Is Thai System integrator ready for the era of digital and AI in manufacturing?

The turn toward AI use in manufacturing has rendered the role of system integrators (SI)—businesses offering network connectivity and tech services

Author: Nantapong Pantaweesak

Is Thai System integrator ready for the era of digital and AI in manufacturing?

-

The turn toward AI use in manufacturing has rendered the role of system integrators (SI)—businesses offering network connectivity and tech services to organizations—increasingly important. Between 2019 – 2023, the market value of SI businesses to facilitate the use of AI in manufacturing is expected to reach THB 45 billion as the manufacturing sector adopts for to AI and digital technologies, especially in large sectors with high potential such as petrochemicals and beverages. As such, demand for SI specializing in AI is set to increase to at least 500 providers by 2023. However, Thai SI businesses will have to contend with many significant challenges: Their revenue model still relies in large part on projects with uncertainty and a high level of competition. They do not have much leverage in negotiating with the owners of the technology, leading to potential issues if a new system configuration is required for connecting with the customer’s existing operation system. Last but not least, a personnel shortage in areas of data science and AI may also affect long-term competitiveness.

- In our view, upgrading Thai SI capacity to level that of international providers is difficult and will take time. It requires the development of a new educational structure that will respond to the demands of the business sector. Thai providers should consider joining hands with their foreign counterparts, for example, as a platform partner or subcontractor, to facilitate access to the technology and equipment in developing AI systems and platforms. They may also consider opening up new revenue channels through other services, such as the development of software for factory operations and data centers, to ensure a consistent stream of revenue. Doing so will allow them to increase the share of revenue from after-sales services and help cut down their reliance on projects with uncertainty.

