The next chapter of modern grocery store

Modern grocery retailing has been a star sector due to its continued growth in market value and the number of stores. In the previous 2-3 years, however, the trend of store closure in modern grocery retailing internationally marked a stark contrast to the previous fortune. This raised several important questions: Are modern grocery retailers in Thailand likely to follow suit? Are there opportunities for expansion in the number of stores, and how do retailers handle the competition in the market?

Author: Puripat Sophonkeereerat

|

Highlight

|

Modern grocery retailers in Thailand are still growing but the sign of an impending slowdown is becoming more evident through increased competition. This trend can be observed in the overall picture of the modern grocery retailer market. During 2006 to 2013, this market used to grow by 8-9% per annum However, In the last 3-4 years, the growth decelerated to 5% per annum. This is attributed to the recent economic slowdown as well as the increasing in competition that can be observed from the reduced figures in the same store sales growth (SSSG) statistics. These statistics reveal that growth in the past occurred through the increase in the number of stores. In addition, the arrival of e-commerce and the introduction of new business models contributed to an increasing competitiveness. EIC analysis shows that modern grocery retailer market in Thailand can still grow but increasing competition means that the level of growth will not reach the previous height, with 4% becoming the new normal over the next 3 years. This is because retailers will become more cautious in the selection of a store location and the changing business models.

Despite the sign of slowing growth in the modern grocery market, penetration of the modern grocery in Thailand remains low compared with the developed economies in Asia. The proportion of modern grocery to total grocery market in Thailand is only 46%. Meanwhile, the value in Japan, South Korea, and Singapore is over 70-80%. This gap shows that there are still opportunities for modern grocery retailers in Thailand to grow, especially through opening new stores in the newly developed area of the country. Based on World Bank’s information, the urbanisation rate in Thailand has further room to grow with the current rate of 50% in contrast to 80-90% in South Korea and Japan. Furthermore, data on modern grocery penetration highlights that the number of stores in Thailand can still grow especially in the form of convenience store and supermarket. Currently, there are 200 modern grocery stores to 1 million people, 3-4 times lower than Japan and South Korea. In any case, major players in the Thai market already have a plan to increase the number of stores focusing on a small format. It is expected there will be an increase of convenient stores and supermarkets by 10% and 7% respectively in 2018. In contrast, the growth in the number of hypermarkets is likely to slow down because of several factors including changes in consumer behaviour, restrictions due to town and country planning law, and the difficulty in finding larger space for new stores. The smaller store format also means faster expansion. Consequently, smaller store format is more appropriate for the modern consumers who have a smaller family and crave convenience.

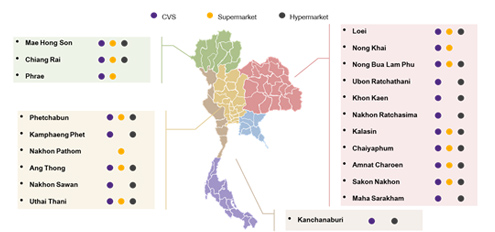

There are rooms for modern grocery retailers in Thailand to expand but business operators are becoming more cautious in selecting locations and business models. This trend can be observed in Bangkok where there is a high congestion in the number of modern grocery stores with heightened competitions. As a result, the selection of a location for a new store is becoming more cautious based on performance consideration such as partnering with residential developers to open new stores in condominiums and opening new stores in underground stations where there are lots of passers-by. Outside Bangkok, there are several cities that deserve recognition for possible expansion especially in second tier provinces. EIC analysis of potential store locations based on cites with the highest growth in gross provincial product per capita in terms of retailing reveals that cities with the highest index of retail saturation1, meaning prime area for expansion, are in northeastern and central regions. These cities are: Mae Hong Son, Nong Bua Lam Phu, Nong Khai, Phetchabun, Kamphaeng Phet, Nakhon Ratchasima, and Chaiyaphum, to name a few. Furthermore, the convenient store format remains the store type that is likely to witness the strongest growth in several areas.

Increasing competition results in retailers needing to develop a storefront that is appropriate to each area while also creating a new experience for the consumers. In the past 10 years, the sizes of modern grocery stores are changing rapidly. The sizes of convenient stores and supermarket per store have grown by 23% and 13% respectively. Meanwhile, the size of a hypermarket store has decreased by 12% as businesses have adopted new store types such as mini-supermarket, a type that is characterised as a larger convenience store. This has led to a more intense competition among different store formats that put pressure on sales per store. To remain competitive, businesses have adopted new business strategies such as the grocerant format where high-quality food products are provided as ready-to-eat alongside the sale of other consumer goods. The example of such a store is a convenience store that specialises in ready-to-eat and drinks that respond to the lifestyle of new generations who desire speed and convenience. Supermarkets are also focusing on products development and food services that provide new experiences, such as dine-in, that creates customer engagement while also increasing the sale of fresh foods.

The emergence of online grocery is playing a larger part in the daily life of consumers. Nevertheless, physical stores remain the channel of choice. The example of this trend is in the USA where online shopping is becoming increasingly prevalent, resulting in an impact to the bottom-line and stores closure. However, a consumer research by Morgan Stanley reveals that almost half of consumers still prefer physical stores when purchasing fresh foods in comparison to the online channel. This finding is in-line with the trend found among Thai consumers where EIC research shows that around 33% of consumers who have purchased online buy consumer goods, 58% revealed that this is because of price and promotion advantages while 35% indicated that this is due to convenience. Nevertheless, the analysis shows that the frequency of online purchase in Thailand remains low with only 20% of respondents have purchased online more than 3 times per month. Meanwhile, the figures for having done shopping for more than 3 times per month at hypermarkets, supermarkets, and convenient stores were much higher (43%, 27%, and 85% respectively). This comparison highlights that physical stores are still the main channel for buying consumer goods. Still, consumers are increasingly relying on multi-channel for information search and products selection. Therefore, the development of online channel alongside physical stores (Omni-channel) remains an important business strategy.

1 Calculated from annual spending data on grocery products per household against total modern grocery store area in the same city. Higher value means high potential for expansion.

|

|

|

|

|

Figure 1: Effective cities for opening new stores are mainly located in northeastern and central regions

Source: EIC analysis based on data from SES and NESDB

Figure 2: Frequency of consumer goods purchase from various channel by consumers who prefer buying online

Unit: Times per month

Source: EIC analysis based on data from EIC survey (February 2017)