thailand's inland water transport systems.

EIC believes that the shipbuilding and repairing industry has boundless potential and opportunities to offer other industries along its value chain in addition to building the foundation for Thailand's future market competitiveness. Moreover, past movements within the industry indicate that success in the global shipbuilding and repairing industry is accomplishable with the right set of tools and level of support. It will therefore be very interesting to see how the competitive landscape plays out in the near future, and EIC will surely keep a close watch on it.