An inside look at the M&E industry – growth drivers and trajectory in 2019

An inside look at the M&E industry – growth drivers and trajectory in 2019

Author: Olan Aeovithayasupon

-

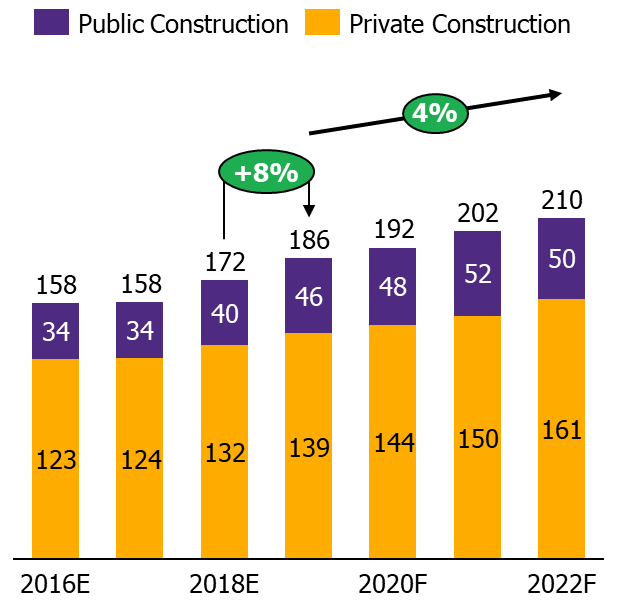

Mechanical & Electrical (M&E) servicing or building service engineering refers to building utility systems services including electrical, plumbing, and ventilation systems. EIC foresees that in 2019, the M&E industry will benefit from a positive construction momentum, both from public and private projects, with estimated 8%YOY growth to a market value of THB 185 billion. Meanwhile, in the medium term (2020-2022)., the M&E industry is projected to continually grow by 4%CAGR.

-

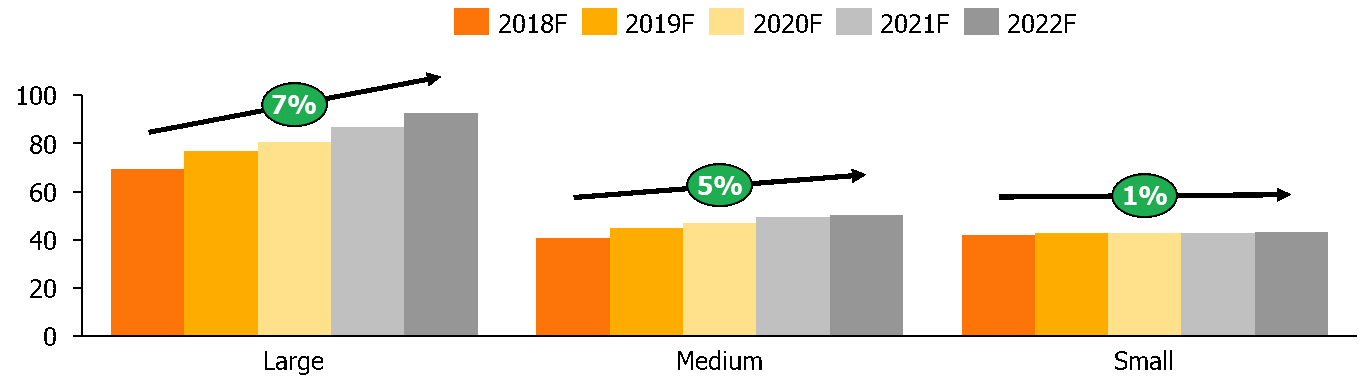

In the medium term, large M&E contractors have the highest growth opportunities with revenue expecting to rise by 7%CAGR, a benefit from the virtue of transportation megaprojects. While mid-sized M&E contractors should see revenue growth of 5%CAGR in the same period driven from prospects of new office buildings in the Bangkok area, as the current occupancy rate already reached 90%. Lastly, small-sized M&E contractors should see only a 1%CAGR revenue growth due to fierce competition in the circle.

