CLMV Monitor by EIC Q4/2019

Growth to moderate; strong domestic demand to cushion the effects from global economic slowdown

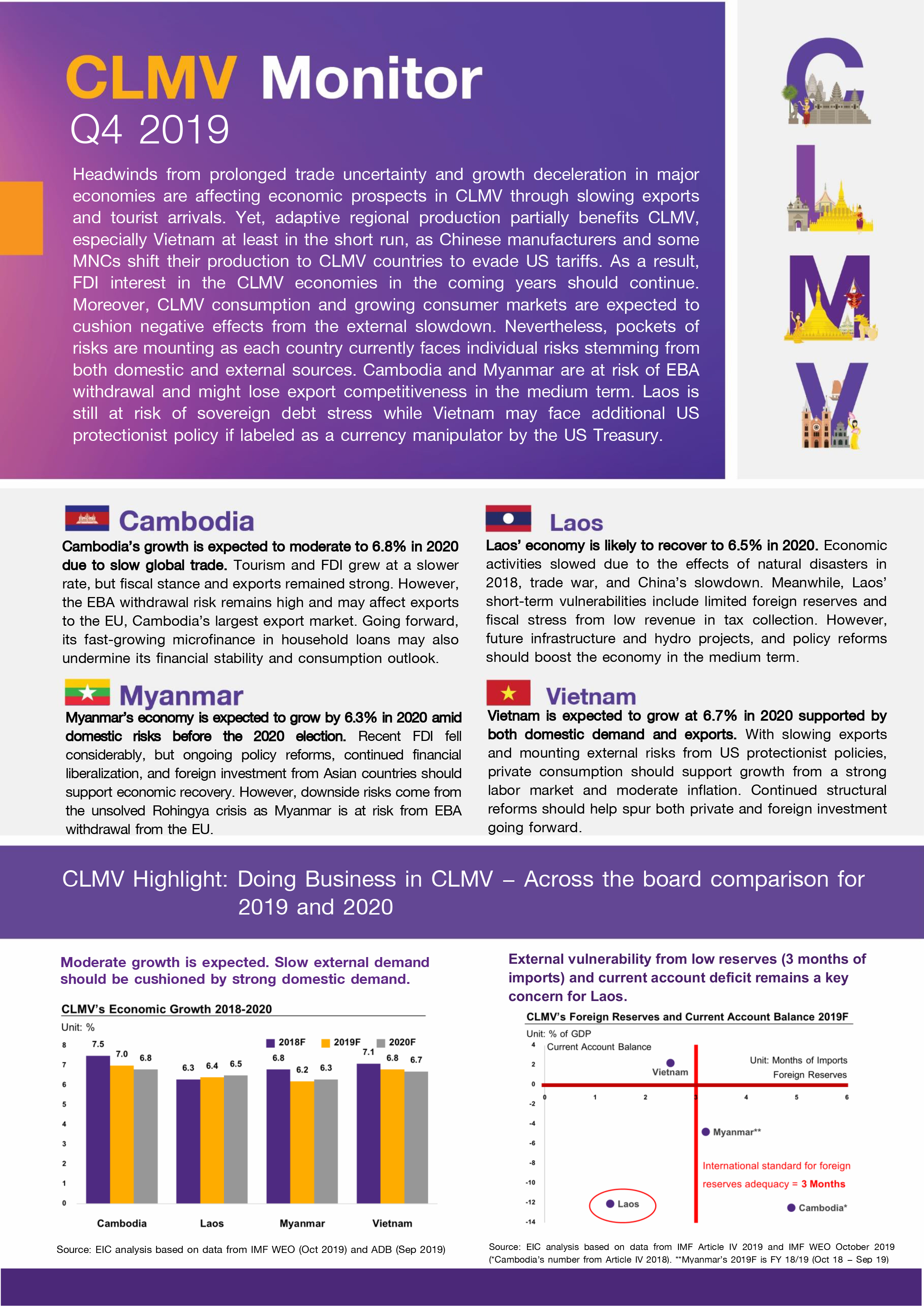

Headwinds from prolonged trade uncertainty and growth deceleration in major economies are affecting economic prospects in CLMV through slowing exports and tourist arrivals. Yet, adaptive regional production partially benefits CLMV, especially Vietnam at least in the short run, as Chinese manufacturers and some MNCs shift their production to CLMV countries to evade US tariffs. As a result, FDI interest in the CLMV economies in the coming years should continue. Moreover, CLMV’s large and still-growing consumer markets are expected to cushion negative effects from the external slowdown. Nevertheless, pockets of risks are mounting as each country currently faces individual risks stemming from both domestic and external sources. Cambodia and Myanmar are at risk of EBA withdrawal and might lose export competitiveness in the medium term. Laos is still at risk of sovereign debt stress while Vietnam may face additional US protectionist policy if labeled as a currency manipulator by the US Treasury.