US-China Trade war heats up once again with both sides raising 25% import tariffs on each other, risking further slowdown in global trade and Thai exports.

On May 10, 2019, the US government annouced to raise import tariffs on Chinese goods worth USD 200 billion from 10% to 25%.

- On May 10, 2019, the US government annouced to raise import tariffs on Chinese goods worth USD 200 billion from 10% to 25%. This was following the trade negotiations between the US and China that did not sufficiently progress. On May 13, China retaliated by also annoucing to increase import tariffs on US goods worth approximately USD 60 billion at a rate of 5-25%.

- The trade war that heats up once again is likely to weigh on Thai exports through 2 channels, directly through supply chain between Thailand and China and indirectly through slowing global trade in line with Chinese and trading partner economies. If the US and China are unable to reach a trade agreement in the short run, it is then highly likely for Thai export value in USD term in 2019 to grow at a lower rate than 2.7%. Meanwhile, Thai exporters should readily diversify export destinations and consider reeping benefits from Thailand’s current free trade agreement to increase opportunity and expand market, and hedge against foreign exchange volatilities in the period ahead.

The US government raised import tariffs on Chinese goods worth USD 200 billion from the previous rate of 10% since September 20181 to 25% starting 10 May 2019. This was after President Trump threathened to raise import tariffs on May 5, 2019 as trade negotiations between the US and China did not sufficiently progress and after the US has postponed the increase in tariffs indefinitely from its original schedule on March 2, 2019. As a consequence, the Chinese government annouced an increase in import tariffs on US goods worth USD 60 billion from previous rate of 5-10% to 5-25%, which will become effective on June 1, to retaliate against the US trade retrictive measures. This was quite a surprise to the global financial market that the US-China trade war erupted once again, as opposed to the development in past few weeks that both sides had almost reached an agreement.

The trade negotiations progressed very slowly and the US offered the explanation that it was because China that reversed on several agreements. President Trump then decided to increase import tariffs to pressure China. The reasons behind this round of new tariffs were the 3 followings. 1) The US said that China backtracked by amending the draft proposals that would be legally binding on key issues already agreed upon by both the US and China since the previous meeting. The 5 key issues, that are to the heart of the negotiation, include violations of intellectual property, forced technology transfers, government supports for firms and state-owned enterprises (SOEs), opening-up of services market, and currency manipulation. On this, China claimed that it was owing to difficutlties in amending domestic laws in China. 2) The trade negotations between China and the US at present has no clear deadline for the reform, while amendments to the Chinese law to comply with the US requests progressed very slowly and were full of restrictions from the Chinese side in the view of the US, which was not acceptable for President Trump. 3) Import tariffs worth USD 200 billion at the original rate of 10% was on conditions that China has to strictly comply with US requests. If the US sees that China is unable to comply with the requests, the US has the right to further increase tariffs to 25% in accordance with Section 301 of the US Trade Act as originally planned. From the abovementioned reasons, President Trump thus decided to raise import tariffs on Chinese goods instantly and saw this round of new tariffs as a strategy to force China to comply with US requests in a more effective manner.

At the same time, China argued that the US should provide insurance for China to be confident before complying with the US requests. The Chinese government outlined two underlying reasons for the inconclusion of the trade agreement. 1) The US did not provide any insurance for China to be confident that all or part of the tariffs will be lifted in the future. China viewed that the US has no clear intention to relax the trade restrictive measures before complying with the US requests. 2) US requests have to be fair and have taken into account the dignity of both nations, where China requested the US to set a realistic target as the process for structural changes within China cannot be resolved easily and will take some time. However, this round of new tariffs by the US reflects that the US will not compromise with China and will not hurry to conclude on the trade negotiation. The US still has an opportunity to pressure China as the US economic outturns in the first quarter came out better than expected.

