Bioplastic’s industry outlook … another business opportunity for Thailand

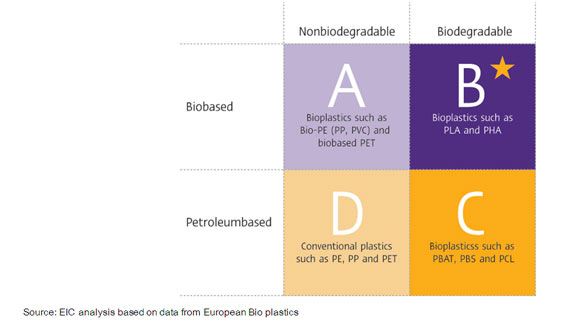

Bioplastic is reaping a higher presence in the plastic market (Figure 1). The product’s bio based raw material helps reduce oil dependency, in addition to its biodegradable property alleviates waste disposal and toxic residues in the environment. The aforementioned characteristics draw global attention to the bioplastic usage, such as in the case in European countries. Various European countries were faced with plastic disposable issues that were increasing in severity. Therefore, the public, business, and household sectors cooperated to increase the use of bioplastic products. Examples of bioplastic support policies are the European Union mandating automotive producers to increase bioplastic component parts in its assembly, Italy’s support for biodegradable single use plastic bags, and Japan’s electronics appliance corporate such as Sony, Panasonic, and Toshiba changing to use bioplastic packaging and increasing bioplastic computer component parts. Furthermore, a research study by Samsung Fine Chemicals indicates that the population at large is willing to change their behavior to consume more of the environmental friendly bioplastic products if the quality were similar and even if they have to pay a higher price.

Author: Chanita Suwanna

Bioplastic 1 is reaping a higher presence in the plastic market (Figure 1). The product's bio based raw material helps reduce oil dependency, in addition to its biodegradable property alleviates waste disposal and toxic residues in the environment. The aforementioned characteristics draw global attention to the bioplastic usage, such as in the case in European countries. Various European countries were faced with plastic disposable issues that were increasing in severity. Therefore, the public, business, and household sectors cooperated to increase the use of bioplastic products. Examples of bioplastic support policies are the European Union mandating automotive producers to increase bioplastic component parts in its assembly, Italy's support for biodegradable single use plastic bags, and Japan's electronics appliance corporate such as Sony, Panasonic, and Toshiba changing to use bioplastic packaging and increasing bioplastic computer component parts. Furthermore, a research study by Samsung Fine Chemicals indicates that the population at large is willing to change their behavior to consume more of the environmental friendly bioplastic products if the quality were similar and even if they have to pay a higher price.

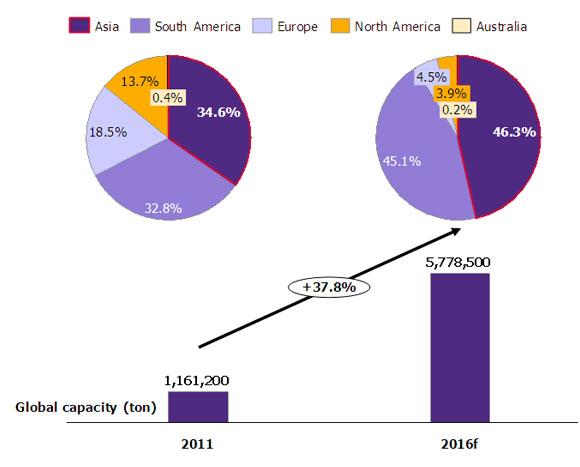

Going forward, global bioplastic production capacity could increase by 40% per annum. In the past, bioplastic production capacity grew by approximately 20-30% per annum. Meanwhile, in the present, bioplastic demand and production capacity is merely at par at 1 million ton, with prospects of demand increasing to 5-6 million tons in 2016 (Figure 2). Hence, production capacity has to increase to catch up demand, in which most of the additional bioplastic plants will be in Asia and South America. The additional capacity will increase Asia and South America's prominence in the bioplastic industry as the regions' production market share will increase from approximately 35% to 46% and 33% to 45% respectively (Figure 2). Factors that increase the region's prominence are technological transfers from bioplastic industry leaders such as the United States and the Eurozone to countries with abundant agricultural commodities in Asia and South America due to production cost competitiveness. Furthermore, when segmenting the plastic market, the bioplastic market share should increase from 0.5% in 2011, to 2% in 2016, and 3% in 2020.

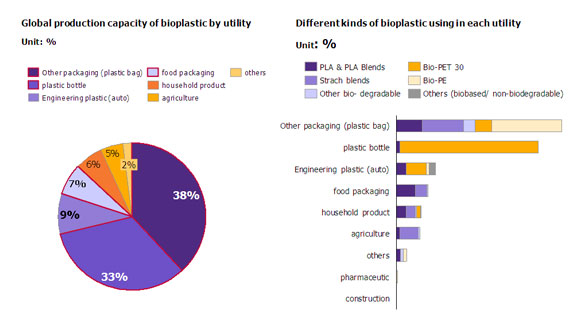

Bioplastic products could replace some of the conventional plastic products, especially packaging. In the present, around 80% of the global bioplastic production is used to serve the packaging industry (Figure 3), in which 40% of the packaging market share goes to producing plastic shopping bags, 33% to plastic bottles, and 7% to food packaging. An important factor that allows the packaging industry to utilize bioplastic products are its biodegradable nature such as plastic bags which has a short life span and does not need special qualifications. On the other hand, the use of bioplastic products in other industries such as automotive parts, construction, and medical treatment is still low. Nova Institute, a biotechnology expert, predicts that Bio-PET plastic bottles will tremendously grow by ten-folds to 5 million tons in 2020. Bio-PET plastic bottles has the potential to replace all of the petrochemical base PET bottles in the future, including PLA packaging which is increasing its market share in the food packagings industry.

