Has the price of Para rubber passed its trough?

A decline in crude oil prices and slowdown in both China and the global economy has resulted in an almost 4-year low of Para rubber price. However, EIC believes that the Para rubber price has already passed its lowest point and should slowly recover, following the rising trend of oil prices and gradual global economic recovery.

Author: Kaittisak Kumse

|

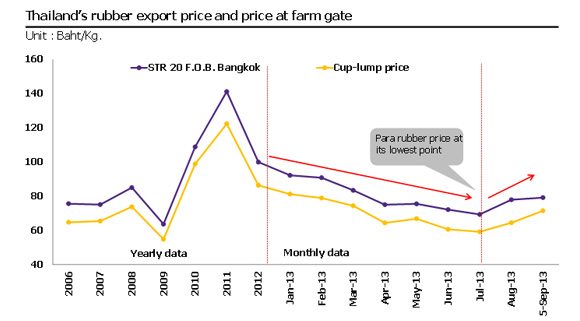

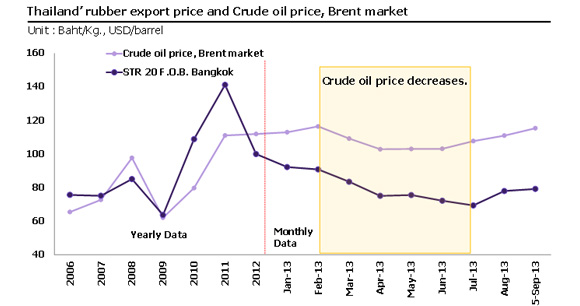

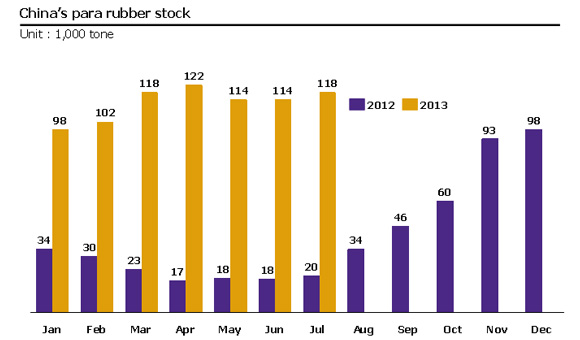

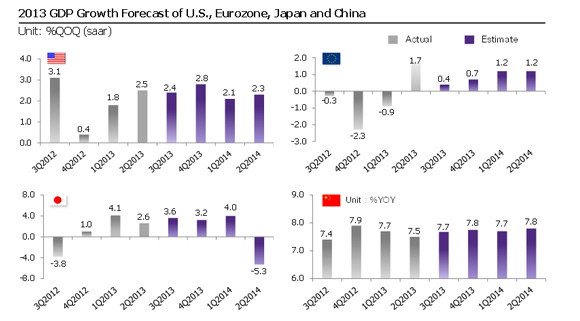

A decline in crude oil prices and slowdown in both China and the global economy has resulted in an almost 4-year low of Para rubber price. However, EIC believes that the Para rubber price has already passed its lowest point and should slowly recover, following the rising trend of oil prices and gradual global economic recovery. Para rubber is an industrial crop which is significant to the Thai economy in terms of GDP, employment, and exports. It makes up about 3.3% of Thailand's GDP, 15% of total employment, and 5.9% of total export value. During 2012, Para rubber export value registered at 8,745 million USD, the highest among agricultural commodities and the fifth largest among all exporting items. During July 2013, the price of Para rubber dropped to its 4-year low. Standard Thai Rubber (STR 20) export price in July fell to 69 Baht per kilogram, a 4-year low record (STR export accounts for 39% of the total Para rubber export from Thailand). This declining of export price caused the cup-lump price (raw material for producing STR) which farmers receive to decline by 21%, from 81 Baht per kilogram in January to 64 Baht per kilogram in July (Figure 1). The reduction in Para rubber price has resulted from global crude oil price slump and slowdown in both China and the global economy. China, as the world's largest consumer and importer of Para rubber, plays an influential role on price movement. In 2012, China imported 2.5 million tons of Para rubber, of which roughly half of total imports or around 1.2 million tons was from Thailand. During the same period, China consumed a total of 3.9 million tons of Para rubber, 83% of which goes to the tire industry. Hence, the demand from the Chinese tire industry is a key driver worth monitoring. Additionally, related variables that effect Para rubber prices include crude oil price, Chinese economy, and the global economy (as more than 50% of Chinese tire production is for re-exporting to the world). Crude oil price is particularly important as it reflects production costs of synthetic rubber. Thus, the reduction in crude oil price, such as of the 5% Brent during the first half of 2013 (Figure 2), lowers synthetic rubber costs which in turn, attracts higher demand as it can be used as substitute product for natural rubber or Para rubber. On top of crude oil price declines, slowdowns in China's economic growth during the first half of 2013 (as evident from two consecutive slow growth quarters: 7.7% in the first quarter and 7.5% in the second) in addition to low growth in the US, the Euro zone, and the Japanese economy, further depress China's demand for Para rubber, especially by the tire industry. This caused the Para rubber prices to decline as well. Furthermore, another factor that lowered rubber prices was China's huge Para rubber stock. During July, China's Para rubber stock was 180,000 tons, a 600% YOY increase (Figure 3). EIC views that Thailand's Para rubber price has already passed its lowest point and should start to gradually pick up following the recovery of Chinese demand and rising trend of crude oil prices. However, EIC believes that Thailand's Para rubber export price cannot increase to a rate that will push domestic rubber price to 120 baht per kilogram as demanded. EIC views that Thailand's STR export price should increase to 105-110 Baht per kilogram during the 2013 year-end and hence, push cup-lump prices up to around 97-102 Baht per kilogram (farmers will receive a higher price due to the cancellation of Cess payments). The main reason EIC believes that Para rubber prices will not be able to increase to 120 Baht per kilogram is because of abundant supply from higher production in 2013. This is because in 2007, Thailand's rubber cultivation area in the Northeastern and Northern region expanded significantly and its rubber can be started tapping this year. In addition, Indonesia and Malaysia's rubber production should increase as well. Data from the International Rubber Study Group (IRSG) also points to the same direction and estimated that in 2013, there will be a Para rubber surplus of 300,000 tons. However, if crude oil prices continue to decline and the global economic is not gradually recovered as expected, Para rubber prices might not increase to the level predicted.

Figure 1: Export price and farm gate price of Para rubber consecutively decreased during Jan-Jul 2013. Source: EIC analysis based on data from Rubber Research Institute of Thailand

Figure 2: Para rubber price has declined in line with crude oil price movement. Source: EIC analysis based on data from Bloomberg

Figure 3: Para rubber stock in China has increased continuously during the first 7 months of this year. Source: EIC analysis based on data from International Rubber Study Group (IRSG)

Figure 4: The world economy shows signs of recovery. Source: Foreign research house (Goldman Sachs, J.P. Morgan, Deutsche Bank, Bank of America)

|

|

|

|

|

|