Implications on the US-China and the global economies

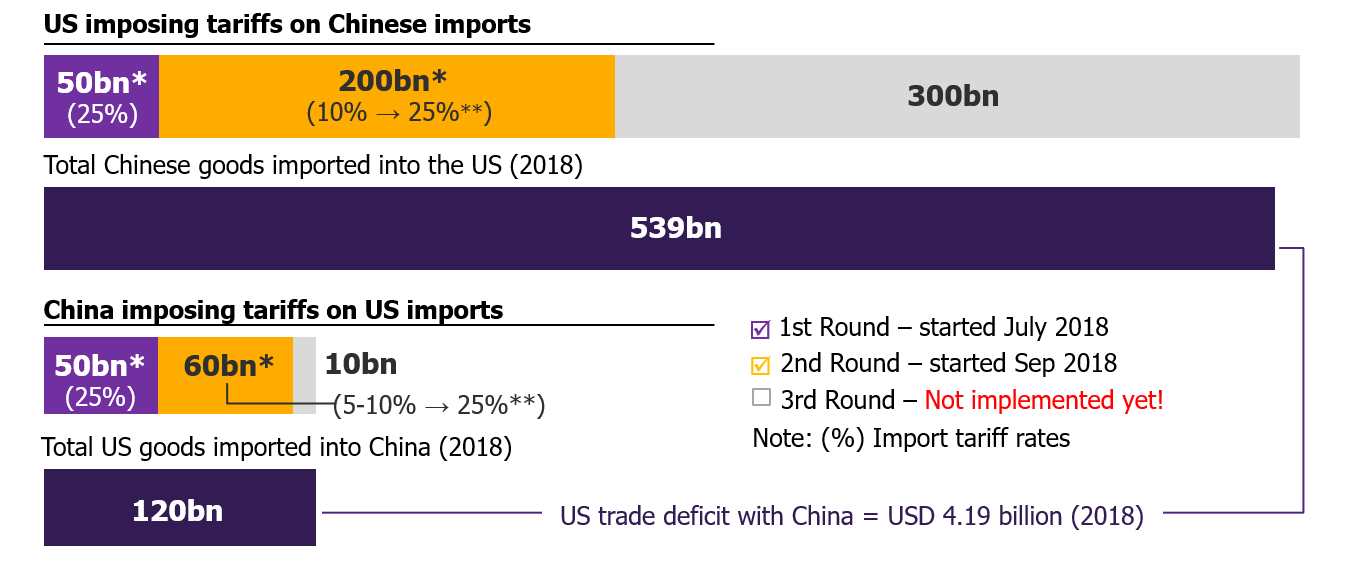

The increase in US import tariffs on Chinese goods to 25% is expected to affect both the US and Chinese economies to a larger extent, espiecially on export-related manufacturing sector in China including electronics and tecnological products. Chinese goods over 5,745 items that will be subject to the new tariffs include mostly goods in electronic and technological categories such as telecommunication equipment, electrical circuits, computer parts, as well as several goods in consumer product category such as furniture, toys, suitcases, etc. In the short run, the new import tariffs will affect Chinese manufacturers and US importers as US importers will have to import goods at higher prices, while they are still unable to find subtitute markets for all goods in such a short amount of time. This will have knock-on effects on some US consumers, which may subsiquently affect inflation, consumption, and investment in the US. Meanwhile, Chinese manufacturers started to be affected from exports of goods to the US through price effect. Nevertheless, in the long run, if the US is able to find more substitute markets for Chinese goods, the impact will pass-through to Chinese manufacturers that may be at the disadvantage against competition with the US and will continue to export a lesser amount to the US. As a result, Chinese export sector will continue to feel the impact this year and in the future. Moreover, President Trump also threatened further import tariffs of 25% on remaining Chinese goods on the targeted list worth USD 300 billion in the period ahead. (Figure 1)

Figure 1: Trade war heats up once again after the US increased import tariffs on Chinese goods from 10% to 25%.

Value of goods exports affected by the US-China trade protectionist measures

Unit: USD Billion

* Such values are based on the import value as of 2017, while values before the measures became effective are projected based on import value as of 2018.

Source: EIC analysis based on data from the USITC

Eyes on the negotiation outlook and the possibility that the US will increase import tariffs of 25% on the rest of Chinese goods on the list worth USD 300 billion. The Office of the United States Trade Representatives (USTR) indicated that the list of Chinese goods that will be subject to the next round of an increase in tariffs will cover goods over 3,805 items, including mobile phones and computers. However, EIC views that possibility of increasing tariffs on remaining Chinese goods on the list is subject to two key considerations.

