CLMV OUTLOOK

14 March 2022

EIC CLMV Outlook 2022

After a sluggish recovery in 2021 pressured by the outbreak of the Delta variant ...

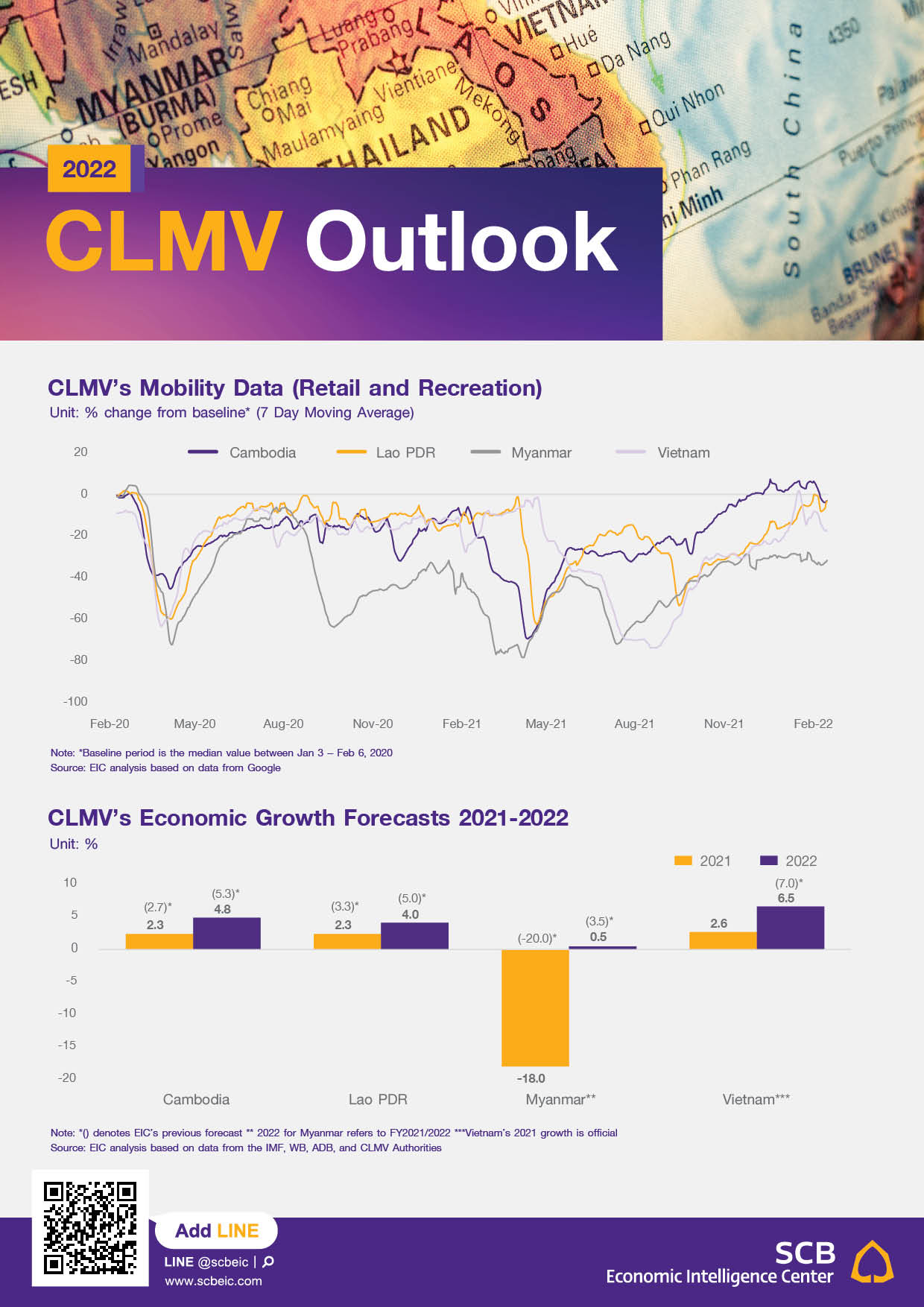

After a sluggish recovery in 2021 pressured by the outbreak of the Delta variant, CLMV economies are expected to see a stronger recovery in 2022 supported by higher vaccination rates, resilient exports, and a gradual return of international tourists.