-

To deal with soaring future workload successfully, M&E contractors should have readiness in 3 aspects; human resource, working capital, and backlog management.

EIC expects that the M&E industry will expand by 8%YOY to THB 185 billion with prospects of 4%CAGR growth throughout the medium term (2020-2022). Going forward, the M&E industry will be driven mainly by the growth of construction projects from both public and private sectors. In 2019, The M&E work in private construction accounts for 75-80% of total M&E market or valued at approximately THB 140 billionwith opportunities for 5%CAGR growth in the medium term. Positive private construction outlooks stem from prospects of new buildings such as office buildings and residential projects. For office buildings, new supply is expected as the current occupancy rate of office buildings are as high as 90%. As for residential projects, large developers are eyeing new mixed-used projects from anticipated high returns coupled with continuing trends of condominiums along the electric train route. On the other hand, In 2019, the M&E work in public constructionaccounts for only 20-25% of total M&E market or valued at approximately THB 45 billion. Though public construction M&E reaps a small portion of the M&E market, its growth potential is higher than private construction M&E. The public construction M&E market is forecasted to grow by 6%CAGR in the medium term driven by various megaproject initiatives such as airports, seaports, and electric/double-track stations. These megaprojects would need investments of more than THB 200-400 billion per year throughout the medium term.

Figure 1: The value of the M&E industry is expected to expand by approximately 8%YOY in 2019 with continual 4%CAGR growth in the medium term (2020-2022).

Unit: Billion THB

Source: EIC analysis based on information from NESDB and Ministry of Transport

M&E growth supports the revenue increments of 3 types of M&E contractors with potential growth in the range of 1-7%CAGR throughout the medium term. According to a study with a sample size of 2,400 M&E contractors worth 85% of total market, M&E contractors can be categorized into 3 distinctive types according to type of work and revenue – large, medium, and small. 1) Large-sized M&E contractors with annual revenue more than THB 500 million, these companies specialize in projects involving large buildings such as condominiums, commercial buildings, factories, and even megaprojects, 2) Medium-sized M&E contractors with annual revenue in the range of THB 75-500 million, these companies also handle systems in large buildings, but do not have the capacity to handle megaprojects, and 3) Small-sized M&E contractors with annual revenue under THB 75 million, scope of work includes single detached houses, townhouses, small buildings, and subcontract work from large and medium M&E contractors.

EIC projects that in the medium term (2019-2022), the revenue growth of the mentioned M&E groups will increase according to M&E work growth. From 2019 to 2022, large M&E contractors should see the healthiest revenue increment of 7%CAGR with anticipated revenue of THB 93 Billion in 2022, as they have the capability to handle megaprojects. Meanwhile, mid-sized M&E contractors will see revenue growth of 5%CAGR in the same period with projected revenue of THB 50 Billion in 2022, driven by growth of large-scale commercial buildings. Lastly, small M&E contractors would see only 1%CAGR revenue growth with expected revenue of THB 43 Billion in 2022. Competition among small M&E contractors is the most extreme reflected from the number of newly registered small M&E contractors that increases continuously by more than 1,000 companies per year.

Figure 2: Revenue generation potential of the 3 M&E contractor groups should grow according to increased M&E workload (2018-2022)

Unit: Billion THB

Source: EIC analysis based on information from BOL-ENLITE

Additionally, business models is one of the critical element to help shape M&E revenue potential. M&E contractors with specialized services see 15% higher growth compared to M&E contractors who provide more general services. There are 2 main business models for M&E contractors, which are One-Stop-Service (OSS) with capability of servicing electrical, HVAC, and plumbing services and Work Package Contractor (WPC) with specialized in particular service. According to a study regarding revenue generation and M&E business model selection, WPC M&E contractors see revenue growth of 17%CAGR during the past 5 years, especially for those specializing in complex services such as smart grid systems and communication systems. Meanwhile, OSS M&E contractors gained only 2%CAGR revenue growth, a growth rate equating to the overall M&E sector. However, OSS M&E contractors have a competitive advantage in bidding projects, as they have more expertise in calculating total project costs and have bargaining power when dealing with suppliers as they usually order supplies in bulk.

