The future of digital TV after NBTC granted license exit opportunity

In Janaury 2019, the National Boardcasting and Telecommunications Commission (NBTC) approved in principle for recall of the 700MHz band

- In Janaury 2019, the National Boardcasting and Telecommunications Commission (NBTC) approved in principle for recall of the 700MHz band, currently being used for digital terrestrail television, for 5G development in Thailand. With this process, the two options are offered 1) switching to 470MHz bandwidth or 2) returning the digital TV license and discontinued operating.

- In consideration of strategic factors, competitiveness and financial stability, EIC expects around 4 operators to give up their licenses. These 4 discontinued operators will lead to insignificant effects on overall industry as the sum of revenues only accounts for 2% of the total digital TV ad spending and consumers still enjoy the remaining digital TV channels. At the same time, digital TV network providers will lose a minimal amount of incomes and NBTC will subsidize about 20-25 billion baht on reforming spectrum.

- However, the remaining digital TV operators will continue facing challenges from economic fluctuations, NBCT’s policies and regulations, and technology deployment. To prepare themselve for future business landscape, trends of Omni-channel, content licenses, and home shopping are arisen to contribute additional revenue and competitiveness.

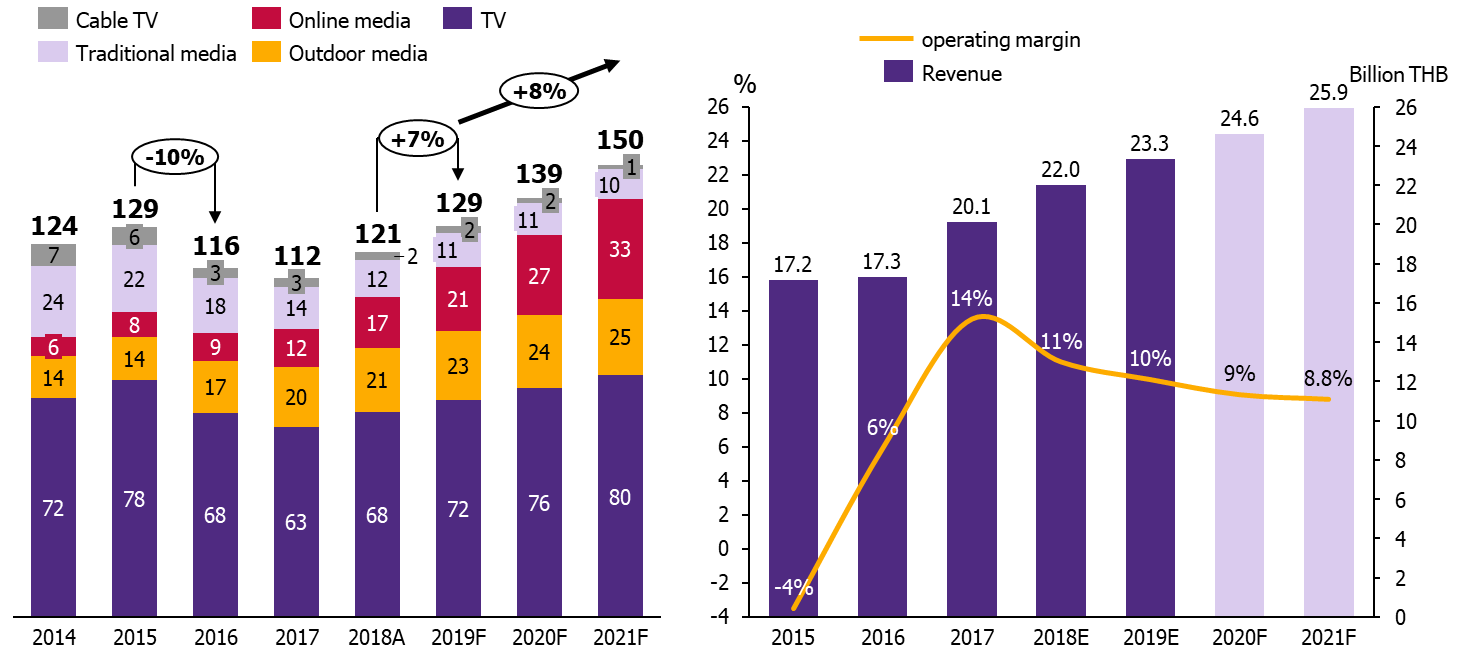

Digital TV industry encounters pressures from both revenue and cost perspectives leading to a downward trend in operating margin. TV industry currently consists of 22 digital TV channels which can be divided into 4 main categories including 1) Children and family, 2) News, 3) Standard Definition (SD), and 4) High Definition (HD). Advertising is main source of Digital TV’s revenue and it has been slightly worrisome in the past 5 years from 124 billion baht in 2014 to 119 billion baht in 2018 (-6%CAGR) in response to economic fluctuations, deceleration of purchasing power, and a shift in consumer behaviour towards TV substitutes and online media. In the middle term (2019-2021), EIC expects the advertising revenues tend to increase by 5%CAGR based on an economic recovery. Due to an intense competition between TV and online media, however, digital TV operators continuously get pressure on the creating a rich content which likely to rise operational costs and reduce operating margin from about 10% in 2019 to 8.8% in 2021. This will result in a downtrend in operating margin of digital TV business

