Hotel Spa: A Win-Win Business Opportunities

The spa industry is worth watching due to its contribution to Thailand’s tourism sector. The overall value of Thai spa industry has seen a steady increase of 8% per annum during 2013-15, reaching THB 35 billion. This figure puts Thai spa industry in the 16th place in the world ranking and the 5th in Asia. In addition, spa represents an important opportunity for hotel operators because of its complementarity to the core business. Also, spa creates a potentially lucrative market for businesses selling complementary items such as cosmeceutical and aromatherapy products.

Author: Pullawat Pitigraisorn

|

Highlight

|

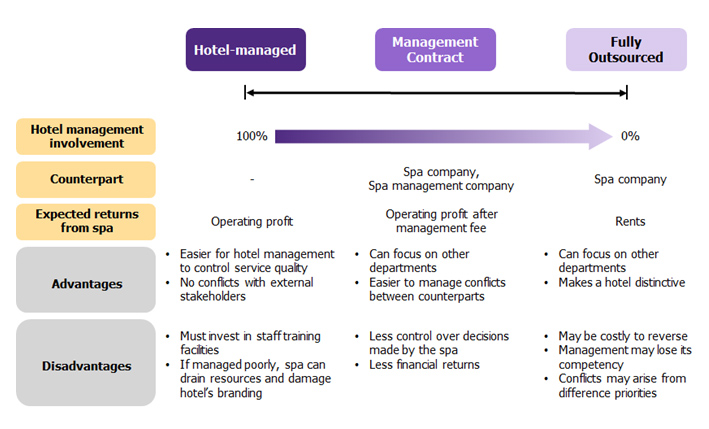

Spa is one of the rising stars of global wellness industry due to its fast-growing record, outpacing the overall growth of the wellness industry. The Global Wellness Institute (GWI) expects the overall market value of the spa industry worldwide to grow 6% per annum, or from USD 1.29 trillion to USD 1.69 trillion during 2015-2020. The rate is faster than the overall growth rate of the worldwide wellness industry which is expected to grow by 5% per annum from USD 3.8 trillion to USD 4.9 trillion in the same period (Figure 1). The reason behind the fast-growing rate of the spa industry is attributed to 1) the rise in aging population in which an analysis of GWI report and the CIA World Factbook shows that 20 countries with highest market value for spa industry have a population median age of over 40 years old, highlighting the need of spa usage that grows alongside the trend of aging society. 2) The rising income of middle-class consumers worldwide that leads to an increase in spending on personal well-being in addition to the daily spending and 3) The fast-paced life of the millennials that create stress.

Thailand’s spa industry is growing by 8% annually, faster than the global average. The information provided by GWI also shows that the overall market value of the spa industry in Thailand is growing as high as 8% per annum, from THB 30 billion in 2013 to THB 35 billion in 2015. This figure puts Thailand at 16th place in the world and the 5th in Asia behind China, Japan, South Korea, and India. The main consumer group for Thailand’s spa industry are international tourists especially those from East Asia, such as China, Taiwan, Hong Kong, South Korea, and Japan, as well as tourists from the western countries. The international consumers also make important contributions to growth in income for Thailand’s wellness tourism sector. From the analysis by GWI, the market value of global wellness tourism is projected to grow by 7% per annum between 2015-2020 from THB 19 trillion to THB 27 trillion. It is expected that Thai spa industry will likely benefit from this growing trend of global wellness tourism also.

Hotel spa is worth watching due to its high growth rate. In Thailand, there are 3 popular types of spa. These are 1) กay spa which is the most common type of spa located in residential areas, offices, and shopping centres. Day spa focuses on providing treatments that last from 30 to 210 minutes without an overnight stay. Popular examples of day spa include PAÑPURI Wellness, HARNN Heritage Spa, and Let’s Relax. 2) Destination spa which provides all-inclusive package that includes accommodation, healthy diets and wellness programs. Customers of destination spa can customise their length of stay and the services that fit their wellness goals, with options ranging from 3 to 28 days. Most of these spas are located in a tourism destination with beautiful natural surroundings. The examples of destination spas include Chiva-som and Amanpuri. 3) Hotel spa located in a hotel/resort property. Hotel spa operates in a similar manner to a day spa. Famous examples of hotel spa include Banyan Tree Spa and Kempinski the Spa. From the mentioned types of spa, hotel spa represents the worth-watching opportunity due to the growing Thailand’s tourism sector, as well as providing tourists with more activity options while contributing to the hotel bottom-line. The rise of hotel spa helps Thailand to become an inclusive destination for international tourism.