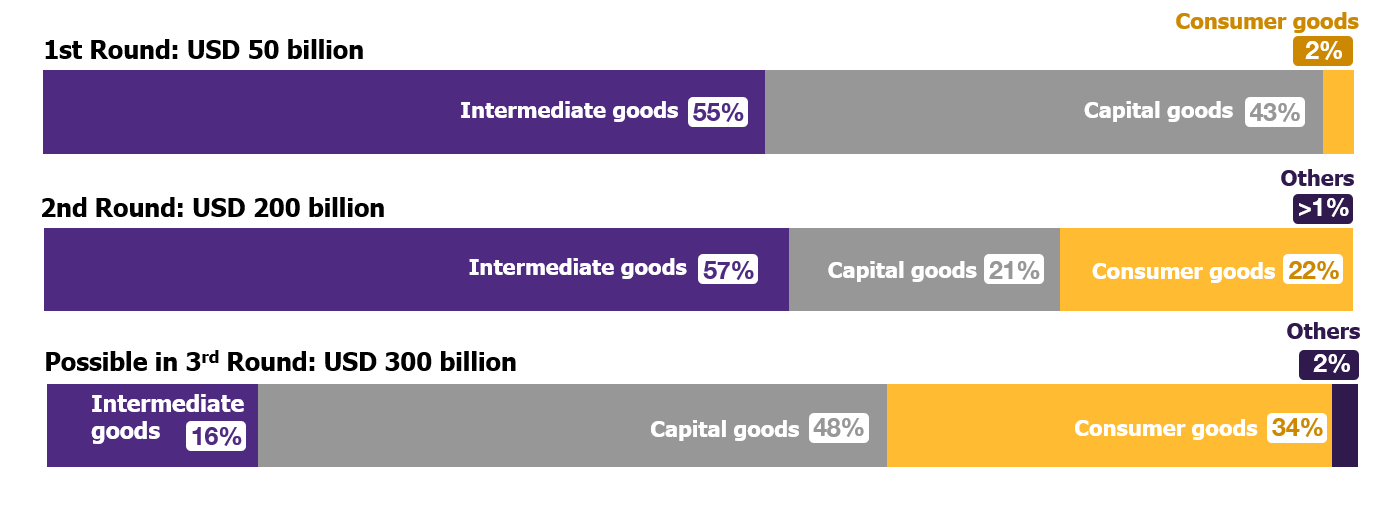

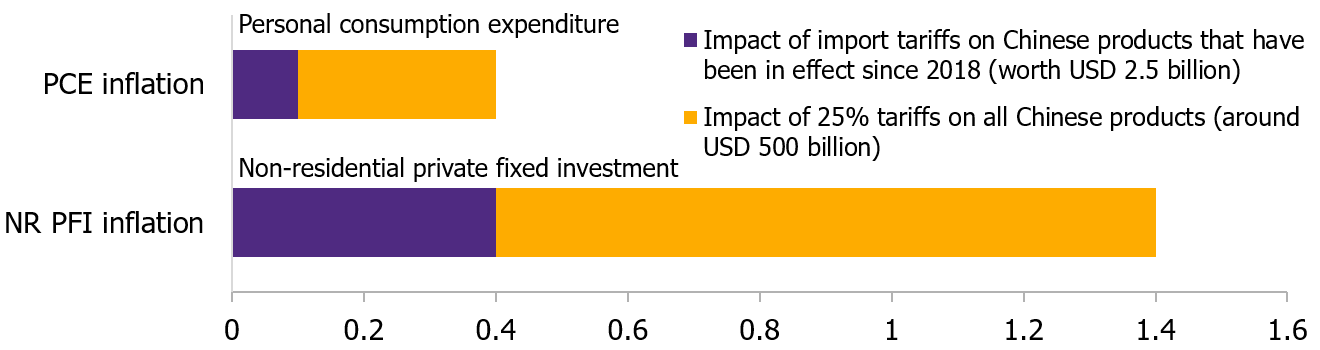

1. Remaning goods on the list has a larger proportion of consumer and capital goods than the previous round The next round of an increase in tariffs will then have proportions of consumer and capital goods as high as 34% and 48% of the total value of goods subject to the new tariffs worth USD 300 billion, respectively, (Figure 2) compared to the previous round where the largest proportion were intermediate goods. If the US decides to increase the tariffs in the next round, US consumers will likely be affected from higher prices of imports and manufacturers may have to bear higher cost of imported capitals. According to the Federal Reserve Bank of San Francisco2, the assessment on the sentivity of inflation to an increase in import tariffs on Chinese goods reveals that in the case that the US increases import tariffs on all Chinese goods on the list at a rate of 25%, personal consumption expenditure (PCE) will increase by approximately 0.4 percentage points and non-residential private fixed investment will increase by approximately 1.4 percentage points. (Figure 3) However, EIC expects that impact on inflation will have no instant and signicant implications on the monetary policy decisions of the Federal Reserve (Fed) as the Fed will have to make a data-dependent assessment before making decisions to hike the policy rate. In addition, the Fed will also consider impacts on private consumption and investment in the US which may likely slow down in the period ahead if the US were to increase tariffs on all Chinese goods on the list.

2. The process to increase import tariffs on all remaining chinese goods on the list will take at least 2-3 months before becoming effective, which may have objections along the way. This is because the USTR will have to conduct a public hearing on June 173 in order to gather opinions from businesses and the public who would be affected before the implementation. However, there may be some objections from the private sector which have implications on votes during periods before the upcoming presidential election in 2020. In particular, if there is a retaliation from China, it will affect consumers and businesses in the US. Given such reasons, EIC believes that the possibility for additional tariffs worth USD 300 billion is low. However, if the US considers that the negotiation will not benefit the US and China is likely to refuse to comply with the US requests on structural changes, an increase in import tariffs on Chinese goods worth USD 500 billion in total is still possible, depending on the outcome of the negotiation between the two parties in the next 1-2 months. If the US decides to raise import tariffs on all remaining Chinese goods on the list, the new tariffs will become effective as sson as in the third quarter of 2019.

