Restaurant business…is it still worth investing?

Restaurant business still has a chance to grow amidst economic fluctuation.

- Restaurant business still has a chance to grow amidst economic fluctuation. EIC estimates a 4-5% business expansion in 2019-2020 as a result of changing population structure: smaller household, urban expansion and changing consumer lifestyle. Moreover, increasing tourists also help boost restaurant growth. However, business competition tends to get more aggressive, especially the expansion of chain restaurants, whereas more new players step into the battle. We have to keep our eye on Asian restaurants, especially the Japanese ones, and cafés like coffee shop because the competition tends to get violent.

- The entrepreneurs have to adapt to key trends that will shape restaurant industry, such as popularity in fast casual restaurant, giving an importance to Foodie influencers and food searching platforms, as well as popularity in delivery channels. Despite its constant growth, a great number of entrepreneurs cannot succeed and go out of business. So before stepping in, it is needed to be careful in choosing a proper location, to focus on quality and service, and to make a difference. More importantly, cost management and building relationship with customers are the key to survive your business in the long run.

Restaurant business overview and its competition

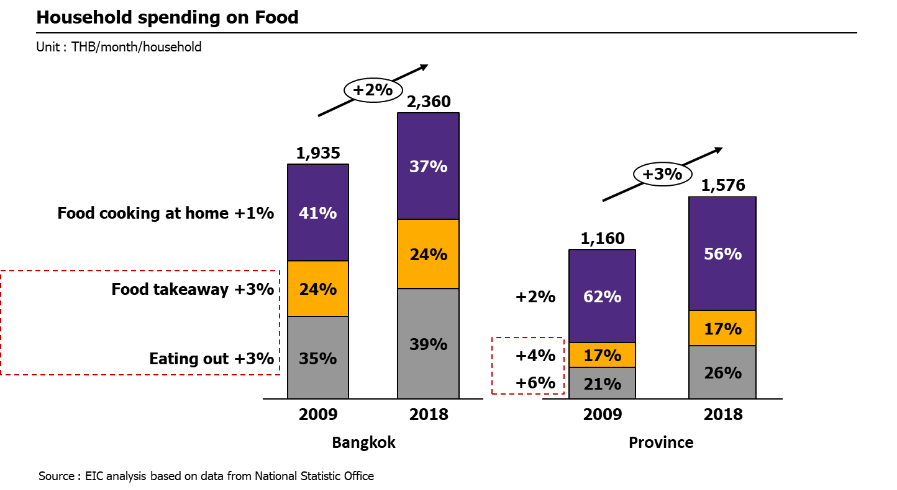

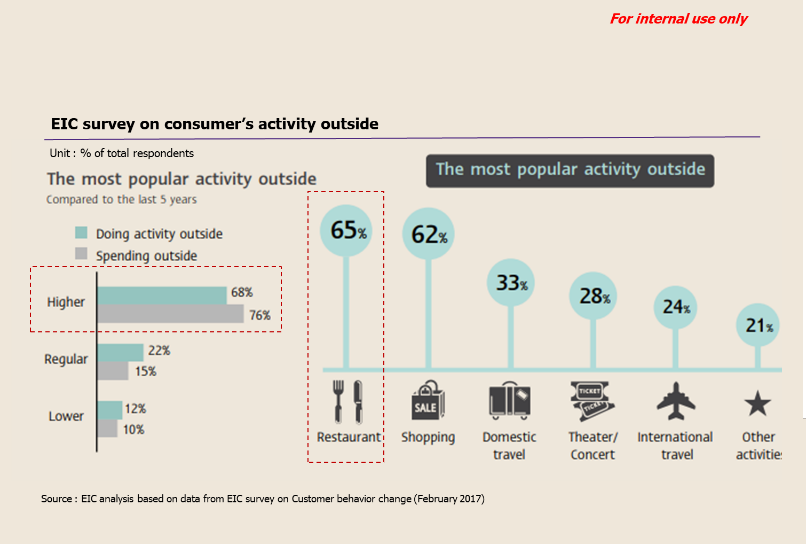

Restaurant business tends to be constantly growing as a result of structural change like smaller household and changing consumer lifestyle. Though the deflation in the consumption from household income hasn’t been much recovered in the last few years and the farm income is low-level, according to Euromonitor, it shows that food service1 business revenue in Thailand can still be constantly growing by 4% per year between 2013-2018. Its growth is more than average private consumption in the same period: 2.4%; leading the market value to increase approximately to 880 billion bahts in 2018. EIC estimates that restaurant service still tends to continuously grow by 4-5% between 2019-2020. The key driving factors are changing population structure of which a household gets smaller and needs more convenience, the urbanization along with the expansion of new shopping centers. These factors affect people to change their behavior: dining out and ordering the takeaway more. According to NSO’s survey of Thai household expenditure on food, it reflects that Thai households spent more on eating out or takeaway approximately by 3% per year between 2009-2018, different from spending on self-cooking meals which grew only by 1% per year in the same period. This information is consistent with the EIC survey on consumption behavior in 2017, which reported that 68% of respondents did more outdoor activities. The most popular one, voted by 65%, was eating out. 76% of consumers spent more money on outdoor activities. Apart from domestic consumption, increasing foreign tourists also help push the income growth for restaurants despite the economic slowdown. According to these foreign tourists’ expenditure on food and beverage between 2013-2017, it tended to constantly grow by 5% per year or approximately 10,568 bahts/person/trip. It reflects the opportunity for restaurant business to grow much more, especially in the significant tourist attractions.