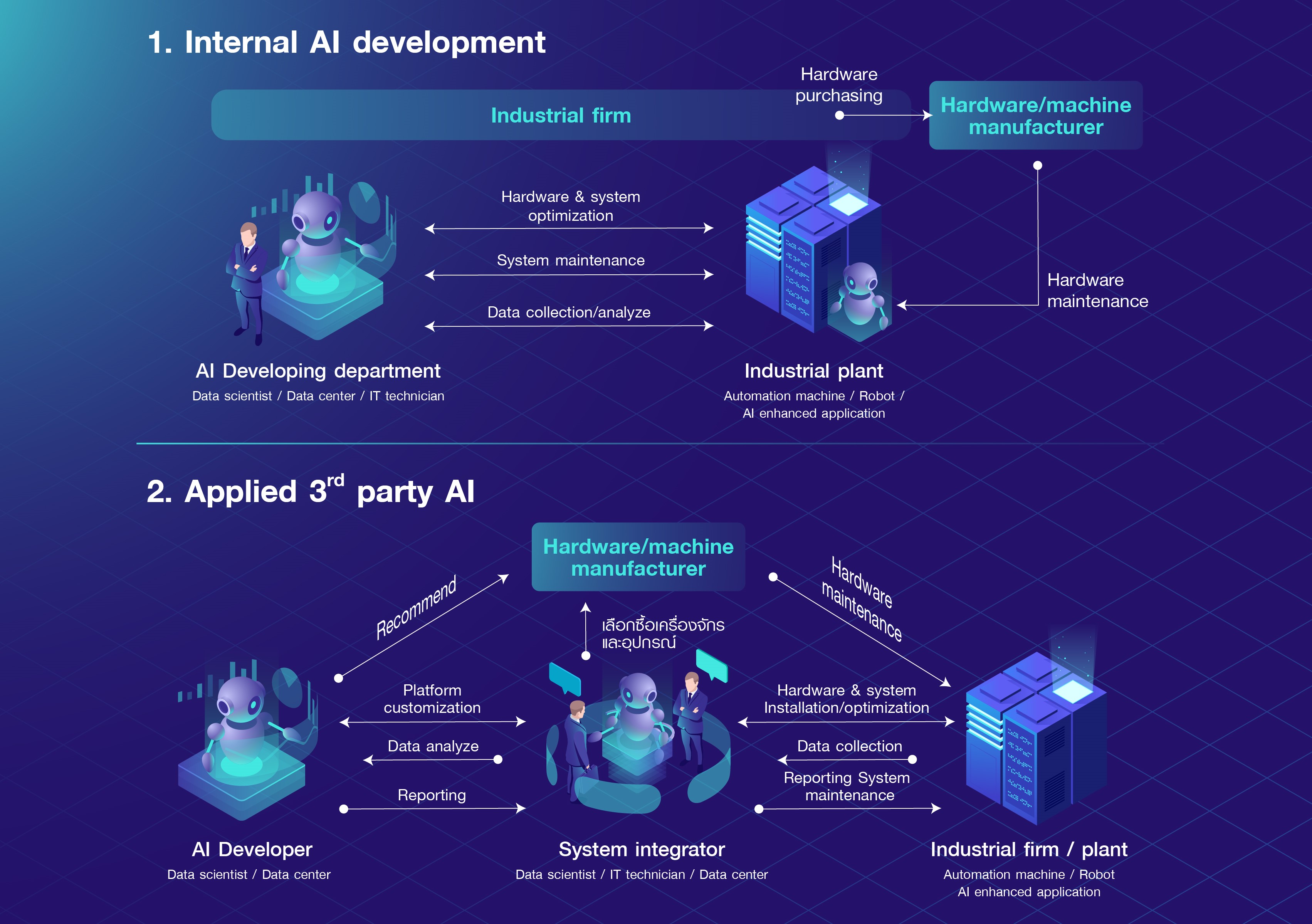

Figure 1: Different models of AI use in manufacturing

Source: EIC analysis

The development of automation and AI technology has led to the increasing need for SI with AI expertise all over the world. According to a survey of 240 European companies by T-system, 70% need an AI system for the control of machinery maintenance, procurement of raw materials and parts, and management of the supply chain. More than 85% expressed the need for SI with AI expertise. In the US, companies such as Rockwell, a major producer of automated machinery, expects more demand for SI amid increasing automation. In 2016, 70% of Rockwell's sales of automated machinery were through SI, 40% of which were third-party companies. In countries facing a labor shortage such as Japan, demand for workers in SI is also rising. In 2017, sales of robots and automated machinery in Japan reached 45,500 units, while there are only 200 businesses providing SI services for AI and robotics.

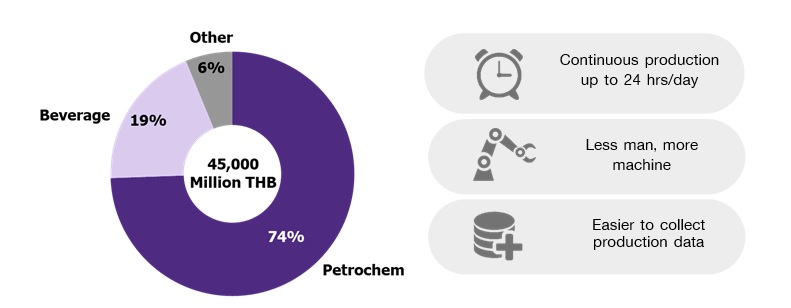

The market value of SI businesses in Thailand has the potential to reach THB 45 billion for the next 5 years, owing to the application of AI in manufacturing. Many industries are expected to adopt digital and AI technologies. The petrochemical and beverages industries, in particular, have the potential to take full advantage of the new technology as their 24/7 manufacturing processes necessitate as little time for annual maintenance and repair as possible (normally their maintenance and repair schedule, including downtime, is strictly set in advance). The two industries, furthermore, use more machinery and equipment than they do human labor in the manufacturing processes. As such, manufacturing data collection, or the installation of equipment for such collection, will be relatively easy (Figure 2), opening up possibility for digital transformation and the use of AI technology such as AI-enhanced predictive maintenance, digital twin, and AI-enhanced supply chain management to manage all aspects of the manufacturing process. Nevertheless, there are also limitations to the use of AI technology in factories. These include the time required to adopt the technology, the long payback period, and the lack of technological know-how and appropriate data collection and storage.