Figure 2: If the US proceeds in raising import tariffs on remaining Chinese goods on the list, there will be a larger proportion of consumer and capital goods than the previous round.

Proportion of US imported goods subject to new tariffs by product category

Unit: % of value of imported goods from China for each round of an increase in tariffs

Source: EIC analysis based on data from the USITC (data as of May 14, 2019)

Figure 3: US inflation may rise as a result of an increase in import tariffs

Sensitivity of US inflation to an increase in import tariffs on Chinese goods

Unit: Percentage points

Note: PCE is the Personal consumption expenditure (consumer price inflation) and NR PFI is Non-residential private fixed investment (business investment goods inflation)

Source: Federal Reserve Bank of San Francisco

China retaliated with an increase in import tariffs on US goods at a rate of 5-25%, where most items are from the original list worth USD 60 billion to be effective from June 1, 2019. China’s stance and its retaliation must be carefully watched in the period ahead. On May 13, the Chinese government announced the list of items to be subject to new import tariffs totalling 5,142 items as a retaliation to the US trade protectionist measures. The tariff rates are divided into 4 tiers which are 5%, 10%, 20%, and 25%. Most items are from the original list already subject to the tarif rate of 5-10% on goods worth USD 60 billion when China retaliated the US trade protectionist measures in September 2018. However, some items on the list were left out since September 2018 such as auto parts (worth USD 700 million). The new tariff rates on US goods will be effective from June 1. In the period ahead, if the negotiation turns out unsuccessful and the US proceeds in increasing tariffs on all Chinese goods on the list, as the worst scenario, China can no longer retaliate by increasing import tariffs on a larger number of US goods. This is because Chinese imports of US goods in 2018 only accounted for USD 120 billion, while there are only USD 10 billion worth of goods that are not subject to the new tariffs. EIC views that next options for China is to use non-tariff measures as retaliation. Three options include the followings.

1) File another complaint to the World Trade Organization (WTO). If the US were to put up full tariff barriers against China, China may see this as a violation against basic principles of the WTO such that it prohibits discrimination by putting up tariff barriers on all Chinese goods. However, such option can be a time-comsuming and prolonged process. In the past, China has filed several complaints on trade disputes. The latest are complaints against the US since April 5, 2018 regarding an increase in import tariffs on steel and aluminum, and since August 27, 2018 regarding an increase in import tariffs on Chinese goods in accordance with Section 301 of the US Trade Act, which is considered unfair for China. These complaints are currently under the investigation.

2) Delay purchases of US treasuries or sell existing holdings. This will be an indirect retaliation which may cause US yield to surge. Currently, China is the largest holder of US treasuries, with holding value as high as USD 1.13 trillion (data as of February 2018). If China sells large volume of US treasuries, this will trigger costs of funding in the US to rise. However, China will be affected also through volatile asset prices and exchange rates in the global financial market. Thus, this may not be the best retaliation option for China.

3) Limiting the scope and creating difficulties for US businesses operating in China, as well as reducing the number of Chinese tourists allowed to travel to the US. US firms and businesses in several industries operating in China may be in a difficult situation. If the trade war becomes intensified and worsen to the point that China begins to use elimination measures as well as campaign against travelling to the US for the Chinese. Chinese tourists, whose travelling costs worth several USD billion per year, will pose an impact on businesses in the US, as similarly happened to Japan and South Korea in the past. If China chooses to use non-tariff measures against the US, this may worsen the disputes between the two countries.

EIC views that the possiblility for China to go for such an extreme retaliation is low and both countries are likely to continue negotiating to find a trade agreement until the end of 2019. This is because if both countries continue increasing tariffs against each other, it will only yield a negative impact on all parties. Also, both countries will start to face impacts from the trade protectionist measures and the ongoing trade war will begin to adversely affect the economic and investment conditions, particularly China that is facing an economic slowdown. Meanwhile, for the US, President Trump will likely cool down the severity of the trade war before the beginning of the period for presidential election in 2020, so that the impact from the trade protectionist measures will not be widespread and become a burden for manufacturers, consumers, and farmers, who are voting bases for the Republicans.

