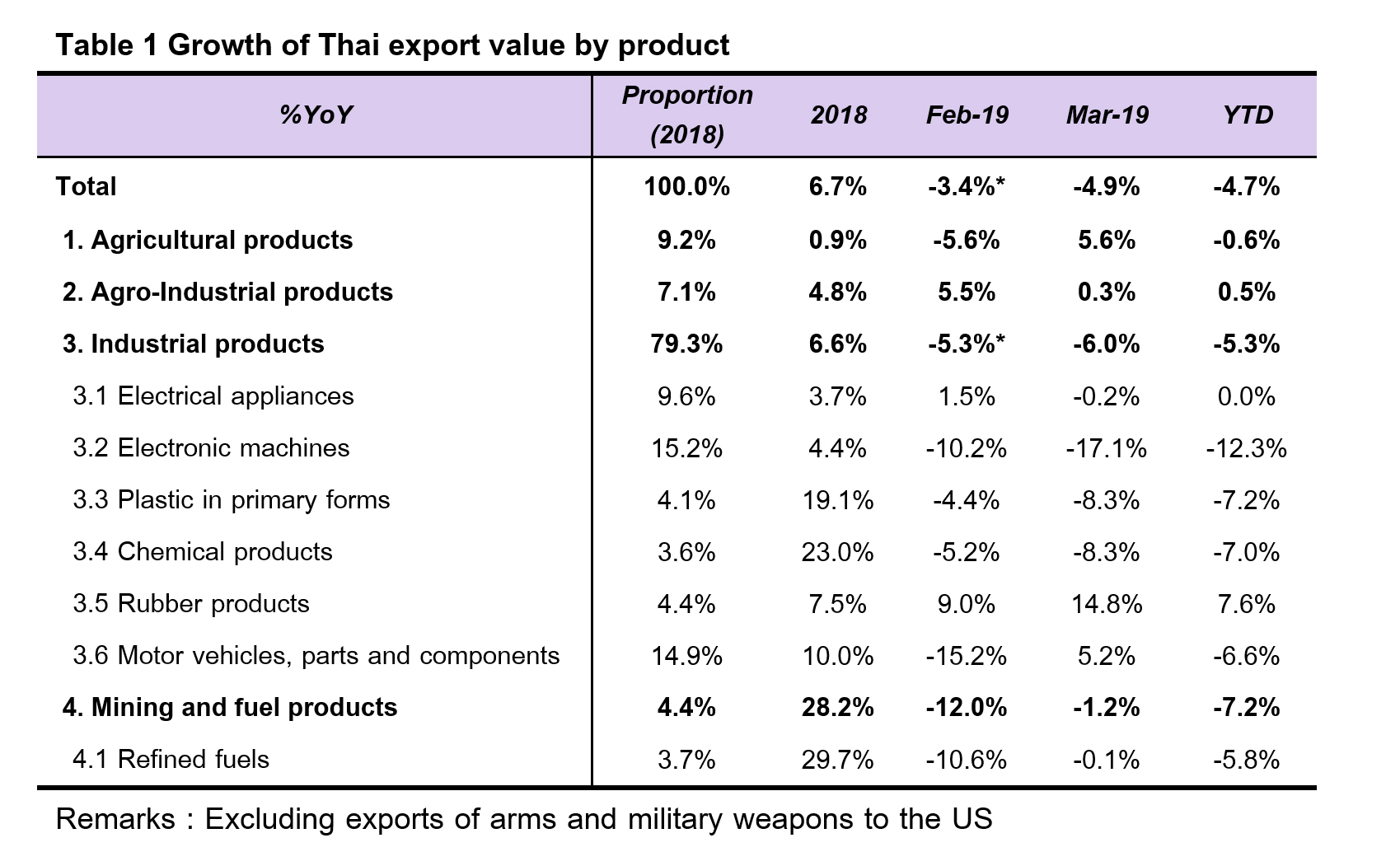

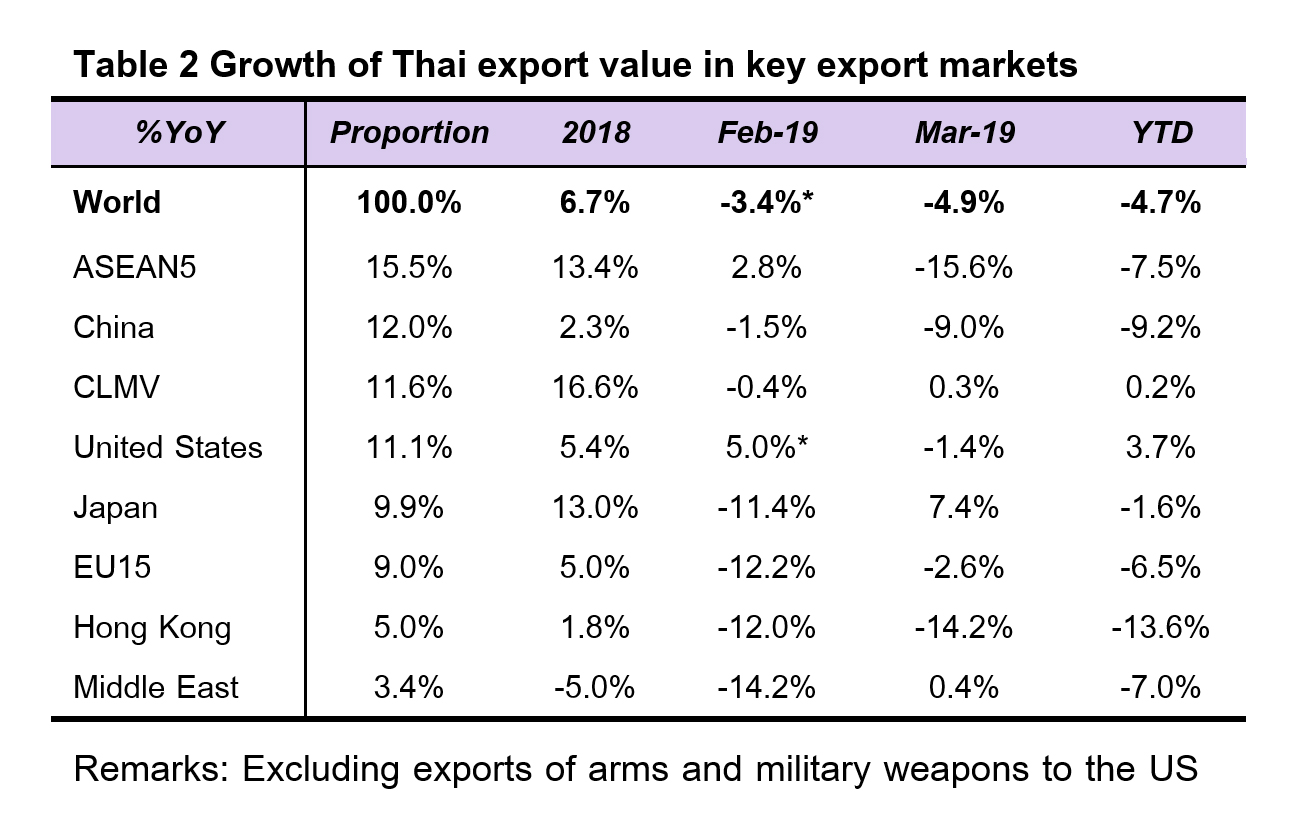

The value of Thai exports dropped by -4.9%YOY in March 2019, a contraction continuing from February 2019 with -3.4%YOY growth (excluding one-time shipments of arms and military weapons sent back to the US). As a result, declining export growth in March 2019 registered a 5 consecutive months drop. Major products faced with export value reductions were computer – parts and components (-20.0%YOY), electronic integrated circuits (-21.7%YOY), and machinery and parts (-19.5%YOY). Similarly, key agricultural products with declining export growth were sugar (-23.0%YOY), rice (-7.7%YOY), and cassava (-9.4%YOY) (details as per Table 1). With such regards, Thai export value in the first quarter of 2019 dropped by -4.7%YOY (excluding arms and military weapons shipment to the US). Meanwhile, Thai import value continued to drop by -7.6%YOY, due to lowering growth in capital goods import in the categories of airplanes, gliders – parts and components and gold with growth declines of -71.7%YOY and -51.1%YOY, respectively. As such, Thai import value in the first quarter of 2019 dropped by -4.4%YOY (excluding imports of arms and military weapons for warfare drills during January).

No indication of Thai export recovery

- Thai export value contracted on a more broad-based level. Proportions of markets and products with Thai export contraction increased significantly, especially when compared between the proportion during Q1-2019 and Q4-2018 (Figure 1). Worsening figures reflected prolonged descending trends in global trade that became more widespread, as a result, no indication of Thai export rebound is present.

- Exports of Thai products that are part of China’s supply chain targeted for export to the US are still undermined by US’s tariff increments. Exports of key products to China in categories of 1) Computer – parts and components, 2) Electronic integrated circuits, 3) Wood – wood products, and 4) Chemical products continued to drop in March 2019 by rates as high as -37.6%YOY, -45.2%YOY, -29.3%YOY, and -15.5%YOY, respectively. The mentioned rates were on par to the rates in the previous period, reflecting that the impact from trade war still exists.