Figure 1 : The total value of the advertising industry, and the revenues and operating margin of digital TV business

Unit : billion baht

Remark : Outdoor media includes billboards, cinema, In store, transit; Traditional media includes magazines, newspapers and radio

Source : EIC analysis based on information from Nielsen, Digital Advertising Association (Thailand) and Enlite

In January 2019, NBTC agreed to recall 700MHz bandwidth from digital TV operators for 5G development and offered digital TV operators with 2 options 1) switching to another designated bandwidth or 2) returning digital TV license and discontinuing operation.

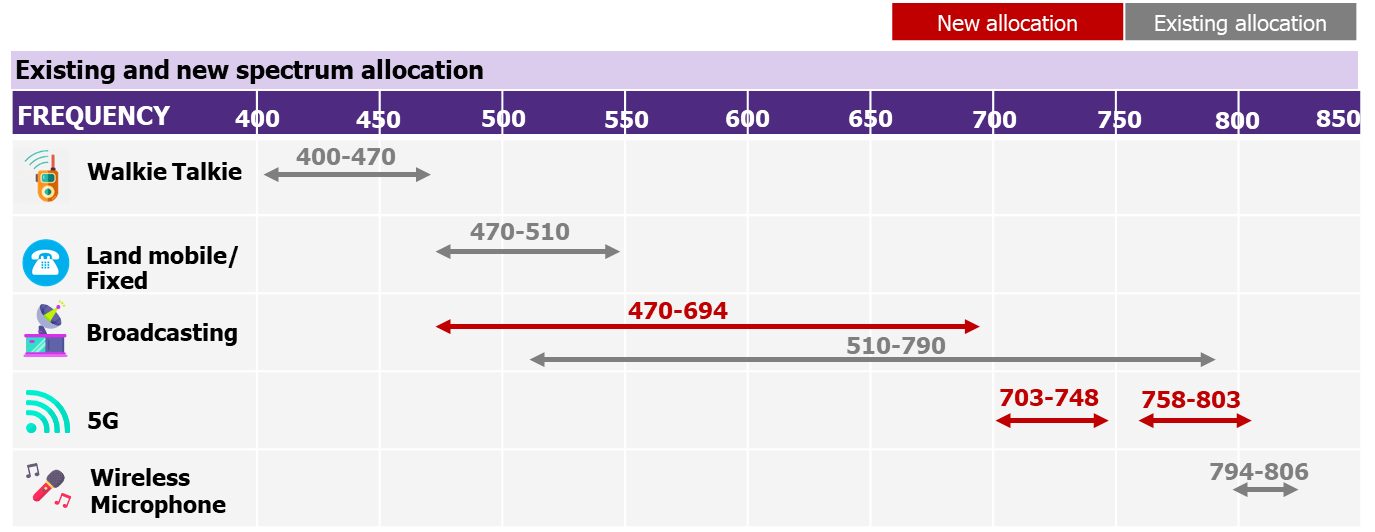

Apart from broadcasting digital TV, spectrum is also used for telecommunication network. In a transition period from 4G to 5G, the International Telecommunication Union (ITU), a specialized agency who develops standards and be responsible for information and communication technologies related issues, has identified 5G spectrum with the combination of sub-1GHz, 1-6GHz and above 6GHz. Currently, most mobile operators in Thailand hold insufficient spectrum in low frequency ranges (sub-1GHz) for 5G development and the 700MHz spectrum band has been occupied by digital TV broadcasting.