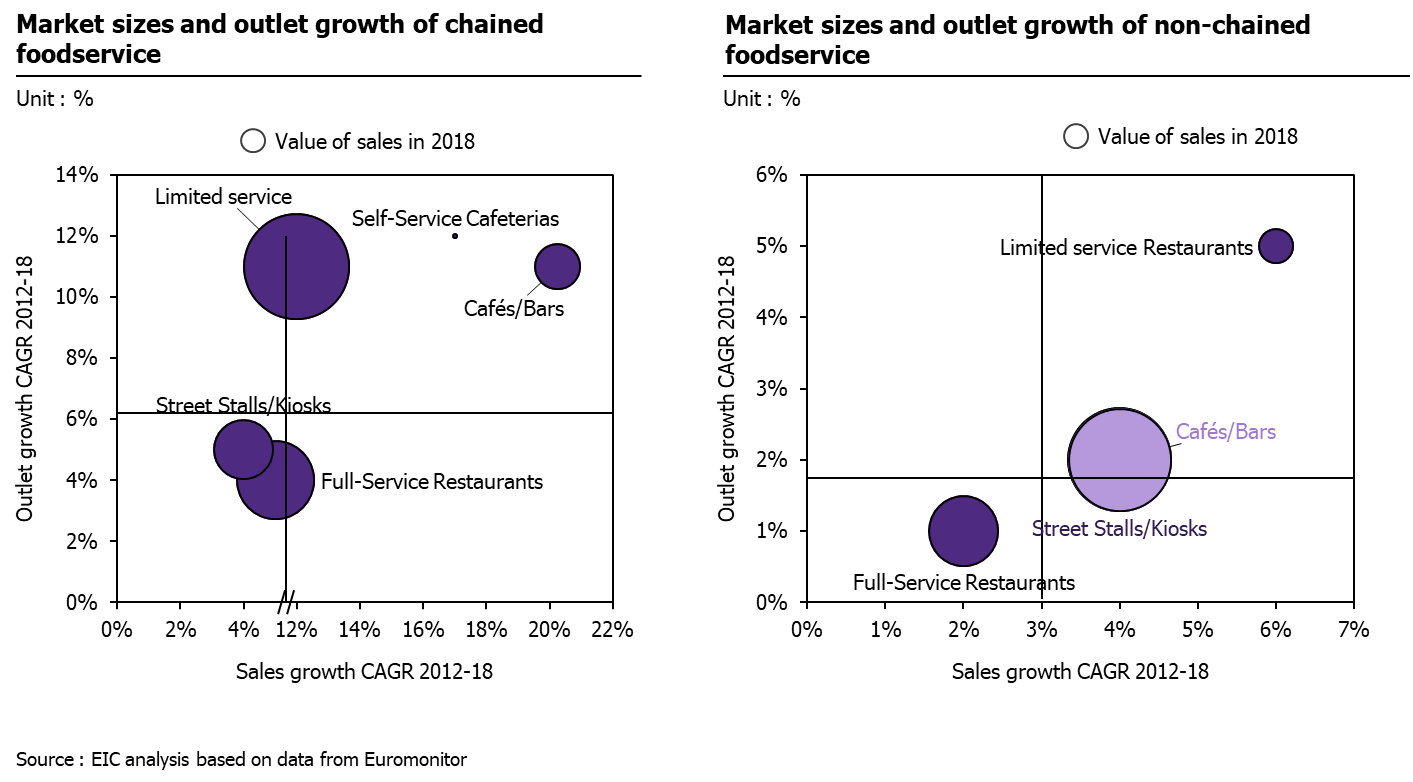

Restaurant growth is mainly the result of chained restaurant expansion. According to Euromonitor, the sales of chained restaurant consistently expanded by 9% per year between 2012-2018, while branch expansion grew by around 8%. Most of the branches were expanded to the growing retail spaces. They grew more than non-chain restaurants whose sales and outlets respectively increased by only 4% and 2% per year. Considering restaurant types, the ones with limited service, such as ordering at the counter and self-service or, in some places, with staff serving, tends to grow so much because they can serve in terms of speed, reduce staff numbers and maximize table turnover. It causes the entrepreneurs to invest this kind of restaurant. In the past, this kind of restaurant was mostly fast-food chain selling burgers; now other kinds of restaurants have improved and adopted this pattern, such as Japanese restaurant and bakery. The competition is likely to get more intense because more new players are joining this market.

Keep an eye on the entrepreneurs of Asian foods in the aggressive competition as well as the tendency to target more on premium segment. Popularity in Japanese and Korean restaurant result in a continuous Asian chain restaurant expansion; and they expand along with shopping center expansion. In the meantime, new entrepreneurs stepping in Asian restaurant competition are rising. More aggressive competition causes the revenue of each Asian chain to slow down on the whole, especially in the chain group whose sale per branch growth rose by about 2% per year between 2012-2018. Fast expansion, diverse kinds of Asian foods and the fact that most entrepreneurs focus on mass marketing, which competitive pricing considerably matters, all of these create various choices for the consumers. The most popular ones are Sushi, Ramen, Izakaya, Shabu and Yakiniku. In addition, the compelling trend now is that the entrepreneurs are likely to make their restaurants more premium in order to attract the high-potential customers. Omakase, for example, focuses on high-quality ingredients. Their chefs create the dishes so that they can charge more prices.