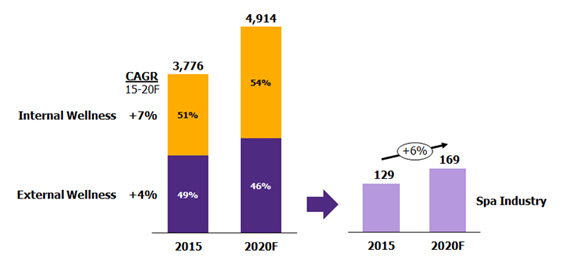

Hotel spa reinforces hotel’s core competency that is reflected in a higher RevPAR while providing an opportunity for spa operators and cosmeceutical business. According to the information from CBRE Hotels, hotels with spa in the US tend to receive a higher revenue per available room (RevPAR) than those without a spa by 27% for urban hotel and 10% for resort (Figure 2). This is attributed to the ability of the hotel to increase a higher rate per room. At the same time, hotel with a spa can create additional and recurring revenues from guests who signed up for a spa membership. In addition, a popular and well-known spa can help by adding value to the hotel through a positive brand image. Furthermore, a hotel spa with a different selling point can create a unique experience for guests of the hotel. For example, Zen Zone Spa, located in a 5-star hotel Gran Hotel La Florida in Barcelona, offers a unique experience by providing a relaxing bubble pods containing 99.5% oxygen to relieve stress under blue light and detox the body, or the K-Spa of K-West Hotel & Spa in London which provides a sub-zero spa experience alongside sauna, known as the “Hot and Cold Therapy” that originated from Finland, that induces blood flow, reduce cellulite, and build the immune system. From another angle, hotel spa creates an opportunity for spa operator to build a customer base by providing services to guests staying in a hotel. This is a significant opportunity because 4 to 5 stars hotels are mostly situated in prime areas while their customers also possess high purchasing power. For spa operators specialised in cosmeceutical and aromatherapy products, they can use this opportunity to advertise and sell their products while creating brand awareness through actual product usage among spa users, potentially leading to a wider consumer base that subsequently lead to higher sales.

Global hotel chains are expanding into the wellness industry through either acquisition of wellness business or joint-venture with spa and related businesses. For example, the Hyatt Hotels & Resorts Group has acquired Miraval Group and Exhale, a popular wellness business operator in the US, with an investment of over USD 375 million in 2017. The Hyatt Hotels & Resorts Group plans to expand Miraval and Exhale’s business in several dimensions including a spa and fitness centre that matches the demand of hotel guests. At the same time, hotel chains can also partner with global names in cosmeceuticals to attract high-spending guests and walk-in customers. Examples of partnership ventures include Hôtel Plaza Athénée in Paris who partnered with Parfums Christian Dior to use their spa brand “Dior Institut” in the hotel, as well as Hotel Sahrai in Fez, Morocco who partnered with Givenchy Parfums to provide spa services under the brand “Givenchy Spa”. These partnerships help to reinforce the luxury image of the two hotels by linking with well-recognised name in the spa industry.

|

|

|

|

|

Figure 1: Global market value of the wellness and spa Industry

Unit: USD billion

Source: Global Wellness Institute (GWI)

Figure 2: Revenue per Available Room (RevPAR) of hotels in the US

Unit: USD per night

Note: Revenue per Available Room = Occupancy Rate x Average Daily Rate

Source: EIC analysis based on information from CBRE Hotels | PKF Hospitality Research

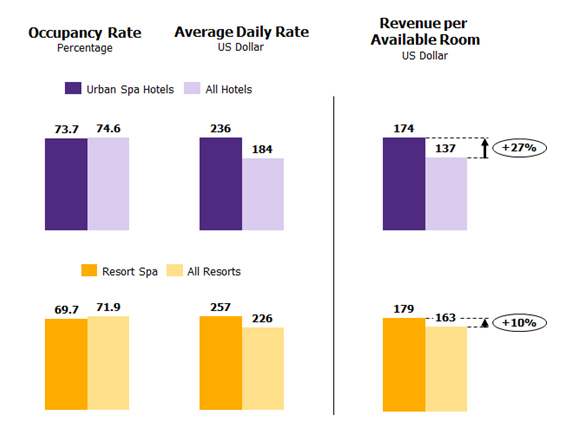

Figure 3: Types of hotel spa business model and advantages/disadvantages of each type