First-home stimulus measure may have limited impact on Thailand’s housing market.

The Thai government has released a housing stimulus measure which grants personal income tax allowance for buyers of first homes worth up to 5 million

Author: Nopphamas Houbjaruen

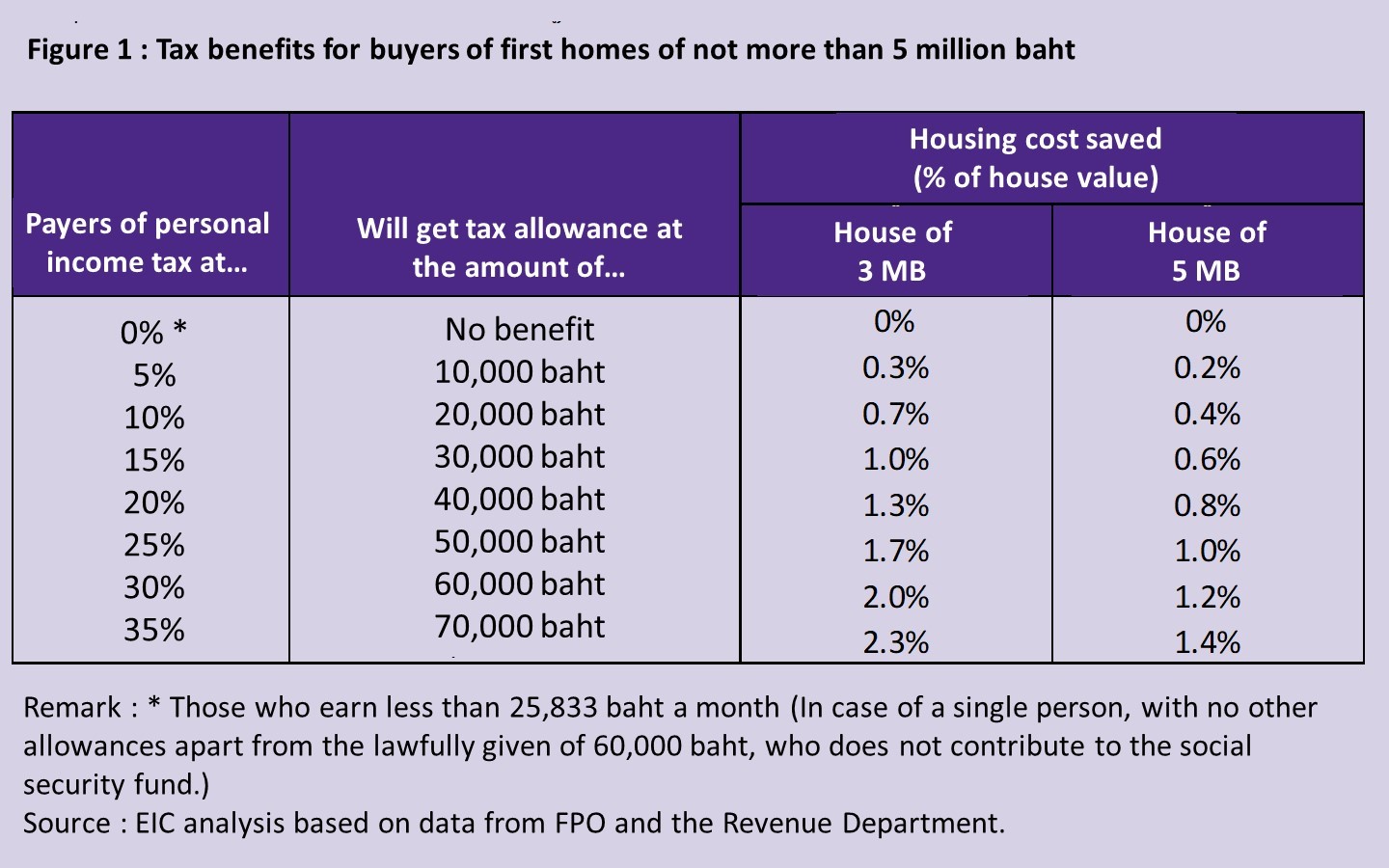

| The Thai government has released a housing stimulus measure which grants personal income tax allowance for buyers of first homes worth up to 5 million baht during April 30-December 31, 2019. This measure will help reduce housing costs based on the personal income tax rate of each purchaser. Although houses with the prices under 5 million baht are account for about 80% of the residential properties in the market today, EIC expects the benefits from this measure to be rather insignificant as (1) the stimulus is limited to the first home buyers, (2) the latest tax privilege being granted has lower degree and shorter runtime than the measures in the past, (3) housing loans from financial institutions are becoming more strict especially with the new LTV criteria, and (4) the household debt is still high while household income expands poorly. Nevertheless, residential developers may take this opportunity to offer more sales promotions to attract home buyers who gain from the new government’s measure in order to run down their unsold complted units |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EIC expects the positive impacts on Thailand’s housing market from the 2019 housing stimulus measure to be rather insignificant. The projection of the value of the country’s housing ownership transfer in 2019 remains with 10% downturn. Although the given tax allowance for first homes spending could help minimize taxpayers’ housing expenses, the advantage gained by the overall housing market could be low due to the following reasons:

The measure supports the sales of houses of under 5 million baht which are account for over 80% of the unsold residential properties in Bangkok metropolitan region, but may not ease the number of the unsold units much.

Property business owners with a large number of unsold houses of under 5 million baht could offer more promotions to attract buyers who benefit from the government’s measure. |

|