-

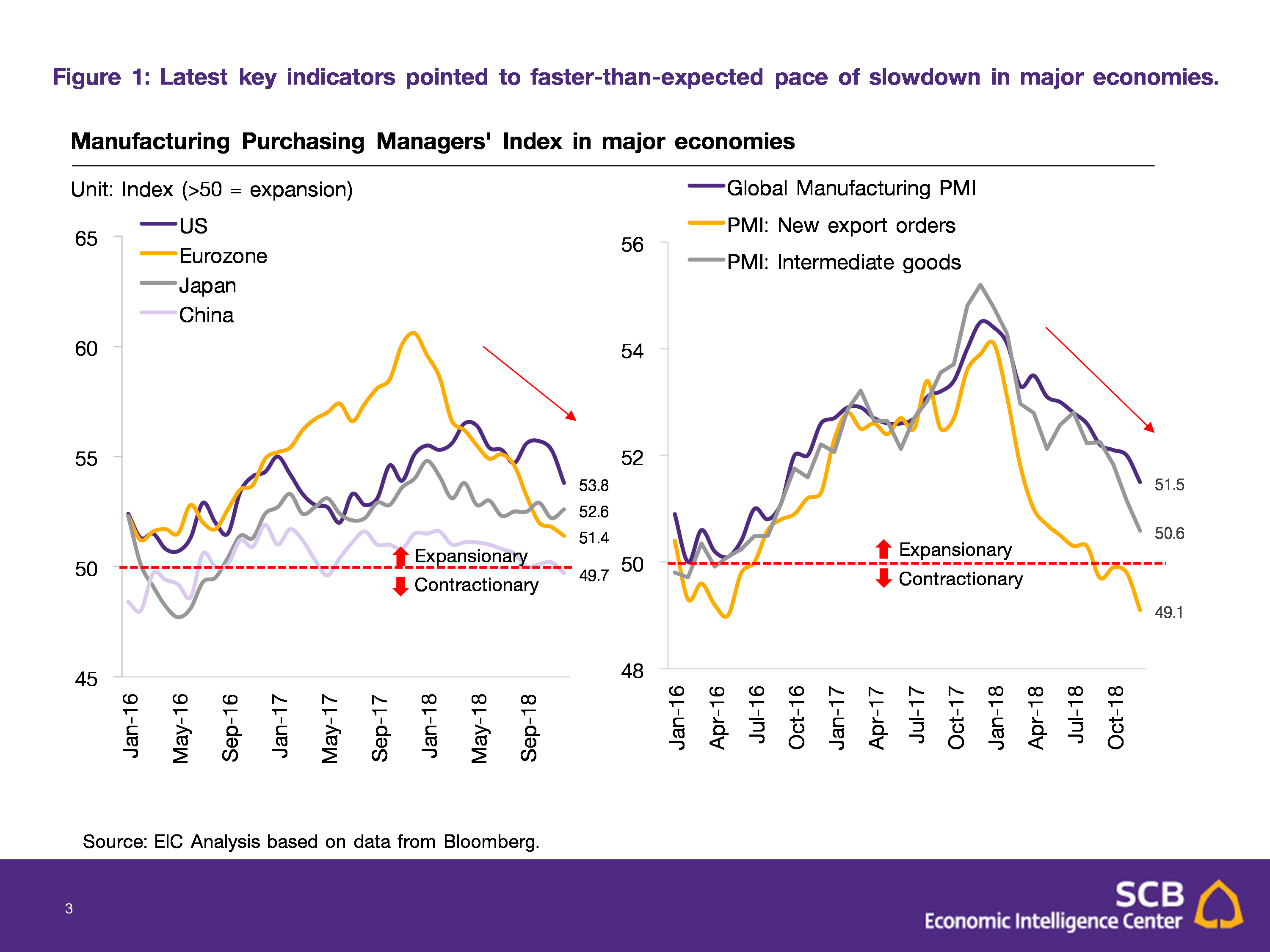

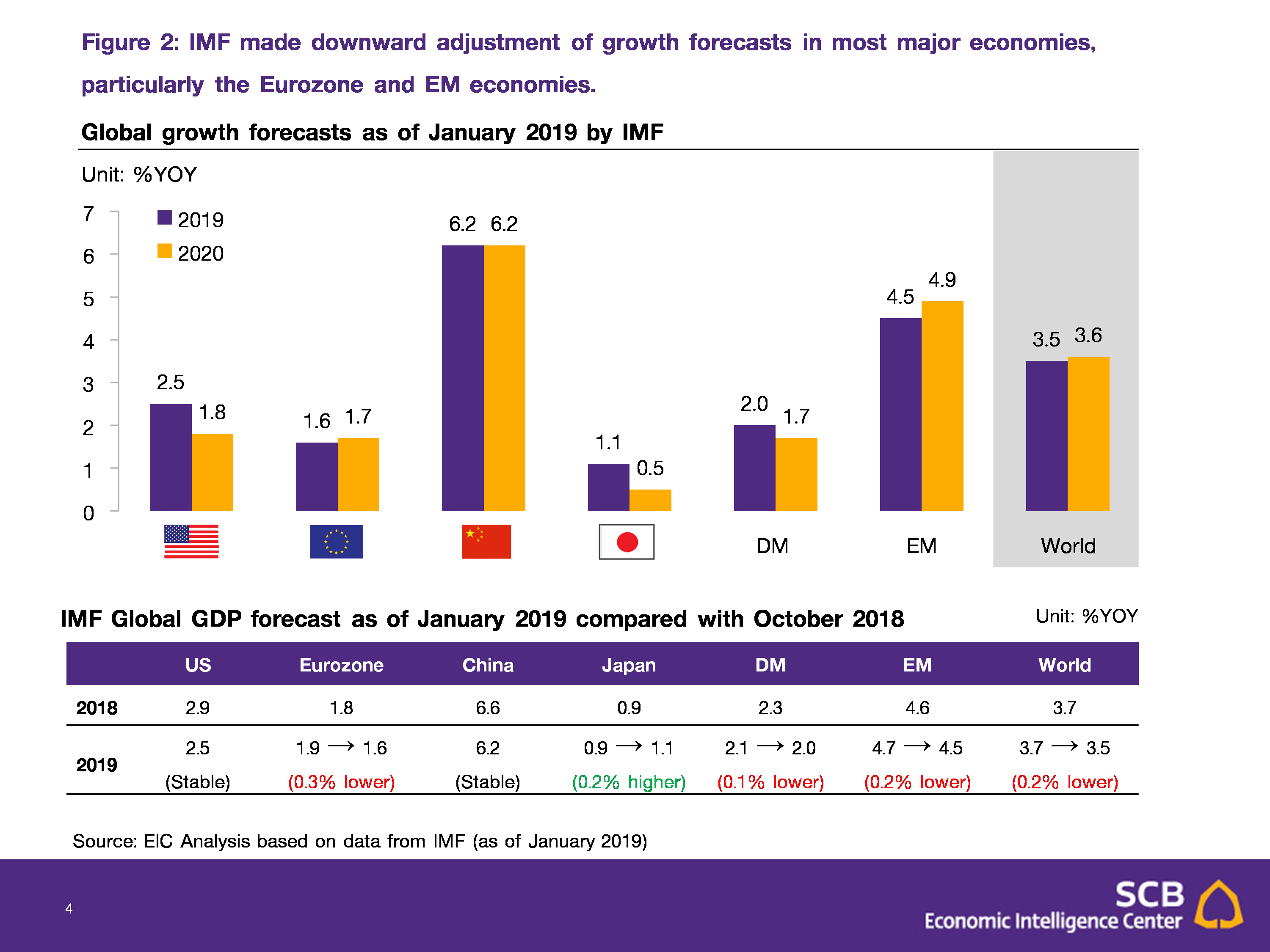

IMF revised down its forecast of global GDP due to faster-than-expected economic slowdown, impact from the trade war, tightening monetary conditions and risks from political instability. The projection of global GDP growth was revised downward in line with a decrease in the manufacturing Purchasing Managers Index (PMI) of the global and major economies, which has trended downward since 4Q 2018 (Figure 1). The sub-index on the export orders pointed to slowdown in economic activities and faster-than-expected deceleration in global trade. Compared with the previous forecasts in October 2018 (Figure 2), the projected growth of major economies was revised downward. Projected growth of Developed Market (DM) economies was adjusted downward by 0.1%, standing at 2.0%. In particular, the growth forecast of Eurozone economy reduced by 0.3% to record at 1.6% mainly due to factors within the region—particularly Germany from a new emission standard in the auto sector and France from the yellow vest protests against the government’s policy. In contrast, the projection for the Japan economy was adjusted upward by 0.2% in 2019 and 2020, standing at 1.1% and 0.5% respectively, reflecting positive impact from acceleration in household spending and the government’s policy to cushion impact from a rise in consumption tax that is set to be effective in October 2019. As for Emerging Market (EM), growth for 2019 was projected to be at 4.5%, a 0.2% decrease from the previous projection due to slowdown in global trade activities, the US trade protectionist measures and rising interest rates. Furthermore, political instability in many major economies both the US and in Europe is likely to be protracted, posing risks to growth in 2019 and 2020.

