Outlook Quarter 3/2018

EIC revised Thailand’s growth forecast for 2018 to 4.3%YOY from the previous forecast of 4.0%YOY, which reflected a stronger growth in recent periods. Thailand’s growth improved in the first half of the year and was more broad-based, driven by external sector from both merchandise exports and tourism which continued to expand at a high rate. This led domestic private demand to begin to recover in conjunction with consumption and investment, while public investment resumed growth after having contracted at the end of the year.

- Thailand economy 2018

- Bull - Bear: Oil Prices

- In focus:

- Box: A close look at global household debt

- Box: The relationship between burden of debt repayment

on income and household consumption

- Summary of main forecasts

EIC revised Thailand’s growth forecast for 2018 to 4.3%YOY from the previous forecast of 4.0%YOY,

which reflected a stronger growth in recent periods. Thailand’s growth improved in the first half of the

year and was more broad-based, driven by external sector from both merchandise exports and tourism

which continued to expand at a high rate. This led domestic private demand to begin to recover in

conjunction with consumption and investment, while public investment resumed growth after having

contracted at the end of the year.

Growth in the latter half of the year faced higher risks than the first half due to the impact of the

trade protectionist measures that were increasingly introduced by the US and the counter measures

by affected countries. EIC assesses that risks to Thailand are quite limited in the short run as only a small

share of Thai export products will be affected. Hence, overall Thai exports in 2018 will likely expand in line

with the global trade. EIC projects that the value of merchandise exports for the whole year will grow

8.5%YOY. However, risks from trade war can possibly worsen, which may affect global trade and Thai

exports in the period ahead. It is therefore increasingly important for exporters to have coping strategies

such as finding new markets or preparing for potentially higher competitions in some markets.

Household income is likely to begin recovering but household debt remains an obstacle. Income

of Thai households tends to recover on the back of farm income which began to expand in the second

quarter after having contracted for 9 consecutive months. Moreover, average wages of workers outside

agricultural sector continued to improve since the beginning of the year, especially in businesses with high

employment in industrial, wholesale and retail, hotel and restaurant sectors. In addition, unemployment

rate also trended down since the beginning of the year. EIC views that household income will likely

continue expanding in the latter half of this year thanks to both domestic and external demand which

are expected to grow and lead to higher demand for labor. However, EIC views that spending growth of

low-income households may take time to recover. This is because household income has just started to

recover after not having increased for a long time, while household debt rose significantly and remains

at a high level. According to survey conducted by National Statistical Office, in 2015-2017 households in all

income groups were observed to have higher debt. Against such backdrop, although household income

will likely improve in 2018, part of the income will be earmarked for debt repayment. As a result, benefits

from rising income will not spilled over to consumption as much as it should.

Thailand’s economic stability remains strong and will provide cushion against volatilities from external

factors. Financial markets’ volatilities increased considerably in recent periods in emerging markets including

Thailand owing to external factors. These included tightening monetary policies of advanced economies,

a stronger US dollar, and concerns on risks of trade war. However, EIC views that due to the Thailand’s

strong economic stability and adequate liquidity in the financial system, risks from such external factors

on the real economy are thus fairly limited.

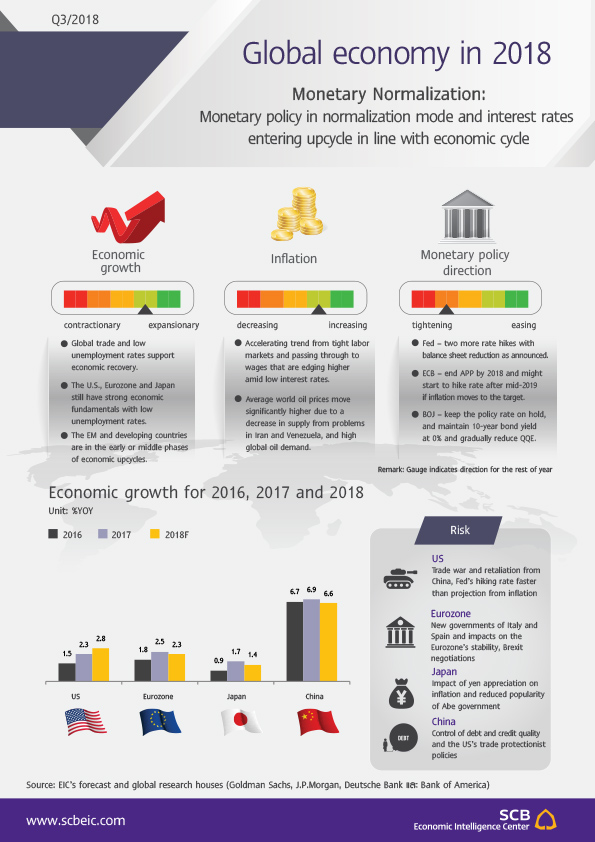

Global economic outlook 2018

The global economy continues to expand in 2018 with accelerating inflation, led by US growth following

tax reform and strong labor market, together with the Eurozone and Japan growth from their historically

low unemployment rates. The overall global economy will continue expanding, driven by strong economic

fundamentals on the back of international trade and tight labor market conditions across many regions.

