The Future of Thailand’s Tourism Industry

Thailand’s tourism industry is expected to recover and expand by relying upon Asian tourists. This presents a dilemma, because along with great growth potential from Asian tourism comes an increasing sensitivity to changes in the behavior of the tourists in this segment. New potential markets, especially Chinese tourists, will have more alternative destinations in the long term, which means market stimulation by means of promotions may not provide ideal results. It would be better to enhance competitiveness, especially through strategies promoting environmental issues and improving ICT (Information and Communications Technology) infrastructure where Thailand is weak at the moment. - Another strategy is to expand the hotel industry tourist base by targeting existing markets, such as European tourists, as they tend to be less sensitive to political events, stay longer, and have higher spending power. Attracting Asian tourists at the same time would assist in enhancing income growth. In addition, Thailand’s tourism industry should look into maximizing the use of the Internet to catch up with consumers who are increasingly involved in online activities and tend to drop their early room booking behavior.

Author: Vithan Charoenphon

|

|

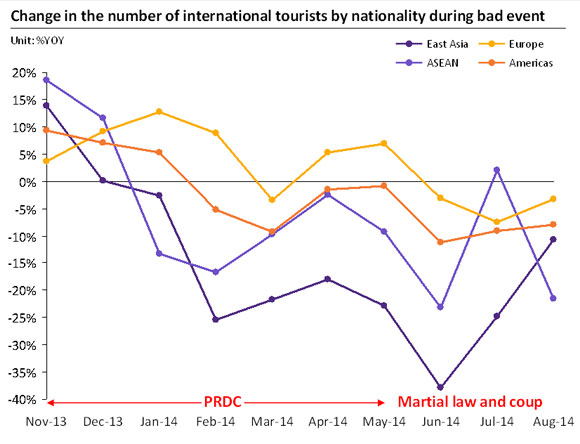

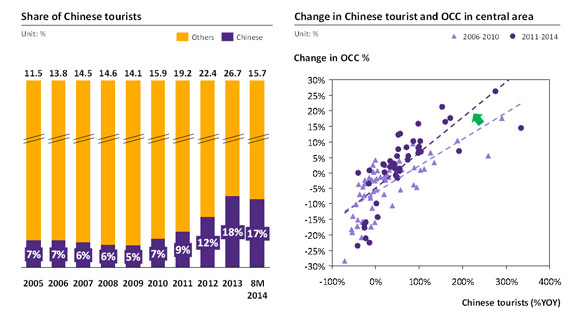

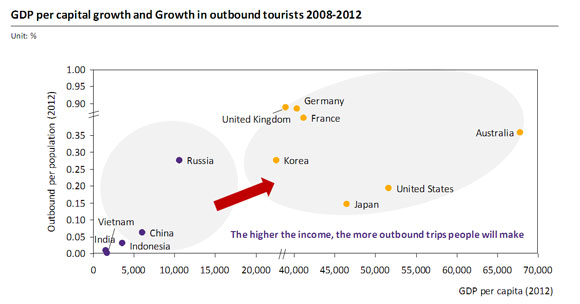

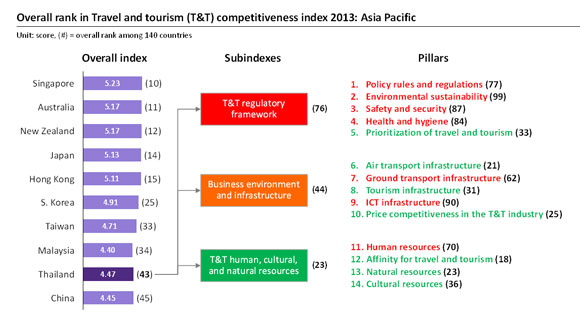

Currently, Thailand's tourism industry awaits market recovery, especially in the Asian tourist segment. The number of foreign tourists has dropped for nine consecutive months since the events of November 2013. The number of foreign tourists is now shifting positively but the market is not yet fully recovered. Previous recoveries usually averaged 3-4 months from bad events, but may take longer this time. The Asian tourist segment declined greatly, especially among the Chinese tourists who currently account for 20% of tourists to Thailand. This has had a significant impact on Thailand's tourism industry as this segment has played a major role in the market. Meanwhile, tourists from Europe and the US were less affected by political events. Between November 2013 and September 2014 tourists from Southeast Asia dropped by 12% YOY, while those from Europe increased by 5% YOY (Figure 1). This implies that European tourists were not deterred by Thailand's political issues and tended to travel to the South, their favorite destinations, despite the protests in Bangkok. The hotel industry appears to rely on Chinese tourists more than before, resulting in the industry being dependent on their behavior. Hotel occupancy rates were closely correlated with changes in the number of Chinese tourists. In other words, a slight change in the number of Chinese tourists could greatly affect hotels. During 2006 - 2010 the number of Chinese tourists increased by 1%, resulting in a rise in hotel occupancy rates in Bangkok of 8%, whereas the figure rose to 11% during 2011 - present (Figure 2). The same effect applied when the number of Chinese tourists dropped. Thailand's tourism industry should therefore deploy a strategy of risk diversification to balance potential growth opportunities with the threat from the political sensitivity of Asian tourists, as well as to