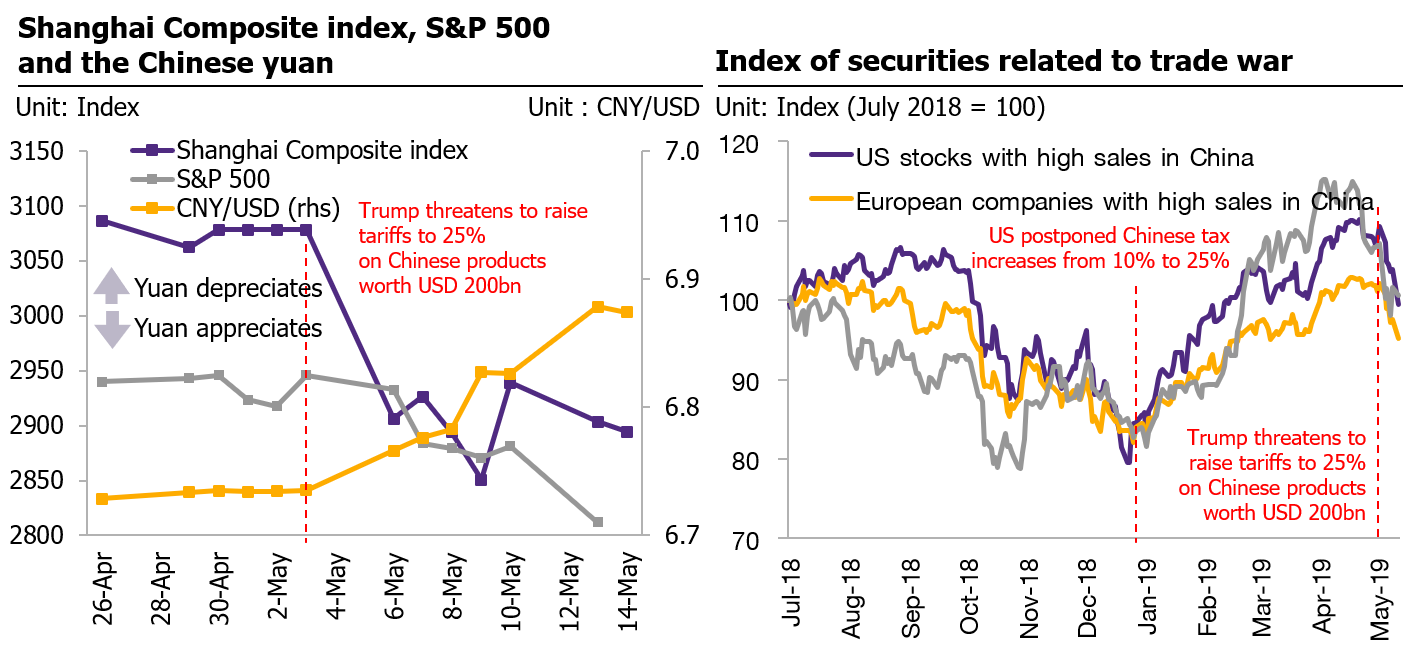

Uncertainties surrounding trade and investment started to heighten, resulting in a negative response of the global financial market, especially the Chinese market. Since President Trump posted a threatening message to raise import tariffs on 5 May, global financial market became volatile and returned to the risk-off sentiment, driven by concerns over the US-China trade war. On May 14, the US financial market (S&P500) dipped 2.8% and the Chinese financial market (CSI300) dropped 6.42%, while the USD index (DXY) weakened by 0.05% and the comparison between Yuan to USD (USDCNY) weakened by 2.06% (Figure 4). Moreover, overall global financial market responded and continued to have a negative reaction, particularly assets that are likely to be directly affects such as securities of US companies with high sale volume in China and securies of Chinese companies with high sale volume in the US. If the trade war continues to escalate, this will cause financial condition to be tighter than expected due to market correction and a fall in asset prices. However, Thai baht is considered one of the safe haven assets for investors, similar to the Japanese yen, for Thailand’s strong external position. This resulted in a stronger THB by 1.23% during May 5 to May 14. EIC still holds our assesment that the baht will stay within range of 31–32 THB/USD from the middle to the end of the year. Supporting factors come from current account surplus which is likely to remain high in 2019 at around 6% to GDP, low headline inflation averaging at 0.9%, and strong external stability, despite facing risks from uncertainties of trade war in some periods.

Figure 4 : Financial markets’ responses to the US-China trade war were largely negative, both in stock and foreign exchange markets.

