Navigating thru China’s cross-border e-commerce: How Thai SMEs collaboration can win over Chinese hearts?

For Thai SMEs planning to tap into the Chinese market, cross-border e-commerce (CBEC) is becoming a prominent and interesting option to consider.

Navigating thru China’s cross-border e-commerce: How Thai SMEs collaboration can win over Chinese hearts?

- For Thai SMEs planning to tap into the Chinese market, cross-border e-commerce (CBEC) is becoming a prominent and interesting option to consider. EIC views that to enhance success in CBEC in China, SMEs need to position themselves strategically, especially on the following criteria 1) select products appropriate for CBEC platform 2) plan online-offline strategy – online via Chinese platform and offline in strategic locations with high Chinese tourist density in Thailand and 3) leverage online medium, for example, social media as tools to communicate with Chinese consumers and to create product familiarity.

- SMEs with limited financial ability should strategically collaborate to list stores and products on China’s online platforms. Collaboration between complementary products or in the form of a multi-brand store will help boost online presence. Other synergistic benefits are, for example, shared cost savings. To facilitate operations in China, SMEs could also hire experienced e-commerce professionals such as online merchant middlemen on Chinese platforms or companies that provide online business operation services.

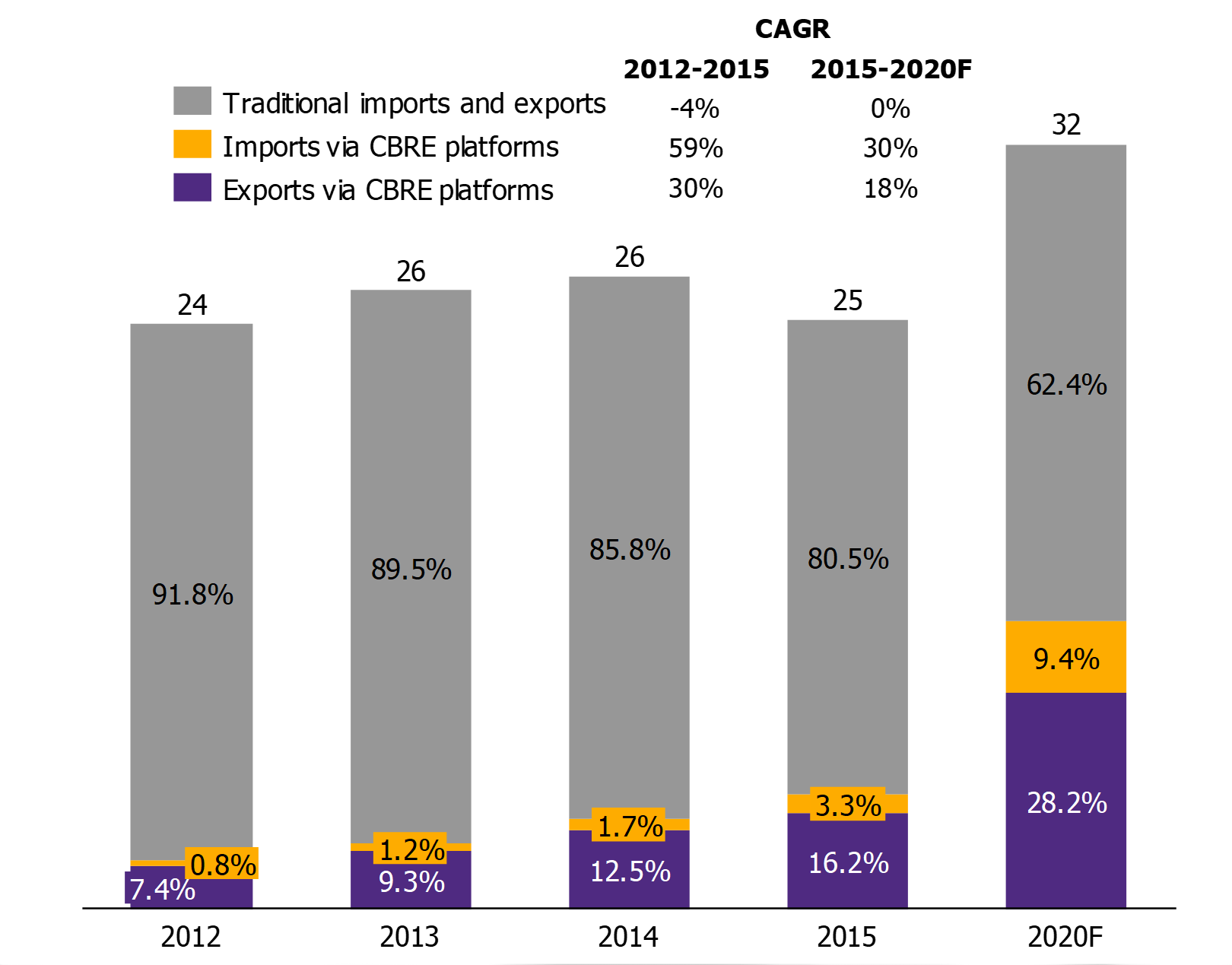

Figure 1: China’s import and export value

Unit: CNY Trillion

Remarks: Traditional import and exports are ones that are not via CBEC platforms

Source: EIC analysis based on data from The Ministry of Commerce, General Administration of Customs, iRearch, Analysys.cn, AliResearch

China’s extraordinary growth in retail CBEC, especially imports, was fueled by relaxed government policy and improved payment services. In 2016, the Chinese government issued a very important piece of policy, the Cross Border E-Commerce Import (CERI), which provides preferential tax for cross-border e-commerce products. Currently, there are three types of taxes that apply to general imports – import duties and consumption tax that varies depending on product category, and value added tax (VAT) of 17%. Under the new policy, eligible CBEC products will enjoy import duties exemption with consumption tax and VAT collected at 70% of the standard rate, but with a set quota. Individual buyers are allowed a limit of CNY 5,000 per single