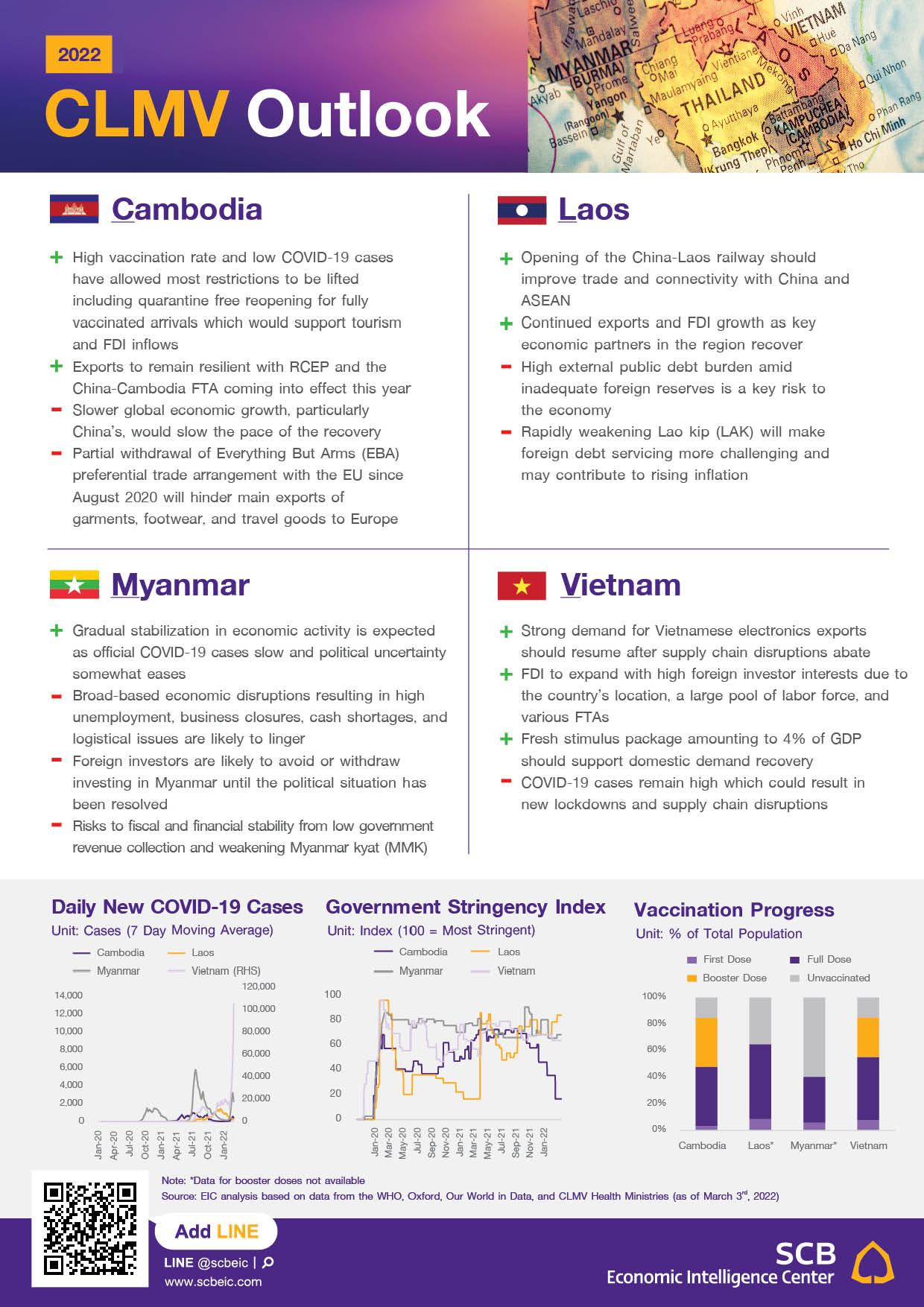

- On the domestic front, higher vaccination rates have allowed authorities to relax lockdown measures, supporting a gradual domestic demand recovery. Officially confirmed COVID-19 cases have plummeted in Cambodia and Myanmar, while Laos and Vietnam have seen steady declines. Recent COVID-19 restrictions have been less stringent than in the past as CLMV economies adapt to living with COVID-19 and resort to partial lockdowns instead of nationwide lockdowns. Additional fiscal stimulus is expected to shore up domestic demand in Cambodia and Vietnam due to their adequate fiscal space, whereas Laos and Myanmar’s space for fiscal stimulus are more limited. Nonetheless, scarring effects from the pandemic would remain a drag on economic activity particularly through elevated unemployment rates and weakening household incomes.

- On the external front, continued global economic growth and border reopening should underpin external demand recovery, supporting exports and foreign investment. CLMV exports are expected to see continued growth in 2022, albeit at a slower pace than 2021, as global demand for goods remains resilient especially for electronics and work-from-home products related to new lifestyles. With a lower economic uncertainty, FDI inflows should gradually return to the region aided by easing border restrictions and shortened quarantine requirements. Foreign trade and investment into the region would also benefit from RCEP which became effective in January. Despite that, the Omicron outbreak remains uncertain, and a prolonged spread would pose downside risks for external demand through possible supply chain disruptions.

- Border reopening would also allow tourists to return gradually, with stronger growth expected in the second half of 2022 as Omicron concerns abate. However, Chinese tourists, which constitute a dominant share of international tourism in the region, are still barred by tight border restrictions. With China’s Zero-Covid policy and high transmissibility of the Omicron variant, EIC believes China’s border reopening for international tourism will be delayed to late-2022 or may be put off until 2023.

- Factors to watch for CLMV economies in 2022 include 1) the Omicron variant or other emerging variants and risks of additional outbreaks, 2) vaccination progress and plans to ease border and mobility restrictions, and 3) fiscal and financial stability, particularly in Laos and Myanmar, amid higher public debt burden and monetary tightening in developed economies. Country-specific factors are also important to monitor, including the political situation in Myanmar and the recent opening of the Boten-Vientiane railway in Laos.

Get the additional info

Tags

CLMVASEANCambodiaLaosMyanmarVietnamBruneiMalaysiaPhilippineSingaporeIndonesiaLaoเศรษฐกิจCLMVเศรษฐกิจซีแอลเอ็มวีCLMVoutlook2022CLMV2022TradeExportImportInterestInterest ratePolicy interest rateGDPGross Domestic ProductExchange rateBahtInflationHousehold debtHouseholdDebtInvestmentGovernmentFiscalGovernment policy