Source: EIC analysis based on data from Bloomberg (data as of May 10, 2019)

Impacts on the Thai economy

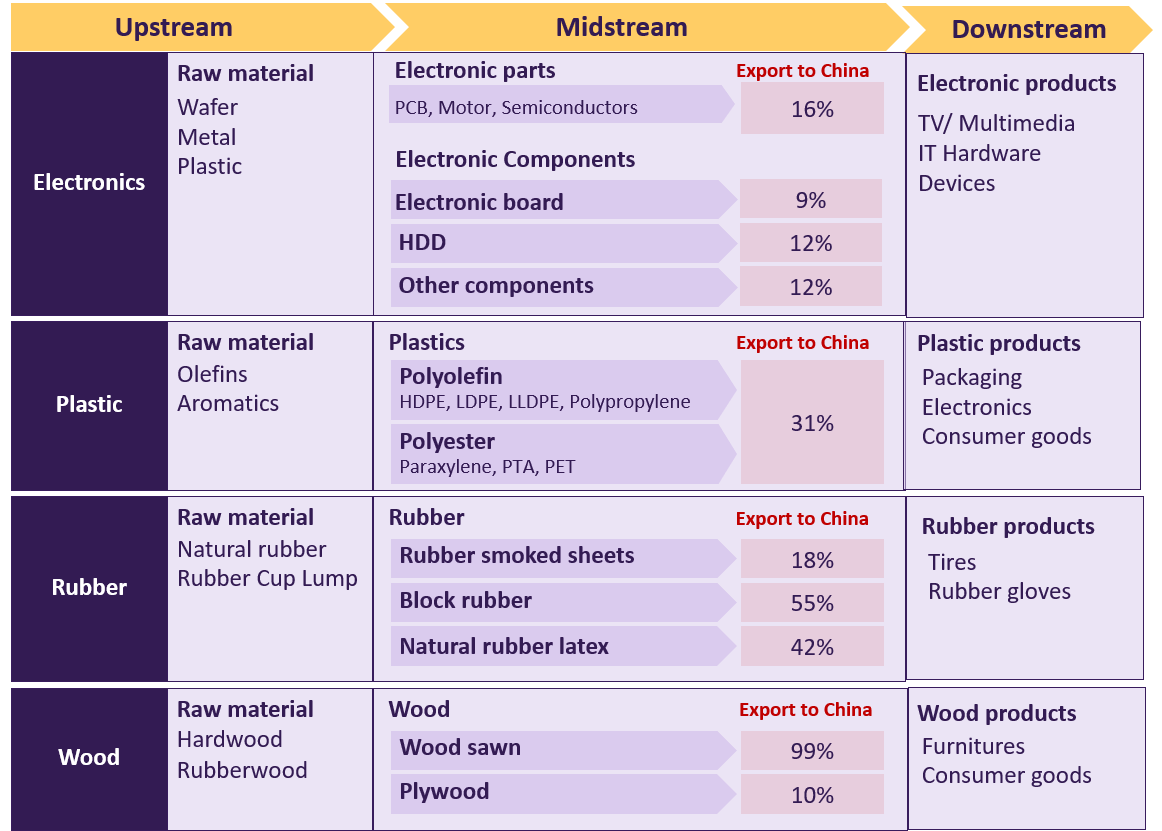

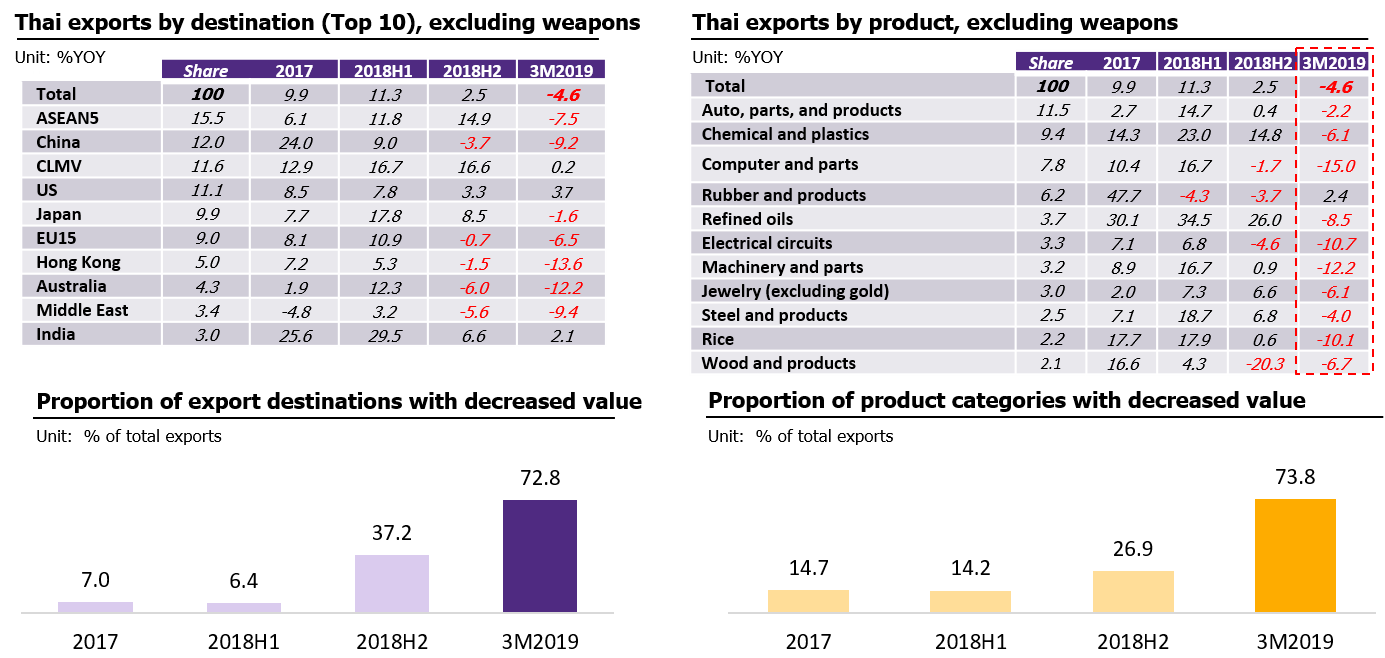

Amid the heat up of the US-China trade war, Thai exports could face both direct and indirect impacts through China’s supply chain and reducing global trade, should China and global economies worsen. The impacts from ongoing trade war on Thai export sector can be categorized into 2 channels. 1) Direct impact on Thailand’s role in China’s supply chain of exports to the US. The majority of Thai goods linked to China’s supply chain are computers and parts, electrical circuits, wood and wooden products and chemical products. Exports of these products, since the first trade restriction imposed in August 2018 up until March 2019, have fell by 23.6%, 30.6%, 36.1% and 75.9%, respectively, and as the trade war prolongs, growth of these exports are unlikely to recover. From the list of Chinese goods worth USD 250 billion facing new 25% tariff rate, Thai exports that are most likely to be affected are primary and intermediate goods such as electrical parts, plastics, rubber and wood (Figure 5). Based on the value of Thai exports in 2018, the estimated impact from the trade war on above 4 categories of exports is at 2.1% of total exports or USD 633.7 million. 2) Indirect effect from slowdown of China and trade partner economies as domestic consumption of partner countries falls. As a result, Thai exports are likely to be affected with respect to both product type and export markets like in Japan, Australia, and EU15 and ASEAN5 (Figure 6). Given that trade war persists and pace of global recovery slows in the latter half of this year, EIC believes growth of Thai exports may miss EIC’s 2019 projection of 2.7%. Thus, Thai businesses and exporters that are reliant on the Chinese market will need to keep close watch on the US-China trade war, in particular, downside risks caused by prolonged US-China trade negotiations and expansion of US tariff imposition on all Chinese goods.