EIC revises down export growth in 2019 to 2.7% from the previous forecast of 3.4% due to various factors including :

- Slower than expected economic growth of major partners in line with IMF WEO’s latest report, which revised down global economic growth in 2019 to 3.3% from the prior estimate of 3.5%.

- Average 2019 crude oil price tends to drop when compared to the price in the previous year (EIC forecasts average crude price reduction of -7%). As such, declining crude price could slowdown exports of refine fuels and chemical products.

- EIC views that during the second half of 2019, Thai export growth could recover. Economic stimulus measures implemented in various countries should help pump up economic growth amid current weakened conditions. Notable events worth mentioning are China’s economic stimulus measures and the increasing adoption of dovish stance among various central banks, which going forward should support economic growth. Furthermore, the low-base effect from the second half of 2018, a period hampered by the trade war, will help accelerate Thai export value growth during the second half of 2019.

- Risks still present in the export sector, for instance, 1) Trade war tensions could resume and 2) Slower than expected global economic growth, albeit economic stimulus measures implemented in various countries.

EIC revises down import growth for the year 2019 to 3.2% from the previous forecast of 3.6%. Imports of raw materials and export-related capital goods tend to slow. Furthermore, import growth could be suppressed by signs of dropping average crude oil price in 2019 that will impact the growth of fuel imports. As such, total import growth in 2019 should slow from 2018.

|