Figure 2: Market value that SI are expected to gain from AI projects in Thai manufacturing (2019 – 2023)

Note: *1,400 companies is target number of system integrator promotion by OIE, **EIC estimated from numbers of registered manufacturing plants under selected industries (Petrochemical and Beverage) and minimum project capabilities for 1 system integrator

Source: EIC analysis based on data from OIE, FIBO and DIW

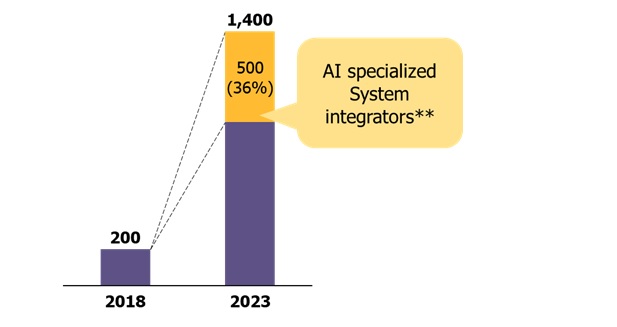

Based on the projected growth of the digital and AI markets in Thai manufacturing in the next 5 years, EIC forecasts a demand for at least 500 system integrators with AI expertise in 2023 (Figure 3). The demand will be driven by the digital transformation trend and the application of AI technology. Based on data from the International Federation of Robotics (IFR), Thailand's use of automated machinery is likely to continue growing, from 18% YOY in 2018 to 21% in the next 3 years (2019 – 2021). On the other hand, currently there are only 200 system integrators in Thailand, of which fewer than 5% specialize in AI. The installation of automated machinery or sensors for existing machinery in the factory requires an organization or expert with AI speciality in order to develop software that will link together different manufacturing systems with AI technologies such as AI-enhanced predictive maintenance and AI-enhanced supply chain management. This limitation constitutes a key challenge facing small- and medium-sized factories (which make up as much as 60% of all factories in Thailand) as they often do not have an in-house IT unit and require SI services.

Figure 3: Number of system integrators in Thailand

Source: EIC analysis based on data from the Office of Industrial Economics and the Institute of Field Robotics

Note: EIC's estimates are based on the number of factories in industries with potential for AI use and SI operational capacity per year.

However, in our view, SI businesses targeting Thai manufacturing face 3 key challenges. Firstly, Thai SI's revenue is largely project-based and, as a result, volatile. This source of income makes up 80% of the annual revenue, with the rest coming from systems services, in contrast with major system integrators in the global market such as Maverick Technologies and Callisto Integration, which have seen their share of revenue coming from systems services increase through the development of services in factory management that enable integration with automation platforms such as Microsoft and Siemens. Secondly, Thai SI's leverage with the technology owners is small. In general, system integrators act as a mediator between client and technology owner. Since Thai SI businesses operate at a relatively small scale compared with major global players, request for change or adjustments to the technology owner's system is often not acted upon, making the task of linking seamlessly, or with minimal interruption, the client's existing system with the new technology rather difficult. They may not be able to satisfy their client's demand fully as a result. Thirdly, the shortage of trained personnel in data science and AI also poses a challenge. Because there is a strong demand for specialists in these fields, the wages of data scientists and AI developers are relatively high compared with those of other occupations. Adecco's survey shows that the average salary of new graduates in data science and AI development in Thailand start at approximately THB 400,000 – 500,000 person/year. In addition, many new-generation IT workers prefer freelance, project-based work. As such, it may be difficult for companies to develop human resources with continuity in the long term.

In order to boost Thai SI competitiveness, various obstacles need to be tackled urgently. First and foremost is the human resources challenge, which cannot be solved through short-term solutions. Instead, there is a need for government policy supporting the development of appropriate educational curriculum in the future. In the meantime, EIC recommends SI businesses, whether existing providers or new-comers, to upgrade their operations and enhance their capacity by joining hands with international SI companies by, for example, becoming a platform partner of AI and automation technology owners in order to access the technology and equipment, such as Intel's AI Builder and IBM's Power AI. Working as a subcontract system integrator within AI projects is also an option, as is hiring foreign experts or consultants specializing in data science and AI in order to adequately meet the technological demand of clients in the short term, with an eye toward knowledge and technology transfers going forward.

In addition, SI businesses should consider enhancing their service offerings, for example, by adding value to their after-sales services in order to reduce risk due to reliance on project-based revenues. New technologies such as automation and AI systems require enhanced services or additional post-installation support to ensure the most effective use of the technology. New support may include database services or 24-hour distance maintenance and repair. System integrators without such services may lose their competitiveness in their bids for new projects. In order to provide the services, however, they may have to develop their own factory management software or software that can provide their clients with the ability to link up with other AI platforms. They may also consider setting up a data center, as well, to ensure the continuous and smooth delivery of data analysis services to their clients and create an alternative to their sole reliance on cloud systems provided by AI platform owners.

Read more