Dumping of cheap Chinese goods should be closely watched to protect domestic industries, especially steel, from the impact of US-China trade war. Since March 2018, the US has imposed a 25% tariff on steel imports from almost all countries in order to protect and promote its steel industry in accordance with section 232 of the Trade expansion act of 1962. Later, the US imposed additional tariff on Chinese steel at a rate of 10% in September 2018 and raised it to 25% on May 10, 2019 as steel imports are among goods targeted under the USD 200 billion list. As a result, Chinese steel exports lost their price advantage in the US market, and fewer steel will be exported to the market going forward. Although, the Chinese government plans to increase domestic use of steel via infrastructure investments as well as cut steel capacity as part of its plan to curb excess output in heavy industries like steel and coal, some of the excess output may still be dumped into markets in the short-run, where protectionist measures are not yet imposed. Thailand may be among targeted countries, whereby the specific types of iron and steel products exposed to dumping are bars and rods (HS7215), wire (HS7217), sheet piling (HS7301), seamless tubes and pipes (HS7304), springs (HS7320). As inflows of cheap Chinese steel will put pressure on domestic prices and hurt domestic exporters and producers who cannot adequately adjust costs of production, these should be closely watched. Nevertheless, existing anti-dumping tariffs on some steel products such as open seam tubes and pipes (HS7306) should lower risk of dumping in those product categories.

Figure 5: The trade war continues to have strong negative impact via China’s supply chain as majority of Thai exports contributes to the chain.

Source: EIC analysis based on data from the Ministry of Commerce (data as of 2018)

Figure 6: Slowdown in trading partner economies will lower value of Thai exports in vaious markets and product categories.