Café is another segment that tends to expand rapidly; particularly coffee and bubble tea shops that compete in various segments with more new players stepping in. Continuous popularity from the consumers made the cafés, especially the chained ones, in Thailand grow by around 20% per year between 2012-2018. Due to chain expansion of the famous brands, many of which take franchising tactic, they can accelerate expansion and spread over many locations. Another interesting strategy is that some entrepreneurs divide their customers into various segments in order to attract different groups. They separate their brands into mass and premium to better serve particular demand for each customer group and location. Apart from café market that is likely to grow high, bubble milk tea is another compelling business. Its rising popularity constantly leads new players to compete in the market. However, we have to keep an eye on the competition in the future since the bubble milk tea can only be a short-term trend and it’s one of the drinks of which brand loyalty barely matters. If the entrepreneurs can’t represent the brand strength or make the difference, it’s possible that they can’t survive in the long run.

While the competition among the restaurants get more aggressive, grocery store is another rival that shouldn’t be looked over since it comes to gain a part of market share. In the present, grocery stores, especially mini mart, are likely to augment the ratio of ready meal which is continuously popular. Moreover, new services have been developed e.g. eating zone, where fresh cooking is offered, and coffee corner are provided to serve the consumer’s demand in rushing time. According to Euromonitor, sales volume of the mini marts in Thailand in terms of food service was likely to grow approximately by 14% per year between 2013-2018. It grew faster than the sales of burger restaurant that grew around by 11% per year in the same period. This information indicates that mini marts can match well with consumer behavior nowadays, as you can see that they offer various kinds of ready-to-eat from sandwich, Stir fried Thai basil to desserts. Looking at the ratio, share of food product of the main grocery store entrepreneurs is constantly growing to an average of 50-70% of all products. Furthermore, supermarkets become a key rival against restaurants because they tend to improve their service: adding restaurant into the grocery store, called Grocerant, which is likely to get more popular. One strong point that many grocery stores adopt, and get a good feedback, is to let their customers choose their own ingredients from the freezer and then get them cooked by chef.