- IMF revised down its growth forecast of DM economies led by the Eurozone and EM economies, reflecting political instability and negative impacts from trade protectionist measures. IMF adjusted its growth forecast of the Eurozone economies to 1.6% (from 1.9%) due to faster-than-expected economic slowdown of the manufacturing sector and domestic political problems particularly among major economies. (1) Germany: the automobile industry slowed down because of the new standard on car pollution emission which reduced automobile producers’ tax benefits, weighing on production and consumption. The export sector started to show some signs of deceleration in line with the global economic conditions. (2) Italy: although the crisis on budget drafts and fiscal policy roadmap has been resolved in collaborative tone with the EU, monetary conditions have tightened as the Italian government bond yields have steeply risen since October 2018, reflecting higher funding costs amid nascent slowdown in economic activities. (3) France: negative economic impact has been felt due to the ongoing yellow-vest protest since 4Q2018. Furthermore, the Brexit deal remains uncertain. In case of no-deal Brexit, the intra-EU trade and investment would be greatly impacted. As for EM economies, the growth projection was adjusted downward to 4.5% (from 4.7%). The economies which were subject to a sizeable decrease in growth forecast include Turkey and Argentina which have faced economic and currency crisis since 3Q 2018, leading to an increase in policy interest rates to stem capital outflows. The tightened monetary conditions nevertheless derailed domestic economic activities. In addition, many countries in Latin America and Middle East have had domestic political instability and received less support from commodity prices, particularly a decline in average oil prices compared with the previous projection in October 2018.