Source: EIC analysis based on data from the Ministry of Commerce

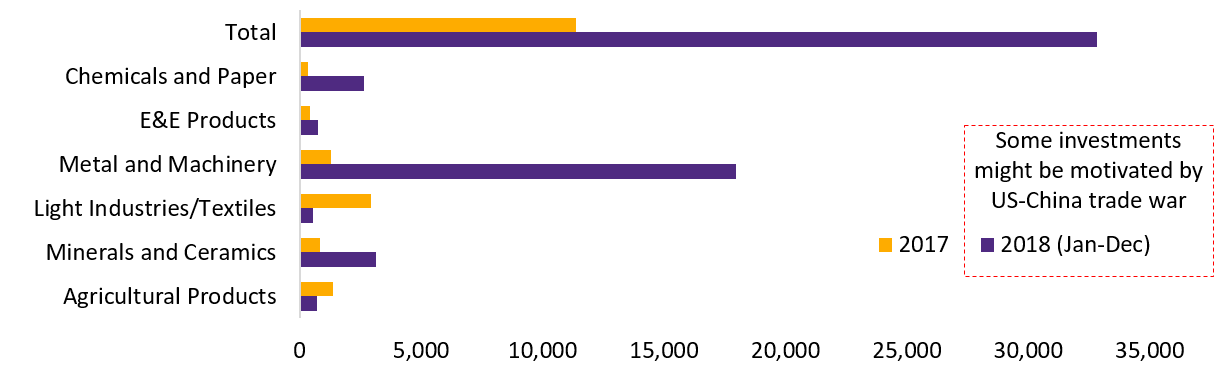

EIC views that although Thai exports face increasing risks from the trade war, Thailand may still gain from increased export opportunities to China and the US, cheaper imports as a substitute market for imports facing higher tariffs, as well as relocation of production base from China to Thailand. As the US cuts down on imports of electronic parts, electrical circuit, and hard disk from China, this offers an opportunity for Thailand exports as the US seeks for import substitutions. At the same time, Thai exports of agricultural products, fresh fruits, frozen and processed food, ready-made food and chicken can also replace US imports to China as Thailand is already a major market supplier in many markets around the world and thus have strong capacity in production. Regardless, Thailand will be competing with similar exporters such as Vietnam and Malaysia and thus benefits arising from trade war may still be limited. Furthermore, ASEAN countries may also gain from a change in China’s investment plans as Chinese businesses consider expanding their production base outside the country to reduce impactd from the tariffs. Thailand are among possibilities that China may use as export production base for the US market and according to data from Thailand’s Board of Investment (BOI), the amount of Chinese investment granted BOI promotion privileges already saw an increase in 2018. Chinese businesses relating to steel, machinery and transportation equipment industries that were top among BOI applicants (Figure 7) are also producers of some of the Chinese products most strongly affected by the US tariffs. These Chinese manufacturers, however, have multiple relocation options. Thus, Thailand needs to be competitive to lower risk of diverting investment into neighboring countries like Vietnam, which already has several FTAs, in particular, the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and EU-Vietnam Free Trade Agreement (EVFTA). Moreover, geographically, Vietnam is closer to China, has cheaper labor costs and is already the manufacturing base for many electronic products like television and mobile phones. Given so, relocation opportunities for Thailand may be limited to products where the country has manufacturing advantage such as rubber and electrical parts industries.

Figure 7: Thailand may have short-term gains from production relocation from China

Value of Chinese investment that have been granted BOI promotion privileges.

Unit: THB million

Source: EIC analysis using data from Thailand board of investment (BOI)

Ongoing US-China trade war will likely have increasing impacts on Thai exports going forward. Thai businesses are recommended to diversify export markets, take advantage of existing trade agreements and hedge against foreign exchange risk. Global economies, especially the US and China, will be negatively affected if trade talks are unsuccessful and tensions escalate further towards an imposition of tariff on all China and US imports. The IMF estimates the rate of impact from the trade war on the US and Chinese economies at 0.2% and 1.16%4, respectively. As such, value of Thai exports in USD term for 2019 may come lower than the expected rate of 2.7%. However, assessments of further development is still required. For businesses and exporters in Thailand, they should diversify risk by expanding into new markets with growth potential like CLMV and India. Moreover, businesses should take advantage of the several FTAs to expand markets in countires that still have low trade value than expected trade values such as South Korea, New Zealand and Peru. Businesses should also safeguard against foreign exchange fluctuations, in particular those using the Yuan, as the Yuan per USD exchange rate may depreciate further given that trade war persists and continues to affect Chinese economy going forward.

1 More info on EIC Flash: The US-China Trade war heats up with the new USD 200 billion tariffs on Chinese goods (19 Sep 2018)

2 Data from the Federal Reserve Bank of San Francisco, “Inflationary effect of trade disputes with China”, Febuary 25, 2019

3 Data from the Office of the United States Trade Representative (USTR)

4 Data from the IMF, “World Economic Outlook: Challenges to Steady Growth”, October 2018, which estimates impact on US and China’s GDP without taking into account effects from domestic monetary policies response to minimize impact.