Compelling restaurant business trends

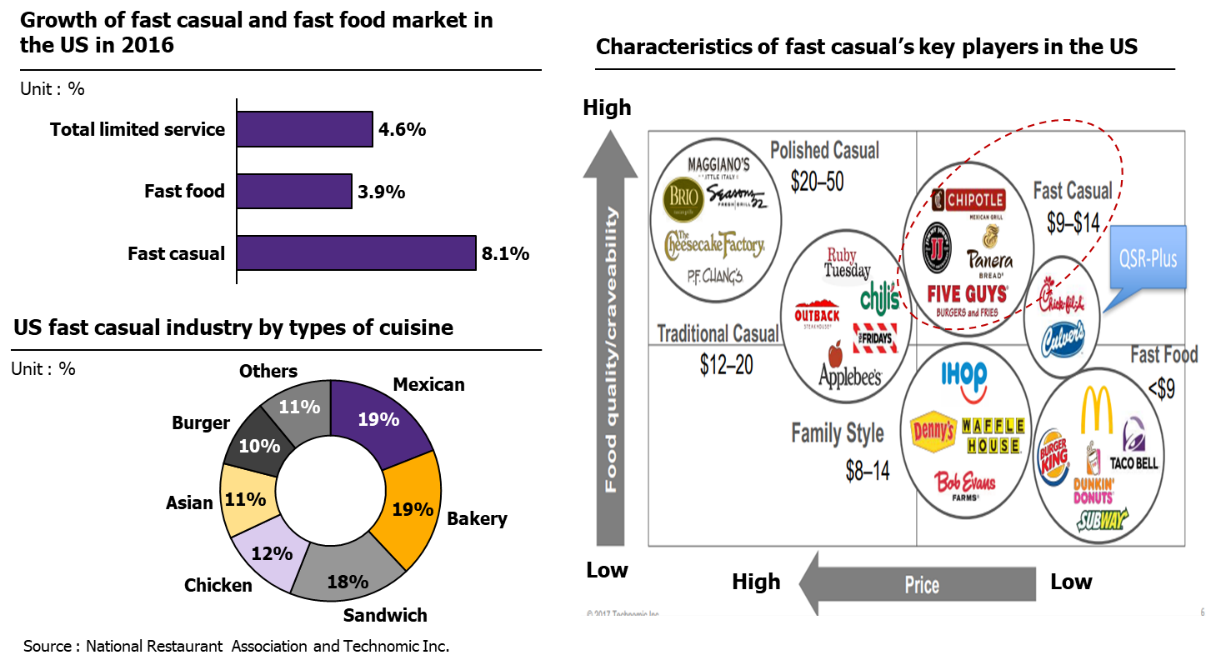

Fast casual is the new style that serves modern consumers’ need which is speed as well as food quality. Fast casual is a kind of restaurant that combines fast food, focusing on speed, and casual dining which emphasizes on quality, atmosphere and various dishes to choose. It tends to get popular all over the world. According to statistics on different types of restaurant business in the US, fast casual type is likely to grow faster than general fast food type. In 2016, it grew by about 8% while fast food restaurant type grew by around 4%. Moreover, fast casual offers quite more kinds of food. In the US, for example, most of fast casual restaurants serve sandwich, Mexican food, and bakery. Shake Shack is a good example of the fast casual restaurant that extremely successful with continuously rising revenue. In 2016, its sales grew approximately by 40%. The reason was that their burgers and sandwiches were made of quality ingredient but with $1-5 different from premium burgers of general fast food restaurants. Furthermore, the consumers can also customize the burgers and ingredients. In Thailand, fast casual restaurant tends to get more popularity because it can match with Thai consumer’s lifestyle that is rush but they’re still selective and concern for quality and healthiness. The kind of food that can match with the consumption behavior of Thai may be Asian food and bakery mainly. However, the entrepreneurs should pick a productive location despite the fact that fast casual restaurant gets more popular. The location can mainly be office or educational institution where salarymen and students are looking for convenience, so that you can present your brand strong points: fast and quality food.

Modern consumers are looking for a restaurant that serves not only food but also a new experience. Modern consumers are selective and always looking for new experiences; and eating out is one of the activities that helps them do so. Apart from the savour that must come first, eye-opening atmosphere can also be a key point in the competition among restaurants nowadays. A good example is plant-based or local-ingredient kind of restaurant where the consumers can pick fruits and vegetables from the plants grown around the place and get them cooked; or dine-in-the-dark kind, where the customers eat in the darkness to get the experience from using all the senses to guess what they’re eating. In addition, food tourism trend create the popularity in visiting famous local restaurants, such as the ones with famous specialty as well as street food that tend to get more popularity among tourists.

