FLASH

25 July 2019

Exports, excluding gold, in June contracted by -8.7%YOY. EIC remains its exports forecast of -1.6% in 2019

The value of Thai exports in June 2019 fell by -2.1%YOY. With the exclusion of gold, exports dropped further by -8.7% YOY

Key Data

- The value of Thai exports in June 2019 fell by -2.1%YOY. With the exclusion of gold, exports dropped further by -8.7% YOY (Gold export in June grew by 317.4%YOY). With the exception of military arms and weapons reshipment to the USA in February, Thai exports value has shrunk continuously for the past 8 months, and the first half of 2019 showing a decline of -4.4%YOY.

- Key products experiencing negative growth are still products within China’s supply chain which are involved in the US’s trade barriers for instance, computers – parts and components (-15.5%YOY), chemicals and plastics (-19.3%YOY) and electronic integrated circuits (-20.6%YOY). Moreover, other categories of export products have taken a hit as well, for instance rice, (-34.6%YOY), plastic resin pellets (-17.6%YOY) electronics (-5.9%YOY), rubber products (-9.2%YOY), and sugar (-19.4%YOY). While the product with positive growth in June is rubber, turning from contraction to grow by 11.8%YOY from exporting to the China (+48.7%YOY) and the US (+10.4%YOY).

- Exports shrunk across all major markets especially exports to China which declined at -14.9%YOY as well as exports to CLMV countries which dropped by -9.3%YOY with a decline of exports to Cambodia (-12.5%YOY, decline mainly from motorcycle exports), Laos (-6.6%YOY, decline mainly from refined fuel exports), Myanmar (-18.0%YOY, decline mainly from machinery exports) and Vietnam (-4.5%YOY, decline mainly from plastic resin pellets exports). However, exports to India managed a growth at 8.1%YOY.

- Key products experiencing negative growth are still products within China’s supply chain which are involved in the US’s trade barriers for instance, computers – parts and components (-15.5%YOY), chemicals and plastics (-19.3%YOY) and electronic integrated circuits (-20.6%YOY). Moreover, other categories of export products have taken a hit as well, for instance rice, (-34.6%YOY), plastic resin pellets (-17.6%YOY) electronics (-5.9%YOY), rubber products (-9.2%YOY), and sugar (-19.4%YOY). While the product with positive growth in June is rubber, turning from contraction to grow by 11.8%YOY from exporting to the China (+48.7%YOY) and the US (+10.4%YOY).

- Import Value shrunk by -9.4%YOY with a decline of all categories, especially imports of fuel products – with a contraction as high as -18.8%YOY. While imports of capital goods and raw materials were also at a contraction of -11.3%YOY and -5.2%YOY respectively. Since imports value was still lower than exports value, there was a trade surplus of USD 3.212 billion in June.