- IMF maintained its growth forecast of the China economy and other EM economies in Asia, pointing to strong economic fundamentals but high risks to the export sector. The IMF maintained the growth projection of the China economy at 6.2% (the growth forecast was previously adjusted downward in October 2018) mainly on the back of positive development of the US-China trade negotiation since the beginning of 2019, reducing short-term risks to the China export sector. Nevertheless, domestic economic activities have continued to slow down, reflected by key economic indicators such as consumption, investment and credit expansion, while the export sector evidently decelerated in 4Q2018. However, the Chinese administration stands ready to introduce economic stimulus measures—both monetary policy such as a decrease in commercial banks’ Reserve Requirement Ratios (RRR) and fiscal policy such as the tax reduction policy to support consumption and SME loans. Overall, the risks of the China economy sliding into hard landing remain low. For other EM economies in Asia that are highly connected with the China economy, the growth projection was maintained at 6.3% as a slight increase in the growth forecast of the India economy (from 7.4% to 7.5%) offseted a moderate decrease in the growth forecast of ASEAN-5 economies (Malaysia, Indonesia, Philippines, Singapore and Thailand) from 5.2% to 5.1% in 2019 from a slowdown in the export sector in line with the China economy. The uncertainty around the trade war has continued to pose risks to the export sector of China and other Asian economies, particularly if the US and China cannot reach an agreement, the US is still likely to raise tariff to 25% from 10% on USD 200 billion worth of Chinese goods.

|