maintain Western tourist markets. In addition, tourists tend to drop their advance room booking behavior in favor of online booking which offers better deals when bookings are made closer to check-in dates. Consequently, the hotel industry aims to maximize the benefits of the Internet to enhance competitiveness and implement marketing strategies in response to consumer behavior. In the future, Thailand's tourism industry will rely more heavily on tourists from China, ASEAN, and emerging markets. Targeting existing markets can help maintain repeat visitors, who are not highly sensitive to political situations, tend to stay longer, and have more spending power. However, a heavy focus on Western tourists can be a threat to potential growth in the future. Once the industry fully recovers it is likely to benefit from tourists from China, ASEAN, and emerging markets due to the fact that the GDP per capita of tourists from these regions is on the rise, combined with an increasing trend to travel abroad among middle class people (Figure 3). It is expected that China, Russia, and India will have the biggest increase in outbound travel rates during 2012-2017. The Chinese outbound market will see an additional 45 million travellers while the Russian outbound market will see an additional 17 million travellers. In the long term, tourists from emerging markets will have an increasing number of alternative destinations. Therefore, Thailand's tourism industry should enhance its competitiveness in order to achieve sustainable growth. Short term strategies and short term growth should not be adopted for Thailand's tourism industry since the industry still benefits from expanding new markets. Instead, sustainable growth is a key to success. Achieving this will require more than just promoting Thailand's advantages in having prominent tourist attractions. Some have suggested that Thailand should be focusing more on environmental issues and improvement of the nation's ICT infrastructure. The Travel and Tourism Competitiveness Index, which measures 140 countries around the world, gives Thailand low marks for these two issues (Figure 4). Regarding environmental issues, Thailand is still facing problems with air pollution, wildlife conservation, and a lack of environmental treaty enforcement. Similarly, Thailand's ICT infrastructure continues to lag when compared to other countries as internet utilization is low despite rapid growth in foreign tourists' online activities. This issue can be tackled progressively with essential support from the government as part of its plan to develop a digital economy. |

|

|||

Figure 1 - Number of Asian tourists affected by political events, showing a greater drop than those from Europe.

Source: EIC analysis based on data from Department of Tourism

Figure 2 - Hotel occupancy rates were more sensitive to changes in the number of Chinese tourists.

Source: EIC analysis based on data from Department of Tourism

Figure 3 - Tourists from emerging markets have higher potential growth than existing markets.

Source: EIC analysis based on data from IMF, World Bank and National Statistical Office

Figure 4 - Thailand's travel and tourism competitiveness lacks a framework for promoting environmental and ICT issues.

Source: EIC analysis based on data from World Economic Forum