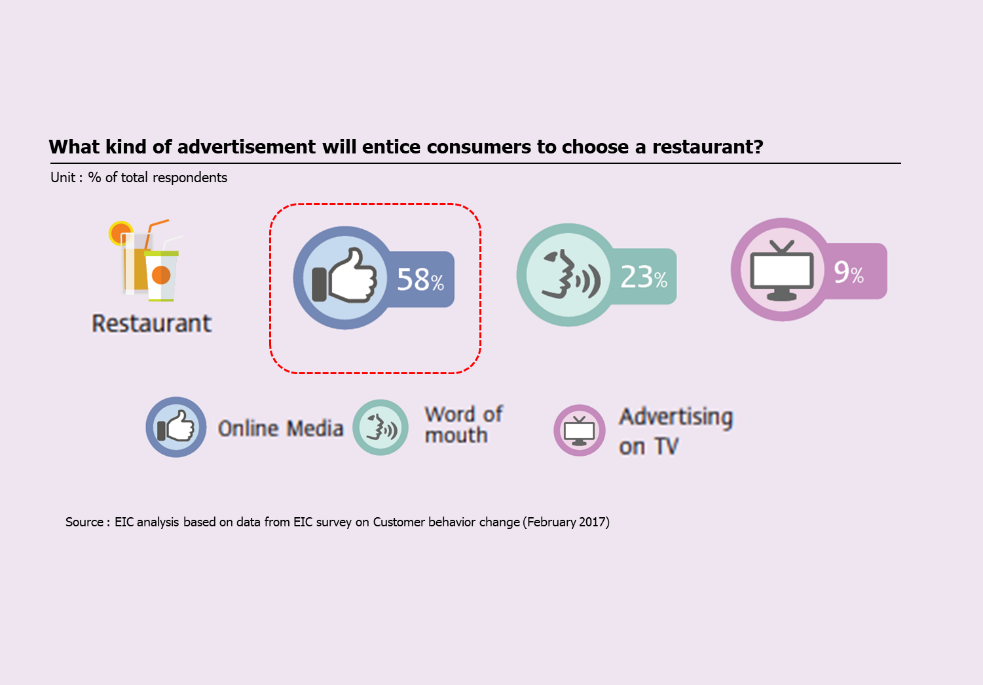

Foodie influencer and restaurant searching platform have an influence in the decisions on choosing an eating place nowadays. According to the EIC survey on the media influential to the consumer’s decision on choosing a restaurant, it showed that social media and reviews are influential in making decision for 58% of respondents, followed by word of mouth for 23% and advertising media for 9% of respendents. This information shows that Foodie influencers have more influence in the consumers. The consumers are likely to concern for restaurant reviews, in terms of quality and service, due to their behavior that becomes more selective and addicted to social media. Platforms that offer restaurants and reviews as well as discounts and sales promotion play a bigger role. Even social media like Facebook and Instagram can also be used to promote the restaurants.

Despite more popularity in eating out, online ordering is the trend that the entrepreneurs shouldn’t overlook. This trend showed in the value of food delivery market that continuously grew by around 10% per year between 2013-2018. The key supporting factors were more widespread access to technology and mobile phone of the consumers as well as food delivery applications that are now developed more and more. Nowadays, some platforms, like Line Man, have more than 3 million active users. All of these reflect the consumers’ behavior that their approach to technology in daily life is increasing as well as the need of convenience. This leads the new players to step into aggressive battle of food delivery market. Mostly they compete on the numbers of restaurant on the platform that have to be diverse, as well as on the quick delivery and lower delivery fee, in order to attract as many users as possible. Thus, the entrepreneurs shouldn’t overlook the importance of delivery channels which could be another way to help boost sales volume, especially those who run the restaurants located in shopping centers where the retail space is limited and the rental is expensive. Delivery channel can help maximize the utilization of retail space.

Restaurant business still has a chance to grow more and continuously attracts new players to do the business. However, more intense competition forces a great number of entrepreneurs to quit their business as well. According to the Department of Business Development’s information in 2018, restaurant was the third most newly founded kind of business, 2,058 entities, accounted for approximately 3% of all newly founded businesses in 2018. Nevertheless, it is the third most quit business as well. In 2018, 566 restaurants or accounted for around 2% of all quit businesses, closed down. Thus, the entrepreneurs who wish to step into this business need to consider a proper location, focus on quality and service as well as make a difference for the brand. And most importantly, cost management and building a relationship with the customers are the key to survive your business in the long run.

1 Food service in this context includes 1) Stand alone restaurant 2) Food service in retail spaces 3) Food service in tourist sites e.g. cinema, amusement park, and stadium 4) Food service in lodging places e.g. hotel and resort 5) Food service during travelling e.g. airport, bus terminal, sea ports and gas station.