transaction with a combined quota of CNY 26,000 per year. CBEC imports exceeding the quota will be taxed in a similar manner as general imports. In January 2019, the Chinese government further relaxed CBEC regulation with these notable changes 1) extending the list of goods eligible for preferential tax, 2) raising the single transaction quota from CNY 2,000 to CNY 5,000 and the annual quota from CNY 20,000 to CNY 26,000 Yuan, 3) expanding the new policy to 22 different cities from existing 15 to reach more citizens. Improved technological advanced in payment services that allowed safe and secured transactions from players such as Alipay or WeChat Pay also played a significant role in boosting CBEC growth. These new and improved payment platforms even allow foreign companies to receive payment without having a bank account in China.

Figure 2: Preferential tax scheme under the new Cross Border E-Commerce (CERI) policy

|

Purchase value |

CBEC tax scheme |

|

CBEC imports with value under CNY 5,000 per transaction and under CNY 26,000 per year |

70% of standard VAT payable (17%) and consumption tax depending on product category |

CBEC imports with value over CNY 5,000 per transaction and under CNY 26,000 per year |

Import duties and consumption tax depending on product category and VAT (17%) |

Source: EIC analysis based on data from KPMG and Netherland Consulate General in Shanghai

China’s social media platform embeds end-to-end payment service facilitation. China possesses a unique online context as social media platforms play a role of one stop service. In other countries, integration of various services, each with a dedicated role, helps consumers make their purchasing decision. A typical customer journey illustration starts with a consumer discovering an interesting product via social media platforms like Facebook or Twitter, the customer then will search and evaluate thru engines such as Google, and hence make a purchase on an e-commerce platform with optional payment service provider or logistic provider up to the case. But in China, the typical customer journey can all be answered within a single social media platform. WeChat, for example, provides chat, online store, online payment, and search and evaluation services. According to a survey by Neilson, more than 70% of respondents answered that WeChat Official Account and Weibo Official Account in social media platforms influence their purchasing decision. Social media’s role and influence, as such, makes the service extremely important to Chinese customers.