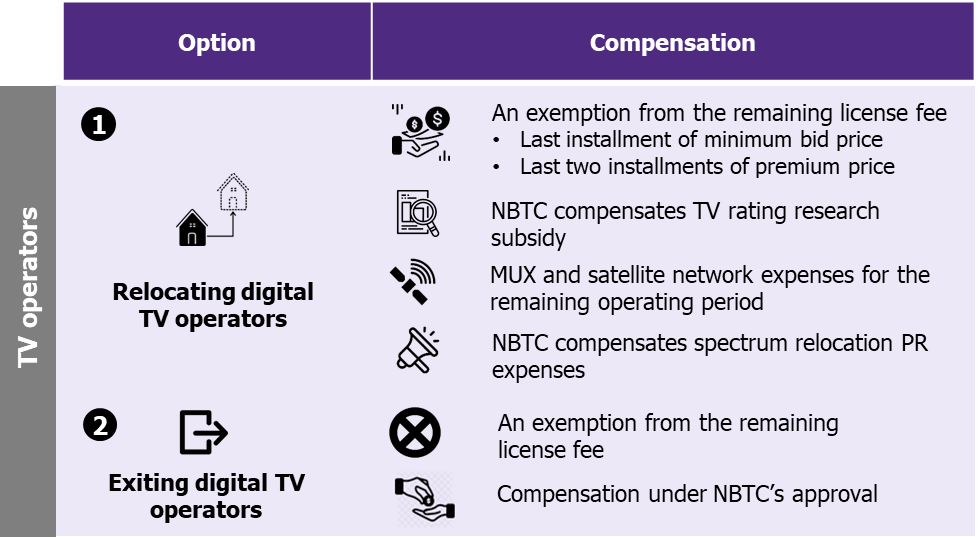

In order to resolve the situation, NBTC approved in principle for recalling 700MHz spectrum band to develop 5G technology to align with other countries such as Spain, Belgium, England, and Malaysia. The commission made the retrieve prior to the end of digital TV license which will be due in 2029 (in the next 10 years) and will allocate 470-510MHz bands for digital TV broadcasting. In process of recalling, NBTC has given 2 options for digital TV operators including 1) switching to the range of 470-510MHz bands without having to pay for the last installment of license’s minimum bid price, the last two installments of license’s premium price, rental fees for broadcasting networks (MUX) for remaining period of the digital TV licenses, TV rating research fees, and other expenses occurred from a process of transferring to 470MHz or 2) returning the digital TV license and discontinue the business by submitting a letter of intent to NBTC. With this option, the operators will be waived the license fee as same as the first option and may receive particular compensation based on NBTC’s consideration.

Figure 2 : Compensation schemes for digital TV operators

Source : EIC analysis based on information from the National Boardcasting and Telecommunications Commission (NBTC)

Figure 3 : Exisitng and new spectrum allocation in Thailand

Unit : Megahertz

Source : EIC analysis based on information from the National Boardcasting and Telecommunications Commission (NBTC)

EIC expects around 4 digital TV channels to return licenses in consideration of 3 main factors; strategy, competitiveness and financial stability. Based upon the failed case of Thai TV and overseas case studies, there are 3 factors derived as main criteria in determining potential returning digital TV operators. That are 1) strategy comprised of TV program content, multi-screen strategy which allows viewers to enjoy the contents via the channel’s website, YouTube or Facebook on top of TV screens, and partnership. 2) competitiveness measured by ratings (share of viewership) and 3) financial stability reflected from revenue growth, operating profit and debt to equity ratio.

Accordingly, EIC expected around 4 digital channel operators to return their license that are 3 news channels and 1 children and family channel. It is found that their content failed to win target consumer has reflected low ratings compared to competitors resulting to continually decrease revenues and operating margin. Moreover, operators holding mutiple licenses may gain more benefit than other players in term of operation cost if returning some of their licenses. With a waive of the remaining license fee payments, it could lead to improve their profitability in the future.