In addition to low unemployment, the US economy will benefit from tax cuts for both corporates and

households, and will gain additional momentum from infrastructure investment projects promised by Trump

going forward. Thus, US growth will accelerate at one of the highest rate this year, which will lift inflation

significantly. As for the Eurozone and Japan, although inflation remains low, continued improvement in labor

market conditions and business performance have translated into higher wages. In addition, robust private

consumption will lead to a gradual and stable rise in inflation. Meanwhile, China’s economy, which is likely

to slow down, as well as other emerging economies will still benefit from the growth of major economies

driven by international trade. In addition, commodity price recovery in almost all categories will support

continued growth. Central banks in major economies began tightening their monetary policies, with the Fed

likely increasing its federal funds rate at least three times this year. At the same time, although the ECB

and BOJ still maintain their quantitative easing policy and the asset-purchase program (QE) while keeping

their policy rates on hold, both short-term and long-term interest rates will clearly be on an upward trend

following the end of asset purchases by the ECB this year.

Global economic risks to be monitored going forward will pivot on three key factors: accelerating inflation

and a tighter-than-expected monetary policy, the end of QE measures, and US trade protectionism measures.

The first risk to be considered is that if inflation accelerates too fast or a greater extent than expected,

central banks in many regions, especially in the US, will have to hike policy rates sooner than markets expect.

Hence, overall financing costs will increase from a faster-than-expected rise in both short-term and longterm

interest rates, which will lead to portfolio adjustments and abrupt capital movements in both global

stocks, bonds, and money markets. The second risk concerns a significant decline in the amount of asset

purchases by major central banks as well as the end of QE measures, which should be carefully watched.

This is because the economy and businesses have become accustomed to having excess liquidity for many

years. In particular, there will be less liquidity in the financial sector. There will also be an impact on asset

price stability, which benefited from QE liquidity, particularly in global financial and real estate markets.

These are the sectors to be carefully monitored following the end of QE measures in the future. The last

risk concerns trade protectionism measures that tend to be more severe and targeted on China’s exports

as well as countries with particularly large bilateral trade surpluses with the US. Import tariffs on washing

machines, solar panels, steel, aluminum, and related products, as well as other upcoming measures aimed

at protecting US Manufacturers will cause global economic volatility. This will then affect global confidence,

trade and investment sentiments.

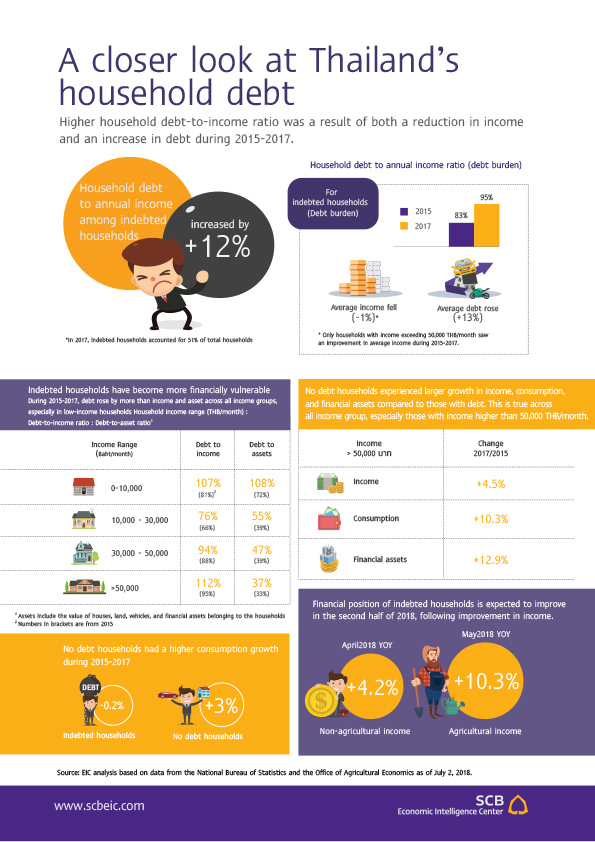

In Focus: A closer look at Thailand’s household debt

One of important structural changes that took place in the Thai economy over the past decade

is the rise in debt-financed household spending. This is reflected in the rapid increase in the

household debt to GDP ratio during 2008-2015, from 51% to 80%. The ratio declined slightly

during 2016-2017, prompting many to believe that the situation has eased, but the latest

analysis of household survey data provides an opposing conclusion. The debt to income ratio

among households with debt across income spectrums did not fall over the last two years.

In fact, it soared as a result of both higher debt and lower incomes, except for high-income

households whose income has increased, yet by less than their debt burden.