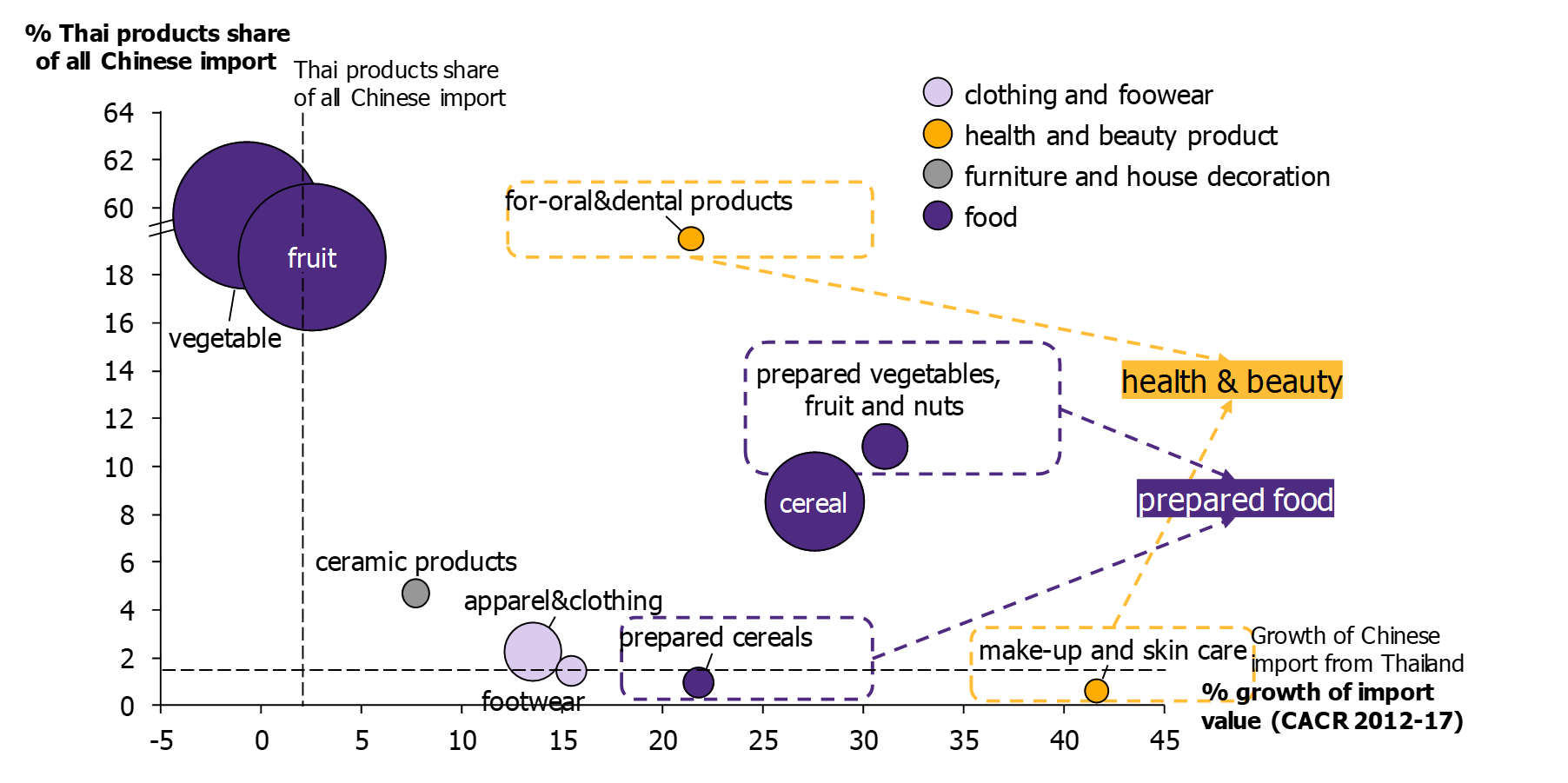

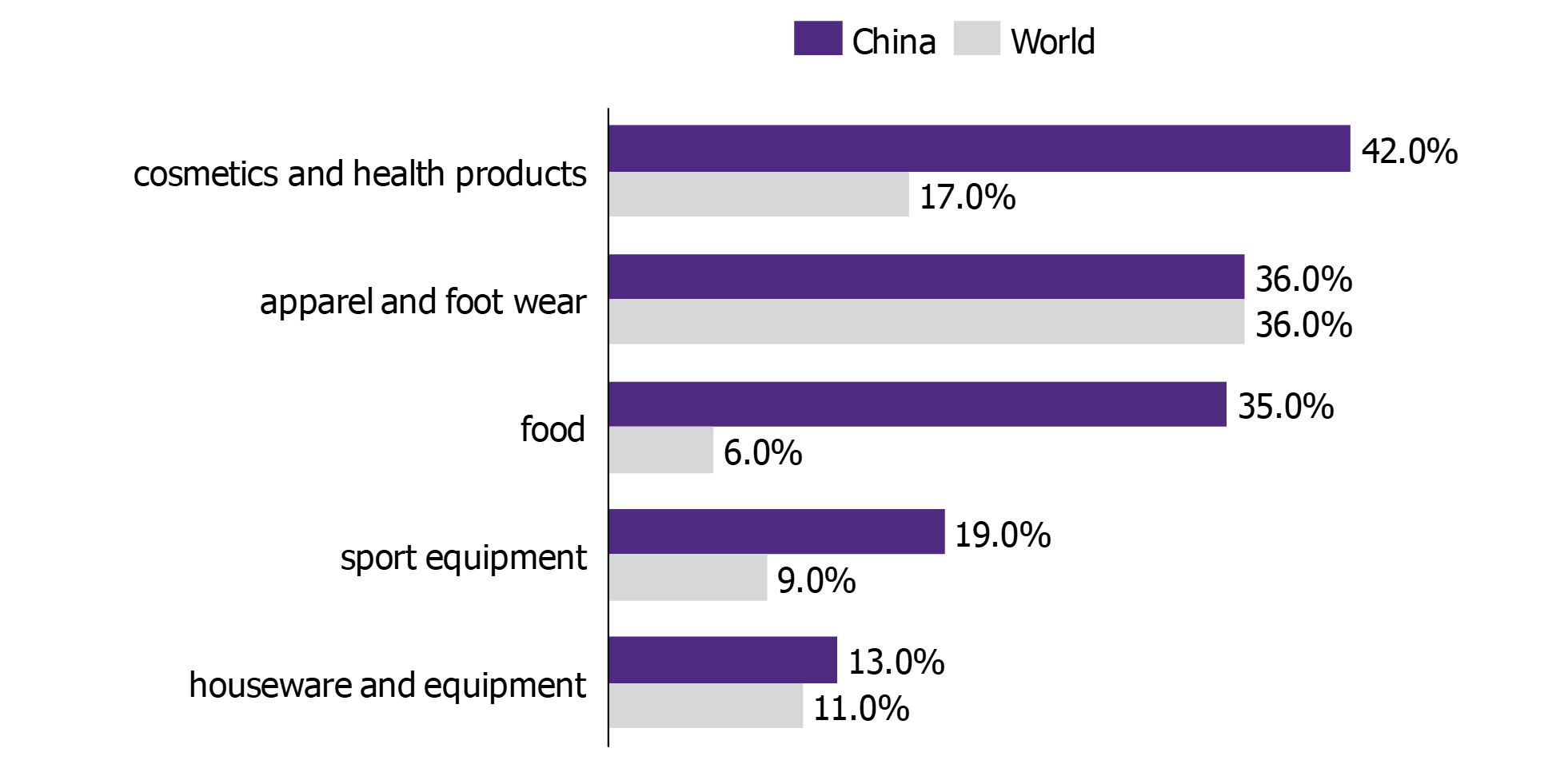

Various Thai products have high opportunities to grow under CBEC. SMEs should offer products appropriate to CBEC platform with these key considerations 1) Limit products to smaller dimensions, as large, bulky products have higher logistics and warehouse costs, 2) Offer products with long shelf life and shipment durability, 3) Target mass markets with pricing within the scope to receive preferential tax. An analysis with regards to the mentioned key considerations and feasibility of Chinese import growth potential reveals many interesting product categories for CBEC export to China (Figure 3). Highlighted categories to consider are skin care products with CAGR12-17 of 42%, oral care products with CAGR12-17 of 21%, processed vegetables and fruits with CAGR12-17 of 31%, and processed grains with CAGR12-17 22%. Meanwhile, Consumer Barometer’s survey on CBEC product purchase also provides interesting findings, the most-purchased categories are food with 35% responding yes (global benchmark at 6%) and cosmetics with 42% responding yes (global benchmark at 17%) (Figure 4).

