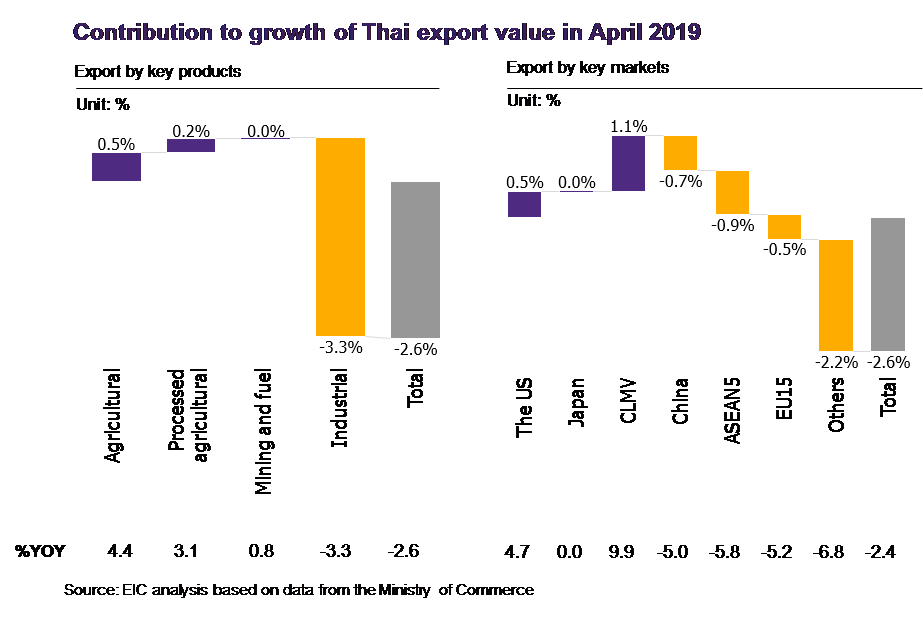

Thai exports in April continued to contract by -2.6%YOY. EIC revises down 2019 exports forecast to 0.6%.

The value of Thai exports fell by -2.6%YOY in April 2019, a downward momentum continuing from negative growth in March at -4.9%YOY.

The value of Thai exports fell by -2.6%YOY in April 2019, a downward momentum continuing from negative growth in March at -4.9%YOY. As a result, the growth decline in April 2019 registered 6 consecutive months drop. Overall export figures during the first 4 months of 2019 on average contracted by -4.2%YOY (excluding military arms and weapons shipment to the US).

- Exports of key products. Exports with declining value were especially clustered among products that were part of China’s supply chain, which received an impact from USA’s import tariff increment. Key items affected were, for example, computer – parts, and components (-10.6%YOY), rubber (-32.0%YOY), and electronic integrated circuits (-4.0%YOY). Apart from Chinese supply chain related, exports of other product categories fell as well, for example, motor vehicles – parts and components (-4.0%YOY) and machinery and parts (-12.3%YOY), in addition to agricultural products such as rice (-20.2%YOY), sugar (-10.8%YOY), and cassava (-4.7%YOY). On a positive light, products with expanding growth were, such as fresh-chilled-frozen-dried fruits (97.8%YOY), electrical appliances (3.1%YOY), motorcycles and parts (23.9%YOY), and chicken (13.9%YOY).

- Exports by key markets. Exports to various key trading partners registered negative growth such as China, ASEAN-5, EU15, and the Middle East with -5.0%YOY, -5.8%YOY, -5.2%YOY, and -8.8%YOY contraction, respectively. On the other hand, exports to CLMV, USA, and India saw an expansion of 9.9%YOY, 4.7%YOY, and 3.4%YOY, respectively.

Value of imports shrank by -0.7%YOY following declining growth in fuel imports. Imports of fuel products significantly dropped by -12.8%YOY. Meanwhile, imports of other product categories still expanded, for example, raw materials, capital goods, and consumer goods with 1.6%YOY, 2.1%YOY, and 5.9%YOY growth, respectively.

EIC slashes export value forecast to 0.6% from the previous estimate of 2.7%.

- EIC revises down export forecast due to the playouts of the actual export figures during the first 4 months of 2019 that significantly contracted by -4.2%YOY (excluding one-time shipment of military arms and weapons to the US). The actual figures were well below the previous estimate. More importantly, trade war tensions between US-China started to resurface. On May 10, 2019, the US ramped up import tariffs worth USD 200 billion on Chinese goods, which will face import tax of 25% from the previous 10%. China quickly retaliated with import tariffs worth USD 60 billion from previous 5-10% to 5-25%. Apart from the trade war, barriers and tensions started to spill over to other sectors led by US ban on Huawei (the current ban is suspended and postponed by 90 days). The new round of US-China trade war will have an additional impact on Thai exports, both directly from Chinese supply chain products that are slapped with higher import tariffs and indirectly from the more sluggish global trade and investment outlooks (compared to the period before trade tension erupted). As such, EIC revises down export value growth to only 0.6% expansion. However, during the second half of 2019, exports should slightly recover following the expected gradual global economic recovery. Key drivers will be from economic stimulus measures implemented in various countries, especially China’s, in addition to increasing adoption of dovish stance among various central banks. Moreover, the low-base effect from the second half of 2018 will help accelerate Thai export value growth during the second half of 2019.

- Risks that needs continual monitoring still circles around the US-China trade tensions, which could be further escalated. The US could potentially impose additional import tariff hike worth USD 300 billion at the import tax rate of 25%. While, China is likely to retaliate as well (Read more at Note: US-China Trade war heats up once again with both sides raising 25% import tariffs on each other, risking further slowdown in global trade and Thai exports ). Furthermore, the US plans to ramp up automotive import tariffs from all countries to anticipated 25%. Negotiations for trade deals with the European Union and Japan are currently in place with expected conclusions within November 2019.

EIC also revises down import value growth in 2019 to 0.8% from 3.2%. The revision is mainly based on declining export growth forecasts, which slows imports of raw material and capital goods in export-related industries. Furthermore, pricing of import products during the first quarter was lower than estimated (import price in terms of USD during the first quarter merely grew by 0.2%YOY), which can cause import value to contract by more than previously anticipated.