Though bioplastic price in the present is more expensive due to higher production costs, future technological advancement should help lower bioplastic price. Currently, the production costs of bioplastic are approximately 1.6-3.0 times higher than conventional plastic, depending on the type of plastic. In the early stages of bioplastic development, bioplastic was made from starch or sugar producing crops. However, in the future producers should start producing bioplastic from other commodities especially from agricultural residues such as rice straw, rice husk, and tree bark, in addition to developing new technologies to reduce production costs so that bioplastic products is able to compete with conventional plastic products.

... Tracking the global bioplastic industry investment status ...

Countries in Europe, the United States, and Japan are considered as bioplastic pioneers and are continuously developing their bioplastic industry. Germany's bioplastic industry has made various developments causing both medium and small sized companies to leap forward, especially in terms of bioplastic compounding technologies, which will facilitate plastic formation and characteristic specification. Meanwhile, both the local and national government is pushing for various support regimes for bioplastic usage and production such as collecting more taxes from non-biodegradable plastic producers, which helps increase cost competitiveness of bioplastics.

The bioplastic industry in Thailand is still at an early stage. The sole Thai investor in the bioplastic industry is PTTGC, which co-invested with USA's Cargill via a bioplastic company named NatureWorks. Currently NatureWorks has a PLA bioplastic plant in the United States with a production capacity of 150,000 tons per year. NatureWorks is planning to construct 2 other PLA bioplastic plants in Asia with production targets of 140,000 tons per year. The new plants will also act as Asia's production and distribution hub for bioplastic products. The company is still selecting for the plant locations, in which Thailand could potentially be the target.

Malaysia's bioplastic support regime should be closely monitored. Malaysia is Thailand's competitor in the bioplastic industry as both aspire to be ASEAN's bioplastic hub. Malaysia has set a clear bioplastic investment incentive regime to support for bioplastic industry growth, for example, via raw material subsidies and 10 years corporate tax exemption. Therefore, if Thailand does not have a regime that could reap bioplastic investments from Malaysia, Thailand could potentially lose the opportunity to add value to agricultural commodities. Furthermore, Thailand's plastic industry would most likely continue to produce low value add plastic products, plastic companies will not gain technological advancements in the bioplastic business, and related industries and SMEs will have less green business development choice.

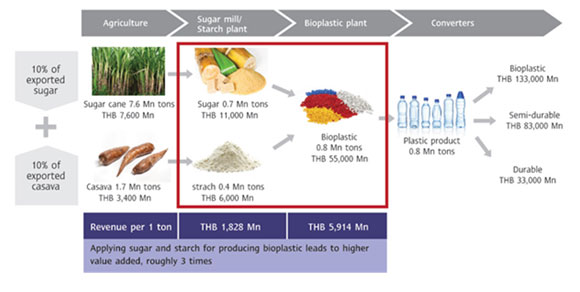

If Thailand could attract bioplastic plant investment, the investment should benefit the agriculture industry and the overall plastic manufacturing supply chain. In the present, Thailand exports cassava and sugarcane in the form of raw materials or with basic processing, in which the products exported have low value add. If the exported products were used in the bioplastic industry, the value add the products will receive will be higher. For example, if 10% of the exported sugar from sugarcanes and 10% of the exported starch from cassava are used to produce bioplastic in the ratio of approximately 2:1 respectively, the value add of the agricultural products will be roughly 3 times higher than of the basic processing format (Figure 4). In the meantime, bioplastic investment in Thailand will help reduce bioplastic imports that historically grew by approximately 42% per year. Bioplastic investment will also help reduce costs and increase Thailand's plastic processing competitiveness, which will also spillover to related industries.

Going forward, EIC views that Thailand has the potential to be one of ASEAN's full service leaders in the bioplastic industry. This is because Thailand has the capability to produce products throughout the value chain from bioplastic to bioplastic products. Thailand's potential arises from 3 key factors:

- 1) Agricultural commodity advantage. Thailand's cassava and sugarcane production exceeds the domestic demand, in which merely 25-30% of the production is for domestic consumption resulting Thailand to be the world's largest cassava exporter and the second largest sugarcane exporter.

- 2) Supply chain readiness. Thailand possesses a complete plastic industry supply chain from upstream products like agricultural commodities and plastic processing to various related industries.

Technological and human resource capabilities. Thailand's R&D human resource capabilities are high, which enables smooth technological transfer. Furthermore, Thai human resource can innovate new technologies. In the present, there are more than 3,000 plastic processing companies, in which the companies are strong and have high capabilities.

1 Bioplastic is a type of plastic that is synthesized from natural products (bio based) and is biodegradable or is a type of plastic that has one of the characteristics mentioned above

Picture 1: "Bioplastic" a kind of plastic categorize by raw material and degradable ability

Source: EIC analysis based on data from European Bio plastics

Picture 2: Global production capacity of bio plastic in 2011 and 2016

Source: EIC analysis based on data from Plastic Institute of Thailand and European Bio plastics

Picture 3: Around 80% of the global bioplastic production is used to serve the packaging industry and bioplastic could replace some of the conventional plastic products in the future, especially packaging

Source: EIC analysis based on data from European Bio plastics

Picture 4: Using sugar from sugarcane together with starch from cassava to produce bioplastic in the ratio of approximately 2:1 respectively, the value add of the agricultural products will be roughly 3 times higher than of the basic processing format

Source: EIC analysis based on data from PTTGC

|

|