Figure 3: Thai products imported to China (online and offline) categorized by product category

Unit: %

Source: EIC analysis based on data from Trademap

Figure 4: Proportion of China vs. global CBEC purchase by category

Unit: % of consumers purchasing CBEC

Source: EIC analysis based on data from Consumer Barometer

CBEC development in China brings convenient opportunities for Thai SMEs. Strategic online partnerships are recommended to boost e-commerce sales. Conceiving a multi-brand strategy (a collection of stores selling similar products) on China’s CBEC platform such as Kaola, JD Worldwide, or Tmall Global brings healthy cost savings. Together, SMEs can drastically reduce online listing costs such as merchant security deposit and sales commission fee. For companies not planning to cooperate, an appropriate alternative with lower costs is to establish a store on smaller Chinese platforms with lower number of users. SMEs should also consider Chinese consumer product familiarity for products not yet well-known or understood, a good strategy is to tag along with popular Thai products such as para rubber pillow, processed durian, and balms to increase eyeball and search. As for popular Thai products, a great way to reduce listing costs on online platforms is to combine listing of different products such as in the case of 24 Shopping (Thai online store on JD Worldwide platform) that offers an aggregation of Thai products such as Beauty Buffet cosmetic and processed fruits.

Cooperation not only provides online listing cost savings, but also helps lower logistic costs. Sales volume dictates the mode of transportation. With high sales volume, low transportation costs will be attained via bonded warehouses located in a free trade zone. Companies will have to stock products in warehouses beforehand, and once a purchasing order is submitted, logistic service providers will fetch the products from the warehouse and deliver to customers. Not only does this management method enables shorter order-to-delivery period, but also makes freight shipping viable, a low-cost option. Another important import mode of delivery is via direct mail, which is suitable for low sales volume products. With this shipment method, customers will receive products directly from companies with customizable packaging. Though, logistic costs will vary according to weight and format of delivery.

There are also many other supplementary platforms SMEs can leverage from. 1) Social media as tools to communicate with Chinese consumers. As discussed, social media have high importance on customer purchase decisions. To gain social media presence and viewership, SMEs can choose to market products via influencers or Key Opinion Leaders (KOLs). SMEs can even set up official accounts on platforms such as WeChat Official Account or Weibo Official Account. 2) Payment service channels to facilitate CBEC transactions. Recommended service providers are Alipay or WeChat Pay from their large customer base and overseas services. 3) Offline store services from online platforms or the Online to Offline (O2O) business model to enhance sales.

However, the road to CBEC platform success has many obstacles, SMEs might face challenges from 1) language barriers and 2) competition from product similarity 1) The main language used in Chinese CBEC platforms will still be Chinese, as such, communication in Chinese is crucial. Additional costs, for example, for language services will incur for those weak in Chinese. Another viable option for SMEs is to establish joint ventures with companies with expertise in China’s CBEC. 2) For many products, it is inevitable to not have competition, especially those with high demand. Similar products could be manufactured or imported anytime. An interesting case study is of Xiao Lao Ban (Tao Kae Noi’s unofficial name in China). In this case, Tao Kae Noi’s own distributor in China decided to copy and sell the same product under the same name in China. Tao Kae Noi’s case demonstrates the high threats of copycat. SMEs should protect themselves and their products with trademarks. If companies plan to establish joint ventures, companies should be extra cautious in terms of documentation. To reduce the severity of fake duplicates, SMEs should dedicate communication to educate Chinese consumers regarding the original products, such as stressing the benefits gained from using original products or how to check if the product is genuine. Platform choice is also crucial, choosing to be exclusive on reliable platforms or on platforms that guarantee 100% genuine is also another option to consider.