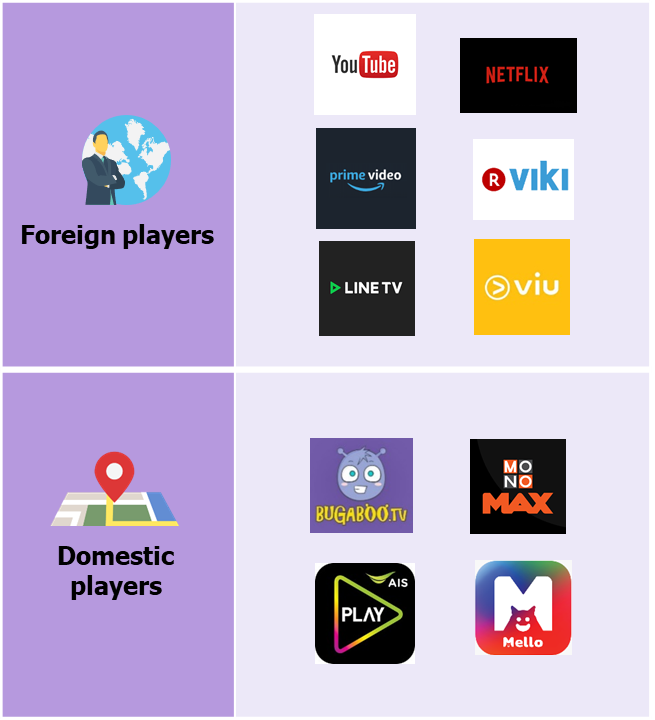

The returning of digital TV licenses may not significantly affect the overall industry and the consumers as advertising revenue of those 4 digital TV channels only accounts for 2% of the total digital TV advertising spending and consumers still have alternative media for the exiting digital TV channels. Advertising spending on the exiting digital TV channels is expected to allocate to the remaining digital TV channels and/or online media. The license returning process may take place during February 2020 to December 2020 and the effects from such movement will occur in 2021. EIC projects the total value of ad revenues of the 4 digital TV channel operators, who are likely to hand back their licenses, to be around 1.2 billion baht or just 2% of the total digital TV ad spending in the industry that may have insignificant impact on the overall TV industry. This amount of ad revenues will be allocated to the remaining digital TV operators, particularly the channels under the same owner of exiting ones (in case an operator owns more than one digital channel) and the channels with similar content types and target viewer group. Beside digital TV operators, ad revenues can be allocated to online media that is over-the-top platform (OTT). Based on Nielsen’s survey on Thai consumer behavior, viewership for online platforms grew significantly. More than 80% of viewers preferring rerun contents and spending an average of 58 minutes per day watching. This has encouraged advertising companies and product producers to put more budget in OTT advertising.

In terms of consumers, the license returns and the ends of some digital TV channels will have modest impact as those channels have low channel ratings. Nevertheless, fewer channels for news and children and family contents could lead to the issue of content diversity that need further attention.

Figure 4 : Over-the-Top platform (OTT) Providers in Thailand

Source : EIC analysis based on information from Nielsen, BEC, AIS and MONO

In addition, EIC expects that digital TV network providers may slightly lose their incomes from the exiting digital TV operators about 40 million baht per year per operator while NBTC may have to subsidize approximately 20-25 billion baht on reforming spectrum. The digital TV network providers (MUX) including ThaiPBS, TV5, the Government Public Relations Department (PRD) and MCOT are likely to earn less incomes from their network operations in the remaining 10 years around 2.5 billion baht. As the 4 digital TV operators are currently using different network providers, the loss of income effect will be at around 40 million baht per operator per year, about 8-12% of the total digital TV network rental revenues. Hence, the impact should not be too high.

For the license returned, NTBC will be benefial with a lower expense. The compensation for the 4 digital channels will be around 1.6 billion baht which higher than the total of NTBC’s incomes of about 180 million baht from the annual license fees earning from these channels in the coming decade. Combined with the relocation of the remaining 18 digital TV channels to the band of 470MHz, NTBC will have to compensate around 20-25 billion baht. This amount will come from the 900MHz bandwidth auction in 2018 and Broadcasting and Telecommunications Research and Development Fun for the Public Interest (BTFP). However, NBTC has estimated the incomes from the coming auction of 700MHz spectrum band retrived from television operations will be more than 75 billion baht.

Nevertheless, the remaining digital TV opeators will continue to face 3 challenges from the economic fluctuations, NTBC policies and regulations, and advanced technology. EIC has found that 1) The correlation between economic condition and advertising budget is as high as 70%. In case of an slowdown economy, a business owner will cut down advertising budget, leading to a decrease in digital TV operators’ advertising revenue. 2) A change or a new of NTBC’s policies or regulations will directly affect income and the profit of the digital TV operators. For instance, a restriction of digital TV advertising time to maximum 12 minutes per hour during primetime and 10 minutes per hour per day on average are likely to pull the incomes of the digital TV operators down, and 3) Advanced technology could lead to consumer bahavior transformation. A growing in the number of online and offline media channels will offer more options for consumers, resulting in changing behaviors pattern. Therefore, the digital TV operators should prepare and adjust accordingly to current and future competition.

Omni-chnnels, content licensening and home shopping are seen as important tools to generate revenue and competitiveness of digital TV channels in the future. Nowadays, EIC has seen these emerging trends in some of digital TV operators. Aparting from an importance of content quality that should meet the needs of target consumer, a study by McKinsey and EY indicated that omni-channel, the seamless online and offline integration, can help creating an ecosystem of the whole media business and enhance the opportunity to engage with more audiences. For instance, Amarin TV has been connecting its business strategy with other four media, including online, print, event and customized activities for brands, to increase its ability to reach more target consumer and provide advertising packages through 5 media in hand.

Also, BEC adopts content licensening strategy by being partner with JKN to be an official distributor of up to 70 TV contents overseas such as Middle East and Latin America and content licensing revenue surged 300%YOY in 2018. Besides, CBS, a TV channel in the United States, has applied the same strategy and expanded overseas market increasing revenue 33%YOY to 1.2 billion U.S. dollars in 2017. On the other hand, RS has altered its main business focus to “health and beauty”. The company utilizes Channel 8 and other media in hand to advertise products through “Shop 1781” program. With this strategy, RS was able to generate revenue of 2.1 billion baht in 2018 or about 60% of the total revernue. These three emerging trends, thus, are believed to increase competitiveness and provide future opportunities.