Implication

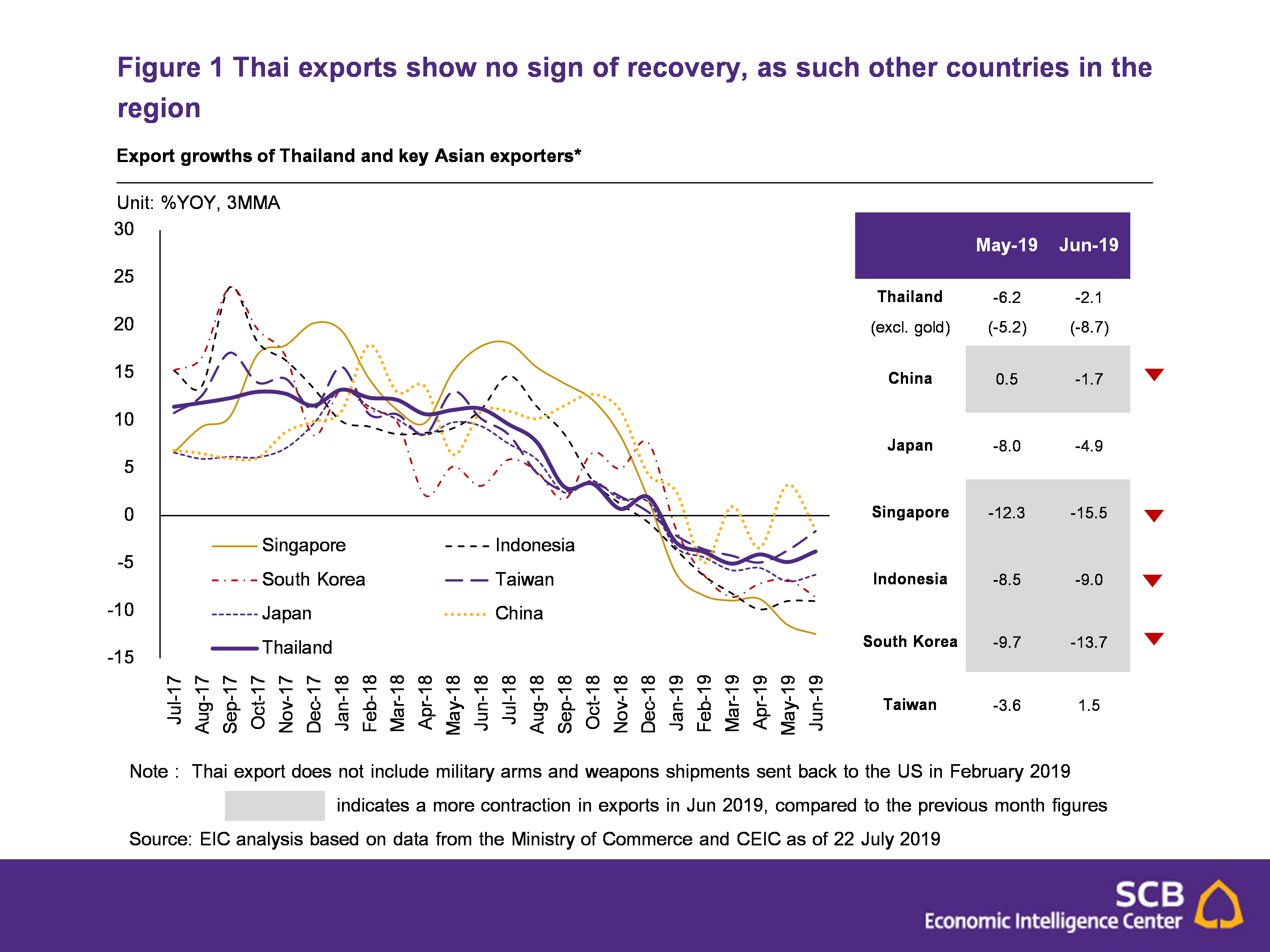

- Thai exports showed no sign of recovery, as such other countries in the region (Figure 1) Many countries’ export values continued to decline and had deeper contraction, compared to May’s figures. Heightened trade war tensions in May could partly be a reason as June is the first month that the effects of such pressures have materialized. Similarly, Thai exports, excluding gold, exhibited a steeper decline as well. EIC therefore views that export situation of Thailand and other regional key exporters has yet to show signs of recovery.

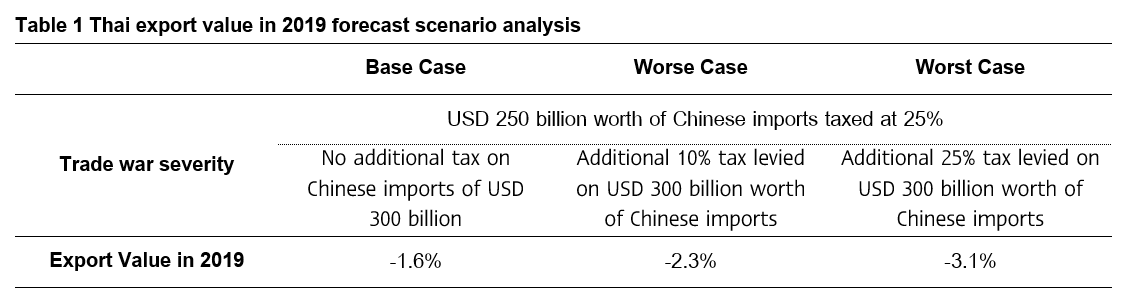

- EIC remains its 2019 exports forecast at -1.6% with the possibility, in the worst-case scenario, of reaching even -3.1%. Based on -4.4% YOY exports (excluding weapon reshipment) in the first half, EIC accesses that the figure remains close to its latest projection (Further reading at Outlook Quarter 3/2019). Although EIC did not expect an improved in exports situation in the second half of 2019, exports growth would be better from low base effect since the second half of 2018 was the period that trade war had just started to be realized. Hence, EIC expects exports in 2019 would have a negative growth of 1.6%, in comparison to the Consensus (Asia Pacific Consensus Forecast, survey date: July, 8 2019) with an average forecast of 0.2%. Even if the trade war situation slightly improved after the G20 Summit at the end of June, with China and the US back in negotiations and also with the suspension of trade war tariff increase, EIC still sees high uncertainties and, therefore, has conducted a scenario analysis (Table 1). Base case scenario assumes unchanged trade war situation from now. However, if the situation worsens, hypothesizing that the US increase tariffs on Chinese imports valued roughly USD 300 billion at 10% that would shrink Thailand’s export growth in 2019 to -2.3%. While in the worst-case scenario, the US increases import tariffs on the aforementioned products at 25%, Thailand’s export growth could be in decline at up to -3.1% (Further reading available about other possible economic effects on Outlook 3Q/2019).

- Continuous contractions in exports likely to slow GDP growth in 2Q/2019 Based on export value, excluding gold (and the weapon reshipment in February) - a figure directly affecting GDP, it has been made apparent that the first and second quarters share the same contraction rate at -5.3%YOY – reflecting no improvement from the first quarter. However, the continuous decline of exports has subsequently spread to other economic sectors such as the slowdown in tourism and private investments. This would cause GDP to grow slower in 2nd quarter, compared to the first quarter’s growth of 2.8%YOY. For the whole 2019, EIC still sees GDP growth at 3.1%.

- Positive risks from government stimulus measures. EIC’s current prediction of government stimulus amount is 20 billion baht (out of the government central budget of 80 billion baht) in the second half of the year. Therefore, if the government stimulates the economy more than expected, the result will be a positive risk towards Thailand’s economic growth in 2019. From EIC’s estimation, stimulating through private consumption worth 30 billion baht would increase GDP by approximately 0.1 percentage point.