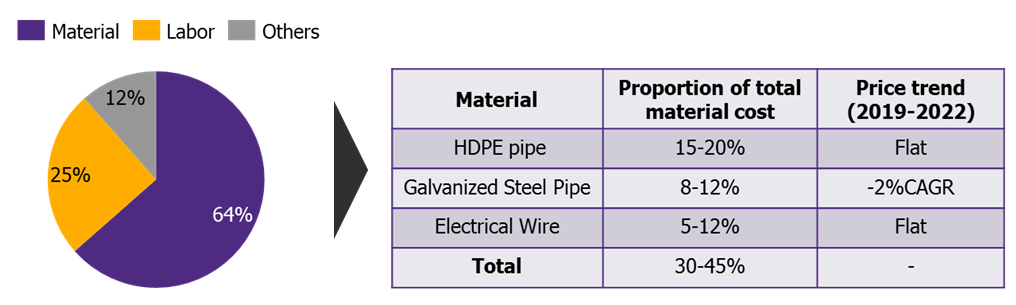

Operating costs projected to increase by 5%CAGR in the short term, similar rate as revenue growth. Operating cost for the M&E business include materials, labor, and other expenses with an overall proportion of 65%, 25%, and 10% of total costs, respectively. The main materials used in M&E systems are galvanized steel pipe, high density polyethylene (HDPE) pipe, and electrical wire. The 3 mentioned materials together account for 30-45% of total materials costs, while the remaining costs are from, for instance, air-conditioning parts and switchboards. EIC forecasts that material costs should increase by 5%CAGR throughout the medium term. Prices of galvanized steel pipes should reduce by 2%CAGR as China’s automotive and construction sector slows, hence, reducing demand for steel sheets, an input used to produce galvanized steel pipes. Meanwhile, prices of HDPE pipes should stabilize as HDPE price moves according to crude oil, the main component for HDPE pipe production. Though crude oil prices should slow from increased production in the U.S., Thailand’s HDPE demand is still strong and will compensate with the price reduction. Along the same lines, electrical wire prices, which have copper as the main input is likely to be stable. World Bank predicts that copper prices will be stagnant in the medium term following global economic growth and supply increment growth that offsets each other.

Labor costs are likely to grow by 5%CAGR in the medium term. A result of increasing labor demand and construction sector wage hike. Growing M&E workload will hype up M&E labor demand by 3%CAGR. Furthermore, increasing M&E labor demand from both M&E contractors and contractors in other construction businesses will create labor competition and increase M&E wages by 2%CAGR.

Figure 3: Material costs account for 65% of total M&E operating costs. Prices of key materials such as galvanized steel pipes are seen to drop by 2% in the medium term

Source: EIC analysis based on information from Bloomberg, World Bank, and the Ministry of Commerce

From the analysis in this paper, EIC believes that the M&E industry will grow continuously between 2019-2022 due to the overall industry revenue growth trajectory. However, operating costs have increased at a rate close to revenue, resulting in a stabilized gross margin.

EIC views that human resource, capital, and backlog management are three factors that M&E contractors should focus on. The three factors play a crucial role in the M&E business. Human resource management is considered the most important part of the business as it covers 25% of total operating costs. Key human resource management tasks include allocating the right personnel to the right project and balancing the amount of personnel to workload, especially during peak periods when outsourcing is required. In addition, personnel management also includes maintaining good relationships with external stakeholders such as project developers, contractors, and suppliers. Meanwhile, effective capital management will allow contractors to have sufficient working capital in each project. To achieve consistent revenue stream in line with plan, the three mentioned factors should be integrated so that backlog management operates according to available human and capital resources. Furthermore, the introduction of modern technologies such as Building Information Modeling (BIM) and Enterprise Resource Planning (ERP) will allow companies to operate efficiently and manage costs effectively.